CNW reports,

PSP Investments Reports Fiscal Year 2011 Result:

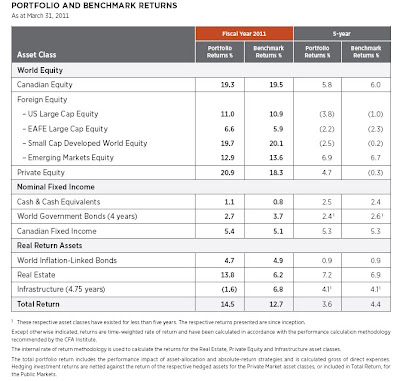

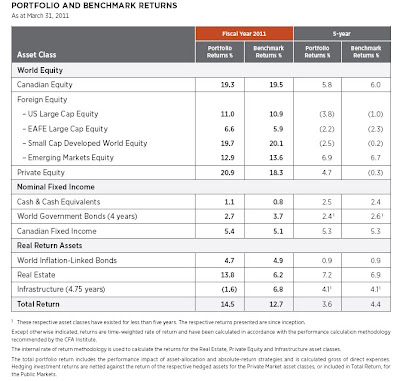

The Public Sector Pension Investment Board (PSP Investments) announced today that it recorded an investment return of 14.5% for the fiscal year ended March 31, 2011 (fiscal year 2011). The robust overall performance for fiscal year 2011 was driven primarily by strong results in Public Market Equity portfolios as well as in Private Equity and in Real Estate, and follows on the heels of the 21.5% total return recorded in fiscal 2010.

The fiscal year 2011 investment return exceeds the Policy Portfolio return of 12.7% by 1.8%.

Consolidated net assets increased by $11.7 billion, or 25%, to a record level of $58.0 billion. During fiscal year 2011, PSP Investments generated net income from operations of $6.9 billion and received $4.8 billion in net contributions.

"The latest results reflect solid performances and contributions from every part of the organization and point to the success of the diversification strategy we began implementing in 2004, with the introduction of private market asset classes such as Real Estate, Private Equity and Infrastructure. Our Public Market equity portfolios also recorded substantial gains, adding to the strong performance of the previous year," said Gordon J. Fyfe, President and Chief Executive Officer of PSP Investments.

For fiscal year 2011, Public Market equity portfolio returns ranged from 6.6% for the EAFE (Europe, Australasia and the Far East) Large Cap Equity portfolio to 19.7% for the Small Cap World Developed Equity portfolio. The Canadian Equity portfolio return for the year was 19.3%.

In private markets, the Private Equity and Real Estate portfolios posted strong investment returns of 20.9% and 13.8%, respectively. The Infrastructure portfolio earned a slightly negative investment return of 1.6% for fiscal year 2011.

The asset mix as at March 31, 2011 was as follows: Public Market Equities 56.5%, Private Equity 9.6%; Nominal Fixed Income and World Inflation-Linked Bonds 20.7%; Real Estate 9.1% and Infrastructure 4.1%.

Special Examination

During the fiscal year 2011, the Office of the Auditor General of

Canada and Deloitte & Touche LLP (the Examiners) jointly carried out

a Special Examination in accordance with applicable legislation, which requires such an audit at least once every 10 years.

The Examiners concluded that PSP Investments maintains systems and practices that provide it with reasonable assurance that its assets are safeguarded and controlled, its resources are managed economically and efficiently, and its operations are carried out effectively. This is the best possible conclusion to such an examination.

"Given that PSP Investments has existed for little more than a decade, has experienced tremendous growth, and is engaged in a business where the requisite systems and controls tend to be both complex and constantly evolving, this finding is a testament to the strength and rigour of our organization," said Paul Cantor, Chair of the Board of Directors of PSP Investments.

For more information about PSP Investments' fiscal year 2011 performance and the Special Examination, consult PSP Investments' Annual Report available at

www.investpsp.ca.

About PSP Investments

The Public Sector Pension Investment Board is a Canadian Crown corporation established to invest the amounts transferred by the Government of Canada equal to the proceeds of the net contributions since April 1, 2000, for the pension plans of the Public Service, the Canadian Forces and the Royal Canadian Mounted Police, and since March 1, 2007, for the Reserve Force Pension Plan (collectively the Plans). The amounts so transferred to the Corporation are to fund the liabilities under the Plans for service after the foregoing dates.

Its statutory objects are to manage the funds transferred to it in the best interests of the contributors and beneficiaries under the Plans and to maximize investment returns without undue risk of loss, having regard to the funding, policies and requirements of the Plans and their ability to meet their financial obligations.

CNW reports, PSP Investments Reports Fiscal Year 2011 Result:

CNW reports, PSP Investments Reports Fiscal Year 2011 Result: