KKR, OTPP and PSP Investments Take Control of Spark Infrastructure

Spark Infrastructure has announced that the Foreign Investment Review Board (FIRB) has approved the $5.2 billion takeover of the power grid operator by a consortium led by United States-based global investment company Kohlberg Kravis Roberts (KKR) and the Ontario Teachers’ Pension Plan (OTPP).

The consortium, jointly owned by entities linked to KKR, OTPP and Canada’s PSP Investments, will take control of the network operator on December 22 if the New South Wales Supreme Court approves the scheme in the mandatory second hearing required for the takeover deal.

The hearing is scheduled for tomorrow (26 November) and already the process to delist Spark Infrastructure from the Australian Securities Exchange (ASX) has begun with the S&P Dow Jones Indices announcing on Wednesday that subject to final court approval of the buyout, it will remove the company from the S&P/ASX 200 effective prior to the open of trading on 30 November.

“With receipt of Foreign Investment Review Board approval, all regulatory approvals required for the acquisition have been obtained,” Spark Infrastructure said in a statement.

“It is expected that Spark Infrastructure securities will be suspended from trading on the ASX from close of trading on 29 November 2021 and the cchemes will then be implemented on 22 December 2021.”

Spark shareholders earlier this week approved the $5.2 billion takeover, with 99.51% of security holders voting in favour of the creditor scheme resolution.

Spark owns a 49% stake in the Victorian distribution operators Powercor and CitiPower, which distribute electricity to more than 1 million customers in Victoria, 49% of South Australia’s distribution network operator SA Power Networks, which is the sole operator of South Australia’s electricity distribution network, and a 15% stake in transmission network operator Transgrid in New South Wales.

Until recently, Spark was exclusively an investor in regulated network infrastructure but it has begun developing a portfolio of wind, solar and storage assets, targeting more than $1 billion of investment in renewable energy generation by 2025.

In July, it announced plans to develop a 2.5 GW hybrid wind, solar PV and battery storage project in New South Wales while the 100 MW Bomen Solar Farm came online last year.

The consortium will own Spark via a peak company PIKA Bidco.

Dan Madge, Director of External Communications at OTPP, alerted me that today is the closing and he also gave me an earlier Reuters article discussing this deal back in August:

Spark Infrastructure Group said on Tuesday it had agreed to let Canadian pension fund Public Sector Pension Investment Board to join a consortium that was looking to buy the Australian electricity infrastructure investor.

The consortium, which includes private equity giant KKR & Co Inc and the Ontario Teachers’ Pension Plan Board (OTPP), had last month offered to buy the Australian electricity infrastructure investor for A$5.13 billion ($3.76 billion).

Spark said it had allowed the revised consortium, that includes the Canadian fund, to continue conducting due diligence activities announced last month.

The new members of the consortium are expected to provide one-third of the total funding required for the acquisition.

However, in case the Public Sector Pension Board does not receive approvals to join the consortium, KKR and OTTP said they had sufficient funds to complete the acquisition.

Key terms and conditions for the buyout remain the same as those announced last month, Spark added. Public Sector Pension did not immediately respond to requests for comments.

Well, clearly PSP Investments did receive approval to join the consortium and late today, a press release was issued that KKR, Ontario Teachers' and PSP Investments have completed the acquisition of Spark Infrastructure:

SYDNEY--(BUSINESS WIRE)--KKR, Ontario Teachers’ Pension Plan Board (“Ontario Teachers’”) and Public Sector Pension Investment Board (“PSP Investments” and together, “the Consortium”) today announced the completion of the acquisition of all issued securities of Spark Infrastructure (ASX: SKI) in an all-cash transaction for approximately A$5.2 billion. All regulatory approvals have been obtained.

Spark Infrastructure invests in essential energy infrastructure businesses within Australia, which serve over 5 million homes and businesses, and are deeply involved in supporting the transition of Australia’s electricity grid to one that is increasingly reliant on renewable energy. Spark Infrastructure’s portfolio comprises:

- 49% of SA Power Networks, the sole operator of South Australia’s electricity distribution network, supplying approximately 896,000 residential and commercial customers across the state;

- 49% in Citipower and Powercor (together known as “Victoria Power Networks”), the operator of distribution networks that supply electricity to over 1.1 million customers in Melbourne and central and western Victoria;

- 15.01% of TransGrid, the largest high-voltage electricity transmission network by volume in the National Electricity Market, connecting generators, distributors and major users in New South Wales and the Australian Capital Territory; and

- 100% of the 120MWDC /100MWAC Bomen Solar Farm located north of Wagga Wagga in New South Wales.

Andrew Jennings, a Director on KKR’s Infrastructure team in Australia, said, “We are excited to invest in Spark Infrastructure, which is a world-class business that plays a critical role in Australian communities. Alongside Ontario Teachers’ and PSP Investments, we look forward to working with the management teams of Spark Infrastructure and its portfolio companies, to support the business’ objectives to improve grid stability and build secure, high-quality and cost-effective electricity infrastructure for customers across the country.”

“Spark Infrastructure aligns perfectly with our strategy to invest in high-quality regulated infrastructure assets globally that will both benefit from and support the transition to a low-carbon economy,” said Bruce Crane, Managing Director and Head of Asia Pacific Infrastructure & Natural Resources at Ontario Teachers’. “We look forward to working with our partners and management to continue to optimize network performance and reliability while also supporting future growth of the portfolio.”

“We are excited to add Spark Infrastructure to our Infrastructure portfolio and to continue nurturing our established relationships with KKR and Ontario Teachers’,” said Sandiren Curthan, Senior Director, Infrastructure Investments, PSP Investments. “As Australia transitions away from coal, Spark Infrastructure’s electricity transmission and distribution networks are well-positioned to enable the clean energy transition toward a low-carbon economy.”

KKR is making the investment through its core infrastructure strategy which focuses on investing in high-quality regulated assets in developed OECD markets.

About KKR

KKR is a leading global investment firm that offers alternative asset management and capital markets and insurance solutions. KKR aims to generate attractive investment returns by following a patient and disciplined investment approach, employing world-class people, and supporting growth in its portfolio companies and communities. KKR sponsors investment funds that invest in private equity, credit and real assets and has strategic partners that manage hedge funds. KKR’s insurance subsidiaries offer retirement, life and reinsurance products under the management of The Global Atlantic Financial Group. References to KKR’s investments may include the activities of its sponsored funds and insurance subsidiaries. For additional information about KKR & Co. Inc. (NYSE: KKR), please visit KKR’s website at www.kkr.com and on Twitter @KKR_Co.

About Ontario Teachers’ Pension Plan Board

Ontario Teachers' Pension Plan Board (Ontario Teachers') is the administrator of Canada's largest single-profession pension plan, with C$227.7 billion in net assets (all figures at June 30, 2021 unless noted). It holds a diverse global portfolio of assets, approximately 80% of which is managed in-house, and has earned an annual total-fund net return of 9.6% since the plan's founding in 1990. Ontario Teachers' is an independent organization headquartered in Toronto. Its Asia-Pacific region offices are located in Hong Kong and Singapore, and its Europe, Middle East & Africa region office is in London. The defined-benefit plan, which is fully funded as at January 1, 2021, invests and administers the pensions of the province of Ontario's 331,000 active and retired teachers. For more information, visit otpp.com.

About PSP Investments

The Public Sector Pension Investment Board (PSP Investments) is one of Canada's largest pension investment managers with C$204.5 billion of net assets under management as of March 31, 2021. It manages a diversified global portfolio composed of investments in public financial markets, private equity, real estate, infrastructure, natural resources and credit investments. Established in 1999, PSP Investments manages and invests amounts transferred to it by the Government of Canada for the pension plans of the federal Public Service, the Canadian Forces, the Royal Canadian Mounted Police and the Reserve Force. Headquartered in Ottawa, PSP Investments has its principal business office in Montréal and offices in New York, London and Hong Kong. For more information, visit investpsp.com or follow us on Twitter and LinkedIn.

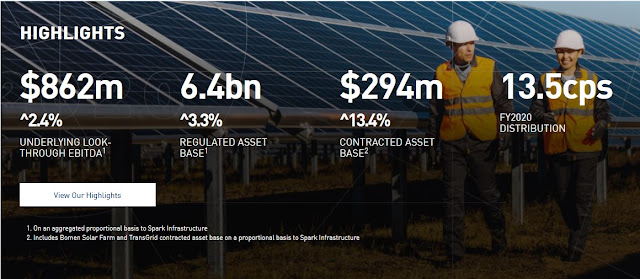

I invite my readers to learn more about Spark Infrastructure here.

I would also invite my readers to read Spark's 2020 Annual Report here (half-year result are also available here):

The sustainability angle is critically important for KKR, OTPP and PSP Investments as they look to achieve net zero in their portfolios.

Clearly, Andrew Jennings, Director on KKR’s Infrastructure team in Australia, is right when he states: “Spark Infrastructure is a world-class business that plays a critical role in Australian communities."

And now both OTPP and PSP Investments will own this world-class company alongside KKR which is making the investment through its core infrastructure strategy which focuses on investing in high-quality regulated assets in developed OECD markets.

Back in May, IPE Real Assets reported KKR raked in $3 billion capital for its open-ended core infrastructure fund and that New Mexico SIC approved a $100 million commitment to KKR Diversified Core Infrastructure Fund.

The rise of private equity mega infrastructure funds over the last five years is quite amazing with KKR, Blackstone, EQT joining the ranks of Global Infrastructure Partners and Brookfield (or closing in on them).

All this capital also means that Canada's large pensions face stiffening competition for global assets but because they already have strong relationships with all these funds, they can co-invest alongside them on bigger deals like this.

Global assetsCarbon neutrality

This too helps explain why OTPP loves highly regulated assets that Spark Infrastructure owns. Also, OTPP recently announced it will reduce portfolio carbon emissions intensity by 45% by 2025 and 67% by 2030, well ahead of the initial 2050 mark.

It's important to note OTPP slashed its fixed income portfolio and is looking for high-quality infrastructure assets to to make up the difference but there is more risk in infrastructure so it's not a perfect substitute.

Still, with yields at historic lows and inflation running at 30-year highs, there are risks with bonds too, and with regulated infrastructure, at least OTPP, PSP and KKR will have some inflation protection (tariffs factor in inflation).

PSP's CIO, Eduard van Gelderen, told me in early November they are looking for infrastructure assets with implicit inflation protection and they're not easy to find, especially in North America.

So, this deal also fits nicely in their portfolio even if they don't have the same liability profile as OTPP.

Interestingly, Eduard also told that symposium he sees rates normalizing over the next five years but I wonder if Teachers' agrees with Barb Zvan's view that "lower for longer" will persist and that is the real reason why they are slashing fixed income holdings in favor of core infrastructure assets all over the world.

In other corporate news, Ontario Teachers’ recently announced it joined KKR as an investor in GreenCollar:

SYDNEY – GreenCollar is pleased to welcome Ontario Teachers’ Pension Plan Board (Ontario Teachers’) as a new long-term investor to back the company’s ambitious growth aspirations and commitment to delivering positive environmental impact at scale. With this latest investment, Ontario Teachers’ joins KKR’s Global Impact Fund as a significant shareholder in the company. Other terms of the transaction were not disclosed.

Ontario Teachers’ is one of the world’s largest pension plans with ~$227.7 billion in net assets. The plan focuses on shaping a better future for the people, places and communities where it invests, including a commitment to have net zero greenhouse gas emissions across its portfolio by 2050. In September this year, it set industry-leading interim reduction targets: to reduce portfolio carbon emissions intensity by 45% by 2025 and 67% by 2030, compared to a 2019 baseline.

Ontario Teachers’ Natural Resources group, which is part of the Infrastructure and Natural Resources department, already has significant experience investing in the agriculture, timberland and seafood sectors, including in Australia where it has a large agriculture portfolio. The group has leveraged its experience in these sectors to increase investments in immediate, scalable natural climate solutions projects that protect ecosystems and reduce greenhouse gas emissions, demonstrating strong alignment with GreenCollar’s approach.

Christopher Metrakos, Managing Director, Natural Resources at Ontario Teachers’, said: “We are thrilled to invest in a leading global environmental markets investor and project developer alongside KKR, the founders and management team of GreenCollar. GreenCollar’s collaborative and scientific approach is driving the development of innovative environmental solutions, particularly within Australia’s carbon market, and the business has great potential for international growth.”

Founded by James Schultz and Lewis Tyndall over a decade ago, GreenCollar is a profit for purpose business working across the carbon, water quality, biodiversity and plastics markets. It exists to value the environment and drive positive impact at scale by creating methodologies and markets that put the environment on the balance sheet.

James Schultz, GreenCollar CEO, commented, “Our mission is to put the environment on the balance sheet through carbon farming, improved water quality, nature positive outcomes, and addressing the global challenge of plastics. The methodologies and projects we’ve developed under Carbon and Water, and the work we are doing in Plastics and Nature credits are setting the global standard for high quality, high integrity credits to drive positive environmental outcomes at scale.

“KKR has been a terrific strategic partner and we are excited to welcome another similarly aligned partner in Ontario Teachers’ as we look to achieve our vision of driving change towards an economy that puts the right value on positive climate change and environmental outcomes. The support of KKR and Ontario Teachers’ will be invaluable as we look to further our international impact,” Schultz said.

Since the investment by KKR’s Global Impact Fund, which seeks to invest behind scalable, commercial solutions to solve critical challenges identified by the United Nations Sustainable Development Goals, GreenCollar has successfully grown its capabilities and offerings through several acquisitions and expanded internationally. Most recently, the company has strengthened its carbon trading marketplace through the acquisitions of carbon advisory and trading firm Sigma Global, Queensland carbon farming business, Devine Agribusiness Carbon, and the consumer-facing offsets platform Go Neutral. It also recently formed a partnership with leading soil carbon operator, AgriProve, expanding its position as the only industry operator to offer the full suite available of nature-based carbon farming methods.

George Aitken, a Director on KKR’s Private Equity team in Australia, said, “We are delighted to welcome Ontario Teachers’ given their significant expertise in the natural resources sector. KKR is aligned with Ontario Teachers’ in our commitment to drive positive environmental impact and we are confident this new strategic partnership taps into our collective strengths to position GreenCollar for its next stage of growth. Carbon credits and environmental offsets remain an important part of the transition towards sustainability and GreenCollar’s continued growth will help to scale this effort further.”

With this new investment, Ontario Teachers’ will join KKR in supporting GreenCollar’s international expansion as well as its growth across water, nature and plastics. Just this year GreenCollar celebrated the establishment of the Reef Credits Registry, validating its foundational work in establishing a world-first water quality market targeting the Great Barrier Reef. It also established a range of pilot projects to reward the positive biodiversity outcomes of good land stewardship under its Nature platform, and registered Australia’s first and the world’s second project under Verra’s plastics standard.

Internationally, GreenCollar’s expansion into new regions includes its plastic recovery projects in West Africa and the Pacific, cook stoves projects in Southern Africa, and its first forest protection projects in South-East Asia.

Again, a great co-investment alongside KKR in a leading company that will play a critical role in the fight against climate change.

You can learn more about GreenCollar here.

GreenCollar is Australia’s largest environmental markets investor and project developer. We aim to prove that the best way to achieve lasting environmental outcomes is to place a value on the environment and enable markets to provide incentives and payment for sustainable land management practices and ecosystem services.

We help farmers, graziers, traditional owners and other land managers to identify and create commercial opportunities through nature-based projects that enhance their productive agricultural enterprise while caring for the environment and delivering tangible social and economic benefits.

We work to create new methodologies and markets that place the environment on the balance sheet, and ensure money flows to the people living and working on the land that deliver environmental benefits for all.

We work with land managers, corporates, government, research organisations, traditional owners and other stakeholders to create methodologies and markets that place the environment on the balance sheet, and ensure money flows to the people living and working on the land that deliver environmental benefits for all.

There are common themes in all these investments:

- Investing in top quality global private assets with or without great strategic partners

- Assets that offer great long-term cash flows that are more attractive than bond yields (with more risk than bonds but less risk than equities)

- There's an inflation kicker embedded in these assets

- And last but not least, assets that will impact the environment in a positive way, reducing carbon emissions, speeding up the energy transition economy.

Lastly, since I am on the topic of infrastructure and it is a holiday week, Andrew Willis of the Globe and Mail reports that OMERS sells stake in Scottish gas network for $1.6-billion:

The Ontario Municipal Employees Retirement System pension fund sold a long-held stake in the U.K.’s second-largest natural gas distribution network on Wednesday for $1.6-billion, more than tripling its original investment and raising capital for new infrastructure projects.

Toronto-based OMERS acquired a 25-per-cent stake in utility Scotia Gas in 2005 for $555-million, and announced it is selling the holding to Global Infrastructure Partners, a US$77-billion private equity fund based in New York.

OMERS did not disclose financial terms of the sale, however, a source involved in the transaction said the sale price was $1.6-billion. The Globe and Mail is not naming the source because they are not authorized to speak for Scotia Gas and the two fund managers. The deal is expected to close in the first quarter of the new year.

“Scotia Gas was our first infrastructure investment in Europe, and we are very pleased with the company’s 17-year track record of successful value creation,” said Alastair Hall, head of European investments for OMERS’s infrastructure division, in a news release. “We will redeploy the capital back into growing our $30-billion direct global infrastructure portfolio.”

The other shareholders in Scotia Gas are the Ontario Teachers’ Pension Plan, which also initially invested in 2005, and a fund controlled by Brookfield Asset Management Inc., which acquired its interest in August. Each of those two partners holds a 37.5-per-cent stake.

Scotia Gas serves six million customers in England, Scotland and Northern Ireland through a 76,000-kilometre pipeline network. In recent years, the 3,800-employee company has invested in hydrogen and carbon capture technology to reduce emissions, including a partnership with Exxon Mobil Corporation announced earlier this month.

Two decades back, Canadian fund managers such as OMERS, Teachers and the Canada Pension Plan Investment Board were among the first institutional investors in the world to begin making direct investments in relatively low-risk infrastructure businesses such as Scotia Gas. The gas distribution business generates dependable, long-term cash that suits many of a pension plan’s investment targets.

Today, most pension fund managers commit a significant portion of their portfolio to infrastructure, along with other alternative assets such as real estate and private equity. A recent survey by the London-based data service Prequin shows institutions have doubled the capital they dedicate to the sector over the past five years, to more than US$800-billion. This flood of money has increased demand for assets, boosted valuations and is triggering deals.

“The infrastructure deals market has emerged resiliently from 2020, with larger assets starting to trade after a wait for an improved exit environment,” said Alex Murray, a Prequin vice-president, in a report. “Rising inflation concerns mean infrastructure is likely to gain more traction as investors look to utilize its hedge inflation mechanisms.”

OMERS’s infrastructure portfolio posted an 8.6-per-cent return in 2020, and was the $114-billion fund’s best performing asset class. OMERS manages retirement savings for more than 500,000 Ontario civil servants, including firefighters, police officers and paramedics.

Infrastructure consistently ranks among the best performing alternative asset classes, returning 13.9 per cent over the past 12 months, according to a survey released in October by Prequin. The consulting firm’s study showed infrastructure outperformed all other alternative asset classes, except private equity, over the previous three and five years, and only real estate did better over 10 years.

BofA Securities advised OMERS on the Scotia Gas sale, and the fund manager used law firm Latham & Watkins LLP. The transaction marked the second shakeup in Scotia Gas’s ownership this year, after U.K. renewable energy producer SSE sold its 33.3-per-cent holding during the summer for £1.2-billion, or $2.1-billion, to Teachers and Brookfield.

I covered why OTPP acquired a bigger stake in UK's Scotia gas back in August.

You can read my comment here.

Why is OMERS selling its stake? Alastair Hall, head of European investments for OMERS’s infrastructure division, stated this in the news release: “We will redeploy the capital back into growing our $30-billion direct global infrastructure portfolio.”

They bought in for $555 million back in 2005 and are reportedly getting $1.6 billion from Global Infrastructure Partners for their stake (these big infra funds add competition but are also natural buyers when it’s time to sell an asset).

It's still a great asset which is why GIP is buying OMERS' stake and why OTPP isn't selling its stake.

It's just that OMERS will realize on its investment and it sees other attractive opportunities to redeploy that capital in global infrastructure.

Alright, let me wrap it up there.

Below, an older (September 2020) interview where Spark Infrastructure Group (SKI) CFO, Gerard Dover spoke with Tom Piotrowski about the strategic vision of the company, the pipeline of projects as a part of the energy transition in to renewables and its FY20 results & guidance.

Listen carefully to his comments and the low risk around revenues of their assets and how their 6% growth is mostly participating in the energy transition economy. This is a fantastic asset to own over the long run for KKR, OTPP and PSP Investments.

Comments

Post a Comment