What Do Asset Owners Expect in 2022?

Asset owners think in years rather than months, but investors expect a handful of key areas will define the year ahead. A clearer view on inflation; poor bond performance and a resurgence in labour rights to name a few.

Inflation

This year investors will find out if inflation is just a temporary blip caused by energy and supply chain bottlenecks, or here to stay thanks to massive Central Bank stimulus in response to the pandemic.

“Central Banks’ ability to combine the conflicting objectives of economic recovery and maintaining the solvency of States with quelling demand-pulled inflation will be crucial in 2022,” says Olivier Rousseau, executive director of France’s Fonds de Reserve pour les Retraites.

While over the past year investors have had varying opinions on inflation, many now believe the Federal Reserve has largely read inflation right. It’s a view held by Charles van Vleet, assistant treasurer and chief investment officer of pension investments at US conglomerate Textron.

“I think the Fed is directionally correct on inflation. Most of the recent inflation is transitory. Q1 2022 will reveal the largest year-on-year increase but settle materially lower by Q4,” he predicts, adding that inflation will continue to drive flows into real assets like timber and property.

Central Bank policy to manage inflation will increasingly transform today’s low volatility high liquidity investment landscape into the exact opposite, predicts David Ross, managing director, capital markets at Canada’s OPTrust. Inflation and interest rates are important to the fund which has around 20 per cent in fixed income and has a liability-driven approach to building resilience in its portfolio.

“With real rates well into negative territory, the market’s uncertainty about the Federal Reserve’s reaction will leave interest rates as a source of volatility and likely driver of the performance of risky assets in the coming year,” Ross says.

Asset classes

This year will be a continued tough environment for bond investors according to Rousseau.

“I see no value in bonds and among the asset class the least bad is probably high yield credit,” says Rousseau who oversees a portfolio divided between performance seeking assets and a liability-hedging allocation invested in government bonds and investment grade corporate bonds.

Elsewhere, the prospect of rising interest rates is already weighing on fixed income.

“The fixed income markets have priced three tightening’s without missing a beat. We expect the 10-year UST to close the year +/- 2 per cent,” says van Vleet.

Another CIO of a UK-based pension fund who declined to be named predicts bonds will have a second year of negative returns in a row: “The whole of the fixed income spectrum, both public and private, looks very unattractive to us.”

With mixed forecasts for equities, expect a “bumpy” year ahead.

“Equities is a very bifurcated asset class. Growth stocks are expensive and vulnerable to a sizable rise in interest rates. Value stocks are darn cheap in Europe and Japan and probably just a bit expensive in the US. Emerging markets may still face a difficult year, but their time will come,” says Rousseau.

In contrast, van Vleet is more positive on US equities.

“We are expecting a solid year for growth assets – S&P earnings growth of 12 per cent leading to SPX returns of 8 to 10 per cent.”

He also believes that China A-shares will be the surprise upside trade – while emerging market equity and fixed income will be the surprise downside trade.

Elsewhere investors see value in real assets (real estate and commodities) but note credit appears more vulnerable given the relatively tight level of spreads.

“Gold is likely to be challenged if real yields continue to rise from their historically low levels,” adds Ross who also argues that emerging market equities may, in fact, regain lost ground in 2022.

“The current equity landscape has been characterized in recent years by the outperformance of the US market versus emerging markets and the rest of the world, as well as by large caps over small caps. With China easing policy and emerging markets likely to finally benefit from what has been a delayed recovery from the pandemic, there is scope for emerging market equities to regain some relative ground.”

At Textron, strategy will continue to lean into trades the pension fund already has onboard and continue to work, including value-added real estate, GP-secondaries, CLO risk retention, and BDCs

Bubbles

The classic bubble signs in tech, clean energy, crypto and SPACs are likely to deflate – although neither the precise timing is easy to predict, or the corporates best positioned to survive.

Rousseau believes crypto, particularly, could keep charging ahead for some time unless two factors spelling disaster appear: a significant rise of short-term interest rates, large scale fraud or government actions (à la China) leading to permanent investor losses.

“In this case, all trust would evaporate – potentially creating systemic problems,” he says.

Still, investors qualify that even if the speculative flows that have been driving price action in crypto and technology likely reverse, long term trends are not going away.

“The structural forces driving both the development of digital assets and financial technology and the necessary shift towards climate-friendly economies and portfolios are not going away. In fact, they are likely to intensify,” says OPTrust’s Ross. “From a long-term perspective, crypto, technology and green assets are major investing themes that are likely going to grow in importance in the years to come.”

Labour rights

This could also be the year labour rights get pushed centre stage with implications for companies on the back foot and wider corporate health.

“Expect a fight from labour to get a better share of the pie. In the US where things have been massively distorted in favour of companies, the cliff is potentially high,” warns Rousseau who argues labour has missed out on “decades” of its share of the distribution of added value.

“If the world starts imitating China in the fight against abuses from the tech monopolies the corporate world will have a rough ride. Europe is doing a bit of this but on a small scale. The US is still by and large captive of the corporate world,” he says.

This is an interesting read which caught my attention.

In particular, I honed in to what David Ross, managing director, capital markets at OPTrust said about how central bank policy to manage inflation will increasingly transform today’s low volatility high liquidity investment landscape into the exact opposite:

“With real rates well into negative territory, the market’s uncertainty about the Federal Reserve’s reaction will leave interest rates as a source of volatility and likely driver of the performance of risky assets in the coming year,” Ross says.

David is right, the real Fed funds rate is well into negative territory and the market is increasingly nervous the Fed is behind the inflation curve:

Real yields on 10-year bonds are the least negative now since April 2021. pic.twitter.com/amNkbQJNgH

— Lisa Abramowicz (@lisaabramowicz1) January 13, 2022

Last week, I wrote my Outlook 2022, Beauty and the Inflation Beast, and stated the three major themes to watch this year are inflation, monetary and fiscal policy.

I told my readers to keep their eyes peeled on rates and flat out stated, the speed of normailization matters most here because if rates back up too quickly, it will spell big trouble for equities.

I also stated that while I see inflation peaking in Q1, it will still remain at historically high levels, forcing the Fed to act if it persists past the first quarter.

This week, we found out US CPI rose 7% in December from a year earlier, the fastest pace since June 1982. Excluding food and energy, so-called core CPI was up 5.5% on the year, the biggest growth since February 1991.

Inflation rises 7% over the past year, highest since 1982 https://t.co/ile1fBT0bi

— Leo Kolivakis (@PensionPulse) January 12, 2022

These are big figures we haven't seen in 40 years!

Not surprisingly, wages are rising but they're not rising anywhere near as fast as inflation, so in real terms, employees aren't making any headway in this environment:

Despite higher wages, inflation gave the average worker a 2.4% pay cut last year https://t.co/pTm47TjKAL

— Leo Kolivakis (@PensionPulse) January 13, 2022

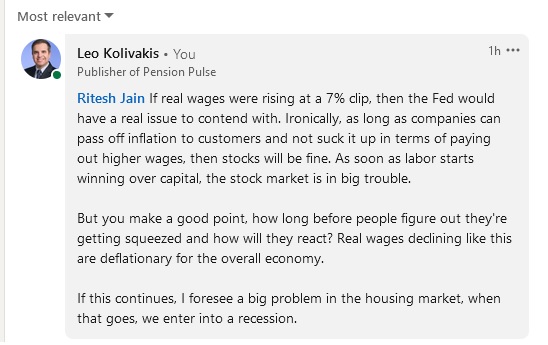

In fact, Ritesh Jain posted this on Linkedin:

And I replied:

The key thing to watch here is if we have wages start rising faster than expected because this will change the inflation dynamic and the way the Fed responds.

Earlier today, I had a nice phone conversation with Senator Clément Gignac, catching up with him.

It was over twenty years ago that Senator Gignac, or Clément as we call him, was our boss at the National Bank Financial where he was the chief economist and chief strategist.

Back then, we were living through the bear market of 2001 and Clément gathered our small group of economists which consisted of Vincent Lépine (now at CIBC Asset Management), Stéphane Marion (now chief economist the National Bank) and me to warn us:

"We are entering a very deep bear market and in bear markets, clients listen to economists, not stock analysts so we need to keep working hard to deliver great content."

And boy did we work hard. We spent long hours with Clément putting together his client presentations and we had to really understand what was going in the economy and link it back to markets because it was rough and volatile.

Anyway, Clément and I talked about pensions and ESG investing and at the end I couldn't help ask him what he thinks about inflation persisting and how the Fed will react.

He told me he thinks this will be "a short cycle" and that those who think the Fed will "engineer a soft landing" are likely to be wrong.

On the supply front, he said that supply chain disruptions are real and China's "zero-COVID policy" is exacerbating them. That will remain a problem this year.

This might be the next big story... zero-COVID policy China has a big outbreak, slams everything shut, no more product from them, supply chain backlog "fixed" (of course in the worst way possible).

— Jim Bianco biancoresearch.eth (@biancoresearch) January 12, 2022

And yes, they will slam shut if cases spike!https://t.co/vcRhWvPbv9

On the demand side, he said that monetary and fiscal policy remain "highly accommodative", there’s a “powerful wealth effect” driving demand and that working from home seems to be the new normal "and employees, not companies, have the power now."

He sees wage inflation but nothing like the 1970s. "Still, it will force the Fed to act more aggressively and that means we will likely see a recession in 2023."

He said the Fed and other central banks might move their inflation targets higher but "there's a real risk doing so and the market might question their credibility."

He added: "The only positive is technological innovation will continue and that will dampen inflationary pressures."

In terms of stocks, he thinks we are in for a rough ride this year, and by the way stocks have been acting these past two weeks, I can't say I disagree.

A lot of people are betting on the "Fed put" but as J.P. Morgan Asset Management’s fixed-income chief Bob Michele warns, this could be a huge mistake:

In a list of five “realistic surprise predictions” with colleague Kelsey Berro, Michele says 10-year Treasury yields could rise to as high as 3% this year from 1.766% currently. The baseline trading range is seen at a more modest 1.875% to 2.375%.

The J.P. Morgan team also expects the Fed to raise rates four times in 2022 starting in March.

“Without the central bank purchases and with cash now offering some yield, let’s see how willing investors are to continue to purchase long-duration government debt at significantly negative real yields,” Michele and Berro wrote.

Michele also warns stock bulls risk overestimating the Powell Put, or the belief that the central bank will meet every potential market hiccup with easier policy.

“We disagree and think the Fed would let the markets drop much further if their primary concern was battling inflation,” Michele said. “The strike of any put is likely to be declines of 15%–30% in equities, not 2%–3%.”

Another well-known stock commentator also thinks the Fed will be way more aggressive than the market is pricing in right now:JPMorgan’s Bob Michele Says Hide in Cash With Treasury Yields Going Higher https://t.co/QwBfJfX4cC via @Yahoo

— Leo Kolivakis (@PensionPulse) January 13, 2022

Fed has to be ‘far more aggressive … than the Street thinks,’ says academic who called Dow 20,000: ‘This is too much money chasing too few goods’ https://t.co/3hW9SjuaNy via @Yahoo

— Leo Kolivakis (@PensionPulse) January 13, 2022

That all remains to be seen but as John Mauldin stated in part 1 of his outlook, A Path-Dependent Year—WWJD?, the Fed's choices are limited here, especially if inflation continues to rise.

What does all this mean for asset owners? It means they can expect a lot more volatility this year and that it's best to remain highly diversified across regions, sectors and strategies, and that across public and private markets.

Below, Priya Misra, Global Head of Rates Strategy at TD Securities, joins Worldwide Exchange to discuss Fed policies, and expectations for how they will mitigate inflation.

And noted Fed-watcher Jim Bianco, president of Bianco Research, joins Yahoo Finance's Jared Blikre to break down what promises to be a challenging — but potentially rewarding — year for investors.

Comments

Post a Comment