Catching Up With Nathalie Palladitcheff, CEO of Ivanhoé Cambridge

1. Hello Nathalie, thank you for agreeing to answer some questions, I really appreciate it. I’d like to begin with some good news. It was recently announced you will serve as Chair of REALPAC for a two-year term starting on January 1, 2023. Can you share with us the purpose of this organization, what will be your role and what is your vision for REALPAC?

It has been a pleasure to be part of the REALPAC team for the past few years, as I held the position of Vice Chair over the period of 2021-2022. I look forward to working more closely with Michael Brooks and his team, and of course, all the other board members.

In the last 2 years, REALPAC hit new milestones on many fronts: the appointment of Toni Rossi as Chair in 2021 & 2022, membership, member services, technology, and engagement. It reflects the increased pace of the industry, a new operating environment and the amplified expectations of our tenants, investors, and other stakeholders.

My appointment comes at a time where commercial real estate faces challenges. After the turmoil caused by COVID-19, interest rates and inflation are now making things more complex. These times call for collaboration, agility and innovation.

I intend to put my abilities and extensive global experience to work to help improve the Canadian real estate landscape, so it becomes a model internationally, particularly when it comes to sustainability. Canada has the conditions and characteristics to set an example for the rest of the world, whether in terms of democracy, resources, or talent. This makes Canada an ideal country for international investors, who are increasingly numerous. It is essential to join forces to seize opportunities and adopt the best global practices.

2. Another piece of good news. Ivanhoé Cambridge just announced that you have obtained the EDGE Certification, which measures, evaluates and recognizes organizations for gender and intersectional equity. That represents a significant step concerning the social impact and inclusion aimed at making Ivanhoé Cambridge a sustainable and inclusive employer and investor. As a female leader, part of a very small club in North America, what does this represent for you?

This means the world to me, and to all of us at Ivanhoé Cambridge. Making diversity, equity and inclusion a priority is the key to creating and investing for a sustainable future, and human capital is at the heart of our success as a company. I often say that, to be true to yourself, to your values, and to your convictions, you have to be rigid about your values, but flexible about everything else. The fact that we are now EDGE Access and EDGEplus certified and that we've joined more than 150 organizations that also put DEI in the forefront totally aligns with my convictions and IC’s values.

3. The last time we spoke was exactly two years ago. You had attended COP26 in Glasgow and shared your thoughts on accelerating the real estate transition. You recently posted on LinkedIn that you will take part in a plenary session at a conference in Paris with major players from around the world and will discuss the importance of collaboration as we rethink global trade and the economy in the face of climate change. Can you share some insights on this conference and topic from your vantage?

As real estate investors, it’s important that we be a part of the solution. To do so, we need to be even more intentional and proactive. Ivanhoé Cambridge set an ambitious objective of achieving a carbon-neutral international portfolio by 2040 – and want to be ahead of conversations with our peers and in global forums such as the 2022 Conference of Paris.

In Paris, I had the pleasure of speaking with Cassandra Lichnock, CEO of CalSTRS; Frédéric Oudéa, CEO of La Société Générale; and Yngve Slyngstad, CEO of Industry Capital Partners. Our discussion “Redefining dialogue” was very insightful.

On the topic of world stability, we are looking at geopolitics with a risk -return lens, since it clearly has a growing influence on our investment strategy and decision-making compared to the previous decade.

There is clearly a lack of collaboration in our industry because common goals are not well recognized yet, so we need to ensure interest alignment. The main key action required to bring about long-term growth, resilience and stability with the transition that is challenging the status quo, is the review of asset valuations to take into account the carbon factor.

4. Also, the last time we spoke, we were joined by Stéphane Villemain, Head of Sustainable Investment. Can you share with us some ESG milestones achieved at Ivanhoé Cambridge since then? Also, is green premium getting more important to the point where it’s a must have in an institutional portfolio? What about carbon negative buildings? I’ve also had conversations with real estate professionals who tell me that in Europe, they are looking into carbon negative buildings, really pushing the envelope there. Do you think that they are coming to North America anytime soon?

We have accelerated our initiatives and moved from commitment to action; therefore, fully integrating our ESG goals into our overall strategic plan.

Green is part of this strategy: with a brown-to-green lens, i.e. investing our capital to transition these brown assets into green, we have the most impact. We are in the process of identifying the best course of action for our higher emitting properties and we have also modelled the impact of climate risk on our portfolio. As for carbon negative buildings, they are still marginal. The main challenge is to fix the existing building stock (which is largely brown currently), rather than focusing on new builds which are obviously greener from the start.

Furthermore, we have made progress on the S of “ESG”. Examples are the implementation of the WELL Equity pilot, ILPA Diversity in Action, EDGE certification and the unconscious bias training to almost all our staff. We have also shifted our own organization with ESG leads per region to get closer to our regional/local partners and assets. We have linked together ESG performance targets with financial incentives. We have also issued our first social loan for US-based assets, and we got recognized at the IPE Real Estate Global Conference & Awards 2022 with the IPE Real Estate ESG Award.

Europe still leads the way in terms of ESG ambitions in real estate (as for other sectors). North America is catching up though.

5. Let’s move on to investments, with interest rates moving up abruptly all over the world this year, it looks all but certain that a major global recession lies ahead. At least that’s my forecast. I see a hard landing ahead as US and other yield curves are the most inverted in 40+ years and inflation pressures remain sticky. I know Ivanhoé Cambridge reported decent performance in the mid-year update and will likely close the year on a positive note but with REITs down 20% this year, it looks like next year will be challenging for private real estate portfolios. How do you see the macro environment and how are you positioning your portfolio for what lies ahead?

In the current economic context, things are definitely more complex. We are looking for the underlying assets that fulfill the best desired risk-return conditions, allowing us to achieve the best portfolio construction. Our focus remains on three long term fundamental trends, which are demographics, urbanization, and digitalization.

At the end of the day, our mission, aligned with that of the CDPQ, is to generate long-term performance for Quebec depositors, while having a positive and sustainable impact on the communities where we invest. All our investments are made with this in mind.

6. In terms of Ivanhoé Cambridge’s portfolio, I recently covered how you are partnering up with NVELOP to expand your logistics portfolio in Germany, all part of your logistics strategy in continental Europe that was initiated with the Hub & Flow portfolio in February 2020. Can you share with us why Hub & Flow is so critically important and why you still see opportunities in logistics properties in Europe?

The logistics sector is one of the major axes of our strategy globally, as it is still driven by strong structural megatrends: the rise of e-commerce, the evolution of consumption habits, supply chain evolution, the growth of urbanization and the digitalization of the economy. The sector also benefits from a strong rental momentum.

For instance, in Europe we aim to create leading logistics platforms focused on the key hubs of the continent and we invest in top-quality assets that can benefit from future value creation. We doubled the size of our Hub & Flow portfolio since its acquisition in 2020, to now reach more than 700,00 sqm. Initially located in France, this portfolio expanded in Continental Europe with the acquisition in May 2022 of a 115,000 m² asset in Hamburg, Germany.

Our logistics strategy in Europe also involves two other platforms: a partnership with PLP in the UK and a collaboration with URBZ Capital to develop a last-mile logistics strategy with more granular assets. Ivanhoé Cambridge also is invested in logistics in North America, in Latin America (partnership with Prologis) and in the Asia-Pacific region (partnership with LOGOS).

7. Another really important sector in real estate is life sciences properties. Ivanhoé Cambridge, Oxford Properties, Cadillac Fairview and other large pension funds are investing heavily in this sector. Is this more a defensive play, similar to student housing or a secular play over the long run?

Investors look to life science real estate for its performance, resilience, and diversification. So do we. It is important to anticipate community needs. Covid has led countries to better think about their independence and health needs. This sector (life sciences) is much supported by secular trends. Life sciences buildings are the perfect example for specialization of spaces based on the type of work that you can’t do at home. We are proactive in the way we invest, for example by developing innovative strategies through the creation of platforms. We have defined a specific allocation to it and focus on clusters near academic and research institutions. We are one of the largest investors in life sciences in the world. We started in the United States – and we have a major project in Boston – and we have continued to invest in this segment, in India and in Europe.

We also have a strong interest for other alternative real estate asset classes such as student housing (ex.: our recent partnership with SCAPE in Australia), co-living (a few weeks ago, we acquired a share in the Cohabs platform, a Brussels-based company specializing in shared housing for young professionals), data centers, self storage, and film studios (we are a co-investor in TPG Real Estate Partners fund, which owns the Cinespace Film Studios that are leased to Netflix and other major players in the industry). Although alternative real estate is a growing focus for Ivanhoé Cambridge, our focus remains on the diversification of traditional asset classes.

8. Which areas of real estate do you find attractive right now and in which geographies? Can you please break down Ivanhoé Cambridge’s portfolio by sector and geography?

Currently, most of our assets are in North America (Canada and United States). We are continuing to move towards greater geographical diversification of our portfolio globally, for instance in Europe, Asia-Pacific, and Latin America where we have an office in Brazil. In Asia-Pacific, we even opened an office in Sydney last October to manage the growing allocation of our portfolio in the APAC region. This new office is in line with Ivanhoé Cambridge’s development strategy for the Asia-Pacific region and emblematic of its desire to amplify investments in its primary markets in that region, namely Singapore, Australia, India, and Japan. The Asia-Pacific region continues to be a source of portfolio diversification and performance, and we intend to continue to grow there. In Europe, our business is focusing on our three main markets (France, United Kingdom, Germany) and we want to accelerate our diversification and strengthen our exposure in other countries, such as Northern Europe (Belgium, The Netherlands), Southern Europe (Spain, Italy), Central Europe and the Scandinavian countries.

Globally, our four main sectors are industrial and logistics, residential, offices and retail. We will continue to invest in these sectors while accelerating our diversification within these asset classes and at the edges, particularly into alternative asset classes or mixed-use properties.

9. CDPQ’s CEO Charles Emond recently stated that its assets in Quebec will increase to $100 billion by 2026 and real estate and infrastructure will figure prominently in this strategy. He referred to mixed-use properties and I know that Ivanhoé Cambridge still has many retail properties in Quebec and across Canada. Are you planning on revamping these properties to convert them to mixed-use? Is this easily done?

Five years ago, the reality of institutional investors was the following: you had offices, shopping centers and a little bit of residential. Nowadays, portfolios of institutional investors are much more diversified to address major changes and resilience (logistics, mixed-use residential, offices, and shopping centres as the smallest asset class).

Since the beginning of 2022, we have a Quebec (Economic Development) team, led by Élise Proulx. Business development in Quebec is important to secure our legacy in the province and fulfill our dual mission of value creation for our depositors and communities.

10. There is still a lot of discussion debating working from home versus working from the office. Pension fund CEOs I talk with emphasize flexibility and tell me the hybrid model is here to stay. Do you agree and if so, what is the future of offices? Will they need to be converted to multifamily properties?

The main place of work remains the office, creator of culture and collaboration. It is our duty to redefine the office experience and find new vocations for them to stimulate user engagement. We are witnessing landlords taking a page from the hospitality playbook: details matter, and the occupant must feel like a guest, included, and as though we have created a bespoke experience. For instance, the addition of concierge services and dynamic programming within our office spaces. In that sense, we are continuously looking for ways to innovate and ensure a sustainable impact.

There are still things to learn from ongoing experiences and many unresolved questions on the employer side. Most are still in “wait and see” mode.

11. Lastly, do you want to share any parting thoughts with my readers on what you’d like the future of institutional real estate to be like or any other parting thoughts?

The future of real estate relies on sustainability and inclusion. These two components go hand in hand and I’m trying to do my part.

Thank you! Merci beaucoup!

I want to begin by thanking Nathalie for taking the time to answer most of the 16 questions I sent her.

She answered the most important ones and I agree with her, the future of real estate relies on sustainability and inclusion.

Real estate was often thought of as location, location, location -- which is still important -- but now you need to think of sustainability and diversification, both by geography (APAC) and by sector/ industry. (logistics, student housing, film studios, etc.).

Nathalie gave a great example of why apart from the secular trends, life sciences properties require specialized real estate where people cannot work from home, they need to go in their workplace to work in a lab and you need to create the perfect workplace to entice companies to sign long-term leases with amenities that appeal to their specialized workforce.

That goes for life sciences, tech, finance and other fields, you cannot have a 1980s mentality when buying, developing and managing large commercial real estate.

You need to find strategic partners who share your values on sustainability, inclusion and diversity because at the end of the day, real estate portfolios are an integral part of the solution or large pensions and sovereign wealth funds to decarbonize their portfolios.

I'll put it to you this way, when you look at any large pension fund in Canada, even though real estate allocations average around 12-15% of the total portfolio, they emit a lot of carbon in the total portfolio and you need to retrofit existing buildings and set high standards for buying new ones.

I recently had a discussion with Jamie Gray-Donald, Senior Vice President, Sustainability & Environmental, Health & Safety at QuadReal to discuss how they are targeting net zero for their entire portfolio by 2050 and their strategy includes reductions of scope 1, 2 and 3 carbon emissions, with Canadian property-level plans to be in place by 2025.

He explained the difference between green-certified buildings and net-zero buildings as well as the difference between carbon audits and energy audits, stating that net-zero buildings are the future, more so than LEED certified buildings:

LEED buildings are better from a sustainability standpoint. Often on the energy efficient and carbon reduction, they get you about 30% of the way there. LEED buildings don't have a net-zero requirement. They have requirements and get lots of points for more energy efficient buildings but they haven't necessarily given significant points to fully electrified buildings. Net-zero takes it further to when natural gas boilers need to be replaced instead of relying on fossil fuel based options.I asked him in their portfolio if any buildings have achieved this net-zero status:

I can't give you exact numbers but the majority of our office buildings are LEED certified. 95+% of our buildings are certified to BOMA Best which is the Canadian green building certification which is more broadly applicable to residential buildings, retail and warehouses. From what we can tell, we are about 30-40% on the way there toward net zero and some leading offices are already at 60-70% carbon reduction. In our Canadian portfolio, we don't have any building which is net-zero certified yet. We have a new office building in London that was built to the UK net-zero standard and another one that is retrofitting to the UK net-zero standard.I asked if he thinks this is the wave of the future, that buildings will be required to go beyond LEED and shift to a net-zero standard:

Yes, definitely. We see regulatory pressure, right now it's mostly at the city level where cities are changing their code requirements for new developments and phase in code requirements on existing buildings. Then we see a lot of Fortune 500 companies with net-zero commitments but have not included net-zero requirements in their leasing commitments but we see that coming over the next few years. We want to get ahead of regulation and market demand knowing it takes a few years of planning and implementation to achieve this. The way we are doing it, we are not just buying carbon offsets, we are making rational changes to equipment and building that takes a couple of years of planning and capital allocation.

Interestingly, the last time I spoke with Nathalie two years ago, she discussed future-proofing the real estate portfolio:

Nathalie told me she is Vice Chair of REALPAC now and she is trying to change the culture of the industry to be more proactive, collaborative and transparent to accelerate the transition to net zero.

This is critical because the industry must advance in unison to do its part in addressing climate change and Nathalie also stressed other reasons, like addressing valuations of assets during this transition period "which is something for the time being we do in a very competitive way, each of us talking to the same valuators but having some trade secrets we don't share."

She added: "We are at a point where we should on the contrary really share a new methodology in the way we are going to take into account CAPEX relating to decarbonization."

I asked her if appraisers are integrating ESG into their valuations?

She answered:

"It's a key element we will have to change because for time being, sometimes they will increase the risk premium if they think the building isn't so green or they take into account CAPEX when we as a landlord tell them we are going to renovate (to make it more energy efficient) but they don't really take into account that the liquidity is going to change dramatically if we don't do anything. So, doing nothing is not even an option for us because if we want our buildings to remain valuable in the future, then we will have to move. For time being it's like black and white, so if we say we want to turn this building into a green one, then we will magically decrease this value by 20% because of CAPEX, but on the contrary if don't do anything, then they will decrease it by I don't know, let's say 2% each year. We will potentially end at the same spot but the thing is it will happen sooner rather than later. So, they will have at a certain point make this ESG shock in the values that they are not really taking into account and of course, nobody wants that, nobody wants the value to decrease by 20% tomorrow so we have to really think as an industry how we will move without being penalized by the appraisers but it's not up to the latter to tell the industry how to move. The entire industry needs to engage as one to further the conversation so we are all on the same page when it comes to integrating ESG in valuations."She added:

"Real estate (and other private assets) is where the revolution lies, this is where disruption will take place. For me, it's not going to be like this building will be discounted a little bit, at one point, it will be zero or one. Liquidity is the main risk in our industry, when you can't find a buyer, there's no value. At a point electricity came into buildings, now you can’t buy a building without electricity. At a point ESG standards will be the same, nobody is going to buy a building where you cannot guarantee the quality of the air, especially after the pandemic, all these factors will be the new normal."

There is no question the green premium is becoming a lot more important to the point where it’s a must have in an institutional portfolio.

This is especially the case in Europe where sustainable buildings have increased the asset values for commercial real estate managers, according to research from Deepki:

More than half of the commercial real estate managers say property values have increased between 16% and 28% because of a green premium, which is the added value of using more sustainable offerings because tenants are willing to pay more for more efficient buildings. More than a quarter of respondents say their rental yields have increased for green buildings.

The industrial sector is the most likely to use sustainable commercial real estate, according to 64% of the respondents. Healthcare followed, with 48% of respondents saying the sector is most likely to use green buildings, and retail came in at 45% according to the research. The sector having the least impact in terms of sustainable space was lodging and resorts, which came in with 4% of the responses.

A third of the respondents also say vacancies have decreased by as much as 15% for sustainable buildings, with 36% saying their void periods have fallen by up to 25%.

“Commercial real estate managers who are taking steps to understand and enhance their ESG credentials are helping to meet their net zero goals and deliver better performance for investors,” says Deepki CEO Vincent Bryant. “Buildings with better sustainability ratings are more likely to be occupied which increases their overall rental income.”

Buildings are a significant source of emissions worldwide, with a growing focus on lowering their carbon footprint.

The World Economic Forum reports that green certifications of properties can result in a rent premium of 6% and a sales premium of 7.6%. Still, the WEF says retrofits to make improvements in existing commercial real estate are at around a 1% to 2% rate and it will take $5.2 trillion over the next decade to decarbonize the built environment and green real estate.

In the United States, the Department of Energy says 30% of energy from commercial buildings is wasted.

Improvements can be made through operations such as automated building management systems as well as efficient lighting and heating and cooling systems. A four-building office complex in Atlanta is an example of a commercial property taking on those efforts in an attempt to be one of the most sustainable developments in the area, including a 1-megawatt solar plant on site.

Earlier in 2022, Measurable acquired Hatch Data to improve its smart ESG management platform for commercial real estate, including tools to meet carbon goals and compliance needs, as an illustration of a system to help monitor building sustainability. Deepki also has an ESG data intelligence platform to help commercial real estate investors and operators with net-zero efforts.

The Deepki research was conducted with 250 commercial real estate management professionals from the United Kingdom, Germany, France, Spain, and Italy.

As Nathalie stated, Europe is in the lead in terms of sustainable commercial real estate properties but North America is catching up.

My sources tell me some European LPs are looking at carbon negative buildings which is taking it a step further.

Last year, McCaffery, Ivanhoé Cambridge and Hines kicked-off construction on T3 RiNo, which is being developed into a six-story, 238,726-square-foot T3 (Timber, Transit and Technology) office building, and will be one of the most environmentally friendly and sustainable developments in Denver.

All this to say there are a lot of exciting developments in commercial real estate, both from a sustainability standpoint and from a diversity standpoint.

Having said this, there's a lot of work left to do and the environment for real estate is getting a lot harder with rising rates and a looming global recession.

Experts I talk to tell me in terms of decarbonizing a real estate portfolio, the first 25% of decarbonizing an existing building is easy low-hanging fruit. The next 25% is hard and the last 50% is nearly impossible to do financially, you must have new technologies to get there.

There are emerging technologies, look at Ivanhoé Cambridge's pilot project with Turntide Technologies at two of our Canadian shopping centres, but I agree, we need a lot more innovation to reach the scale we need to revamp older buildings and make them more energy efficient in every way.

Another issue? Glass skyscrapers, some of which Ivanhoe and other large Canadian pension funds have developed.

In 2019, former New York City mayor Bill De Blasio said “glass skyscrapers have no place on our Earth”. He received criticism but environmentalists praised him.

One expert told me these glass buildings are almost like buildings using plastic on the windows as an extra layer of insulation:

If you are really serious about "built to last" buildings in an era of Net Zero, shouldn’t you focus on building more non-glass exterior cladding and highly insulated and air-tight buildings? Building certifications are virtue signaling, not a performance certificate! It’s all about the building envelope.

The other issue I keep raising on my blog is this time is different, it's much worse!

I'm increasingly worried that we are headed for a deep and protracted global recession and the likelihood of a double dip recession similar to the 1970s is increasing.

So far, private markets have been spared the hardship we are seeing in public markets.

But the hardship in public markets is only going to get a lot worse in the first half of next year and in the second half, you will see a significant rise in unemployment across the G7, that much I am certain of.

It might be pushed out a little to 2024 if inflation pressures first subside but as wage inflation picks up, forcing central banks to keep tightening more, it will be catastrophic for public and private assets.

This should worry the risk departments at all our large pension funds, heed my warnings seriously because I'm rarely wrong on big negative calls like this one (even cost me my job at PSP back in 2006).

Last night, Bank of Japan Governor Haruhiko Kuroda just gave investors a glimpse of what to expect when the world’s boldest experiment with ultra-loose monetary policy comes to an end:

In the face of sustained market pressure, Kuroda shocked markets Tuesday by saying he’ll now allow Japan’s 10-year bond yields to rise to around 0.5%, double the previous upper limit of 0.25%.

Whether this is a strategic tweak to buy time for his yield-curve control settings until his decade-long term ends in April or the start of the end for his unprecedented monetary easing remains to be seen.

But one thing is clear: a crack has opened that markets around the world will keep pricing in the weeks and months ahead.

“This is a step toward an exit, whatever the BOJ calls it,” said Masamichi Adachi, chief Japan economist at UBS Securities and a former BOJ official. “This opens the door to a chance of a rate hike in 2023 under a new governorship.”

The yen strengthened sharply against the dollar after the decision and continued gains, briefly touching 132.00 from 137.16 immediately before the decision. The yield on 10-year Japanese government debt jumped to 0.46% from the previously capped level of 0.25% following the BOJ’s move.

Japanese bank stocks surged in afternoon trading as investors expected improved earnings for financial institutions, but overall Tokyo stocks ended down.

The ripple effects also spread far outside Japan, with the fallout touching everything from US stock-index futures to the Australian dollar and gold.

The market moves suggested investors interpreted the move as a tightening measure.

I spoke to a buddy of mine trades currencies this morning. He was a bit surprised by the timing of the BoJ’s decision but not the shift in policy:

“Inflation in Japan is vastly understated because energy is a huge component and they lock in energy prices for two years. That was fine during the era of deflation, not now that inflation is picking up there. With the US moving to onshore, the BoJ has to shift its focus from exports to fighting inflation which is officially running at 3.7% YoY but is really a lot higher for the reasons I stated. Remember this, central banks can lose battles but they ultimately win the war.”

The yen carry trade has been a cheap way to fund all sorts of assets as you borrow in Japan to invest all over the world but if the BoJ starts shifting its target rate, watch out, the unwinding of that carry trade will have massive ripple effects all over the world.

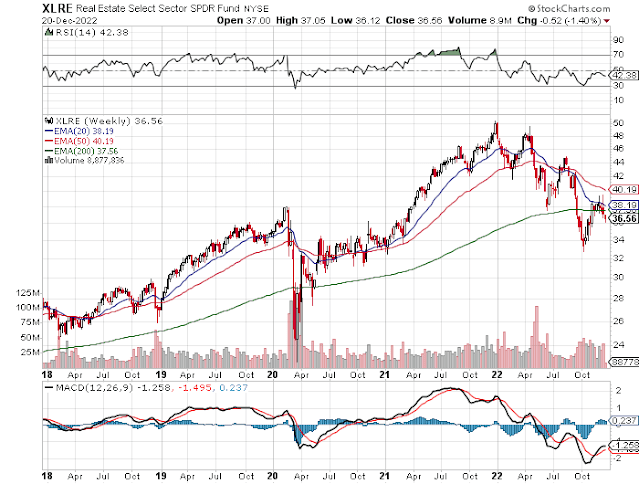

As far as US REITS, they're down 29% year-to-date, and are one of the worst performing sectors (Canadian REITS are just as bad):

This gives you an indication that tough times have already arrived in commercial real estate and I believe more pain lies ahead:

This is why Canada's large pension funds were smart to diversify their portfolios by sector and geography but they won't escape the carnage, especially if my prediction of a deep and protracted global recession materializes.

The good thing however is real estate is a long-term asset class that offers inflation protection and Canada’s large pension funds can weather the storm ahead and keep great assets in their portfolios.

Anyway, let me end all this doom and gloom talk and once again thank Nathalie Palladitcheff, CEO of Ivanhoé Cambridge for taking the time to answer my most important questions.

I wish her and everyone at Ivanhoé Cambridge happy holidays and all the best for the new year, plein de joie, de santé et de prosperité!

Below, Nathalie Palladitcheff, president and CEO of Ivanhoé Cambridge, discusses resilience, and how risk can be

assessed in real estate amid volatile market conditions. She is right on target, I wish they had all the conversation from the entire panel.

Also, Bill Gross, PIMCO co-founder, joins the 'Halftime Report' to offer his outlook on the markets going into next year in the face of more Fed rate hikes. Take the time to listen to Gross, he's excellent and even discusses risks in commercial real estate earlier today but they cut this clip too soon so it’s not here (I see risks in both residential and commercial).

Comments

Post a Comment