Is Higher For Longer Finally Sinking In on Wall Street?

U.S. stocks dropped for a third straight session and suffered a second straight week of losses on Friday as fears continued to mount that the Federal Reserve's campaign to arrest inflation would tilt the economy into a recession.

Equities have been staggered since the U.S. central bank's decision to raise interest rates by 50 basis points (bps), as expected. But comments from Fed Chair Jerome Powell signaled more policy tightening, and the central bank projected that interest rates would top the 5% mark in 2023, a level not seen since 2007.

Further comments from other Fed officials fueled the concern. New York Fed President John Williams said on Friday it remains possible the U.S. central bank will raise rates more than it expects next year. The policymaker added that he does not anticipate a recession due to the Fed's aggressive tightening.

In addition, San Francisco Federal Reserve Bank President Mary Daly said it is "reasonable" to believe that once the Fed's policy rates reached their peak, they could stay there into 2024.

"It feels as if finally the market is starting to understand that bad news is bad news, and that is what is starting to occur. Since the October bottoms, the market has continued to price in what I would consider a substantial amount of optimism at the fact the Fed could navigate and pilot a successful soft landing," said Dave Wagner, equity analyst and portfolio manager for Aptus Capital Advisors in Cincinnati.

"Finally, the market is taking into consideration that bad news should mean bad things for the market."

The Dow Jones Industrial Average fell 281.76 points, or 0.85%, to 32,920.46; the S&P 500 lost 43.39 points, or 1.11%, to 3,852.36; and the Nasdaq Composite dropped 105.11 points, or 0.97%, to 10,705.41.

For the week, the Dow lost 1.66%, the S&P fell 2.09% and the Nasdaq declined 2.72%.

Money market bets show at least two 25 bps rate hikes next year and a terminal rate of about 4.8% by midyear, before falling to around 4.4% by the end of 2023.

On the economic front, a report showed U.S. business activity contracted further in December as new orders slumped to their lowest level in just over 2-1/2 years, although easing demand helped cool inflation.

The tech-heavy Nasdaq on Thursday closed below its 50-day moving average, a key technical level seen as sign of momentum. On Friday, the S&P also closed below its 50-day moving average.

The prospects of a "Santa Claus rally", or year-end uptick, in markets this year have dimmed, as the majority of global central banks have adopted tightening policies. The Bank of England and the European Central Bank were the most recent to indicate an extended rate-hike cycle on Thursday.

Markets pared losses in the last hour of trading, however, possibly due in part to the simultaneous expiration of stock options, stock index futures and index options contracts, known as triple witching, which can exacerbate market volatility.

Each of the 11 major S&P 500 sector indexes were in the red, led lower by a drop of more than 2.96% in real estate stocks.

Meta Platforms Inc advanced 2.82% after J.P. Morgan upgraded the stock to "overweight" from "neutral," while Adobe Inc gained 2.99% after the Photoshop maker forecast first-quarter profit above expectations.

Exact Sciences Corp surged 16.39% after rival Guardant Health Inc's cancer test missed expectations, while General Motors Co (GM.N) lost 3.91% after its robotaxi unit Cruise faced a safety probe by U.S. auto safety regulators.

Volume on U.S. exchanges was 17.28 billion shares, compared with the 10.63 billion average for the full session over the last 20 trading days.

Declining issues outnumbered advancing ones on the NYSE by a 2.47-to-1 ratio; on Nasdaq, a 1.66-to-1 ratio favored decliners.

The S&P 500 posted one new 52-week high and 18 new lows; the Nasdaq Composite recorded 79 new highs and 392 new lows.

Sarah Min and Alex Harring of CNBC also report the Dow closes more than 200 points lower, falls for a second straight week as recession fears grow:

Stocks dropped Friday, building on their year-end sell-off, as fears grow over a recession taking place as the Federal Reserve continues raising rates.

The Dow Jones Industrial Average lost 281.76 points, or 0.85%, to 32,920.46. The S&P 500 fell 1.11% to 3,852.36. Meanwhile, the tech-heavy Nasdaq Composite declined 0.97% to 10,705.41.

The indexes notched a second consecutive week of losses. The S&P 500 fell 2.08% for the week, and putting its December losses at 5.58%, as hopes for a year-end rally fizzle. The Dow and Nasdaq slid 1.7% and 2.7%, respectively.

Trading was especially volatile Friday with a large amount of options expiring. There were $2.6 trillion worth of index options expiring, the highest amount “relative to the size of the equity market in nearly two years,” according to Goldman Sachs. At session lows, the Dow was down as much as 547.63 points, before paring back some of those losses.The sell-off was broad-based, with three stocks falling for every advancer at the New York Stock Exchange. At one point, there were only 10 S&P 500 names in positive territory. The real estate and consumer discretionary sectors were the biggest laggards, down nearly 3% and 1.7%, respectively.

Stocks fell this week in the wake of the Fed’s 50 basis point interest rate hike on Wednesday — the highest rate in 15 years. The central bank said it would continue hiking rates through 2023 to 5.1%, a larger figure than previously expected.

Following the policy update, the Dow dropped 142 points on Wednesday, plunged 764 points Thursday, and declined further on Friday.

“At the beginning of the week, we had the hope, given the very soft CPI number, that we could expect the Fed, and maybe the other central banks of the world, to be less hawkish,” Bokeh Capital founder Kim Forrest said.“But because they didn’t, and they had some stern words for investors and consumers alike that they were really focused on getting inflation down quickly, that has taken away a lot of our hope for a soft landing,” Forrest added.

Alright, it's Friday and there's lots to cover in markets.

Let me begin on a serious note, this is how the soft landing will look like next year:

The Fed trying to achieve a soft landing pic.twitter.com/lXB9cnS1fL

— Ramp Capital (@RampCapitalLLC) December 16, 2022

In all seriousness, have a look at the table below:

Global Central Bank Update:

— Charlie Bilello (@charliebilello) December 16, 2022

-Mexico hiked rates 50 bps to 10.50% (13th hike)

-Colombia hiked rates 100 bps to 12.00% (11th hike) pic.twitter.com/TYNIHtIOeM

Importantly, pretty much all over the world except for Japan, China, Russia and Turkey, central banks are raising rates and yet their real policy rate remains negative because inflation pressures persist and inflation remains at historic highs.

I don't care what Tom Lee, Ed Yardeni and other permabulls are saying on CNBC, there's no way the Fed, ECB, Bank of England, Bank of Canada, Reserve Bank of Australia, you name it are going to engineer a soft landing next year.

Prepare yourselves mentally and in your portfolios for a deep and protracted global recession and bear market unlike anything we've seen since 1973-74.

As Mr. T. once famously quipped in Rocky III: "PREDICTION?... PAIN!"

I know, we had a few very nice bear market rallies this year, one really nice one after the June CPI report and one more recently after the September CPI report but don't be fooled by the Santa Claus Rally nonsense, when the real bear market commences, fear will set in fast on Wall Street and the CBOE Volatility Index (the VIX or market fear gauge) will shoot up to levels we haven't seen since the early days of the pandemic:

Don't worry, I don't see this happening just yet unless we get another black swan event, but as the US economy slows significantly and unemployment rises, and the Fed doesn't pivot and drop rates because inflation remains stubbornly high, then watch out, it's going to be a bloodbath.

However, I agree with those who see inflation pressures subsiding in the short run due to lower energy prices, used car prices, freight rates and other prices:

Signs of lower US inflation rates to come...

— Charlie Bilello (@charliebilello) December 16, 2022

-Gas prices down 37% from June peak

-Used car prices down 19% from peak

-Global freight rates down 81% from 2021 peak

-Fertilizer prices down 45% from March peak

-Rents down in Sep, Oct, & Nov

-Home Prices down over 10% from June peak

The problem is the starting point. We are still at a 7.1% YoY on US CPI. We peaked a little bit above 8% and we remain at multi-decade highs.

Employees are demanding higher salaries and most of them are getting them:

Rolls-Royce car plant workers win pay deal worth up to 17.6% https://t.co/0qwt8DDRcX

— FT World News (@ftworldnews) December 16, 2022

What happens if wage inflation picks up all over the world as the Fed and other central banks pause? Will see see a repeat of the 1970s episode?

Even top labor economist Alan Blinder who just penned an important comment, The Use and Abuse of Inflation History, admits this in his comment's second point:

Let’s start with an obvious but much-ignored fact. Today’s inflation problem in the US is relatively recent, dating only from the spring of 2021. In February 2021, the 12-month CPI inflation rate was still a mere 1.7%, but by that May it had reached 5%. In contrast, when Volcker took the reins at the Fed in August 1979, the US had already experienced nearly 15 years of high inflation. As he settled into his new office, the headline inflation rate was a stunning 11.8%, having been above 5% since April 1973 and over 8% since September 1978. High inflation had become deeply ingrained in Americans’ business plans and popular psychology. Surveys showed that people expected 8-10% inflation to persist for years.

That brings us to the second big difference. Inflation expectations today are remarkably well contained. In fact, they are nearly consistent with the Fed’s 2% inflation target for the Personal Consumption Expenditures Price Index (PCE). Of course, expected inflation is higher than 2% in the near term, because people can see that inflation is running higher right now. But over a five- or ten-year horizon, the numbers cluster in the 2-3% range.

This matters a lot, because inflation expectations tend to become embedded in wage settlements, interest rates, and household and business plans. Once they rise to high levels, as they had for Volcker in 1979, it can be hard to bring them down. At least for now, Powell doesn’t face that problem.

Third, consider the different macroeconomic conditions under which Powell and Volcker embarked on their disinflation campaigns. In August 1979, at the start of Volcker’s tenure, the US unemployment rate was 6%. That wasn’t so bad, perhaps; but by May 1980, after the short but sharp recession of 1980, it was up to 7.5%.

The Fed under Powell came late to the fight against inflation, for which it has been justifiably criticized. But when it finally started raising interest rates, in March 2022, the unemployment rate was at a historic low of 3.6%, and recent rates of payroll job creation were above 500,000 per month. To put that last number in perspective, the number of new jobs needed to hold the unemployment rate steady is probably around 75,000-100,000 per month. That means the US had a tight and booming labor market in March 2022 – and still does.

It also means that tightening monetary policy today can drive monthly job creation rates all the way down to the 0-100,000 range, and the unemployment rate up to 4.5% or so, without causing terrible hardship. If the Fed can achieve that outcome (which will, admittedly, require both skill and luck), observers will declare that Powell and his colleagues have achieved an economic soft landing. Volcker was afforded no such luxury.

I disagree with Blinder on his last point because it has never happened in the history of economics that a soft landing was engineered when the Fed and other central banks are raising rates with inflation above 5%. Never, not one episode.

History says the Fed can't meet its inflation goal without a recession https://t.co/KnTcUT9I2g

— Leo Kolivakis (@PensionPulse) December 16, 2022

As I stated last week, this time is different, it's much worse!

Admittedly, the thing I find crazy is how stock traders and investors on Wall Street keep hoping for some magic pivot from the Fed and they keep getting rejected.

But this week, after the Fed raised rates 50 basis points and Powell kept the hawkish tone and after the ECB raised rates by 50 basis points and Lagarde said more ‘significant’ rate increases still to come, it finally started sinking in on Wall Street and global equity markets that higher for longer is here to stay.

Again, stocks don't go up and down in a straight line, unless there's a global crash, but investors need to prepare for more pain ahead.

The 2-year Treasury yield, now at 4.16%, is inverted with the lower bound of the Fed Funds Rate by 9 bps. The 6-month Treasury is currently the highest yielding point on the curve at 4.63%, about 50 bps less than the Fed's median 5.1% peak on the dot plot.

— Bespoke (@bespokeinvest) December 16, 2022

Lots of conversations on what constitutes a Fed pivot. My (low-conviction) view here is that the Fed will have pivoted not when it cuts or pauses or does something with QT/QE... but when the 2-year real yield stops climbing like a SpaceX rocket shot into space. Thoughts? pic.twitter.com/vylyN2yj0B

— Marko Papic (@Geo_papic) December 16, 2022

Consumer Discretionary $XLY, Energy $XLE, Financials $XLF, and Communication Services $XLC are down more than 7% MTD. pic.twitter.com/ZhlYpbjDwU

— Bespoke (@bespokeinvest) December 16, 2022

Is it really so different this time? pic.twitter.com/00VuMJmWWx

— Willie Delwiche, CMT, CFA (@WillieDelwiche) December 16, 2022

Here is my official price target. pic.twitter.com/ouve6wekqm

— Mac10 (@SuburbanDrone) December 16, 2022

Of course, it wasn't all bad news, buyouts are still happening in healthcare and private equity funds flushed with billions in dry powder are starting to snap up publicly listed companies:

Amgen said Monday it would purchase Horizon Pharmaceuticals for $27.8 billion, marking the latest bet by a large #pharma company on the lucrative market for treating a rare disease. https://t.co/DCcU1Vk74Q

— STAT (@statnews) December 13, 2022

Thoma Bravo snags Coupa for $8B despite activist pressure to hold off for higher price https://t.co/zyOVR08j5L by @ron_miller

— TechCrunch (@TechCrunch) December 12, 2022

Maxar Technologies Agrees To Be Acquired By Advent At 129% Premium https://t.co/vA83vIBd2M via @YahooFinance

— Leo Kolivakis (@PensionPulse) December 16, 2022

And then there were the dogs, like Tesla shares which keep sinking lower, erasing billions this year from Elon Musk's net wealth:

I've been recommending to short Tesla shares on any pop since they crossed below $248 and I'm waiting for one more pop back to or above its 200-week moving average before another major leg down, the big Tesla DUMP!

Or maybe short sellers will just continue to destroy this stock as Elon sells more shares to fund his Twitter acquisition where he's going all 'Kanye' or 'Ye', tweeting way too much nonsense lately:

Elon Musk is going full Kanye West. pic.twitter.com/dRRsXcEXKz

— Mac10 (@SuburbanDrone) December 16, 2022

A few closing thoughts.

In his weekly market wrap-up, Potential Industrial Recession Alert, Martin Roberge of Canaccord Genuity notes:

Aside from the Fed and the ECB, what caught our attention this week is the rapid deceleration of the front-end of the economy. In short, mfg. activity is feeling the pinch of demand destruction dynamics from inflation eroding consumers’ real income, rising financing and input costs as well as bloated inventories. On the latter point, and as shown in our Chart of the Week, business inventories increased for an 18th consecutive month in October (+0.3% MoM), clocking in at 16.5% YoY (first panel). Unfortunately, we fear several companies will need to clear excess inventories before ordering anew. And this view seems consistent with the new orders sub-component of the Philly Fed business survey plunging to levels last seen through past recessions (second panel). Already, mfg. production has stalled (+1.3% YoY). As such, despite a resilient US labour market, we believe a manufacturing recession has become unavoidable going into 2023. In turn, we expect S&P 500 profits to take a hit considering that goods producing industries account for 47% of the S&P 500 earnings (vs. 32% for the economy). That said, we believe productivity gains through the pandemic will cushion margins. Thus, we reiterate our view that earnings should decline in 2023 but likely less than the ~20% average through recessions.

I'm not as optimistic as Martin on productivity gains and the decline in earnings in 2023 but he's right there's a manufacturing recession ahead.

In fact, another short recommendation which Steve Weiss discussed on CNBC Halftime Report earlier today was to short Industrials (XLI) which are set to get clobbered next year:

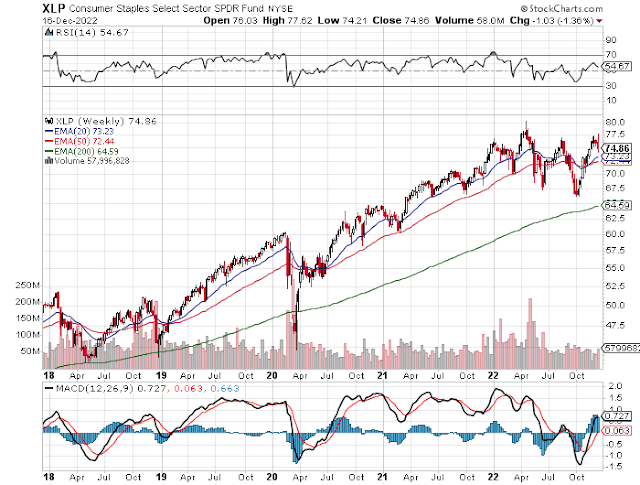

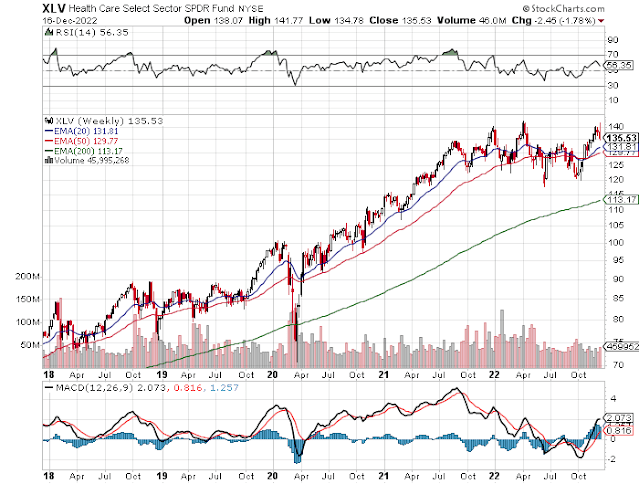

In fact, I'm pretty much short all sectors including safe sectors like Utilities (XLU), Staples (XLP) and even Healthcare (XLV) where valuations are stretched here:

Interestingly, the recent rally in US long bonds and high yield bonds is getting long in the tooth here, which is also worth noting because if they start getting hit, it could spell big trouble ahead:

Lastly, some parting thoughts from Francois Trahan of Trahan Macro Research who sent this on Thursday morning and posted some great tweets:

Yesterday was the third time that the "Fed is about to pivot" crowd saw their hopes crushed. Instead of trying to read into the subtext of the Fed's comments investors might be better off focusing on the bigger picture. This is the most intense Fed tightening cycle in decades. pic.twitter.com/4bulO2u28c

— Francois Trahan (@FrancoisTrahan) December 15, 2022

"This conclusion on my part makes me optimistic for the future, because I am confident that monetary policymakers will not forget the lessons of the 1970s." - Ben Bernanke, 2/20/2004

— Francois Trahan (@FrancoisTrahan) December 14, 2022

Consensus is not always wrong. Pundits are largely justifying their bullish stance on equities in 2023 by pointing out consensus expects a recession.

— Francois Trahan (@FrancoisTrahan) December 14, 2022

There's a wide spread between the most bullish and bearish expectations for EPS, which just tells us that investors are confused. pic.twitter.com/DSUSoGUNW4

I'm accumulating housing charts at the 2000 bubble peak or above it. Early on in a recovery, demand lifts this series. Early on in a slowdown, it is homebuilders getting land off their books that make this soar. I suspect the explosion higher in the last six months is the latter. pic.twitter.com/ZrjgtLNEP4

— Francois Trahan (@FrancoisTrahan) December 13, 2022

And my favorite tweet of the week goes to Rosie:

My pal Jim Paulsen just announced his retirement after 40 years in the biz. On his way out, he’s predicting 5,000 for the S&P 500 a year from now (could put the ERP at zero!). Something tells me he’s trying to talk up his 401(k)!!

— David Rosenberg (@EconguyRosie) December 16, 2022

Alright, let me wrap it up there and wish everyone a nice weekend.

Please note, if you want to link in with me on LinkedIn, just send me an invitation and use my email : LKolivakis@gmail.com.

Below, CNBC's Halftime Report Investment Committee discusses whether falling bond yields could help stocks, if there's enough time for a 'Santa Claus' rally and more. Listen to Steve Weiss, he's the best panelist there. You can watch CNBC live for free here.

Second, Brian Belski, BMO chief investment strategist, joins the 'Halftime Report' to discuss what's happened since his last appearance on CNBC, Belski's thoughts on fighting the Federal Reserve and more.

Third, earlier this week, Tom Lee, Fundstrat Global Advisors head of research, joined the 'Halftime Report' to discuss his strategic outlook, things investors should consider and what he doesn't want to hear today from the Federal Reserve.

Fourth, Ed Yardeni, Yardeni Research president, joins 'Closing Bell: Overtime' to discuss what caused today's market sell-off and whether he thinks we're headed for a recession next year.

Fifth, Cameron Dawson, NewEdge Wealth chief investment officer, joins 'Closing Bell: Overtime' to discuss the Fed and her market outlook for earnings, market lows and inflation. Sixth, Nouriel Roubini, chairman and CEO at Roubini Macro Associates, recently discussed how a recession can impact US equity and credit markets with Francine Lacqua on "Bloomberg Surveillance Early Edition."

Lastly, Federal Reserve Chair Jerome Powell holds a news conference on Wednesday following the Federal Open Market Committee meeting. Listen to the Fed closely!

Comments

Post a Comment