Beware! We Are Entering Brutally Cold Phase Of The Bear Market

Stocks fell Friday as a strong jobs report worried some investors that the Federal Reserve would keep hiking rates. Still, the S&P 500 notched its fourth weekly gain in five weeks as investors bet falling inflation is ahead.

The S&P 500 declined 1.04% to 4,136.48. The Nasdaq Composite shed 1.59% to 12,006.95. Meanwhile, the Dow Jones Industrial Average slipped 127.93 points, or 0.38%, to 33,926.01 — even as Apple shares gained.

Regardless, the broader market index and Nasdaq Composite notched a positive week. The S&P 500 closed the week higher by 1.62%. The Nasdaq Composite gained 3.31%, posting its fifth-straight winning week as it rode a tech-fueled rally to outperform the other major indexes. Meanwhile, the Dow was the outlier, down 0.15%.

Investors absorbed a stronger-than-expected January jobs report that spurred bond yields higher. The U.S. economy added 517,000 jobs in January, blowing past Dow Jones’ estimates of a jobs gain of 187,000 last month. The 10-year Treasury yield topped 3.5% after jumping more than 12 basis points following the report.

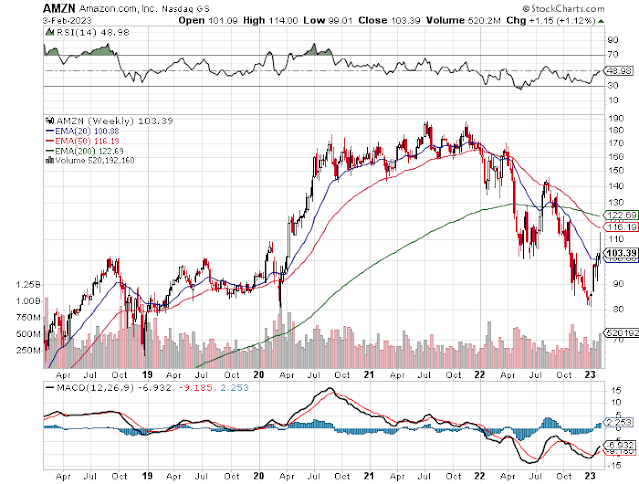

Wall Street also digested earnings results from major tech companies. Apple shares jumped 2.4%, reversing earlier losses after the company missed estimates on the top and bottom lines in its most recent quarterly report. Meanwhile, Google-parent Alphabet fell 2.8% following disappointing results. Amazon’s stock also declined 8.4% in its worst day since April after the e-commerce giant’s report, though it still notched a 1.1% gain on the week.

Even so, investors took hope from recent signs of falling inflation, as well as some well-received comments this week from Federal Reserve Chair Jerome Powell saying the disinflationary process has begun.

“I think the market’s coming closer to our view that inflation is declining rapidly,” said Jay Hatfield, CEO at Infrastructure Capital Management. ”[The Fed’s] models have proven to be terrible. They missed this inflation on the upside, and now they’re missing the deflation.”

Alexandra Semenova of Yahoo Finance also reports stocks slide after jobs report shocks, Big Tech results disappoint:

U.S. stocks tumbled Friday after government employment data showed more than half a million jobs were added in January — throwing a wrench in hopes for a pause on rate increases — while subpar earnings results from Big Tech giants weighed on investor sentiment.

The U.S. economy added 517,000 jobs last month, far more than payroll gain of 188,000 expected by economists. The unemployment rate fell to 3.4%, the lowest since 1969.

The S&P 500 (^GSPC) dropped 1%, while the Dow Jones Industrial Average (^DJI) shed abut 130 points, or 0.4%. The technology-heavy Nasdaq Composite (^IXIC) finished lower by 1.6%

Continued resilience in the labor market likely takes the pressure off the Federal Reserve to reverse course on its rate hiking campaign, an outcome markets have been betting on happening later this year, which in part helped fuel the stock market rally to start the year.

“Assuming there is no irregularity in the data, today’s employment report was unexpected as it showed outsized strength in labor markets across the board," Goldman Sachs Asset Management head of multi-asset retail investing Alexandra Wilson-Elizondo said in a note.

"The report will make insurance cuts less likely as there are no material signs of stress to force a rate cut," Wilson-Elizondo added. "In other words, this print gives the Fed more room to allow for stagnation in the macro economy and risk remains skewed to over-tightening causing a recession.”

On the earnings side, Apple (AAPL), Amazon (AMZN), and Google parent Alphabet (GOOG, GOOGL) — the market's most heavily weighted companies — all posted quarterly results that underwhelmed Wall Street. Shares of Apple reversed losses, gaining 2.4% on Friday, while Amazon and Alphabet plunged 8.4% and 2.7%, respectively.

Apple said revenue fell 5% as headwinds from COVID lockdowns in China and worker protests at manufacturer Foxconn’s facility in the nation weighed on shipments during the period. iPhone sales, a key metric for the company, dropped 8% year-over-year to $65.8 billion, a meaningful miss from estimates of $68.3 billion.

Amazon, meanwhile, unveiled better-than-expected sales growth in the fourth quarter but disappointed on profit — largely the result of big losses from its stake in electric vehicle maker Rivian Automotive. Amazon's AWS cloud unit grew more than 20% compared to the same period in 2022 but fell short of expectations.

Alphabet's results also missed forecasts on revenue and earnings per share, as advertising declined year-over-year. The numbers come after the company laid off about 12,000 employees in January, a move CEO Sundar Pichai blamed on Alphabet overhiring during the pandemic boom.

"We have significant work underway to improve all aspects of our cost structure, in support of our investments in our highest growth priorities to deliver long-term, profitable growth," Alphabet CFO Ruth Porat said in a statement.

Elsewhere outside of technology companies, investors were watching Nordstrom (JWN) following reports investor Ryan Cohen has built a big stake in the department store. The move was confirmed to Yahoo Finance by a person familiar with the matter. Shares surged more than 24% on Friday.

Stocks have been on a tear to start 2023 as investors bet that weakening economic data will prompt the Federal Reserve to end its rate hiking cycle sooner than expected.

That view was bolstered by remarks from Federal Reserve Chair Jerome Powell on Wednesday that suggested signs of "disinflation" are building in the economy as the U.S. central bank raised interest rates by a smaller hike of 0.25% — even as he asserted more increases were ahead.

Still, many strategists have been skeptical of the market's uptrend and Wall Street's anticipations the Fed will pause its interest rate hiking campaign this year.

"Now is not the time for nuance. Aggressive tightening in 2022 has led to signs of decelerating inflation but from levels that remain unacceptably high," Lazard chief market strategist Ron Temple said in a note. "Falling bond yields and higher equity prices have complicated the task by easing the financial conditions that the Fed is trying to tighten, necessitating forceful messaging from the FOMC this week."

"The Fed won’t be able to rest until labor market conditions ease significantly from current levels, and that is unlikely without higher rates for longer than the markets currently expect."

At an investment conference in Miami, Florida, earlier this week, Morgan Stanley's top market strategist Mike Wilson attributed the rally to the January effect — a market theory that securities' prices increase in the month of January more than in any other month after a year-end sell-off for tax purposes.

Ms. Semenova also reports stocks rally in 2023, investors can't stop thinking about 2021:

The year is 2023. But hindsight is still 2021 on Wall Street.

For an industry known to be forward-looking, investors are still trying to make sense of the last two years.

In 2021, easy money policies and post-pandemic stimulus ushered in the "meme stock" era and investor enthusiasm for anything tech-related and growing fast. Bonus points were awarded if the company didn't make any money as a bubble broke out that year.

Then in 2022, much of this mania came crashing down as the Federal Reserve raised interest rates aggressively in an effort to slow inflation.

"It’s not higher interest rates that are the problem — it's the transition from stupid, free, incredibly ridiculous money at zero cost to something more normal," Rich Handler, CEO of investment bank Jefferies, said during an interview at the iConnections Global Alts conference in Miami, Florida last week.

But in the new year has emerged a new market. And a new market that looks a bit like what we witnessed two years ago.

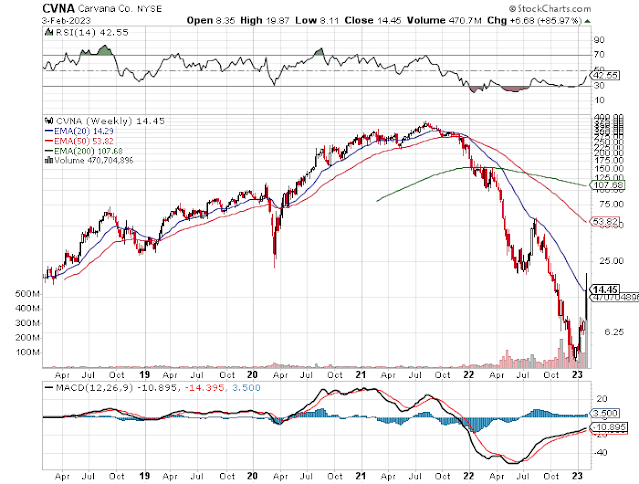

The Nasdaq has soared 15% to start 2023, spurred higher by rallies in some of the biggest losers of last year like Tesla (TSLA) and Coinbase (COIN). Even beleaguered, left-for-dead names like Carvana (CVNA) have been on a tear.

"Every time the so-called 'meme stocks' — the garbage — have taken off, that's been the end of the rally, not the beginning of the rally," short seller Jim Chanos said during a panel discussion.

Across dozens of panels and on-stage discussions at the event, the excesses of 2021 and the consequences investors continue to face as a result served as a dominant theme.

Social Capital founder Chamath Palihapitiya, known for sponsoring a wave of SPACs — or special purpose acquisition companies — that brought speculative tech companies to the public market, is now calling the era of low interest rates a mistake.

As the market waned last year, two of the six blank-check companies Palihapitiya launched were liquidated and the others that went public are trading well below their listing price.

"In the industry we are in, there are a couple of dirty little secrets, or the dirty soft underbelly," Palihapitiya said, referring to the technology sector, in an on-stage interview Wednesday at the Fontainbleau Hotel. "One of them is that only 10% of all firms in our asset class actually generate real returns, which means 90% are basically floundering around burning money."

"There's this dance that this industry has been able to play because interest rates have been at zero, so as investors, the asset class I think is very challenged in order to generate real returns now," Palihapitiya added.

"The companies that we funded as a result of all this excess capital have been more poorly run than otherwise, and so we need to course correct. We need these rates to be sustained for five, six, seven years frankly, hopefully, in order to really flush it through the system."

Chamath Palihapitiya says rates need to stay at this level for “5, 6, 7 years — hopefully” in order to “really flush” out excess capital in the market pic.twitter.com/Bsddcm5XYL

— Alexandra Semenova (@alexandraandnyc) January 31, 2023While many recollect the mistakes of the post-pandemic market, however, it's unclear whether lessons have been learned just yet.

The Federal Reserve has now raised interest rates eight times since March 2022, bringing the federal funds rate to 4.50% from near-zero levels. Federal Reserve officials keep asserting rates will go higher, and likely above 5%.

But markets have seemed to ignore them — even pricing in cuts by the end of the year — and the start of 2023 continues to see many of 2021's themes, even as some investors say they're behind us.

"The market just does not want to believe that the Fed is going to continue to be hawkish and remain hawkish, and we have multiple price cuts baked into the cake here by the end of the year," SEI chief investment officer Jim Smigiel said in a recent note. "We would probably call this a junk rally: there’s too much disconnect between what's happening with monetary policy and what the market's interpretation of that is right now."

Morgan Stanley's top stock strategist, Mike Wilson, said during a panel last week recent gains across the stock market are merely an outcome of the January Effect — a seasonal anomaly that sees stocks rise in the first month of the year following a year-end sell-off for tax purposes.

With expectations for corporate earnings growth to turn negative, Wilson sees the S&P 500 falling as low as 3,200 this year, even if a recession doesn’t play out. On Friday, the index closed at 4,136.

The way Jefferies chief market strategist David Zervos sees it, the Fed is giving investors "tough love," he said during a panel discussion.

"For the long-term equity investor, this Fed is doing exactly what you want."

I'm not sure this Fed is doing exactly what I want because Chairman Powell went from being more like Paul Volcker to being more like Arthur Burns in his presser on Wednesday afternoon.

It's Saturday morning and I'm trying something new because most people don't want to read market comments on Friday night and they are important comments.

Trust me, I have better things to do with my time than share my deep market knowledge and expertise on the internet for free (for those of you who have never done so, please pay your dues using my PayPal options on the top left-hand corner of my blog under my picture and any amount is appreciated).

Anyway, I'm recovering from a brutally painful bout of sciatica and it's brutally cold in Montreal so let me throw some cold water on this bull rally.

[Note: Someone sent me Harvard's guide to finding solutions for back pain which was very useful. I also ordered George F. Best's book "Sciatica: Exercises and Home Treatment" which is superb.]

Let's begin with what is the most obvious, to me at least, the January 'junk' rally was another bear market rally led by ARKK, Tesla, Big Tech, semis and it's coming to a close with the garbage meme stock rally:

Admittedly, some of these weekly charts look better than others.

For example, NVIDIA -- aka, hedge funds' favorite beta beast -- looks like it's breaking out on the weekly chart as do semis but I warn you, they're going to get clobbered very soon.

I can say the same thing about Meta and Netflix, great rallies off their lows and they're on fire lately but I would use any strength to sell and get out as they too will be clobbered shortly.

Apple, aka Ms. Cash Cow, is still doing well but it's going to roll over very soon too despite all the bullish talk by some analysts.

Apple’s earnings were a lot better than they look https://t.co/fUYOCA1DbX via @YahooFinance

— Leo Kolivakis (@PensionPulse) February 4, 2023

Apple is an important stock, systemically important which is why the indexers (BlackRock, Vanguard and Fidelity) as well as the Fed's Swiss surrogate, the Swiss National Bank, always buy it whenever the market looks like it's about to implode (that is the real reason Buffett owns a huge stake in it, never mind the fundamentals!).

But as we enter the brutally cold phase of the bear market, it will soon slide lower and lower.

Same with Microsoft, another great company which is a tech stalwart.

As far as the garbage stocks like Coinbase, Carvana and other meme favorites, their days are numbered as we enter the brutal phase of the bear market.

The famous short-seller Jim Chanos is right, these garbage stocks tend to rally when we reach the end of the bear market rallies.

For me, they're easy short candidates after a huge spike up.

That brings me to my favorite ESG piñata, Tesla, which is experiencing a great start of the year, up more than 50% and rallying strongly after getting clobbered last year.

I've been looking at this latest Tesla rally closely. Both the weekly and daily charts tell me this rally is coming to an end very soon, it might test its 200-day moving average at $229 but I doubt it.

Importantly, I remain short Tesla shares and as I stated in my Outlook 2023, by this time next year its shares will be trading below $30, destroying retail investors and Elon Musk's artificially inflated wealth (he'll be fine as long as he shifts his focus to SpaceX where the real money lies).

I also put up shares of Shopify because they've rallied hard this year but some hedge fund in Toronto keeps sending me quarterly performance commentaries telling me it's the next Nortel.

I have no clue if Shopify is the next Nortel but given my bearish views, I'm not buying this breakout or that of any long duration stock.

Interestingly, however, there are some great biotech stories I'm following closely and think some of the biotechs I track closely are going to be bought out this year (only those who pay me big bucks can get access to that information, just email me).

But biotechs are risky assets by nature and they too will get clobbered when the market shifts violently:

Ladies and gentlemen, the most important message I want to get across here is forget about January's junk rally, reminiscent of last year's January blow-off rally before stocks headed south, we are about to enter the brutal phase of the bear market, a long brutal winter has already arrived.

"Oh Leo, you're so bearish, stop copying Francois Trahan, grow a pair and buy some risk assets!"

I'm not copying Francois Trahan, I respect him a lot and even if I wanted to, I can't reproduce his great research papers.

I definitely track him on LinkedIn and on Twitter where he posts great comments like these:

Reminder that bear markets end when a bottom in earnings is on the horizon, which won't happen soon. EPS usually trough 2-years AFTER a peak in rates. I know. I wish it were otherwise too.

— Francois Trahan (@FrancoisTrahan) February 4, 2023

Don't fall for the bear trap. Focus on what matters, and in a bear market that's earnings. pic.twitter.com/L6WCaMDsB3

We should not be surprised by today's unemployment rate. After all, Initial Jobless Claims are still unusually low and that is the leading indicator of employment. So, Claims will have to rise before we can start thinking about the unemployment rate trending higher. pic.twitter.com/Z9mPuIdWub

— Francois Trahan (@FrancoisTrahan) February 3, 2023

That first one on the bear trap is important because there are to many dummies falling for it, listening to some guru on television telling you there's no better time to buy stocks.

Nonsense! As Francois states, EPS usually trough 2 years AFTER a peak in rates.

And keep in mind, the Fed isn't done tightening and neither is the ECB even if some other central banks (like the Bank of Canada) seem to be hitting pause here.

When it comes to stocks and risk assets, global liquidity matters.

That's why I'm even more bearish than Francois who tends to look almost exclusively at US markets but he also mentions foreign markets from time to time:

This sums up well why EMs are at risk in a global downturn. The reality is that the U.S., Japan & Eurozone drive trends in the Global PMI. They are the source of demand for most of the world's exports. EVEN if China revives its economy in 2023 it will not make a large difference. pic.twitter.com/7XdTkq7sfn

— Francois Trahan (@FrancoisTrahan) February 1, 2023

Anyways, there's a reason why top money managers pay Trahan Macro Research for his research, it's truly excellent and that's why he was inducted into the All-America Research Team Hall of Fame seven years ago when he turned 47.

He's also a nice guy. Most people in the investment industry with his credentials and track record are arrogant jerks, not Francois.

We texted each other earlier today and he told me he thinks this bear market rally will end by the end of this week. I agreed and said it might go on until February 15th when 13-F information becomes publicly available and CNBC will be telling us that Soros, Druckenmiller, Griffin, Tepper et al. all bought tech stocks last quarter (and are selling them this upcoming week).

By the way, you'll know we are in the brutal cold phase of the bear market when all these big, powerful hedge funds are getting clobbered including potentially Ken Griffin's Citadel which made $16 billion in profit after fees in 2022, recording the largest annual gain ever by a hedge fund manager, according to estimates by a major industry investor.

If you're wondering how Citadel made so much money last year, I don't know either but it has raised eyebrows with senior allocators I talk with. All I know is Citadel Securities which raked in a record $7.5 billion in 2022, is the market maker for over 60% of the NYSE stocks and almost all the options traded.

[Note: Citadel Securities took the top spot when it comes to payment for order flow (PFOF), forking out $2.6 billion in 2020 and 2021 according to 606 reports gathered by the US’ Securities and Exchanges Commission (SEC).]

Griffin isn't smarter than any other elite hedge fund manager nor does he hire smarter people than them, but he sure has an edge in these markets.

That's the main reason institutional investors pay Griffin 2& 20 to manage money.

There are other more suspect activities. Last year, for example, a bunch of UK hedge funds with close ties to the government made a killing shorting the pound and gilts, and calls for an investigation into leaks went nowhere.

[Note: I should write a book, "The Global Hedge Fund Mafia: How the New Financial Dons Control the Market and Governments." If one day, you hear of my unexpected death or that I committed suicide, don't believe a word, I was taken out by a hedge fund hitman! LOL!]

Anyway, you'll know when we are in the brutal phase of the bear market when Citadel and other top hedge funds are getting clobbered and some will be nuked out of existence.

We aren't there yet, far from it, but trust me, it's coming soon and I should know, I used to allocate millions to all these top hedge funds and know what lies ahead. If you don't believe me, read my last comment covering top funds' activity for Q3 2022 as well as the one prior to that covering top funds' activity in Q4 2021 where I warned investors: "Never mind chasing Chase Coleman and other gurus, that’s a sure road to ruin!" (my timing was perfect)

When it comes to hedge funds, I can sit down with the best of them and rip their portfolios apart. The more arrogant they are with me, the more I enjoy going for the jugular and ripping them to shreds (I know, it's a nasty and childish trait but I can't stand arrogant money managers who are nothing more than glorified asset gatherers charging their clients exorbitantly high fees).

[Note: Just because you're a billionaire, don't expect me to be impressed, it takes a lot to really impress me and wealth and status aren't my top criteria, humility, character and brains are!].

Alright, speaking of arrogance and nonsense, why are so many so-called experts touting yesterday's stupendous US jobs report, foolishly stating it means we will avoid a hard landing?

Read this: https://t.co/eqLT2Xi09F

— Leo Kolivakis (@PensionPulse) February 4, 2023

Lots of dollar strength coming because wage inflation will pick up as the US economy heads into recession (counterintuitive) and the Fed won't be able to lower rates, it might have to start hiking them again. Also, if a crisis develops, flight to safety augurs well for USD.

— Leo Kolivakis (@PensionPulse) February 4, 2023

Here are some more tweets worth understanding on the "stupendous" jobs report and what it means for markets:Terrible analysis, in 2019 you didn't have inflation at a 40-year high and the Fed wasn't tightening as aggressively as now. Hard landing is coming, be prepared or prepare to have your head handed to you!

— Leo Kolivakis (@PensionPulse) February 4, 2023

Combining the benchmark revisions with a separate upward revision in December employment, and the December figure went from a previous 153,743 (thousand) to 154,556.

— John P. Hussman, Ph.D. (@hussmanjp) February 3, 2023

The January figure is 155,073, a gain of 517,000 jobs for the month. That's how we just hit 3.4% unemployment. https://t.co/Hz2dpDp4qM

If you believe in that nonfarm payroll report then you de facto believe that either productivity is falling out of bed in Q1 or real GDP is surging at 5% SAAR. Or maybe you just believe in magic. The reality is that the pop-adjusted HH survey & ADP came to a different conclusion.

— David Rosenberg (@EconguyRosie) February 3, 2023

This labor market is so hot, hot, hot that the level of full-time employment was lower this past month than it was last May! Something the nonfarm payroll report doesn’t tell you.

— David Rosenberg (@EconguyRosie) February 3, 2023

Policy makers have to worry about “the next inflation problem.”

— Nick Timiraos (@NickTimiraos) February 4, 2023

If the economy continues to add more than 200,000 jobs a month without a large increase in the labor supply, “whatever labor market tightness you have now would look worse in six months.” https://t.co/DEWaieCjCb

The U.S. unemployment rate has fallen to the lowest since 1969, at 3.4%. pic.twitter.com/j6tHYV2adB

— Lisa Abramowicz (@lisaabramowicz1) February 3, 2023

It's fair to say low unemployment and periods of inflation tend to precede recessions; that high inflation tends to be followed by rising unemployment; and that absent recession or crisis, inflation tends to resolve over years, not quarters. Beyond that, it's kind of a crapshoot. pic.twitter.com/Zk13zNVnxQ

— John P. Hussman, Ph.D. (@hussmanjp) February 3, 2023

I remain convinced the US and global economy are headed for a very hard landing and that we will soon be entering the brutally cold phase of the bear market:

Two trends that are a bit concerning:

— Markets & Mayhem (@Mayhem4Markets) February 3, 2023

1) Record options volume, the highest ever

2) Record retail participation as a % of total market volume

Both happening at the same time. pic.twitter.com/hhvHRjVd3a

Imagine the Smell $SPY pic.twitter.com/NMvnRBx9HI

— TrendSpider (@TrendSpider) February 4, 2023

There was a good reason for both FAAMG rally and the following correction. They just follow earnings 👇 (Goldman Sachs) pic.twitter.com/pBA9zUknQK

— Michael A. Arouet (@MichaelAArouet) February 3, 2023

We can't rule out "bit in the teeth" speculation, but keep in mind where valuations stand from a full-cycle perspective.

— John P. Hussman, Ph.D. (@hussmanjp) February 3, 2023

It's reasonable to adjust for profit margins since 2000 averaging 25-30% above historical norms.

But understand the pre-2000 price/revenue norm was just 0.9. pic.twitter.com/4YBA1pjh6o

The root cause of the current inflation can be traced back to the excessive money printing by central banks during the pandemic.

— HOZ (@MFHoz) February 3, 2023

To effectively combat inflation, the FED must implement aggressive QT measures, even if it means causing discomfort to Wall Street.

Powell is another Arthur F. Burns.

— HOZ (@MFHoz) February 3, 2023

He falls short of the decisive leaders like Paul Volcker, who used to smoke cigars during his meetings and didn't cave to pressure.

Unemployment is currently at its lowest point in 53 years. Inflation is coming back with vengeance.

All this to say, even though a 'soft landing' is being priced in, that doesn't make it more likely:

This soft landing is the holy grail for the Powell Fed: An economy in which inflation comes back to the Fed's 2% target and doesn't tip into recession filled with a spike in job cuts and pain.

"Many forecasters would say [a soft landing is] not the most likely outcome ... But I would say there's a chance of it," Powell said in a press conference on Wednesday.

Powell leaned into "disinflation" rhetoric, which investors absolutely loved. The Nasdaq spiked over 5%, adding to a furious rally that followed the index's best January return in two decades, where it rose 10.7%.

The strength in stocks since Wednesday bucks the trend over the last three Fed meetings, which saw stocks sold off sharply after the central bank's policy announcement and throughout Powell's Q&A.

But some investors have taken notice of the growing divergence between Fed rhetoric and economic reality.

"The window for the (misplaced) soft landing narrative is now extended," tweeted Alfonso Peccatiello, founder and CEO of The Macro Compass.

Why misplaced? In Peccatiello's view: "The first innings of a recession always look like a soft landing, as growth and inflation come down but not to alarming levels yet – exactly like [today's environment]."

Here's a Reuters article he points to from 2007 that could pass for something published yesterday — "U.S. economy on track for soft landing - Dallas Fed."

Contrast the current post-Fed euphoria with Peccatiello's tweet only a few days back: "In 4-5 months, I expect the US to be in a recession."

Peccatiello laid out four macro indicators that point to a "bad" U.S. recession by the end of the second quarter this year. Specifically, these indicators are the global credit impulse, the Conference Board's leading indicators index, the NAHB housing index, and the Philly Fed's new orders index.

"Pricing in a soft landing doesn’t actually mean we are going to get a soft landing," Peccatiello said.

The result is that investors have two epically diverging views of the economy — and it's the stock bulls betting on the soft landing who are currently winning.

But according to Peccatiello, the bulls can get runover in two different scenarios — (1) if economic data comes in hot, forcing Powell to amp the hawkish talk once again, or (2) if economic data comes in "recessionary-like," meaning very weak, which takes the soft landing off the table.

In other words, it will take Goldilocks data — not too good, but not too bad — until the Fed's next meeting in mid-March to avoid the nasty conclusion that we're heading for recession.

Peccatiello is right, choose your poison carefully, a super hot economy means a lot more Fed rate hikes and a super lousy ones means we are headed into a long recession.

My biggest fear remains the Fed will pause, the US and global economy will slow, and wage inflation will pick up, forcing the Fed and other central banks to raise rates again, killing the economy and stock market for a very long time.

Maybe that why smart investors like R. Michael Burry aren't being fooled by the January rally and deleted his Twitter account after posting "SELL":

‘Won’t get fooled again’?: Nasdaq jumped over 10% in January. Here’s what history shows happens next to the tech-heavy index https://t.co/LaAjmmLfFQ

— MarketWatch (@MarketWatch) February 1, 2023

$SPY great eye, Allen. The two candles are nearly identical to the 2 from mid August top. https://t.co/uLuseTehtF pic.twitter.com/2I16jgURXE

— Reformed Tr🅰️der (@Reformed_Trader) February 3, 2023

'Big Short' Michael Burry Bets on a Stock Market Crash - TheStreet https://t.co/5ARxo5TvSB

— Leo Kolivakis (@PensionPulse) February 4, 2023

I have a lot of respect for Dr. Michael Burry but my favorite hedge fund manager of all time was a guy I never met nor did Michael Lewis ever interview for his book, The Big Short.

His name is Andrew Lahde, who famously scored huge gains in 2007 by correctly betting on the meltdown in subprime mortgage-backed securities and then wrote a farewell letter and returned all the money back to his investors:

Lahde, 37, nailed the subprime collapse, and reaped a reported 866% one-year return on his call.

But after that brilliant move, he shunned publicity. Last month, he said he was returning clients’ money and leaving the fund business because he considered the risks in the financial system to be extreme.

You can read Lahde's farewell letter below:

October 17, 2008

Today I write not to gloat. Given the pain that nearly everyone is experiencing, that would be entirely inappropriate. Nor am I writing to make further predictions, as most of my forecasts in previous letters have unfolded or are in the process of unfolding. Instead, I am writing to say goodbye.

Recently, on the front page of Section C of the Wall Street Journal, a hedge fund manager who was also closing up shop (a $300 million fund), was quoted as saying, “What I have learned about the hedge fund business is that I hate it.” I could not agree more with that statement. I was in this game for the money. The low hanging fruit, i.e. idiots whose parents paid for prep school, Yale, and then the Harvard MBA, was there for the taking. These people who were (often) truly not worthy of the education they received (or supposedly received) rose to the top of companies such as AIG, Bear Stearns and Lehman Brothers and all levels of our government. All of this behavior supporting the Aristocracy only ended up making it easier for me to find people stupid enough to take the other side of my trades. God bless America.

There are far too many people for me to sincerely thank for my success. However, I do not want to sound like a Hollywood actor accepting an award. The money was reward enough. Furthermore, the endless list of those deserving thanks know who they are.

I will no longer manage money for other people or institutions. I have enough of my own wealth to manage. Some people, who think they have arrived at a reasonable estimate of my net worth, might be surprised that I would call it quits with such a small war chest. That is fine; I am content with my rewards. Moreover, I will let others try to amass nine, ten or eleven figure net worths. Meanwhile, their lives suck. Appointments back to back, booked solid for the next three months, they look forward to their two week vacation in January during which they will likely be glued to their Blackberries or other such devices. What is the point? They will all be forgotten in fifty years anyway. Steve Balmer, Steven Cohen, and Larry Ellison will all be forgotten. I do not understand the legacy thing. Nearly everyone will be forgotten. Give up on leaving your mark. Throw the Blackberry away and enjoy life.

So this is it. With all due respect, I am dropping out. Please do not expect any type of reply to emails or voicemails within normal time frames or at all. Andy Springer and his company will be handling the dissolution of the fund. And don’t worry about my employees, they were always employed by Mr. Springer’s company and only one (who has been well-rewarded) will lose his job.

I have no interest in any deals in which anyone would like me to participate. I truly do not have a strong opinion about any market right now, other than to say that things will continue to get worse for some time, probably years. I am content sitting on the sidelines and waiting. After all, sitting and waiting is how we made money from the subprime debacle. I now have time to repair my health, which was destroyed by the stress I layered onto myself over the past two years, as well as my entire life – where I had to compete for spaces in universities and graduate schools, jobs and assets under management – with those who had all the advantages (rich parents) that I did not. May meritocracy be part of a new form of government, which needs to be established.

On the issue of the U.S. Government, I would like to make a modest proposal. First, I point out the obvious flaws, whereby legislation was repeatedly brought forth to Congress over the past eight years, which would have reigned in the predatory lending practices of now mostly defunct institutions. These institutions regularly filled the coffers of both parties in return for voting down all of this legislation designed to protect the common citizen. This is an outrage, yet no one seems to know or care about it. Since Thomas Jefferson and Adam Smith passed, I would argue that there has been a dearth of worthy philosophers in this country, at least ones focused on improving government. Capitalism worked for two hundred years, but times change, and systems become corrupt. George Soros, a man of staggering wealth, has stated that he would like to be remembered as a philosopher. My suggestion is that this great man start and sponsor a forum for great minds to come together to create a new system of government that truly represents the common man’s interest, while at the same time creating rewards great enough to attract the best and brightest minds to serve in government roles without having to rely on corruption to further their interests or lifestyles. This forum could be similar to the one used to create the operating system, Linux, which competes with Microsoft’s near monopoly. I believe there is an answer, but for now the system is clearly broken.

Lastly, while I still have an audience, I would like to bring attention to an alternative food and energy source. You won’t see it included in BP’s, “Feel good. We are working on sustainable solutions,” television commercials, nor is it mentioned in ADM’s similar commercials. But hemp has been used for at least 5,000 years for cloth and food, as well as just about everything that is produced from petroleum products. Hemp is not marijuana and vice versa. Hemp is the male plant and it grows like a weed, hence the slang term. The original American flag was made of hemp fiber and our Constitution was printed on paper made of hemp. It was used as recently as World War II by the U.S. Government, and then promptly made illegal after the war was won. At a time when rhetoric is flying about becoming more self-sufficient in terms of energy, why is it illegal to grow this plant in this country? Ah, the female. The evil female plant – marijuana. It gets you high, it makes you laugh, it does not produce a hangover. Unlike alcohol, it does not result in bar fights or wife beating. So, why is this innocuous plant illegal? Is it a gateway drug? No, that would be alcohol, which is so heavily advertised in this country. My only conclusion as to why it is illegal, is that Corporate America, which owns Congress, would rather sell you Paxil, Zoloft, Xanax and other addictive drugs, than allow you to grow a plant in your home without some of the profits going into their coffers. This policy is ludicrous. It has surely contributed to our dependency on foreign energy sources. Our policies have other countries literally laughing at our stupidity, most notably Canada, as well as several European nations (both Eastern and Western). You would not know this by paying attention to U.S. media sources though, as they tend not to elaborate on who is laughing at the United States this week. Please people, let’s stop the rhetoric and start thinking about how we can truly become self-sufficient.

With that I say goodbye and good luck.

All the best,

Andrew Lahde

This letter is priceless and much has happened since Lahde went off the grid -- massive QE perpetuating the bubble the Power Elite need to survive and thrive, the explosion in private debt which might be where the next crisis originates, legalization of pot in Canada and many US states, and a lot more but his advice still rings true today, especially this part:

Some people, who think they have arrived at a reasonable estimate of my net worth, might be surprised that I would call it quits with such a small war chest. That is fine; I am content with my rewards. Moreover, I will let others try to amass nine, ten or eleven figure net worths. Meanwhile, their lives suck. Appointments back to back, booked solid for the next three months, they look forward to their two week vacation in January during which they will likely be glued to their BlackBerries or other such devices. What is the point? They will all be forgotten in fifty years anyway. . . . I do not understand the legacy thing. Nearly everyone will be forgotten. Give up on leaving your mark. Throw the BlackBerry away and enjoy life.’

So let me wrap in up there on this brutally cold Saturday, February 4th, 2023 and tender to my brutally painful sciatica which doesn't benefit from me sitting down four hours straight to write this comment.

Remember, you're not going to read this stuff from your favorite broker or on CNBC and other financial sites, so please take the time to contribute to my blog on the top left-hand side under my picture.

Below, Jan Hatzius, Goldman Sachs chief economist, joins 'Squawk on the Street' to discuss the January jobs report.

Second, Optiver's Paul Aronson joins 'Power Lunch' to discuss trades in the bond market, the jobs report driving actions in the market, and anticipation about Powell's upcoming Tuesday remarks.

Third, Jim Chanos joins CNBC's "Fast Money" to discuss rising tensions with China, his short-selling strategy and his short position on Tesla shares.

Fourth, Joe Terranova, Jason Snipe, and Kari Firestone join 'Halftime Report' to discuss ETF rebalancing, interest rate hikes, and tech earnings.

Fifth, Anastasia Amoroso, iCapital's chief investment strategist. says the January US employment report challenges Federal Reserve Chair Jerome Powell's view that disinflation has started. Speaking with Jonathan Ferro on "Bloomberg The Open," Amoroso also says that stocks are approaching overbought levels.

Lastly, Jeffrey Gundlach, Doubleline founder, joins 'Closing Bell: Overtime' to discuss Fed chair Powell's rate hike decision.

Comments

Post a Comment