A Conversation With John Graham on CPP Investments Fiscal 2023 Results

The Canada Pension Plan Investment Board posted a net return of 1.3 per cent for the fiscal year ended March 31, ending the year with net fund assets of $570 billion compared to $539 billion a year earlier.

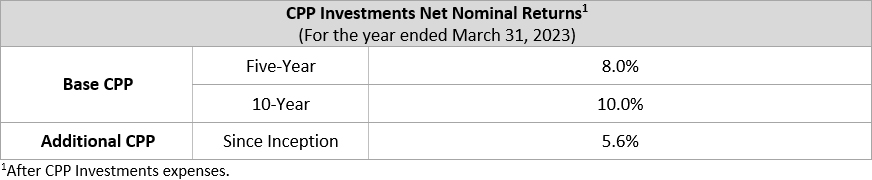

The CPP fund has a 10-year net return of 10 per cent.

The $31 billion increase in net assets this year consisted of $8 billion in net income and $23 billion in net transfers from the Canada Pension Plan (CPP).

Net CPP cash flows in fiscal 2023 were higher than usual due to higher employment rates, an increased limit to the year’s maximum pensionable earnings, an increase to additional CPP contribution inflows and a lump-sum inflow in the fourth quarter due to forecasting adjustments made by the CPP.

Since its inception in 1999, CPPIB has contributed $386 billion in cumulative net income to the fund.

“Our strong long-term return of 10 per cent over 10 years demonstrates that our active management strategy is on track,” said John Graham, chief executive of the pension investment organization.

“Despite significant declines in global equity and fixed income markets during our fiscal year, our investment portfolio remained resilient, delivering stable returns while outperforming major indexes.”

In an interview, Graham said the fund’s diversification by geography and asset class helped during what was a volatile year, with renewables and some credit portfolios performing well despite challenges in sectors such as real estate and retail.

In private credit, tightening credit conditions resulting from a handful of bank failures and rescues in the United States have opened up opportunities for non-bank players like pension funds, he said.

Meanwhile, global infrastructure deals are beginning to take place without prices being reset, while “price discovery” remains in flux in other areas.

“So we kind of had headwinds and tailwinds in the portfolio, which is the point of diversification,” Graham said.

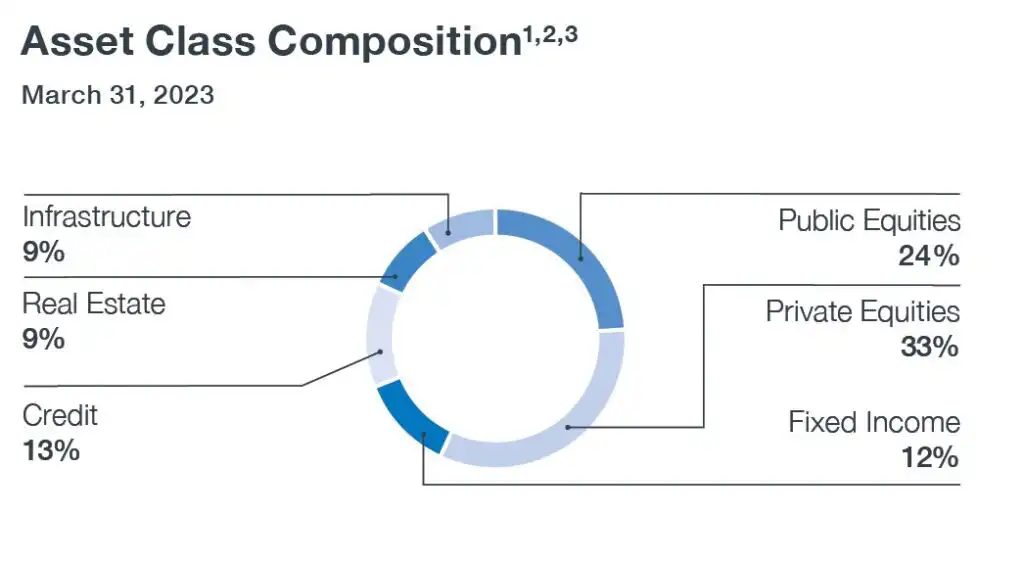

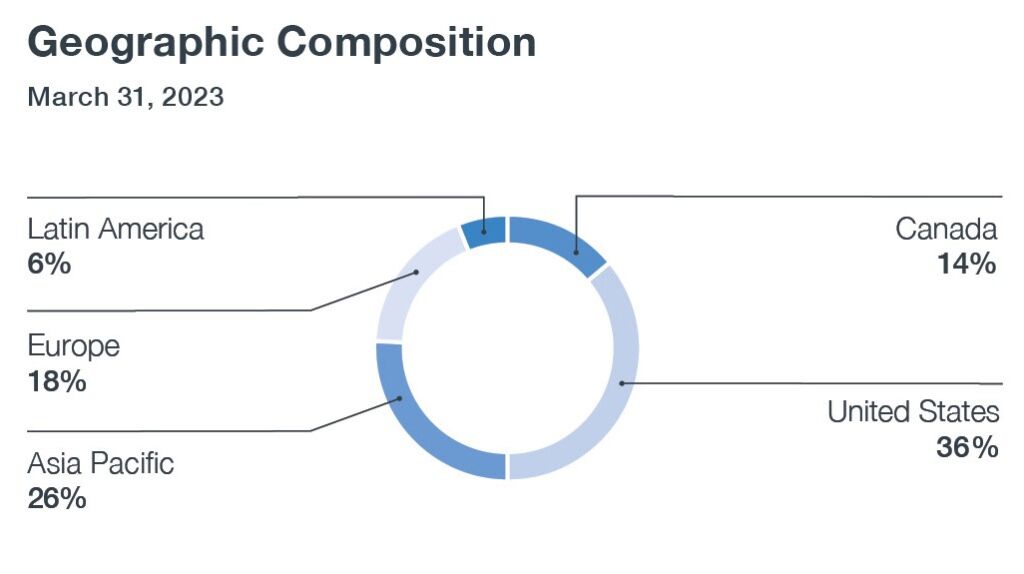

Ongoing macroeconomic and geopolitical risks are being assessed, and CPPIB intends to continue to pursue an asset split of 80 per cent in developed markets and 20 per cent emerging markets, he said.

There are no immediate plans to make an adjustment to the CPP fund’s investments in China which represent about nine per cent of the portfolio and include direct investments as well as exposure through passive share ownership.

“We do continue to believe that (as) … a global investor that it’s important to invest in the largest, fastest growing economies around the world,” Graham said. “I think it would actually be challenging to understand the global economy without understanding the largest economies within it.”

He described the fund’s investments in China as “surgical,” adding that he is comfortable with the companies and that the majority of the investments are liquid, meaning there is less risk if they needed to be sold.

“The percentage (of investments) is really grounded in what we think the forward looking returns are, but what the forward looking returns will be from a risk adjusted basis, ensuring that we get compensated for the risk,” he said.

Christine Dobby of the Toronto Star also reports CPP

Investments posts 1.3% return as inflation and high interest rates hit

results, as CEO says fund does not plan to divest from fossil fuel

investments:

It was a “very rare” year in which stocks and bonds both slumped while inflation and interest rates soared around the world, but Canada’s biggest pension fund still eked out a modest return.

John Graham, CEO of the Canada Pension Plan Investment Board (CPP Investments), said in an interview Wednesday that the fund’s diversified investing approach helped it weather the financial-market strife, as its infrastructure and private-equity holdings delivered solid returns.

Graham also told the Star he has not changed his view on two controversial topics: continuing to invest in China and refusing to divest from oil and gas assets.

CPP said it earned 1.3 per cent in its most recent fiscal year (ended March 31). That beat the fund’s reference portfolio (an internal benchmark it sets for itself), which had a return of just 0.1 per cent, and brought the fund to a 10 per cent annualized return over the past decade.

There’s probably more volatility on tap for stock markets, Graham said, adding he’s “cautiously optimistic” about what lies ahead for the fund this year as certain sectors in some parts of the world appear ready to soar.

“For an active investor, that provides opportunities,” Graham said, referencing CPP Investments’ approach of combing the globe and often making direct investments in a wide range of assets, from airports to toll roads and energy utilities to malls.

Graham cited logistics, enterprise software businesses and multi-family residential buildings as areas of opportunity for CPP, adding, “I continue to believe in being a global investor.”

He said European investments have recently performed well as have real estate holdings in India, where workers have returned to the office in higher numbers than in North America.

CPP’s real estate investments actually declined in value by 1.2 per cent last year, in large part because of the North American office sector, where many businesses have been slashing their leases as they adopt hybrid work models.

CPP’s infrastructure division posted a 5.6 per cent return; it earned 6.8 per cent on private equity; and its credit investments increased by six per cent. The fund also got a boost on its investments held in U.S. currency because the loonie declined in value against the U.S. dollar (as well as other foreign currencies) during the year.

Earlier this month, CPP’s Michel Leduc, global head of public and corporate affairs at CPP, spoke with a federal parliamentary committee on Canada’s relationship with China, which has grown increasingly tense in recent months over claims of Chinese interference in Canadian politics.

Leduc, who said about 9.8 per cent of CPP’s overall portfolio is in China, said the fund uses several tools to carefully evaluate its investments and avoids stakes in “companies involved in wrongdoings, especially violations of human rights.”

“The organization feels we need to be exposed to China,” Graham said Wednesday. “It’s the second-largest economy in the world.”

He also reiterated that CPP does not plan to divest from fossil fuel investments despite calls from some climate activists to stop funding businesses that have no viable path to reducing their carbon emissions to zero.

“We’ve been quite clear that we’re going to go down a path of engagement and not a part of divestment,” Graham said, referencing the view held by many investors that they can “engage” with the companies in which they hold stakes and influence those businesses to enact climate-friendly transition plans.

In a pension “report card” published in January, the eco-advocacy charity Shift: Action for Pension Wealth and Planet Health gave CPP an overall grade of C minus. Shift praised the pension fund for taking a more urgent approach to climate issues and for setting a target of reaching net-zero carbon emissions in its portfolio by 2050.

But Shift said CPP could do better, criticizing its refusal to divest from fossil fuels as well as the fact that it has not set interim targets on how it plans to reach net-zero by 2050.

Graham said he believes interim targets create an incentive to sell off investments in high-emitting businesses (which will likely be financed by someone else, he said), rather than spending the money it takes to reduce emissions.

By the end of its fiscal 2023 year on March 31, CPP Investments had net assets of $570 billion, up from $539 billion a year earlier.

CPP Investments manages the Canada Pension Plan money that is not needed to pay immediate benefits to beneficiaries. Most working Canadians pay into the CPP and it has 21 million contributors and beneficiaries.

David George-Cosh of BNN Bloomberg also reports CPPIB CEO says global growth to be 'challenging' over long-term:

The head of Canada’s largest pension fund said there are still “outstanding questions” about how the global economy will grow over the long-term and cautioned his fund is unlikely to record the same double-digit returns it booked over the past decade.

John Graham, president and chief executive officer of the Canada Pension Plan (CPP) Investment Board, told BNN Bloomberg in an interview that he expects the U.S. to resolve its debt ceiling debacle and is looking to raise liquidity to take advantage of “opportunities” the fund sees in equity and fixed-income markets.

“What is going to drive global growth over the next 10 years? That’s one of the things that keeps us up at night,” Graham said.

Graham’s comments come in the wake of CPP Investments releasing its latest annual report for fiscal 2023 on Wednesday, in which the pension fund reported a 1.3 per cent return. That was the lowest return over the past 10 years but above the 0.1-per-cent benchmark tied to its reference portfolio measures.

Funds under CPP Investments’ management increased by a total return of 10 per cent over the past 10 years, it reported, which Graham acknowledged “would be challenging over the next 10 years to repeat that.”

Canada’s largest money manager said it has $570 billion in assets under management, up about $31 billion due to a profit of $8 billion and net transfers of $23 billion from Canadians in its last fiscal year.

The fund’s return for the year recorded a shortfall in its fixed-income and real estate investments as long-duration government bonds and higher interest rates led to a drag on those asset classes. Those declines were offset by strong gains from its private equity, infrastructure and credit investments, CPP Investments said.

Meanwhile, Graham described the fixed income markets as “interesting” as central banks around the world lifted interest rates to help combat rapidly rising inflation. CPP Investments’ booked a 0.8-per-cent decline among its fixed-income assets that it attributed to exposure to longer-dated government bonds. He noted that CPP Investments will continue to be “constructive” in its energy portfolio investments.

“The path to get here was painful with discount rates rising,” said Graham. “But we’re in a better place in terms of fixed income than we were a year ago.”

A weaker Canadian dollar served as a tailwind to CPP Investments as 78 per cent of its net assets were derived in foreign currencies. CPP Investments recorded a $25 billion gain, or an annual increase of 5.1 per cent, thanks to its foreign exchange investments.

CPP Investments also said that Graham’s compensation rose slightly higher to $5.38 million last year – $4.6 million of which was tied to various annual incentives.

Earlier today, CPP Investments released its fiscal 2023 results, gaining 1.3% with net assets of $570 billion, compared to $539 billion at the end of fiscal 2022:

Highlights1:

- Fiscal 2023 net return of 1.3%

- 10-year net return of 10.0%

- Net assets increase by $31 billion for fiscal year

- One-year dollar value-added of $2 billion or 1.3% above the Reference Portfolios

- Compounded dollar value-added of $47 billion since inception of active management

TORONTO, ON (May 24, 2023): Canada Pension Plan Investment Board (CPP Investments) ended its fiscal year on March 31, 2023, with net assets of $570 billion, compared to $539 billion at the end of fiscal 2022.

The $31 billion increase in net assets consisted of $8 billion in net income and $23 billion in net transfers from the Canada Pension Plan (CPP). CPP Investments received greater than usual net CPP cash flows in fiscal 2023 due to higher employment rates, an increased limit to the year’s maximum pensionable earnings, an increase to additional CPP contribution inflows, and a lump-sum inflow in the fourth quarter due to forecasting adjustments made by the CPP.

The Fund, which includes the combination of the base CPP and additional CPP accounts, achieved a net return of 1.3% for the fiscal year. Since the CPP is designed to serve multiple generations of beneficiaries, evaluating the performance of CPP Investments over extended periods is more suitable than in single years. The Fund returned a 10-year annualized net return of 10.0%. Since its inception in 1999, CPP Investments has contributed $386 billion in cumulative net income to the Fund.

“Our strong long-term return of 10% over 10 years demonstrates that our active management strategy is on track,” said John Graham, President & CEO. “Despite significant declines in global equity and fixed income markets during our fiscal year, our investment portfolio remained resilient, delivering stable returns while outperforming major indexes.”

The positive fiscal-year results reflect returns on investments in infrastructure and certain U.S. dollar-denominated private equity and credit assets, which benefited from foreign exchange. External investment managers employing quantitative, equity, and fixed income trading strategies also contributed positively to results. Our performance was partially offset by significant declines in both equities and fixed income across major markets as high inflation and rising interest rates weighed heavily on both asset classes. The Canadian dollar depreciated against the U.S. dollar and other major currencies during the year, influenced by the impact of evolving monetary and fiscal policies across global economies. This had a positive impact on investment returns with a foreign currency gain of $25 billion.

Performance of the Base and Additional CPP Accounts

The base CPP account ended the fiscal year on March 31, 2023, with net assets of $546 billion, compared to $527 billion at the end of fiscal 2022. The $20 billion increase in net assets consisted of $8 billion in net income and $12 billion in net transfers from the CPP. The base CPP account achieved a 1.4% net return for the fiscal year and a five-year annualized net return of 8.0%.

The additional CPP account ended the fiscal year on March 31, 2023, with net assets of $24 billion, compared to $13 billion at the end of fiscal 2022. The $11 billion increase in net assets consisted of $331 million in net income and $11 billion in net transfers from the CPP. The additional CPP account achieved a 0.3% net return for the fiscal year and an annualized net return of 5.6% since its inception in 2019.

The additional CPP was designed with a different legislative funding target and contribution rate compared to the base CPP. Given the differences in their design, the additional CPP has had a different market risk target and investment profile since its inception in 2019. As a result of these differences, we expect the performance of the additional CPP to generally differ from that of the base CPP.

Furthermore, due to the differences in their net contribution profiles, the assets in the additional CPP account are also expected to grow at a much faster rate than those in the base CPP account.

Long-Term Financial Sustainability

Every three years, the Office of the Chief Actuary of Canada, an independent federal body that provides checks and balances on the future costs of the CPP, evaluates the financial sustainability of the CPP over a long period. In the most recent triennial review published in December 2022, the Chief Actuary reaffirmed that, as at December 31, 2021, both the base and additional CPP continue to be sustainable over the long term at the legislated contribution rates.

The Chief Actuary’s projections are based on the assumption that, over the 75 years following 2021, the base CPP account will earn an average annual rate of return of 3.69% above the rate of Canadian consumer price inflation. The corresponding assumption is that the additional CPP account will earn an average annual real rate of return of 3.27%.

“CPP Investments has a clear mission to help ensure the long-term financial sustainability of the CPP, which includes navigating through periods of volatility. In challenging economic times, it is helpful to reflect on how far we’ve come,” said Graham. “When CPP Investments was first created, it was projected that the Fund would earn $256 billion in investment income and grow to $368 billion at the end of 2022. Since that time, CPP Investments has made many strategic choices that have set the Fund on the path to exceed those projections by more than $200 billion. At $570 billion, this outperformance is due in part to the $386 billion in investment income earned over that period.”

Relative Performance

The CPP is designed to serve today’s contributors and beneficiaries while looking ahead to future decades and across multiple generations. CPP Investments has established benchmarks of passive, public-market indexes called Reference Portfolios that reflect the targeted level of market risk that we believe is appropriate for each of the base CPP and additional CPP accounts, while also serving as a point of measurement when assessing the Fund’s performance over the long term. CPP Investments’ performance relative to the Reference Portfolios can be measured in percentage or dollar terms, or dollar value-added, after deducting all expenses.

On a relative basis, the Fund’s net return of 1.3% outperformed the aggregated Reference Portfolios’ return of 0.1%. As a result, in fiscal 2023, net dollar value-added for the Fund was $2 billion. Over the five-year and 10-year periods, the Fund delivered an aggregate dollar value-added of $7 billion (or percentage value-added of 0.8%) and a dollar value-added of $18 billion (or 0.8%), respectively.

In investing for the long term, the Fund grows not only through the value added in a single year, but also through the compounding effect of continuous reinvestment of gains (net of losses). We calculate compounded dollar value-added as the total net dollars that CPP Investments has added to the Fund through active management, above the returns of the Reference Portfolios. CPP Investments has generated $47 billion of compounded dollar value-added, after all expenses, since the inception of active management in 2006.

For information on which of our decisions are adding the most value, please refer to page 39 of the CPP Investments Fiscal 2023 Annual Report.

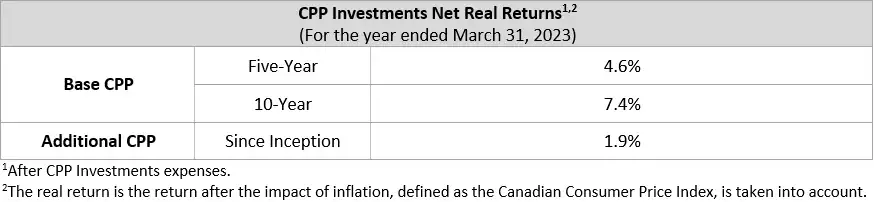

Asset and Geography Mix

CPP Investments, inclusive of both the base CPP and additional CPP Investment Portfolios, is diversified across asset classes and geographies:

1 Fixed income consists of cash and cash equivalents, money market securities and government bonds, all net of financing liabilities. Public Equities include absolute return strategies and related investment liabilities.

2 As at March 31, 2023, the Real Assets investment department managed $52 billion of real estate, $52 billion of infrastructure and $32 billion of our private equity investments associated with sustainable energies. Collectively, these holdings represented 24% of net assets.

3 Credit consists of public and private credit investments of which $52 billion forms part of the Active Portfolio and $20 billion forms part of the Balancing Portfolio as at March 31, 2023, both managed by the Credit Investments department.Performance by Asset Class and Geography

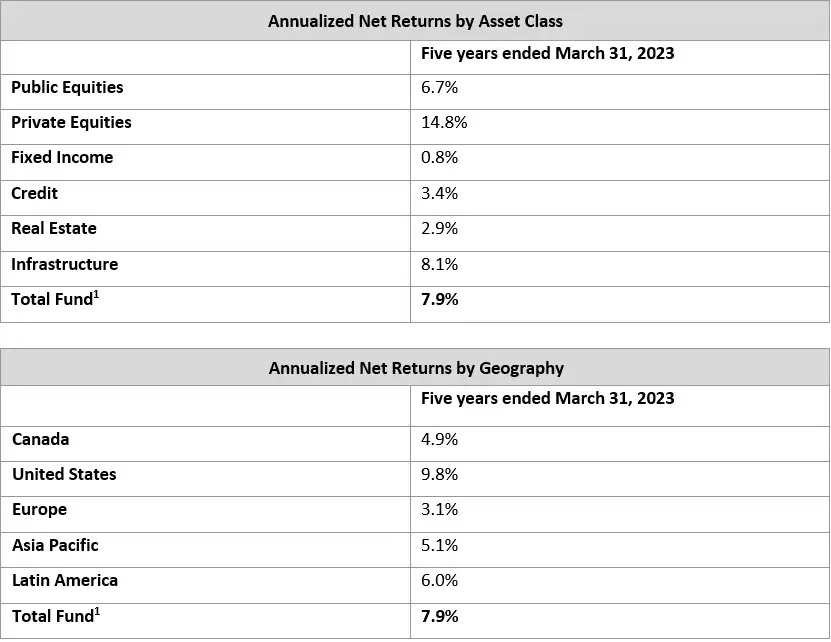

Five-year Fund returns by asset class and geography are reported in the tables below. In fiscal 2023, both emerging and developed markets contributed positively to our annual and five-year returns. A more detailed breakdown of performance by investment department is included on page 48 of the Fiscal 2023 Annual Report.

1 The performance of certain investment activities is only reported in the total Fund return and not attributed to an asset class and/or geography return. Activities reported only within total Fund net returns include those from currency management activities, cash equivalents and money market securities investments, and absolute return strategies. For the geography-based presentation, total Fund net returns also include securities, such as swaps, forwards, options and pooled funds, that are without country of exposure classification.

Managing CPP Investments CostsDiscipline in cost management is a main thrust of our public accountability as we continue to build an internationally competitive enterprise that seeks to create enduring value for multiple generations of beneficiaries of the CPP.

Overall, total expenses have increased compared to the previous year. Operating expenses increased by $112 million due to an increase in full-time globally positioned talent, continuous improvements to our technology and data infrastructure, and the development of our investment science capabilities. Our operating expense ratio was 28.6 basis points (bps), which is below the five-year average of 29.0 bps and up marginally from 27.1 bps observed in fiscal 2022.

Management fees increased by $165 million, due to an increase in average assets managed by external fund managers. Performance fees decreased by $621 million driven by fewer realization events in the private equity portfolio given the low transaction activity through the year, partially offset by strong performance of hedge funds.

Transaction-related expenses, which decreased by $151 million, vary from year to year according to the number, size and complexity of our investing activities. Other categories affecting our total cost profile include taxes and expenses associated with various forms of leverage.

Page 27 of the Fiscal 2023 Annual Report provides a discussion of how we manage our costs. For a complete overview of CPP Investments combined expenses, including year-over-year comparisons, refer to page 46.

Operational Highlights for the Year

Leadership announcements

- Announced the following Senior Management Team appointments:

- Maximilian Biagosch as Senior Managing Director & Global Head of Real Assets;

- Kristina Fanjoy as Senior Managing Director & Chief Financial Officer;

- Priti Singh as Senior Managing Director & Global Head of Capital Markets and Factor Investing;

- Kristen Walters as Senior Managing Director & Chief Risk Officer; and

- Jon Webster as Senior Managing Director & Chief Operating Officer.

- Appointed Richard Manley as Chief Sustainability Officer.

Board appointment

- Welcomed Judith Athaide to the Board of Directors. Appointed in November 2022, Ms. Athaide is President and CEO of The Cogent Group Inc., and a corporate director. She previously held a variety of senior commercial and technical roles in the energy industry, as well as academic positions at the Universities of Alberta, Brandon, Calgary and Mount Royal.

Strategic developments

- Achieved our objective for CPP Investments’ operations to be carbon neutral across Scope 1, 2 and 3 (business travel) emissions this fiscal year as part of our commitment to achieve net zero by 2050. Our approach is to pursue opportunities to decarbonize our operations, with carbon credits only being used to compensate for the remaining emissions. Consistent with this, we will continue to monitor and manage the emissions associated with our air travel and office footprint in fiscal 2024, capturing learnings from the hybrid working models used during the COVID-19 pandemic.

- Signed a statement of commitment to the FX Global Code, which represents a set of principles generally recognized as good practice to promote the integrity and effective functioning of the wholesale foreign exchange market. The FX Global Code was developed by a partnership between central banks and market participants from 20 jurisdictions around the globe.

- Created a distinct Risk department, as part of the division of the Chief Financial and Risk Officer role, to further strengthen the governance of the Fund as the organization grows. The Risk department, led by the Chief Risk Officer, develops the organization’s overall risk framework, provides objective oversight and helps ensure risk considerations are incorporated into investment and operational processes.

Public accountability

- Hosted nine in-person public meetings – one in each province that participates in the CPP – along with a national virtual meeting, which provided an accessible forum for more contributors and beneficiaries to ask questions of our senior leaders. These meetings reflect our continued accountability to the CPP’s more than 21 million contributors and beneficiaries.

Investment Highlights for the Year

Active Equities

- Invested C$207 million for a 0.3% stake in London Stock Exchange Group (LSEG) through a private placement with a selling consortium that included CPP Investments. LSEG is a global market infrastructure, data and analytics provider.

- Invested C$401 million for a 2.0% stake in Commerzbank, one of the largest banks in Germany serving retail and small business customers.

- Invested an additional C$309 million in Airbus SE, increasing our ownership stake to 0.5%. Based in Europe, Airbus is a leader in designing, manufacturing, and delivering aerospace products, services, and solutions to customers globally.

- Invested an additional C$459 million in Z Holdings Corporation, a Japanese holding company that owns and manages a portfolio of businesses including Yahoo! Japan, increasing our ownership stake to 2.1%.

- Invested approximately C$113 million for a 1.8% stake in Sendas Distribuidora, the second largest food retailer in Brazil, operating more than 260 cash-and-carry stores across the country.

- Invested C$277 million for a 3.1% stake in Frontier Communications, a broadband and voice services exchange carrier, expanding its fibre-to-the-home network by six million homes, operating across 25 U.S. states.

- Invested C$150 million for a stake of less than 1% in Cheniere Energy, a producer and exporter of liquefied natural gas in the U.S.

- Invested US$292 million for a 9.3% stake in the Hong Kong-listed shares of China Tourism Group Duty Free, a leading duty-free operator in China.

- Exited Orpea SA, a France-based company that operates retirement homes, outpatient and rehabilitation clinics, and psychiatric care. Net proceeds from the sale were €26.1 million. Our original investment was made in 2013.

Credit Investments

- Committed US$350 million to Blackstone Credit’s BGreen III fund, an energy transition-focused private credit fund that targets global opportunities in a variety of sub-sectors including renewable power generation and storage, energy efficiency services, and critical energy infrastructure.

- Invested US$148 million in the senior secured notes of Auna S.A.A., a leading health care service provider in Mexico, Colombia and Peru.

- Invested R$200 million (C$52 million) in the debt facility of Rio Energy alongside Lumina Capital Management. Rio Energy is an independent renewable energy company in Brazil.

- Invested US$200 million in an asset-purchasing vehicle with Gordon Brothers to acquire asset-backed loans originated by the company. Headquartered in Boston, U.S., Gordon Brothers is a global advisory, restructuring and investment firm.

- Committed INR 18.5 billion (C$310 million) to the first close of the Kotak Infrastructure Investment Fund, which will provide senior and secured financing to operating infrastructure projects in India.

- Invested US$75 million in a mezzanine loan backed by a sponsor-owned, Grade-A office and retail property in Shanghai, China.

- Invested US$115 million in the second-lien term loan of HCP Global Ltd. (HCP) to support Carlyle’s acquisition of the company. HCP is a global premium cosmetics and skincare packaging manufacturer serving most of the top cosmetic companies worldwide.

- Closed a C$230 million investment in the term loans of Legal Search, a provider of property- and corporate-related search services in Australia, the U.K., and the U.S.

Private Equity

- Entered into a definitive agreement alongside Silver Lake to acquire Qualtrics, a U.S.-headquartered leader in the experience management software category in an all-cash transaction that values Qualtrics at approximately US$12.5 billion.

- Committed US$400 million to Carlyle Asia Partners VI, L.P., which focuses on control buyouts and minority investments in mid-to-large companies across Asia.

- Committed US$150 million to GTCR XIV/C, L.P., which is focused primarily on mid-market buyouts in North America in the health care, financial services, technology, media & telecommunications, and business & consumer services sectors.

- Invested in Hexagon Bio’s US$77 million Series B funding round. The U.S.-based biopharmaceutical company has an interdisciplinary drug discovery platform to identify novel therapeutic molecules with an initial focus on oncology and infectious diseases.

- Invested US$180 million for a 9.8% stake in Tricor Group, a leading Asia-focused provider of business and corporate services based in Hong Kong, alongside BPEA EQT.

- Committed US$400 million to Clayton, Dubilier & Rice Fund XII. Clayton, Dubilier & Rice is one of the world’s oldest private equity firms and focuses on upper middle market and large value-oriented buyouts, as well as build-ups in North America and Western Europe.

- Acquired a significant minority stake in Universal Investment Group, a leading third-party management company and fund administration service provider serving both institutional investors and asset managers across European fund markets.

- Invested US$334 million to acquire a 19.3% stake in D1, the market leader in Latin America’s expanding discount food retail space.

- Committed US$1 billion to Blackstone Capital Partners IX, the flagship fund of Blackstone, which focuses on large-scale, control buyouts in North America, Europe and Asia.

- Committed US$79 million across Radical Ventures III and Opportunities I, after previously committing to Fund II as an anchor investor. Radical Ventures is an early-stage manager based in Toronto, Canada, focusing on artificial intelligence opportunities in Canada and the U.S.

- Committed €400 million to EQT X, which will pursue investments in high-quality companies operating in attractive sub-sectors within health care, technology, media & telecommunications, services, and industrial technology. Headquartered in Sweden, EQT is a global alternative asset manager operating across private capital and real assets.

Real Assets

- Agreed to acquire an additional 29.5% stake in ReNew Energy Global (ReNew) through two transactions totalling C$925 million, bringing our total economic stake to 51.9% with C$1.8 billion of invested capital. ReNew is one of the largest renewable energy independent power producers in India.

- Launched Floen, a 50%/50% partnership with Votorantim S.A. focused on investing in the energy transition in Brazil.

- Agreed to purchase 49% of Aera Energy from international asset management group IKAV. Aera Energy is one of California’s largest oil and gas producers and accounts for nearly 25% of the state’s production.

- Committed additional capital to our Indian toll roads portfolio company IndInfravit Trust through two transactions, in which we now own 49.9%. We committed up to C$700 million to help fund the acquisition of five operating road concessions and invested C$86 million for the secondary acquisition of an additional 6.1% stake in IndInfravit.

- Allocated an additional C$322 million in equity to the Japanese Data Centre Development venture with Mitsui & Co. Ltd., for a total allocation of C$730 million since the venture was established in 2021. The venture is focused on hyper-scale data centre developments in Japan.

- Committed US$205 million to IndoSpace Logistics Park IV, a real estate vehicle managed by India-based real estate company IndoSpace.

- Awarded an 80,418-acre floating offshore wind lease off the central coast of California for US$150 million, through Golden State Wind, our 50%/50% joint venture with Ocean Winds.

- Invested R$2.5 billion (C$639 million) for a stake of approximately 9.5% in V.Tal, the largest neutral fibre-to-the-home network provider in Brazil.

- Increased our equity allocation by C$755 million to the second tranche of the Tricon Multifamily joint venture, for a total allocation of C$1.5 billion. Alongside Canada-based Tricon Residential, the joint venture will develop more than 2,000 Class-A purpose-built rental units in the Greater Toronto Area.

- Allocated €475 million to a new joint venture focused on the European hospitality sector with Hamilton – Pyramid Europe, a leading hotel operator and co-investment partner forming part of the Pyramid Global Hospitality group of companies, which committed €25 million. The first asset acquired as part of this new partnership was the W Rome hotel for €172 million.

- Increased our commitment to BAI Communications, a U.K.-headquartered global communications infrastructure provider, alongside partners Manulife and AIMCo to support BAI’s ongoing growth strategy, including the acquisition of ZenFi Networks. We have committed approximately C$3 billion to BAI since 2009 and hold an 86% ownership stake.

- Expanded our strategic partnership with Octopus Energy to support its global expansion and renewables strategy with a total financial commitment of US$525 million since our partnership was established in 2021. Octopus Energy is a global clean energy technology pioneer based in the U.K.

- Sold our minority interests in five regional malls across the U.S., including two in St. Louis, Missouri and three in Southern California. Net proceeds from the sales were C$379 million. The original investments were made between 2012 and 2014.

- Exited the investment in Crowne Plaza Times Square, a mixed-use hotel property in New York City. Net proceeds from the investment were nil. Our original investment was made in 2010.

- Agreed to sell our 33.33% indirect stake in Skyway Concession Company LLC, which manages, operates and maintains the Chicago Skyway toll road. Net proceeds from the sale were US$1 billion. We initially acquired our stake in 2016.

- Sold six logistics warehouses in Western China in the Goodman China Logistics Partnership (GCLP). Net proceeds from the sale were approximately C$340 million. GCLP was established with Goodman Group in 2009 to own and develop logistics assets in mainland China and we have an 80% ownership interest in GCLP.

Transaction Highlights Following the Year-End

- Invested US$20 million in PT Samator Indo Gas Tbk, the largest industrial gas company in Indonesia, alongside CVC Capital.

- Invested US$40 million in the acquisition and merger of two leading Australian frozen food producers, Patties Foods and Vesco Foods, alongside PAG. We own a 16.3% stake in the combined company.

- Sold our 50% interest in Kumho Asiana Tower, a prime-grade office building in Seoul, South Korea. Net proceeds from the sale were C$181 million. Our original investment was made in 2018.

- Committed US$160 million to Multiples Private Equity Fund IV, which targets mid-market growth opportunities in India.

About CPP Investments

Canada Pension Plan Investment Board (CPP Investments™) is a professional investment management organization that manages the Fund in the best interest of the more than 21 million contributors and beneficiaries of the Canada Pension Plan. In order to build diversified portfolios of assets, investments are made around the world in public equities, private equities, real estate, infrastructure and fixed income. Headquartered in Toronto, with offices in Hong Kong, London, Luxembourg, Mumbai, New York City, San Francisco, São Paulo and Sydney, CPP Investments is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At March 31, 2023, the Fund totalled $570 billion. For more information, please visit www.cppinvestments.com or follow us on LinkedIn, Facebook or Twitter.

1 Certain figures may not add up due to rounding

Alright, CPP Investments released its fiscal 2023 results and earlier today, I had a chance to talk to CEO John Graham and asked him some tough questions.

Before I get to my discussion with John, I urge you to carefully read CPP Investments' F2023 Annual Report which is available here.

Below, the table of contents for this comprehensive report:

Next, here are the performance highlights for fiscal 2023:

I always encourage my readers to read Dr. Heather Munroe-Blum's (Chairperson) message:

I note the last page of Dr. Munroe-Blum's message:

This year, 2023, will be my last as Board Chairperson. I remain in the role until my retirement – planned for the end of the calendar year. As I approach the end of my tenure, not only as Board Chairperson but as a Board Director, I look back in admiration at the accomplishments of this organization over the years I have served on the Board. In 2010, when I was first appointed, we had assets of $128 billion; today, we manage $570 billion. Over the past 13 years, CPP Investments has grown not only in size, but in sophistication, expanding from a largely domestically focused organization to one with a highly diversified investment portfolio operating across nine global offices. Amidst managing such growth, CPP Investments also developed the operational capacity to invest the additional contributions arising from the CPP enhancement that came to pass in 2019.

These accomplishments can directly be tied back to the wisdom of the authors of the Canada Pension Plan Investment Board Act of 1997, which promulgated an organization and governance model that is the envy of pension and wealth funds globally. It functions at arm’s length from governments so that investment decisions are based on the best interests of contributors and beneficiaries, rather than on politically based projects or priorities. Board members are fully independent. The authors of that legislation had the foresight to envision an enduring organization that will serve generations and generations of Canadians.

The value of independence, constancy and clarity of purpose is clearly demonstrated during times of renewal, either in government or within the Board itself. As new Board members join the organization, they know they will assume a mantle of deep responsibility, transparency and accountability that stretches far into the future.

Adherence to these principles has been a hallmark of CPP Investments and a testament to the wisdom of its government stewards. During my nine years as Chairperson, I have engaged with more than 40 sitting governments at the federal, provincial and territorial levels – all of whom upheld and respected the sole public purpose and necessary independence of CPP Investments. This astounding level of collaboration and cooperation does not generate headlines, yet to my mind, it is a high achievement of the Canadian polity in modern times.

In Closing

While there is a tendency to look back in one’s final year of service, I remain deeply engaged in working with my fellow Directors to support a smooth transition for my successor, and importantly, to continue the work we do to guide the organization as it grows to manage a trillion-dollar Fund. I thank my fellow Board Directors – past and present – for bringing their great talent, unwavering commitment and dedication to CPP Investments.

As well, led by our outstanding CEO John Graham, I commend the exceptional Management team, and all of our highly skilled, dedicated employees, for the work they do daily to ensure that Canadians now and for generations to come will have a secure base for their retirement. It is an honour and joy to work alongside such talented and devoted people. The Board, Management and all of our employees carry out their work with excellence and with integrity to serve the best interests of the more than 21 million CPP contributors and beneficiaries.

Since its inception nearly a quarter of a century ago, CPP Investments’ reputation as a Canadian success story has been hard earned. The “Canadian model” for pension management is now envied around the world. This success was built on the generations of employees, senior leaders and Directors who have all contributed their expertise and commitment as custodians in service of a truly enduring organization, in support of a great public cause. It has been my tremendous privilege to serve, as Chairperson of CPP Investments, and to count myself as one of many to contribute to this great institution.

Sincerely,

Dr. Heather Munroe-Blum

There is a reason why CPP Investments is the biggest and best pension fund in Canada and one of the top globally, it rigorously follows what I call the "GATP principles" which stands for: Governance, Accountability, Transparency and Performance.

And Dr. Munroe-Blum deserves high praise for being the Chairperson of this organization for a very long time, she has seen it all and has dedicated a good part of her life serving this Board, making sure everyone follows the highest level of integrity and excellence in their duties.

Trust me, being the Chairperson of this organization isn't a picnic, it's a lot of work and often requires difficult decisions.

[As an aside, I recently had a conversation with Malcolm Hamilton, my favorite retired actuary in Toronto and jokingly asked him: "How come they never invite us to sit on these prestigious boards?". Malcolm bluntly replied: "Leo, these board members are typically the jovial types who go along with everything and don't rock the boat, we do not fit that profile."]

Next, I urge you to read John Graham's message:

I note this:

Both our portfolio and organization performed well in a challenging year. The portfolio returned (after all expenses) 1.3% and the CPP Fund grew to $570 billion. These gains – despite a significant decline in global equity and fixed income markets – were the result of our active management strategy, which enabled us to outperform most major indexes. We benefitted from solid returns on investments in renewable energy assets and infrastructure, and gains in U.S. dollar-denominated assets, which benefitted from foreign exchange gains. As a result, we delivered $2 billion (1.3%) in dollar value-added over the Fund benchmarks. In fiscal 2023, the Office of the Chief Actuary of Canada released its triennial review of the CPP, which concluded the existing benefit levels are sustainable for at least the next 75 years.

We see the market volatility from fiscal 2023 continuing through 2024 and market returns may continue to be low over the short and medium term. That is why we focus on strengthening the resilience of our portfolio over the long- term horizons we care about most. Competition for attractive opportunities will remain fierce and may intensify, but we will stay focused and disciplined.

John also noted to safeguard and grow the assets of the CPP Fund,

they focused on several key areas in fiscal 2023.

Built for times like these

For more than 15 years, we have been building an organization that seeks to generate above-market returns by searching the world for the most promising investment opportunities and constructing a broadly diversified, multi-asset class portfolio. Nevertheless, we must operate in a state of continuous improvement, always challenging the status quo and pushing ourselves to the next level. To complement our global reach and diversification, we made changes to the structure of our organization this fiscal year. We advanced our risk management and took steps in working together more closely and effectively, as one cohesive enterprise.

Strong risk management

These changes include further enhancing our risk management practices. Strong risk management allows for the efficient allocation of risk to the best investment opportunities. This is most visible in times of market turmoil. For example, we made the decision years ago to avoid investments in Russia because of the potential for significant political risk.

In fiscal 2023, we also created distinct roles for our Chief Risk Officer (CRO) and Chief Financial Officer (CFO), appointing Kristen Walters as CRO and Kristina Fanjoy as CFO. After many years of honing our approach to active management and integrated risk management, we are confident these steps will serve the Fund well.

Investment activities

We made significant investments and divestments across the globe. Some of this year’s highlights include increased investment in Octopus Energy, a global clean energy tech pioneer and one of the largest renewables investors in Europe. We sold six logistics warehouses in Western China in the Goodman China Logistics Partnership. The partnership was established with Goodman Group in 2009 to own and develop logistics assets in mainland China. And, we closed one of Latin America’s largest private equity deals with our investment in the rapidly growing discount food retailer D1, marking our first-ever private equity investment in Colombia.

After a seven-year investment, we sold our stake in the Chicago Skyway, a toll road that forms a critical link between downtown Chicago and its southeastern suburbs. We expanded our joint venture with Tricon Residential, which will focus on developing high-quality rental apartments near major transit and employment nodes in the Greater Toronto Area. Finally, in our largest buyout deal of the year, we announced an investment in Qualtrics, positioning it to drive innovation on its path to becoming an enterprise cloud software platform leader.

Maturing our organizational structure

As the Fund grows, our ability to excel will depend on how well we execute our investment activities and conduct our operations. As our global reach and diversification expands, a challenge we face is ensuring we continue to work together as a single, cohesive enterprise. To that end, we brought together complementary functions under a new Chief Operating Officer, Jon Webster. Among Jon’s responsibilities is partnering with our Chief Sustainability Officer, Richard Manley, to deliver on the Fund’s operational journey to net zero. This intensified executive oversight on reducing greenhouse gas emissions complements the Fund’s ongoing efforts to deepen the integration of climate change considerations into the entire investment life cycle. Our latest report has an update on our path to net zero, including details on our latest sustainability-related achievement: achieving carbon neutrality across Scope 1, 2, and 3 (business travel) emissions.

Our people, your investors We continue to recruit and retain some of the brightest talent in Canada and around the world to work in your best interests by investing the money of the CPP Fund. Our highly qualified people, working across nine offices globally, remain our most important asset, and we took several important steps to support them over the past year. We continued to challenge ourselves to be more equitable, diverse and inclusive, which supports better overall business strategy and decision-making. This has helped us become a more purposeful and connected workplace.

Alongside flexibility, we know opportunities for professional advancement are critical to promoting employee well-being. We have put a new emphasis on training to support employee retention, skill building and talent attraction. Many of our more than 2,000 employees enhanced their skills by participating in development sessions to improve their ability to drive returns and add value to the Fund

All great points, however, on that last point, I would urge CPP Investments to specifically target and recruit Canadians with disabilities.

I'm relentless on this front for the simple reason that it's criminal that so many Canadians with a disability are being ignored by top employers and since CPP Investments (and PSP Investments) are the two largest Crown corporations, I want to see a specific targeted recruitment campaign for people with disabilities.

I'm dead serious on this and purposely calling out CPP and PSP Investments because they lead by example and the rest of Maple Eight follow them.

What else? We know CPP Investments lost Deb Orida who now leads PSP Investments but they recently lost Scott Lawrence too, an outstanding infrastructure investor and one of the best in Canada (along with Andrew Claerhout, another top Infra & PE investor).

I am going to be a lot more vocal on my blog when it comes to hiring the "best & brightest" because there are too many great people (including yours truly) who should be working at these large Canadian pension funds and for some dumb (political or discriminatory?) reason, we aren't (I should start my own Brookfield Asset management with all the top people I know, that's why I trade and make my own money).

Conversation with John Graham

Alright, let me get to my conversation with John Graham which took place earlier today.

Before I do, I want all of you to repeat after me: "We do not pay Leo enough money for all the work that goes into his blog. The guy is relentless, recovering from major back surgery and still sits down every day to enlighten us on markets and pensions."

Damn right I do, and I appreciate those of you who show your support through dollars via the PayPay options on the top left-hand side (kind words don't pay the bills!!).

Alright, back to John and our conversation.

I want to thank him taking some time on a very busy day to talk to me and I also want to than Frank Switzer for setting the call up.

As a point of reference, I sent John some questions prior to our call:

- What is the percentage of assets in private markets vs public markets? Can you please provide a breakdown by asset class and summarize where performance came last fiscal year?

- What percentage of Total Credit assets are in Private Debt? Is it still 80%? If so, are you worried about underwriting standards at an industry level and how it will impact your immense portfolio?

- Please discuss the overall asset mix and where you see risks and opportunities going forward?

- Did CPP Investments write down its private equity and real estate holdings (especially offices) to reflect the valuations in public markets in these areas?

- CPP Investments invests 10% of its assets in China, the bulk of which is in public equities. What are the opportunities if any in private markets there and are they worth the economic and geopolitical risks?

- Do you see India continuing to grow nicely over the next decade and if so, where do you want to be positioned there?

- In our discussion last year when you were in Montreal, we talked about the real possibility of a deep and prolonged global recession. Is CPP Investments prepared for a long and deep global recession? If so, what are you doing specifically?

- Lastly, there were some prominent executives who left the organization over the last 12 months, Scott Lawrence being one of them. How are you making sure you maintain proper staff and train the new generation to take over when called upon?

John had nothing but good things to say about Scott Lawrence, called him a "friend" who he worked with for many years but he also praised Maximilian Biagosch, Senior Managing Director, Global Head of Real Assets & Head of Europe who came from Permira an is now responsible for Real Assets (taking over from Deb Orida).

He also praised James Bryce, Managing Director and new head of Infrastructure. James was previously head of the Portfolio Value Creation group, supporting management teams of individual investments to achieve full value potential.

In general, John is very happy with CPP Investments' bench strength and that's why it is important to keep all these people happy or else the rest of Canada's Maple Eight will try to recruit them away.

I began by telling John that I'm feeling a lot better after my back surgery but have to do a lot of physio and be patient to regain my leg strength so I can be back to where I was last summer (it's coming along but slowly).

He began by giving me an overview:

Think about total performance, we returned 1.3% after all costs, outperformed the Reference Portfolio by 120 basis points and within that there was a lot of tailwinds and a lot of headwinds within the portfolio, real dispersion. This time last year, I highlighted we expected volatility but we probably didn't expect it to be as volatile as it was. Starting at the beginning of the fiscal year, still trying to figure out what the Russian invasion of Ukraine meant; probably around this time last year, capitulation on inflation where the word transient stopped being used, rates started moving up quickly and many assets that have long dated cash flows like technology, really started to see a real impact. the same with cryptocurrencies, they went through a serious meltdown and then there was Silicon Valley Bank and regional bank crisis.So it was a really volatile year and you had fixed income and equities which were highly correlated which presented a really challenging dynamic for institutional investors. We run an 85/15 so not as exposed as a 60/40 portfolio but it's a challenging dynamic.

Looking at the portfolio, headwinds in Real Estate, Office in particular, Retail continuing to be challenged, Technology - challenges there. Tailwind perspective, I would say the Renewable Energy portfolio continues to be quite robust; Infrastructure continues to be quite robust, we sold our Chicago Skyway, countries like India...our office portfolio in India was positive.

So you see dispersion all over the world with respect to assets but overall 1.3%. $25 billion of that is from currency, an appreciating US dollar. That is very deliberate. One of our foundational beliefs in portfolio construction is the flight to US dollars in declining markets. So that unhedged exposure was certainly a benefit last year. Longer term, 10% over ten years,the Chief Actuary said the Fund continues to be sound for 75 more years,the active management strategy delivered $47 billion in cumulative DVA (dollar value-added) since inception.

One last thing. When I reflect on what were the bigger accomplishments over the past year was what we didn't do We didn't have direct assets in Russia or crypto, we didn't have exposure to the retail dynamic, so in many ways, risk management was the star last year.

I told John that when we met here in Montreal last June, we talked about the prospects of a deep and prolonged global recession which will present more challenges to institutional investors. I told him I see a deep and prolonged global recession and I've been writing about the potential private debt and real estate crash as a consequence of the crisis in regional banks. Given that office vacancy rates have hit a high of 32% and 24% in San Francisco and New York City respectively, I asked him specifically about the valuation gap between public and private real estate and private and public equities:

If you read the annual report, you'll see we try to put a lot of rigor into our valuation process. I wouldn't make blanket statements on private valuations. As I highlighted, there are some markets that are still quite robust, the renewable energy and infrastructure space, but Office is in a price discovery mode for sure, trying ot find a clearing price (bid-ask spread). As you highlighted, one of the challenges is you can't do a transaction without the financing up, you highlighted bad commercial real estate loans sitting on the bank books and one of the implications of that is availability of commercial credit going forward and is this going to amplify any type of monetary policy in the broader market and I think that's a big question. We are going to see a contraction of credit because of commercial real estate woes.

In real estate, location. Some markets around the globe are in better shape than others, for sure. We see it in our data. Some of our offices in Hong Kong, Dubai and London are almost back at pre-Covid levels of attendance whereas n North America, we are probably sitting at 60% attendance.

For us, we took some big markdowns in our US office portfolio and in the retail portfolio too. Our portfolio is class A, higher quality buildings, we are not going to sell, we are going to wait for supply and demand to come back in equilibrium. We do believe they will come back in equilibrium, but for lower quality buildings, it will be problematic for a long time.

John added:

In private real estate, we embedded public real estate five years ago, and a fair amount of the capital deployed in real estate last year was in public real estate. We are doing relative value between public and private.

In Private Equity, we do have public equities because of positions like Informatica and others where we exited and kept some public shares so there was an adjustment writedown in PE as well because there was some public exposure as well.

As far as growth equity and VC, there were writedowns there too but it's very small.

As far Real Assets things are going well.

I asked him about China and the whole brouhaha about Canadian pensions investing in China. I told him I have serious concerns about investing there because it's a communist country, tensions with the US and Canada remain high and I asked him how they're navigating all this:

We have about 20% of the portfolio in emerging markets (9% in China) and that exposure will not change in the foreseeable future. We invest in EM to gain access to fast growing economies and they within the next decade be 50% of global GDP. So from a GDP basis, we are going ot be grossly underweight as part of the global economy.

As far as China, we continue to believe it's important to have exposure to the world's second largest economy. We believe if you want to understand the global economy, you have to understand Chna's role in that global economy. You may have seen today, Germany had double digit decline in exports so far this year to China whereas the rest of Europe is up, so the Chinese economy definitely has influence in the global economy so we have to spend time to try to understand it.

But then as you highlighted, it's not straightforward or easy as to how to invest in China. We spend a lot of time thinking of what assets we want, scrutinizing all positions including those in our passive portfolio.

The other question is what is the right amount? It's at 9% today and the answer is what is the forward looking risk-adjusted return will be and if we feel we are getting compensated for it, we will incorporate it into our models.

You highlighted China's demographic challenges, it's a big economy, it's not going to grow at 6% forever, on a dollar notion is will grow but its growth rate will eventually converge to developed world economies growth rates.

China is an interesting country, you cannot ignore it but investing there is far from straightforward.

Even in India where you have a social democracy and rule of law, there are challenges:

India is a key market for us. We are very constructive on it, I will be there later this summer, but everyone is talking about India now - a lot of people! It's like technology, it may change the world but it doesn't mean it's not overpriced.

I chuckled and said when everyone is on the same boat, that boat tends to sink from the sheer weight of global investors.

I finished off by stating that CPP Investments has the liquidity to take advantage of immense opportunities that will arise when the next global recession hits.

John shared this:

Yesterday we were talking about the recession which is always around the corner but the amount of liquidity in the consumer balance sheets and financial system keeps pushing it out.

From a portfolio perspective, it's really hard to forecast these events. Two things we are thinking a lot about is optionality and resilience, How to we build a resilient portfolio through various macro, economic scenarios, various geopolitical regimes knowing it's really hard to forecast and predict events. And then how do yo make sure you have the optionality in the portfolio to be somewhat nimble if opportunities present themselves.

The counter to that is optionality costs money, options aren't free. And if you pay too much optionality it will be a drag on portfolio performance so how you thread that need le in having optionality which in some ways is liquidity in portfolio to take advantage of some selloff but not pay too much in the cost of carry.

We ended off by talking off the record on infrastructure opportunities in Canada and how we can increase the opportunities so they are attractive to large domestic and global investors.

Anyways, that is a discussion for another time.

Once again, I thank John and Frank for taking the time to talk to me and before I forget, I did email them and Michel Leduc once last question:

One question I did not ask you is whether you're concerned about a private debt bubble going on right now. I noted that Credit did very well for F2023, gaining 6%, but wanted to ask you about what is going on in the private debt industry in general and specifically at CPP Investments and Antares Capital. My fear is a deep and prolonged recession will impact this area as companies are unable to meet their loan requirements.Any thoughts would be appreciated.

Private debt makes up 78% of CPP Investments' Credit portfolio. Michel responded by email:

Hi Leo, I know you're a top expert in the field and so will offer our approach with the deepest respect. Bottom line is you ask a fair question, yet it is more in line with what might be posed to a monoline bank or lender as a pure play business. Digging deep into one sector - as in this case - goes against how we think and build a global portfolio, which, by definition, will have different parts affected more meaningfully during the tightest parts of an economic cycle. By falling into the "fear" angle we compromise how we truly see the world of investing within the context of our risk appetite, our prudent liquidity management, our exceptionally long investment horizon and so on. I hope you appreciate us not commenting more generally on this.

Fair enough, I do appreciate the general comments and have to openly state, CPP Investments' Credit headed by Andrew Edgell is doing an exceptional job, they are the best in Canada and the world doing this type of stuff and along with Antares, their underwriting standards are high.

It doesn't mean they're immune from a global downturn, far from it, but they will shift their portfolio and cease opportunities along the way.

One last shout-out to Priti Singh, Global Head of Capital Markets and Factor Investing, she and her team did a great job last year and so did their external managers, adding significant value add in a year which was challenging for most investors and their external hedge fund programs.

And as I always do, below is a table of executive compensation at CPP Investments with footnotes:

Take the time to read the full discussion on compensation starting on page 71 of the F2023 Annual Report.In fact, take the time to read the entire annual report carefully to really dig deep into each asset class and more on how CPP Investments conducts its business.

Alright, it's late, need to eat something light, watch some hockey and go to bed.

Please remember to kindly support this blog through your dollars, not just words, by going to the PayPal options under my picture on the top left-hand side. Thank you!

Below, the CPP Fund increased by $31 billion in Fiscal 2023, ending the year at $570 billion in net assets. Watch the clip below featuring John Graham to learn more.

Also, John Graham, president and chief executive officer of CPP Investments told BNN Bloomberg in an interview that he expects the U.S. to resolve its debt ceiling debacle and is looking to raise liquidity to take advantage of “opportunities” the fund sees in equity and fixed-income markets.

Lastly, the Queen of Rock 'n Roll, Tina Turner died today at the age of 83. She was an icon and a legend and simply the best! RIP Tina Turner, your music will inspire us forever!

Comments

Post a Comment