Echoes of 2008: Why Are Regional Banks Being Sacrificed?

Stocks popped on Friday as regional bank shares climbed off their lows and market-darling Apple jumped after posting better-than-expected quarterly earnings.

The Dow Jones Industrial Average added 546.64 points, or 1.65%, to close at 33,674.38. The S&P 500 climbed 1.85%, ending the day at 4,136.25. The Nasdaq Composite advanced 2.25% and closed at 12,235.41.

Despite Friday’s rally, the Dow and the S&P 500 logged their worst week since March. The 30-stock Dow lost 1.24%, while the S&P 500 dropped 0.8%. The Nasdaq eked out a small weekly gain of 0.07%.

Stocks rose even as April’s jobs numbers came in hotter than expected. The U.S. economy added 253,000 jobs in April. Wall Street had expected 180,000 new jobs, according to Dow Jones.

Late Thursday, Apple posted beats on the top and bottom lines for the fiscal second quarter, propelled by iPhone sales. Apple shares gained about 4.7%.

The rebound for regional bank stocks was boosted by a note from JPMorgan, which upgraded Western Alliance, Zions Bancorp and Comerica to overweight. The firm said those three banks appear “substantially mispriced” in part due to short-selling activity. The SPDR S&P Regional Banking ETF (KRE) advanced more than 6%. PacWest — which is down sharply this week on news it’s considering strategic options that include a sale — popped 81.7%. Western Alliance also jumped 49.2%.

Shares of regional banking companies have been under pressure this week, as traders fear other institutions could suffer the same fate as Silicon Valley Bank and Signature Bank. Both banks collapsed in March.

Liz Young, head of investment strategy at SoFi, doesn’t believe the fallout in the regional banking sector is over despite Friday’s rebound. “When the whole news cycle started, it was sort-of explained away … as a unique circumstance for certain institutions. The reality is that liquidity is a universal challenge,” she said.

“The issue originally was that deposit flight was occurring. … But now that the pressure is no longer necessarily deposit flight. It’s this mark to market of the securities on all their books,” Young continued.

“So I don’t think that this news cycle isn’t necessarily over. … I also don’t think it dies of natural causes in the sense [that] it heats up and then just kind of cools down with no effect,” she added.

Jesse Pound of CNBC also reports that PacWest stock jumps 80% as regional banks rebound on Friday, but still down sharply for the week:

Regional bank stocks bounced back on Friday, but the rally was not enough to erase the sector’s steep losses for the week after the failure of First Republic.

Shares of PacWest jumped nearly 82%. Western Alliance gained 49%, and Zions Bancorp added about 19%. The SPDR S&P Regional Banking ETF (KRE) rose by more than 6%.

However, Friday’s rally made only a small dent in the week-to-date losses. PacWest still finished the week down 43% and below its closing level from Wednesday. The bank confirmed this week that it is exploring strategic options.

Western Alliance, which said it is not seeking a sale, has also been under heavy pressure this week, falling 27% even after Friday’s rally. The KRE finished the week down about 10%.

The steep declines, which came even at banks that reported much smaller deposit outflows than First Republic, led Wall Street analysts to warn that the stocks have become detached from their fundamentals.

“We are arguably reaching a point of hysteria,” Fundstrat strategist Tom Lee said in a note to clients on Friday.

Analysts at JPMorgan Chase upgraded Western Alliance, Zions and Comerica

to overweight on Friday, saying the bank stocks “appear substantially mispriced to us.”

This week’s slide came after First Republic was seized by regulators and sold to JPMorgan Chase before the market opened on Monday. JPMorgan CEO Jamie Dimon and Federal Reserve Chair Jerome Powell, among others, have said this week that they think the stage of banking crisis caused by deposit outflows is largely over, but the fall for the stocks shows investors are less confident.

Many on Wall Street are looking to Washington for regulatory changes to calm the banking system, such as potentially expanding deposit insurance rules. Some have raised the possibility of temporarily banning short-selling on bank stocks. Former Federal Deposit Insurance Corporation Chair Sheila Bair told CNBC’s “The Exchange” on Thursday that some of the share price declines are likely being driven by short-selling.

The big news this week is US regional banks. I know, Apple's earnings were good and the stock popped today. I also know Shopify's (SHOP) earnings were good and that stock popped 30% this week.

But today was just another huge short covering rally as short sellers booked profits, I wouldn't read too much into it and expect bears will be back full force in the weeks ahead.

The better-than-expected US jobs report kicked things off earlier today and momentum carried through as regional bank shares (KRE) were bid up throughout the day.

Before I get to regional banks, the subject of this post, a few insights on today's jobs report:

The jobs report was strong, with average hourly earnings rising in April at the fastest pace since July 2022. Yet traders still seem way more interested in the next shoe to drop in the banking sector. https://t.co/wY3v1OrVPl

— Lisa Abramowicz (@lisaabramowicz1) May 5, 2023

Last month I wasn’t sure why people were saying the labor market is slowing.

— Jason Furman (@jasonfurman) May 5, 2023

But based on the latest data it appears that jobs are slowing. Jobs in Feb and Mar were revised down by 149,000 cumulatively.

So now is a ~225K pace, down from the previous ~325K pace. https://t.co/ESwSNX2qcC pic.twitter.com/g5A5NHEaSN

Nonfarm payroll growth beat expectations at 253K, but downward revisions pull 3 mo average falls to 222K. pic.twitter.com/xE7wqi9t7X

— Kathy Jones (@KathyJones) May 5, 2023

The Black unemployment rate fell to 4.7% in April, the lowest level on record pic.twitter.com/Q39THfWdIA

— Nick Timiraos (@NickTimiraos) May 5, 2023

Huge improvement here: prime-age labor force participation rate rose to 83.3% in April, which is highest since March 2008 pic.twitter.com/MZGjbVpfBo

— Liz Ann Sonders (@LizAnnSonders) May 5, 2023

What was with the 25k jump in financial sector jobs in April? Insolvency lawyers?

— David Rosenberg (@EconguyRosie) May 5, 2023

My own takeaway from this morning's US jobs report is employment growth is slowing and wage inflation pressures are perking up, which can pose big problems for the Fed in the last quarter of the year.

Either way, there was nothing to cheer about, the US economy is definitely slowing and all those interest rate hikes are starting to bite.

And there may be more to come which is why the euro dropped below 1.10 after the jobs report was released:

Euro dropped <1.10 Dollar after hot US jobs data. pic.twitter.com/kWJEsNyqRl

— Holger Zschaepitz (@Schuldensuehner) May 5, 2023

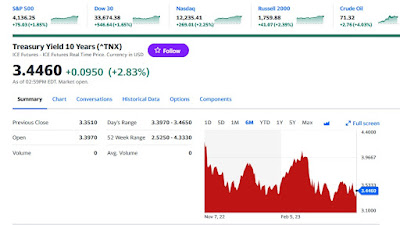

And the 10-year Treasury yield climbed 9 basis points to close at 3.446%:

As shown above, the 10-year Treasury yield is still hovering around a six-month low. Fears of a global recession are weighing it down but if wage inflation pressures persist in second half of the year, that yield can easily jump to 5% or more.

Anyway, the big news this week is the slaughter of regional banks.

They surged today but are down for the week after flirting with pandemic lows yesterday:

The huge volatility in regional banks doesn't portend well for the sector and might be an ominous sign of things to come.

In fact, Ben Marlow of the Telegraph warns to brace yourselves, the banking crisis is just getting started:

If Jamie Dimon was pondering a career change as a fortune-teller, he’d be wise to stick to the day job. On the other hand, if someone of Dimon’s stature could be so wrong about the banking turmoil that continues to sweep across the US, a cynic might ask whether he was still the right person to be running one of the world’s largest financial institutions, particularly when that organisation is right at the centre of Government-led efforts to prop up the whole system.

Having ridden to the rescue of California lender First Republic over the weekend, JP Morgan’s superstar boss had a message for financial markets: its shotgun takeover of First Republic heralded the end of the crisis. He should know better than to be drawn into the realms of speculation about things he has no control of but then Wall Street is so deferential to figures like Dimon that they start to believe they can walk on water.

Still, the speed with which Dimon’s words have come back to haunt him comes as a shock. A mere 48 hours later, and it looked as though the game was up for yet another regional American bank – the fourth since the end of March.

On Wednesday, shares in PacWest plunged by as much as 60pc in after-hours trading, prompting the bank to announce that it was seeking salvation either through an emergency cash call, or, like its stricken rivals, in the arms of a bigger competitor.

The following morning, Western Alliance was forced to deny it was exploring a fire sale despite its share price plummeting 40pc at one stage. Zions Bancorp and Comerica were also under the microscope as investors continued their frantic efforts to work out where the weakest links in the financial system lie hidden.

As with those that failed before it, two things stand out with PacWest. Firstly, this is a bank that had already shored up its balance sheet by raising a $1.4bn (£1.1bn) lending facility from Apollo-backed investment firm Atlas SP Partners. And yet, that clearly wasn’t enough to assuage concerns about its true financial state.

When that failed, it resorted to old-fashioned words: “Our cash and available liquidity remains solid,” the bank said. That also fell on deaf ears. Events followed a similar pattern at Signature Bank, Silicon Valley Bank, and First Republic before all three ended up in the hands of the US banking regulator.

Dimon can take some comfort in the fact that other major names have offered similarly ill-judged and premature reassurances.

On Wednesday night it was the turn of Federal Reserve chairman, Jerome Powell. The banking system is “sound and resilient” he declared, presumably to the bewilderment of PacWest shareholders who will almost certainly be wiped out if the Federal Deposit Insurance Corporation is forced to step in again.

Powell’s soothing words seemed all the more peculiar given that its decision to raise borrowing costs again risks crystallising further material bank losses.

Still, you’d think these illustrious figures would have learned their lesson. “Americans can rest assured that our banking system is safe,” Joe Biden told the American people in March as Silicon Valley Bank unravelled. Yet the dominoes have continued to fall.

The reality is that the establishment is in no position to offer any guarantees. Such reassurances are founded on the same rigid metrics that regulators judge all big banks upon but the experience of Credit Suisse showed that those measures are far from fool-proof.

The Swiss giant met all of the strict capital requirements that were imposed on the industry after the financial crash. According to the rules, it had sufficient capital, ample liquidity, and was adequately funded but in the end it was crushed by sentiment and fear.

The problem is that once investors lose confidence, it is desperately difficult to regain, and regulators quickly become helpless bystanders. Similarly, for all the regulation that was ushered in following the financial crash of 2008, when customers take fright, bank runs are practically impossible to stop.

In an era of social media, smartphones, and online banking, the system is arguably more vulnerable than ever despite the intense scrutiny that followed the financial crash.

This is particularly true of America’s sprawling mid-tier banking sector, which has managed to escape the same oversight as its more muscular rivals after regional lenders successfully persuaded the Fed and the FDIC that they were not systemically important.

They also claimed that over-burdensome regulation would be a brake on growth and competition. Is it any wonder then that so many appear to have indulged in such reckless lending?

Meanwhile, for every optimist, it is just as easy to find a pessimistic one such as Robert Kaplan, the former president of the Dallas Federal Reserve who thinks “we’re in the early stages, not the late stages” of a banking crisis. Ditto Warren Buffett’s right-hand man Charlie Munger, who has warned that US banks are “full of” bad, yet unrealised commercial property loans.

Likewise, for every measure that supposedly demonstrates resilience, another can be found that rings alarm bells. Academics at New York University estimate unrealised US bank losses to be $1.7 trillion (£1.3 trillion), while the FDIC admits that uninsured deposits at US banks tripled to $7.7 trillion between 2009 and 2022.

Amid such fragility, a proposal to lift the deposit insurance cap from $250,000 sounds like a recipe for even more exuberance.

Evidently, the banking crisis is clearly not over. On the contrary it may just be getting started. The question everyone should be asking is how bad is it likely to get?

And earlier this week, Nicholas Gordon of Fortune reported that legendary investor Bill Ackman is warning America’s regional banks are at risk: ‘At this rate, no regional bank can survive bad news’:

Billionaire hedge fund founder Bill Ackman called for a “systemwide deposit guarantee regime” in the U.S., as regional banking stocks were pummeled in the wake of this weekend’s sale of First Republic Bank to JPMorgan.

"The regional banking system is at risk," the founder and CEO of Pershing Square Asset Management tweeted on Wednesday evening. “The [Federal Deposit Insurance Corporation’s] failure to update and expand its insurance regime has hammered more nails in the coffin.”

Regional banking shares fell on Wednesday, led by California-based PacWest Bancorp, whose stocks fell by over 50% in after-hours trading, following media reports that the company was considering a sale. Late Wednesday, PacWest confirmed that it was in discussion with partners about strategic options, and that it had not seen “out-of-the-ordinary deposit flows” since the weekend.

“Banking is a confidence game,” Ackman wrote on Twitter. “At this rate, no regional bank can survive bad news or bad data as a stock price plunge inevitably follows.”

Regulators and Wall Street CEOs hoped First Republic Bank might have marked the end of the confidence crisis in the banking sector. On Wednesday, U.S. Federal Reserve chair Jerome Powell suggested that the takeover would help “draw a line” under the current turmoil.

Deposit insurance

Ackman suggested on Wednesday that First Republic Bank “would not have failed if the FDIC temporarily guaranteed deposits while a new guarantee regime were created.”

The hedge fund manager has consistently supported stronger government intervention in the banking sector since turmoil began in early March, calling for a government bailout of Silicon Valley Bank when customers first started to abandon the struggling lender.

On March 12, U.S. regulators took over both Silicon Valley Bank and the Signature Bank of New York, and pledged to protect deposits at both institutions in full, rather than just up to the $250,000 normally protected by insurance.

Despite an early flurry of interest in expanding deposit insurance after SVB’s collapse, energy to change regulations has cooled. U.S. Treasury Secretary Janet Yellen gave mixed messages in late March about whether the administration was considering blanket deposit insurance. There’s also a lack of consensus in the policy space, with conservative groups worried that broader insurance would encourage risky behavior by banks, and progressive groups choosing to focus on other issues like executive compensation.

On Monday, the FDIC recommended that Congress allow the agency to guarantee more deposits. The regulator suggested that it could offer more protection for payment accounts held by businesses, which would use deposits for employee wages.

Yet the FDIC stopped short of recommending a broad expansion of deposit protections due to worries about “moral hazard,” referring to the economic concept that insurance causes people to act in riskier ways.

Ackman is right, the failure of the FDIC to guarantee deposits created an unprecedented situation where people fled from these regional banks as they feared they'd lose their deposits.

On LinkedIn, professor Campbell (Cam) Harvey didn't mince his words:

On Thursday, I sent this out ot my readers:

Was talking to my favorite currency trader in Toronto earlier this morning and I said: "You'd have to be nuts to invest in US regional banks (KRE), the writing is clearly on the wall, they are sacrificing them to allow big banks to gain market share, tighten lending standards and allow private credit funds to flourish. The KRE will soon take out its pandemic lows and plunge into oblivion. Yellen and Powell gave hedge funds a green light to short the sh*t out of them."

He agreed and added: "I'm very, very worried about was is going on, it reminds me of when Bear Stearns went under in March 2008 and JPMorgan bought them out at $2 a share. They kept saying the banking system is fine and then in October, it all unraveled in a catastrophic way. The same thing is happening now, I'm derisking my portfolio every day. I think these big banks are taking on loan portfolios from these regional banks which will come back to haunt them and create a massive credit event."

He also added: "I wouldn't be surprised if the Fed cuts by increments of 200 bps when the next crisis hits us."

***

Federal Reserve Chair Jerome Powell said Wednesday that the seizure of First Republic was "an important step toward drawing a line under" turmoil in the banking system. Within two hours the stock of another troubled regional lender was down more than 50%.

The trigger was a series of media reports that the Beverly Hills, Calif.-based PacWest (PACW) was weighing a range of strategic options, including a sale or capital raise.

Other regional banks under scrutiny from investors also plunged overnight, including Western Alliance (WAL) in Phoenix and Comerica (CMA) in Dallas. First Horizon (FHN) also plummeted in pre-market trading after Toronto-Dominion Bank called off its deal to acquire the Memphis regional lender because of a lack of clarity around regulatory approvals.

The new round of volatility for regional banks punctuates a disconnect in the financial world as the industry’s unrest drags into an eighth week.

While top figures on Wall Street and Washington display optimism that the worst is over, investors continue to punish other regional lenders that share any characteristics of the three mid-sized banks already seized by regulators.

Federal Reserve Chair Jerome Powell said Wednesday that the seizure of First Republic was "an important step toward drawing a line under" turmoil in the banking system. Within two hours the stock of another troubled regional lender was down more than 50%.

The trigger was a series of media reports that Beverly Hills, Calif.-based PacWest (PACW) was weighing a range of strategic options, including a sale or capital raise. Its stock continued to fall during Thursday morning trading, down by more than 45% after being halted temporarily.

Other regional banks under scrutiny from investors also plunged, including Western Alliance (WAL) in Phoenix. First Horizon (FHN) also plummeted more than 38% Thursday after Toronto-Dominion Bank called off its deal to acquire the Memphis regional lender because of a lack of clarity around regulatory approvals.

'The regional banking system is at risk'

On Monday JPMorgan Chase (JPM) CEO Jamie Dimon captured the industry’s hopes when he said "this part of the crisis is over" after announcing JPMorgan’s purchase of First Republic. Jane Fraser, CEO of Citigroup (C), on Monday called First Republic "the last remaining main uncertainty of the small handful of banks that did not do a good job with asset liability management."

Powell reinforced this view on Wednesday, citing the failures of First Republic, Silicon Valley Bank and Signature Bank as the "three large banks really from the very beginning that were at heart of the stress we saw in early March," he said.

"Those have all now been resolved" and the US banking system, he added, is now “sound and resilient.”

Billionaire hedge fund manager Bill Ackman offered a much more pessimistic take on the situation Wednesday night on Twitter. The Pershing Square Capital Management CEO called on the US government to put in place a systemwide deposit guarantee to prevent more bank failures, saying that "the regional banking system is at risk."

Banking, he added, is a "confidence game" and “at this rate, no regional bank can survive bad news or bad data as a stock price plunge inevitably follows, insured and uninsured deposits are withdrawn and 'pursuing strategic alternatives' means an FDIC shutdown over the coming weekend.”

Read full analysis here: https://finance.yahoo.com/

news/plummeting-bank-stocks- test-predictions-that-worst- of-the-crisis-is-over- 123744150.html

In my opinion, the Power Elite are knowingly sacrificing regional banks for a few reasons:

- First, give more power to big banks which can then tighten lending standards. This will benefit their private equity clients which are lending money to small & medium sized enterprises through their private debt funds.

- Hide the extent of bad commercial real estate loans the regional banks have undertaken. There seems to be a concerted effort to keep these loans secret, it's that bad.

I know this might sound like a conspiracy but Yellen, Powell and company have given hedge funds and big trading outfits (like JPMorgan to short regional bank shares into oblivion).

So, forget about today's "powerful" shot-covering rally, there is more fallout to come in thi ongoing regional bank saga.

And they keep telling us the US banking system is sound but it does feel like 2008, by the fall we will be hearing horror stories about what these regional banks had on their loan books.

What will Jamie Dimon say then?

Tread carefully here, avoid buying stocks of regional banks that are being sacrificed on the altar.

More pain lies ahead and the recession hasn't even started yet.

Below, DoubleLine CEO, Jeffrey Gundlach interviewed on CNBC Closing Bell with Scott Wapner following the FED quarter point rate hike. Originally aired May 3, 2023.

Next, Jeremy Siegel, Professor at Wharton School of Business, joins 'Closing Bell' to talk next steps for the Federal Reserve, the U.S. jobs report, and regional banks.

Third, Stephanie Link, Jason Snipe, and Rob Sechan join 'Halftime Report' to discuss this week's jobs data beating expectations, the bond market pricing in rate cuts, and recession considerations.

Fourth, Julie Biel of Kayne Anderson Rudnick joins 'The Exchange' to discuss bank exposure to commercial real estate in San Francisco, California's loan risk status, and real estate pricing out the San Francisco population.

Lastly, Ellen Lee, Causeway Capital Portfolio Manager and Savita Subramanian, BofA Head of US Equity and Quantitative Strategy dive into the latest stresses the banks are facing. They also discuss what is driving consumer and corporate health. Lee also explains why valuations in Europe are more attractive than the US.

Comments

Post a Comment