AIMCo Opens Its First Asia Office in Singapore

Alberta Investment Management Corp. (AIMCo) is opening its first Asian office, but the Edmonton-based fund manager says it will steer well clear of China to focus instead on markets with less geopolitical risk.

The official opening Tuesday of AIMCo’s new Singapore office marks the first foray into the Asia-Pacific region for what is one of Canada’s largest institutional investors, with $158 billion of assets under management as of 2022.

CEO Evan Siddall said AIMCo, which invests on behalf of 17 pension, endowment and government fund clients in Alberta and manages more than 30 pools of capital, has up until recently been missing out on some of the investment opportunities that exist within the large, fast-growing economies of the Asian continent.

“We really are very under-represented in Asia. You know, we have less (investment) in Asia than we do in Alberta,” Siddall said in an interview.

“I don’t want to look in the rear-view mirror, but we’ve missed opportunities for sure.”

Siddall said the Singapore office opening is part of a larger push by AIMCo towards greater diversification globally. The fund manager — which invests in public and private markets, real estate and infrastructure — already has offices in Calgary, Toronto, London and Luxembourg, in addition to Edmonton, and will be opening a New York City office soon.

But Siddall said Asia is important, as many countries there have economic growth that’s outstripping that of the U.S and Europe.

“In many of them, we just don’t have any experience. But on a risk-adjusted basis, we think we can and we should do more (in Asia),” he said.

“We have no rule of thumb, we have no target … but it’s more than we’re doing now, and it’s a fair bit more.”

AIMCo is lagging behind many other Canadian institutional investors when it comes to establishing a foothold in Asia. A report by the Asia Pacific Foundation of Canada found that between 2003 and 2017, Canadian pension funds invested $25 billion in the region.

The Ontario Teachers’ Pension Plan Board has had an on-the-ground presence on the continent for over a decade, and currently has offices in Singapore as well as Hong Kong and Mumbai. The Canada Pension Plan Investment Board also has offices in Mumbai and Hong Kong.

However, Canadian pension funds have also been under scrutiny recently for their exposure to China, particularly given questions around the health of that country’s economy as well as its ongoing tensions with the West.

According to a Reuters report earlier this month, the Canada Pension Plan Investment Board has laid off at least five employees at its Hong Kong office as it steps back from deals in China.

Last spring, representatives of the Ontario Teachers’ Pension Plan and the British Columbia Investment Management Corporation told a parliamentary committee studying Canada-China relations that they had paused new direct investment in China because of the increasing risks associated with that country.

Siddall said geopolitics is a significant risk factor in investing, and is the reason AIMCo has chosen to focus on the comparatively safe Singapore market rather than setting its sights on the world’s second-largest economy.

“We’re not rushing into China. We basically have almost nothing (invested) in China and really only in passive instruments,” Siddall said.

“There are some countries, where the rule of law and corruption are concerns, that we would rather just avoid, frankly.”

After reporting a loss of 3.4 per cent for 2022, AIMCo says its performance has improved significantly in 2023. The fund manager said for the six-month period ending June 30, its net investment return was 4.5 per cent.

Summer Zhen of Reuters also reports Canada's AIMCo to open its first Asia office in Singapore:

Canadian pension fund manager Alberta Investment Management Corporation (AIMCo) said on Tuesday it was expanding into Asia and opening its first regional office in Singapore.

The fund manager, which manages $158 billion in assets, invests globally on behalf of 17 pension, endowment and government funds in the Canadian province of Alberta.

"We believe the long-term growth opportunities in Asia-Pacific are compelling and well-aligned with AIMCo’s long-term investment horizon," said Evan Siddall, CEO of AIMCo.

AIMCo is the latest global asset manager to set up an office, or expand their team, in Singapore as financial firms seek alternative bases to China amid rising geopolitical tensions and China's own faltering economic growth.

UK asset manager Legal & General Investment Management last week announced they had opened an office in Singapore in addition to its existing offices in Hong Kong and Tokyo.

Pension funds in Canada are also facing heightened scrutiny by the Canadian authorities on investments in China. CPP Investments, Canada's biggest pension fund, has laid off at least five investment professionals at its Hong Kong office recently as it steps back from deals in China, Reuters reported last week.

In a separate interview with news agency The Canadian Press, Siddall said that "AIMCo is not rushing into China".

AIMCo put out a press release stating it is expanding its global presence with new Singapore office:

Singapore and Edmonton - The Alberta Investment Management Corporation (AIMCo) today announced the opening of the AIMCo Singapore office to focus on investment opportunities in Asia-Pacific, reflecting the firm's strategy to diversify the portfolio globally and tap into attractive growth opportunities in the region.

The Singapore office is AIMCo's first in Asia and third internationally and is strategically located in the heart of Singapore's central business district. This brings the firm's total number of global offices to six, in addition to Edmonton, Calgary, Toronto, London, and Luxembourg.

"We are exceptionally proud to establish our presence in a globally recognized financial hub such as Singapore," said Evan Siddall, CEO of AIMCo. "We believe the long-term growth opportunities in Asia-Pacific are compelling and well-aligned with AIMCo's long-term investment horizon, all of which will help us fulfill our purpose of providing superior, risk-adjusted returns for our clients."

"Our newest office gives AIMCo on-the-ground access to Singapore, including the deep expertise of its financial services community, world-class infrastructure, as well as greater connectivity to the rest of the Asia-Pacific region, which holds some of the world's most dynamic, developed and emerging markets," said Dr. Marlene Puffer, Chief Investment Officer, AIMCo. "Singapore is a logical next step to build and strengthen relationships with new and existing investment partners in the region and position us to further diversify our global asset mix," added Dr. Puffer.

Leading AIMCo in Asia is Kevin Bong, who brings with him 20 years of global portfolio construction and capital allocation experience, and deep ties to the investment industry. In his role as Senior Managing Director, Chief Investment Strategist and Head of Singapore, Mr. Bong is responsible for setting both AIMCo's global investment strategy and its strategic direction for Asia-Pacific. Mr. Bong joined AIMCo from GIC, Singapore's sovereign wealth fund.

"Our Singapore office and leadership create new opportunities to attract regional talent and develop our existing global talent, and we look forward to continuing to grow our team here," added Mr. Siddall.

So Kevin Bong will be leading AIMCo in Asia and he has tremendous experience working at GIC, Singapore's sovereign wealth fund.

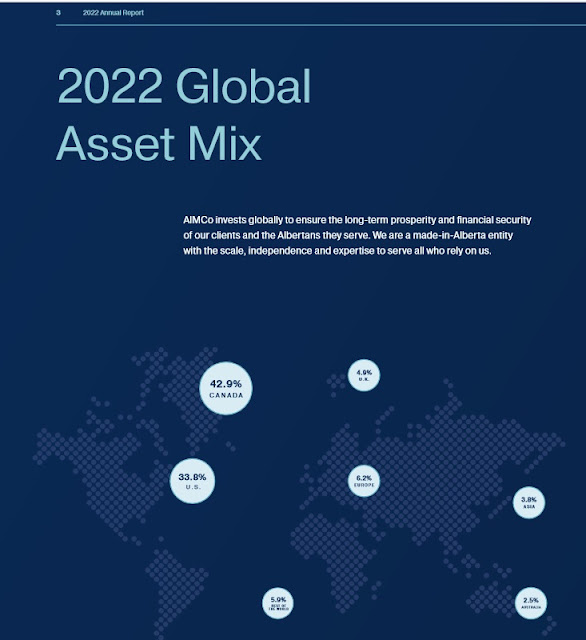

Let me begin with the obvious, AIMCo invests globally but its presence in Asia is non-existent and it only has 3.8% of its total assets invested there, almost exclusively in public equities and fixed income:

In the Canadian Press interview, AIMCo's CEO Evan Siddall was upfront about this:

“We really are very under-represented in Asia. You know, we have less (investment) in Asia than we do in Alberta,” Siddall said in an interview.

“I don’t want to look in the rear-view mirror, but we’ve missed opportunities for sure.”

Siddall said the Singapore office opening is part of a larger push by AIMCo towards greater diversification globally. The fund manager — which invests in public and private markets, real estate and infrastructure — already has offices in Calgary, Toronto, London and Luxembourg, in addition to Edmonton, and will be opening a New York City office soon.

But Siddall said Asia is important, as many countries there have economic growth that’s outstripping that of the U.S and Europe.

“In many of them, we just don’t have any experience. But on a risk-adjusted basis, we think we can and we should do more (in Asia),” he said.

“We have no rule of thumb, we have no target … but it’s more than we’re doing now, and it’s a fair bit more.”

He also admitted geopolitics is a significant risk factor investing in China right now:

“We’re not rushing into China. We basically have almost nothing (invested) in China and really only in passive instruments,” Siddall said.

“There are some countries, where the rule of law and corruption are concerns, that we would rather just avoid, frankly.”

As I stated yesterday when I covered Suyi Kim and what drives success at CPP Investments' giant PE portfolio, investing in communist China when it comes to private markets is fraught with risks.

But Asia is a lot bigger than China. You have India, Indonesia, Maylasia, Singapore and other countries that are growing fast because of secular headwinds.

To ignore this region because of tense relations with China is quite frankly, inexcusable.

Having said this, to invest in private markets in Asia, you need boots on the ground and you need to develop the right relationships with top funds and like minded global investors.

There will be plenty of opportunities for AIMCo to partner up with GIC and other sovereign wealth funds in the region, as well as Canadian peers on bigger deals there.

AIMCo's CIO, Marlene Puffer, explains it well in the press release:

"Our newest office gives AIMCo on-the-ground access to Singapore, including the deep expertise of its financial services community, world-class infrastructure, as well as greater connectivity to the rest of the Asia-Pacific region, which holds some of the world's most dynamic, developed and emerging markets. Singapore is a logical next step to build and strengthen relationships with new and existing investment partners in the region and position us to further diversify our global asset mix."

Earlier today, Marlene was interviewed on Bloomberg Television. She spoke with Haslinda Amin from the sidelines of the 10th Milken Institute Asia Summit in Singapore.

I embedded the interview below and here are some key points:

- They're starting off looking at the infrastructure space (broad infrastructure) and will then look at private equity.

- She said they see a lot of opportunities in the infrastructure space in particular around the energy transition.They're focused on that globally and they feel there are a lot of opportunities in Asia around energy transition "as the drive for decarbonization is inevitable as technology matures and is applicable at scale."

- She said in a high interest rate environment, there are a number of places where they see opportunities including mortgage lending where they're "selective". She added they also see opportunities in private debt where rates are floating but are cautious in their "security selection and credit research."

- Interestingly, in real estate, they see pockets of opportunities in retail and offices (she wasn't asked to elaborate on this but I would have pounced).

- She said AIMCo's investments in China are "primarily through passive index investments and a small amount in private equity through fund partners," but she said they're very cautious and are seeking opportunities in Chinese growth more "outside of China through multinationals."

- She said they're excited to open an office in Singapore and tapping local talent, focusing on infrastructure for now and she said they're looking for strong partners in Asia to help them gain a solid foothold in the region and "slowly begin to co-invest alongside them and leverage their expertise."

- In terms of countries, Marlene mentioned they're looking at infrastructure opportunities in India, they're looking at Japan where low rates are relatively stimulative and some smaller countries benefiting from supply-chain readjustments.

- She said over a long horizon, they remain bullish on Asia where GDP growth remains strong and capital markets are maturing.

Take the time to watch this excellent interview below.

I also embedded a great podcast with Ted Seides where she discusses her path path to pension management from roots in academia and fixed income, her first CIO role at the Canadian National corporate pension fund, and transition to AIMCo earlier this year.

They also discuss AIMCo’s asset-liability matching investment strategy, global team, internal and external management, compensation, external manager selection, opportunities and risks, and the unique qualities of Canadian pensions.

Quite fascinating, she started university very young at the age of 15, and through the help of a great guidance counselor, she pursued her love for math and went on to study economics at the University of Toronto and then completed a Ph.D. in Finance and Applied Statistics and a M.Sc. in Business Administration

from the University of Rochester. She holds a CFA charter and the ICD.D

designation granted by the Institute of Corporate Directors. Take the time to listen to this interview.

Lastly, Mark Wiseman, chair of the Alberta Investment Management Corp. (AIMco) board, recently spoke with the Financial Post's Larysa Harapyn about today's complex investing environment, and explains why Canada and India offer opportunities for investors.

Update: On September 14th, AIMCo's CIO Marlene Puffer took part in a panel discussion at the Milken Institute Asia conference on Thriving Amid Change: An Investment Management Perspective:

There is more risk in capital markets today than at any stage in history. Amidst tight global economic conditions, all investors have to grapple with unrelenting waves of change. Today, achieving the same returns as before requires more risks, more creativity, and more diversification across asset classes. How are asset owners and managers reviewing their asset allocation strategy and measuring performance in the new regime of sustainability development, energy transition, and emerging technology? Are investors seeking safety in the harbor of traditional instruments like equities and debts? Or will alternatives stay attractive? What other questions should investors be asking?

You can watch this panel discussion here.

Comments

Post a Comment