Vestcor Names TTC's Sean Hewitt as its New CEO

FREDERICTON – Vestcor Inc. (Vestcor), an integrated investment management, pension and benefits administration organization providing services to over 20 different Atlantic Canadian public sector client groups, today announced the upcoming appointment of Mr. Sean Hewitt, CFA, ICD.D, as its new President and Chief Executive Officer.

The Board of Directors of Vestcor Inc. undertook a comprehensive search process after John Sinclair, who has successfully led the organization for 20 years, announced his plans to retire last year. Sinclair will remain as President and CEO at Vestcor, which has over $20 billion in investment assets under management, until Hewitt joins the organization in mid-April.

Hewitt has nearly 20 years of progressive experience within the pension and investment industries from across Canada. In 2016, he was appointed to his most recent position as the inaugural Chief Executive Officer of the Toronto Transit Commission (TTC) Pension Plan. He was instrumental in assembling the leadership team under a new organizational structure and developing its strategic approach. Today, the TTC Pension Plan represents over 25,000 members and retirees, with over $8 billion in assets under management.

“I am very pleased with the outcome of the work of our Board of Director’s Ad-Hoc CEO Search Committee” said David Losier, Chair of Vestcor’s Board of Directors. “Their comprehensive nationally based search process resulted in interest from a great number of qualified candidates who were extensively assessed by our committee. We are now actively engaged with both John and Sean to ensure a prudent transition and we look forward to introducing Sean to our many stakeholders in due course.”

Tanya Chapman, Vestcor Director and Chair of the Search Committee noted “Sean Hewitt brings a wealth of experience in the pension and investment industry. He led the establishment of the TTC Pension Plan as an independent organization, which had many parallels to the creation of Vestcor Inc. Sean’s focus on establishing collaborative and transparent culture of strong financial performance and member service excellence mirrors the approach Vestcor continues to follow. We are confident Sean’s experience and strategic approach will benefit Vestcor and our clients over the long-term.”

Hewitt obtained a Bachelor of Economics from the University of Calgary, is a CFA charterholder, and holds the ICD.D designation with the Institute of Corporate Directors.

Vestcor is an independent not-for-profit company headquartered in Fredericton, New Brunswick that provides global investment management services and benefits administration to public sector client groups representing 150 employer groups and more than 111,000 individuals. Assets under management have grown from approximately $6 billion in 2003 when Sinclair assumed his leadership role to over $20 billion today.

About Vestcor

A Partner in Creating and Delivering Sustainable Financial Security.

Vestcor is an independent not-for-profit company located in Fredericton, New Brunswick which provides global investment management services to 10 different public sector client groups representing approximately $20 billion in assets under management as of December 31, 2022, and administration services to 11 public sector pension plans and 4 employee benefit plans.

Vestcor’s team of more than 150 service professionals provides innovative, integrated, cost-effective investment management and pension and benefit administration services solutions to public sector entities. Vestcor currently services the requirements of over 111,000 individual plan members and 150 participating employer groups. Further information about Vestcor is available at Vestcor.org.

A little background on this.

Back in July, Vestcor CEO John Sinclair announced he was stepping down after successfully leading this organization for 20 years:

–Sinclair Will Stay on as CEO Until Board of Directors Completes a Comprehensive Search Process–

Fredericton, NB —Vestcor Inc. (Vestcor), an integrated investment management, pension and benefits administration organization providing service to 22 different New Brunswick public sector client groups, today announced that its Chief Executive Officer John Sinclair has informed the Board of Directors of his intention to retire after a successful 20-year period leading the organization. Sinclair will stay on as CEO at Vestcor, which has over $20 billion in assets under management, until a successor is named following a Board-led executive search process considering qualified internal and external candidates.

“On behalf of the Board of Directors and the over 150 professionals who work at Vestcor, I want to thank John Sinclair for his commitment to this organization and the over 111,000 pension plan and benefit program members who have benefited greatly from his expertise and leadership over the past two decades. His long-term vision and prudent management have enabled Vestcor to exceed the long-term objectives of clients,” said David Losier, Chair of Vestcor’s Board of Directors. “We appreciate that John has accepted to stay on as CEO, supported by his strong leadership team, until the Board completes a national search for the next leader of this important organization, so leadership continuity is ensured.”

Vestcor is an independent not-for-profit company headquartered in Fredericton, New Brunswick that provides global investment management services and benefits administration to public sector client groups representing 140 employer groups and more than 111,000 individuals. Assets under management have grown from approximately $6 billion in 2003 when Sinclair assumed his leadership role to over $20 billion today.

“I have been part of Vestcor for more than two decades and over that time we have built a world class investment management and pension services team based right here in New Brunswick for the benefit of New Brunswickers,” said John Sinclair, CEO of Vestcor. “I want to thank my Vestcor colleagues, our owners and stakeholders for their strong support over the years and I will be watching with great interest as the organization continues its steady growth in the future.”

John and his team have done an astounding job at Vestcor, properly diversifying that portfolio across public and private assets.

That diversification helped Vescor beat its benchmark despite a challenging 2022:

Vestcor achieved overall returns of -3.63% during 2022. This is particularly significant when compared to the median gross returns (pre-fee) of Canadian defined benefit pension plans, which was -10.3% for the same period, as noted in a recent report by RBC Investor & Treasury Services (RBCITS). More importantly, Vestcor’s longer term 4-year gross annualized pension plan return was 5.99% at year-end, comparing favourably to the 5.32% 4-year median return also reported by RBCITS.

Also of significance was the return realized above clients’ investment policy benchmarks. The active management activities of Vestcor’s highly specialized employees led to an outperformance of client-set benchmarks by a record 2.63% during the year, adding $538 million in value to clients. These additional returns have added 1.31% per annum or over $1 billion in investment earnings for clients during the most recent four-year period.

Now, in terms of what we can expect with Sean Hewitt, I'd say more of the same.

Three years ago, Benefits Canada published a nice article on how the TTC Pension Fund Society is staying on track during the coronavirus crisis:

Since last March, the coronavirus pandemic has derailed the best-laid plans of many organizations, including the Toronto Transit Commission.

With so many white-collar employees working from home, and worries about public health, it’s no secret the TTC’s ridership and revenue have been hit hard. Between the first and last weeks in March 2020, for example, lockdown measures contributed to a 75 per cent decline in weekly revenue. Cost-saving measures included temporary layoffs and a pause in salary increases for non-unionized employees.

Despite these stark challenges, the TTC Pension Fund Society didn’t experience either contribution reductions or a retirement spike.

“We have a very stable contribution regime, being a jointly sponsored pension plan, so there really hasn’t been much in the way of contribution volatility [and] we actually saw retirements go down this year versus the previous year. . . . That was interesting to us [and] perhaps not totally expected,” says chief executive officer Sean Hewitt.

In July 2020, the plan felt confident enough to announce an ad hoc cost of living increase of 1.96 per cent, effective as of January 1, 2020, for pensioners who retired in 2019 or earlier. “That speaks to two things: one, how well we’ve performed through this pandemic period, and, two, our stable contribution regime and long-term focus,” Hewitt says, adding, “We entered into the pandemic in perhaps the best financial position that we had been in our history as a result of very strong returns over the last 10-plus years. That also helped.”

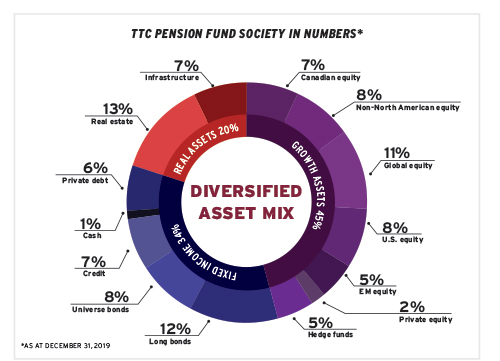

Making inroads in private debt, equity Hewitt attributes the plan’s robust performance to a diversified portfolio, with exposure to alternatives (especially real estate) stretching back several decades. In addition, the plan has historically been fully invested so it was able to benefit from the past decade’s strong returns. The road ahead looks tougher, however.

“[In 2020], we exceeded our targets for financial performance, but that comes with the caveat that our future return expectations are muted and getting lower. In our view, achieving our desired rate of return going forward will be harder . . . but we have strategies to help combat that,” Hewitt says.

Because fixed-income yields are low and getting lower, Hewitt says the plan can’t rely on meaningful returns from its substantial allocation to Government of Canada and provincial bonds. As a result, it has started pivoting towards private debt and private equity. “It’s a several-year program. We’re going slowly but methodically into those investments,” he says. However, he cautions, “There are liquidity challenges that come with that, so on an annual basis we review our liquidity needs and stress test for all sorts of different circumstances.”

The stress testing looks at factors ranging from contribution volatility on a year-by-year basis to mark-to-market settlements on hedges and capital-call requirements, and then calculates how four times the worst results in the past 10 years would affect them.

“We build a maximum budget for illiquidity based on those factors . . . and then we build in an additional cushion so that we can be a provider of liquidity and invest opportunistically into very stressed markets.”

The pandemic added a new threat for the TTC to build into its stress tests and also generated volatility that made it difficult to rebalance speedily. That’s prompted Hewitt to look at synthetic rebalancing tools utilizing derivatives that would enable the plan to quickly take advantage of opportunities when they present themselves.

Hewitt’s main concern these days is that market valuations are very high across multiple asset classes, which makes it harder to deploy capital. But, he says, “by maintaining a long-term focus, I think we’ll be in excellent shape going forward, despite, perhaps, some short-term volatility.”

If he was concerned with market valuations back then, I can only imagine how he feels nowadays.

Anyways, let me publicly congratulate Sean Hewitt for being appointed Vestcor's next CEO and wish John Sinclair all the best as he gets set to retire.

As I said, Sean Hewitt has a good team there to lean on, including Vestcor's CIO Jon Spinney.

Below, Aswath Damodaran, NYU professor of finance, joins 'Closing Bell' to discuss the high prices of the ‘Magnificent 7’.

And Leon Cooperman, Omega Family Office chairman and CEO, joins 'Squawk Box' to discuss the latest market trends, the Fed's rate path decision, state of the economy, antisemitism on campus, 2024 race, Elon Musk, and more

Comments

Post a Comment