Pension Systems on the Brink?

Robert Powell, editor at Retirement Weekly, wrote an editorial for MarketWatch on pension systems on the brink:

A train wreck waiting to happen. That's the only way to describe the mess that state pension systems are in right now, according to a report published today by the Pew Center on the States. According to Pew, there's a $1 trillion gap between the $3.35 trillion in pension, health care and other retirement benefits states promised their current and retired workers as of fiscal year 2008 and the $2.35 trillion they have on hand to pay them.What's worse, the gap may be even higher given that the study was conducted prior to the market collapsing in 2008 and given the way most states allow for smoothing of investment gains and losses over time.

How did this come to pass? And more importantly, what can be done to solve it?

Investment losses account for part of the funding gap. But the bigger problem, according to Pew, is that many states simply fell behind on their payments to cover the cost of promised benefits -- and that was even before the Great Recession.

"Many states shortchanged their pension plans in both good times and bad, and only a handful have set aside any meaningful funding for retiree health care and other non-pension benefits," Susan Urahn, managing director of the Pew Center on the States, wrote in her report.

And now, state policy makers who ignore the current shortfall do so at their own peril. Indeed, states that fail to address under-funded retirement systems face the very real possibility of raising taxes or taking taxpayer money that could be used for education, public safety, and other necessary services just to pay public-sector retirement benefit obligations.

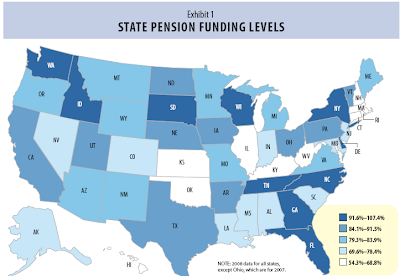

To be fair, not all states are in the same pickle. Illinois and Kansas are in really bad shape. Those states each have less than 60% of the necessary assets on hand to meet their long-term pension obligations, Pew said. Illinois is in the worst shape of any state, with a funding level of 54% and an unfunded liability of more than $54 billion. Meanwhile, nine states had pensions funded above 90% and Florida, Idaho, New York, North Carolina and Wisconsin all entered the current recession with fully funded pensions.

Most experts suggest at least an 80% percent funding level. Pew found that 21 states were funded below that recommended level in 2008. Of those 21, eight had more than one-third of the total liability unfunded: Connecticut, Illinois, Kansas, Kentucky, Massachusetts, Oklahoma, Rhode Island, and West Virginia.

In all, Pew said just 16 states are "solid performers"; meanwhile, 19 are in serious trouble.

Other benefits pose similar problems

As for retiree health care and non-pension benefits, Pew said that's another huge bill coming due. In fact, the total needed to pay for current and future benefits is $587 billion. Unfortunately, only $32 billion -- or just over 5% of the total cost -- was funded as of fiscal year 2008. Half of the states account for 95% of the liabilities. As with pension funding, some states are worse off than others.

"Only two states had more than 50% of the assets needed to meet their liabilities for retiree health care or other non-pension benefits: Alaska and Arizona," Pew said. "Only four states contributed their entire actuarially required contribution for non-pension benefits in 2008: Alaska, Arizona, Maine and North Dakota."

Bridging the gap

What can be done to make up the $1 trillion gap? In a word, reform. Not extreme reform. Rather, reform that brings the public sector more in line with the private sector. Here's what Pew recommends:

1. Keep up with funding requirements

According to Pew, generally, the states in the best shape are those that have kept up with their annual funding requirements in both good and bad times. Arizona and Connecticut are required to fully fund their obligations. But that's just part of the battle.

"States also need to make sure the assumptions used in calculating the payment amount are accurate -- for example, estimating the lifespan of retirees or the investment returns they expect." For instance, many states based their assumptions on investment returns of more than 8%. By contrast, the top 100 private pension plans had an average assumed investment return of 6.36% as of December 2008.

Yes, some states, Utah and Pennsylvania among them, are reducing the assumptions on investment returns. But more states need to address funding requirements and investment return assumptions.

2. States should reduce benefits or increase the retirement age

Most states can't reduce pensions for retirees or current employees, but they can for new employees. And that's exactly what several states are doing now. According to Pew's report, Nevada, New York and Rhode Island recently reduced benefits for new employees either by altering the pension formula or raising retirement ages. More states need to examine and consider this tactic.

3. States should share the risk with employees

A few states, the Pew report notes, have taken a page out of the private sector's pension world. They are "sharing more of the risk of investment loss with employees by introducing benefit systems that combine elements of defined-benefit and defined-contribution plans," the report said. "These hybrid systems generally offer a lower guaranteed benefit, while a portion of the contribution -- usually the employees' share -- goes into an account that is similar to a private sector 401(k)."

Nebraska and Georgia have hybrid plans in place for new employees, while Michigan and Alaska have 401(k) plans in place for new workers. But movement away from defined-benefit plans to defined-contributions plans is easier said than done. "Because unions and other employee representatives often have vigorously opposed defined-contribution plans, it is unclear whether any state will find such a switch viable, or if such plans are primarily being proposed as a starting point for hybrid plans or other compromises," the Pew report said.

4. Increase employee contributions

Employees already contribute about 40% of non-investment contributions to their own retirement. "But states are looking toward their workers to pay for a larger share," the Pew report noted. "In many states, the employee contribution is fixed at a lower rate than the employer contributions." But some states have put in place reforms to change that. Arizona, for instance, has a system where employee and employer contribute the same amount. And other states, such as Iowa, Minnesota and Nebraska, have the ability to raise employee pension contributions if needed.

What's more, Pew noted that several states also began asking employees and retirees to start making contributions for their retiree health-care benefits -- just as happened with retirees from the private sector.

5. Improve governance and investment oversight

In recent years, Pew noted that "some states have sought to professionalize the complex task of pension investments by shifting oversight away from boards of trustees to specialized bodies that focus on investment." Other states have worked on making sure boards of trustees for pensions are well trained, that the division of responsibilities between board and staff makes sense, and that the composition of the board is balanced between members of the system and individuals who are independent of it. States being praised for reforms in the right direction include Vermont, Oregon, and even Illinois.

To be fair, states aren't standing still when it comes to reform. According to Pew, 15 states passed legislation to reform some aspect of their state-run retirement systems in 2009, compared with 12 in 2008 and 11 in 2007. Still, it would seem that more need to get on the reform bus. Especially given the alternative.

In the absence of paying down this $1 trillion deficit, Pew said the debt will increase even more significantly. "This will leave the states, and tomorrow's taxpayers, in even worse shape, since every dollar needed to feed that growing liability cannot be used for education, health care or other state priorities," the Pew report said.

You can read the Pew report by clicking here. You can also read Mike Shedlock's analysis of this report, by clicking here.

I do not plan on going into great details on this report as its findings didn't surprise me. Instead, I want my readers to keep in mind of certain basics governing pension funding:

- First, pensions are not just about assets, they are there to meet future liabilities. In other words, it's all about asset-liability matching. This is important because while pension fund managers try to "shoot the lights out", often taking excessive risks to meet their actuarial rates of return (which are way too high), they expose funds to serious downside risk.

- Second, there is a growing gap between public sector pensions and private sector pensions that is fueling anger and discontent out there. In an era of fiscal deficits, there will be increasing pressure to reign in all benefits, including public sector pensions. is this justified? In some cases, yes, but in other cases no. Governments will use any excuse to reign in public sector pensions but they allowed this situation to spiral out of control.

- Third, and most importantly, governance matters. I can't stress this last point enough. Governance means that there are appropriate checks and balances governing pension funds and all their activities.

The New York State Common Retirement Fund (CRF) announced it has returned 22.3% through the first three quarters of 2009. As of Dec. 31, 2009, the end of the fiscal third quarter for the pension, the plan’s holdings were valued at $129.4 billion. That was good for a 3.4% rate of return in the third quarter.

New York State Comptroller Thomas DiNapoli has been working hard at increasing the transparency of the CRF since he took office following the resignation of Alan Hevesi. Part of DiNapoli’s effort has included releasing quarterly performance reports to the public. This plan was started last year. Prior to that, the plan released annual performance reports.

DiNapoli has also released monthly investment reports for the fund. In those reports, DiNapoi discloses where CRF capital has been committed, the amount and the date of the closing of the investment.

In the plan’s latest monthly investment report for November 2009, the CRF closed seven transactions worth more than $591 million. Nearly all of that capital was committed to alternative investments.

The CRF closed two deals in its private equity portfolio worth $40 million, three deals in its absolute return strategy totaling $300 million, and one deal in its opportunistic alternatives portfolio valued at $250 million. The remaining deal included a real estate transaction worth $1.4 million.

The NYT reports that New York City’s freshly elected comptroller, John Liu, announced this week what he called major reforms in the way the city’s pension fund works. Mr. Liu said he wants to ease a ban on the placement agents to help mostly smaller funds, including those run by women and minorities, that don’t have the staff or expertise to win contracts on their own.

I remain highly skeptical on placement agents as most offer no value added whatsoever. These smaller pension funds should not even exist. They should be rolled up into a larger plan which has proper oversight and expertise to manage pension monies.

Finally, the NYT published an AP article, Missouri Auditor Calls for More Pension Oversight:

Lawmakers considered a bill Thursday to give the Missouri state auditor legal authority to monitor state pension systems.The bill comes in response to a recent court ruling that found the state auditor only has the authority to review internal audits completed by the pension systems. A Cole County Circuit Court judge quashed a subpoena from the auditor to review more documents and interview employees with the state's Local Government Employee's Retirement System.

The auditor's office has appealed the court's decision.

The bill's sponsor, Sen. Jason Crowell, R-Cape Girardeau, told the Senate pensions committee that many other state retirement systems allow the auditor to perform a full audit despite the ambiguous language.

His bill would permit a full audit of any retirement plan created by the state.

State Auditor Susan Montee said Missouri has performed audits on pension funds without a problem since the 1980s, but it is better to clean up the language.

''The ability to have oversight into our retirement systems is beneficial,'' Montee said.

The state auditor goes beyond a simple fiscal audit to examine whether agencies spend money properly. This includes looking at bidding processes and travel expenses.

Montee said it doesn't make sense for her office to only review fiscal audits completed by independent auditors.

''It's an exercise in futility for us to come in and look at someone else's work,'' she said.

Officials with other state retirement funds spoke in favor of the change, saying they encourage the extra level of accountability.

A Pew Center on the States report released Thursday found that Missouri's overall pension system is considered healthy despite the state's current economic woes.

The report states that the systems ''need improvement.'' Missouri is still better off than neighboring Kansas and Illinois, which had less that 60 percent of the necessary assets on hand in 2008.

Interestingly, the Board at the Missouri State Employees' Retirement System (MOSERS), recently announced it is reviewing staff compensation structure:

I am following compensation structures at public plans very closely and I have a feeling what is happening at MOSERS will affect other plans too. Also, like in other states, the fiscal situation is dire in Missouri, and they're tightening their belt:The MOSERS board voted to revise the MOSERS staff compensation structure for the fiscal year that begins July 1, 2010. At the November meeting, the board directed staff to develop a compensation proposal that included recognition of the investment performance of the system’s assets but limited incentive payments to staff to only those years when the fund’s return is positive.

Executive Director Gary Findlay offered a proposal at the January 21, 2010, meeting to eliminate the performance-based pay plan and instead, adopt a base pay compensation structure that is market-based. The proposal was adopted by the board. The board will consider hiring a compensation consultant to evaluate and recommend market-based pay levels for all staff positions.

As part of the most recent announcement of additional expenditure restrictions necessary to balance the state budget, the State of Missouri, Division of Budget and Planning announced yesterday that the employer incentive (match) associated with the State of Missouri Deferred Compensation Plan (the Plan) will be suspended at least through June 30, 2010.Please keep in mind that MOSERS is one of the best public pension funds in the United States. Their governance puts most other US plans, and Canadian plans, to shame. They don't just talk transparency, the actually deliver on it.

Are pensions on the brink? The answer to this question ultimately depends on whether the Fed, central banks and governments around the world are able to re-engineer inflation through asset reflation. If they fail, and we run into a protracted period of deflation, the majority of pension funds that are highly exposed to private/public equities, real estate, and alternatives like hedge funds are cooked. All other pension reforms are useless if deflation sets in.

Comments

Post a Comment