A Conversation With OPTrust CEO on Their 2024 Funded Status Report

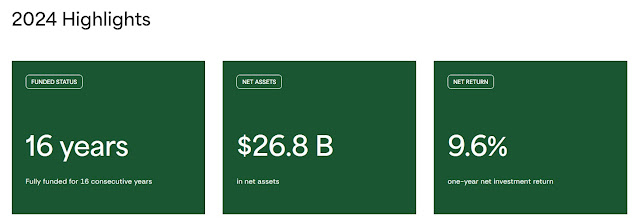

TORONTO, March 11, 2025 — OPTrust released its 2024 Funded Status Report, Your Future. Our Mission. today, which details the Plan's financial results and funded status. In 2024, OPTrust remained fully funded for the 16th consecutive year and achieved a net investment return of 9.6 per cent. Over the past 10 years, the Plan's average net investment return is 7.0 per cent.

“At OPTrust, we are dedicated to securing our members' financial future,” said Peter Lindley, President and CEO of OPTrust. “For the 16th consecutive year, OPTrust is fully funded, and our 114,000 members can continue to rely on a secure, sustainable pension. Looking ahead, our focus remains on ensuring pension security and delivering peace of mind in retirement to our members.”

Investment returns account for more than 70 per cent of the benefits paid to OPTrust members in retirement, with $1.4 billion in entitlements paid in 2024. Lifetime pension benefits offer financial stability for retirees, who spend 98 per cent of their pensions in Canada, supporting local economies and workers.

OPTrust's Member-Driven Investing strategy is designed to keep the Plan sustainable over the long term, without taking excessive risk. The Plan’s average annual net investment return since inception in 1994 is 7.9 per cent. OPTrust continued to advance its climate change strategy in 2024, achieving an 11 per cent reduction in emissions intensity and investing $400 million in green bonds through the year.

“Our strong return in 2024 is a testament to the success of our diversified investment strategy and the outstanding skill of our investment team,” said Lindley. “As long-term investors, our strength lies in our ability to look past short-term noise to see long-term value.”

In 2024, OPTrust Select membership grew at a steady pace, with total membership increasing to over 4,600. OPTrust also continued to provide exceptional service to members, who rated their service satisfaction as 8.7 out of 10. The Plan was recognized among the top 10 pension plans globally for service by CEM Benchmarking Inc.'s annual rankings.

Find more information about OPTrust's 2024 strategy and results in Your Future. Our Mission.

About OPTrust

With net assets of over $26 billion, OPTrust invests and manages one of Canada's largest pension funds and administers the OPSEU Pension Plan (including OPTrust Select), a defined benefit plan with over 114,000 members. OPTrust was established to give plan members and the Government of Ontario an equal voice in the administration of the Plan and the investment of its assets through joint trusteeship. OPTrust is governed by a 10-member Board of Trustees, five of whom are appointed by OPSEU/SEFPO and five by the Government of Ontario.

Here are the 2024 highlights:

And this:

Advanced our climate change strategy to strengthen the fund’s resilience and net-zero alignment. See more in our 2023-24 TCFD report.

Published our Asset owner’s toolkit for advancing inclusion, diversity and equity in investment portfolios.

Achieved an 11% emissions intensity reduction.

Voted at 882 company meetings in 30 countries.

Engaged 169 companies on key ESG issues.

Invested $400 million in green bonds over the year.

Signed the 2024 Global Investor Statement to Governments on Climate Change.

Continued to be an active voice in investor collaborative initiatives, including UNPRI’s Private Equity Advisory Committee, Thinking Ahead Institute, Ceres and the International Centre for Pension Management.

Here is the message from Peter Lindley, President and CEO of OPTrust:

Fully funded in 2024

Over the past year we provided pension security and financial stability to our more than 114,000 members. Despite modest economic growth, inflation concerns and high interest rates affecting consumer spending and housing, OPTrust achieved a strong one-year net investment return of 9.6 per cent in 2024, bringing our 10-year net investment return to 7.0 per cent. For the 16th consecutive year, OPTrust is fully funded, and is delivering on our mission of paying pensions today, preserving pensions for tomorrow – even in uncertain times.

Supporting our members

We take pride in supporting members through all stages of their careers and into retirement, helping them better understand their pension options and associated benefits. Our members tell us they appreciate the services we provide, giving us a strong service rating year-over-year.

Looking ahead

As we mark another year of being fully funded and providing exceptional service to our members, these achievements reflect the dedication and passion of the entire OPTrust team and the guidance of our Executive Team.

Our focus remains on ensuring pension security and delivering our members peace of mind in retirement.

“Thanks to our Member-Driven Investing strategy, long-term perspective and our world-class team of investment professionals, we have continued to deliver strong results on our investments, and pension certainty for our members and retirees.”

Peter Lindley

President and CEO

Take the time to read OPTrust's 2024 Funded Status Report here.

Earlier today, I had a chance to catch up with CEO Peter Lindley to discuss the report and more.

I want to thank Peter for taking the time to talk to me and also thank Claire Prashaw and Justin Stayshyn for setting up this discussion and sending me material to review beforehand.

Before I get to my discussion with Peter, just a quick note that these are solid results, 16 years of being fully funded -- no easy feat - and a solid long-term performance:

The strong performance last year came from Public (21.3%) and Private Equity (14.4%), Credit (9.5%), Multi-Strategy (9.8%), Infrastructure (6.7%). Their Risk Mitigation Portfolio also had a stellar year, gaining 33.9%.

Only Real Estate had a negative year, down 4.5% due to ongoing issues with that asset class.

Also worth noting is they divide their Total Portfolio into four sub-portfolios — each with a specific purpose — to help them achieve their investment objective: the Liability Hedging Portfolio, the Return Seeking Portfolio, the Risk Mitigation Portfolio and the Funding Portfolio.

Peter began by giving me an overview of last year's performance:

Our approach is really about being fully funded. I'm really happy about being fully funded 16 years in a row. As I told my Board, 16 years in a row makes it sound like it's really easy but it's not. Being consistent and having an investment strategy that delvers the results we need for our members is really a fine balancing act between enough risk, enough return, properly diversified and I think we thread that needle very effectively. It's not easy but the results are very positive so we are pleased about that.

While there were a lot of tailwinds last year in terms of the market, there was a lot of uncertainty on economic growth, inflation, etc. so in hindsight, it made it look a lot easier than it was. There was a lot of concern on where we are in the inflation cycle, is it going to be persistent, is it going to come down, what does it mean for growth. There are lots of potential things that could have gone wrong, so having the right positions, taking the right amount of risk was not an obvious thing in 2024.

The one-year return of 9.6% are very good, I was very pleased with that. We are a mature plan so we take less risk than some of our peers which are less mature. They can afford to take more risk. And of course we have a guarantee on inflation, the cost-of living adjustment is guaranteed in our plan. Those are all things that require us to take a slightly lower level of risk than others.

But what really matters is longer-term returns -- 10-year return of 7%, since inception 8% -- so consistency is really important to us and that speaks to the approach we. We are liability aware, we are very cognizant of our liabilities and we have liability-hedging portfolio. We vary that hedging ratio over time but it's an important part of what we do. It's all about managing the liability risk.

The other thing that is very important is having an appropriate discount rate. The returns we had last year allowed us to reduce our discount rate from 5% to 4.9% on a nominal basis, so 2.9% real rate which is conservative. That feels good as well because again the idea of being conservative is it's like a piggy bank so you put money in during good times to be able to take it out in bad times of needed.

That's the investment background, as far as the individual asset classes, strong returns from the Private equity portfolio, hedge fund and credit strategies were also good, our Infrastructure returns were also good. The one which you pointed out, negative return in our Real Estate portfolio was to be expected. If you look over the past four years in Real Estate, the last two years were negative, very strong returns prior to that. So we have good long-term returns in Real Estate, the negative year just reflects the challenges we have in the market. That's still going to work its way through, I don't think there is any magic solution to that. The higher interest rates, the correction on the values, rents and prices have all plateaued out. I think affordability is the issue there.

Our approach in real Estate is building to core in strong locations like Toronto and Vancouver so we feel it's a matter of time before that comes back.

That is the benefit of the Return Seeking Portfolio but I will pause there before going on to other benefits from our research and other areas.

I asked Peter about the Risk Mitigation Portfolio which is made up of hedge funds, gold, US dollars and whether it's an overlay on Public Markets, noting the strong return last year of 34%.

He told me these are public market assets but it's really risk mitigation for the entire plan as they take a total portfolio approach, "hedging some of tail risk". They were overweight gold and it generated a very healthy return last year.

He stressed it's really the risk mitigation of the entire portfolio:

We look at the total portfolio approach here. We start with our core (illiquid) assets - Private equity, Real Estate and Infrastructure -- then you build into it the liquid part where we have geographical or other factors that we want to build into the portfolio, then we have the interest rate part of it, the liability hedging then we have risk mitigation where we consider what systematic risk we have and try to hedge against tail risks.

Peter told me the Risk Mitigation varies between 5% and 10% of the total portfolio and it is implemented through assets, derivatives, some of it through overlay, some through physical commodities.

In Real Estate, he told me their strategy over last five years has been away from Offices and Retail into Residential and that has helped them weather the downturn but they do have exposure to Offices.

He also told me real Estate is almost exclusively in North America whereas Infrastructure an Private Equity is more global. They have an office in Australia to handle Asia Pacific investments and one in the UK to handle European investments.

Peter told me using their total portfolio approach, if they have a big asset in PE in Australia, which they do, they are likely to take less exposure to the Australian public market.

He also told me they don't publish their benchmark as their benchmark is their liabilities so they want to focus on the funded status.

Their funded status is 100% and when they have a good year like in 2024, they lower the discount rate to add a cushion.

In terms of other initiatives, Peter shared this with me:

I think there are three things I am proud about. the first one is our climate strategy. We increased the coverage of our measurement across pretty much everything we can measure in our portfolio which I was really happy about because some of it is easier to do than others. At the same time we managed to get a reduction of 11% of carbon emissions intensity. Carbon intensity emission is a measure but it's not the only measure that matters in climate change but it's an important one we report and we are very proud about that.

The other part is we are a mature pension plan so we pay out more than we take in. That's also good news for the economy and our research with HOOPP and UPP really talked about that. Overall, there are 1.3 million retirees in Ontario which receive about $43 billion in benefits and a lot of that contributes significantly to Ontario's GDP. The other part is the jobs it creates in Ontario -- roughly 250,00 jobs -- is supported by those entitlements so it's a big part of the Ontario economy. When I speak to ministers they recognize the importance of DB plans for Canada and Ontario.

One of the things that came out of that research was the leverage, for every dollar of benefits, you generate $1.43 in economic activity in Ontario so the multiplier effect is really important. Of course, more than 70 cents of every dollar that gets paid out is actually owned by investment, so it's not recycling contributions, it's multiplying contributions and then there is another multiplying effect that comes out of that in terms of economic activity and jobs that get supported.

Peter told me part of the reason behind this research was to answer the question whether pension investment managers do enough to support the local economy and the says they answered that question.

Lastly, I noted Kevin Zhu left OPTrust to become chief investment strategist at Qatar Investment Authority, replacing Don Raymond.

Peter praised Kevin saying he was instrumental in designing their total portfolio approach along with CIO James Davis and he was replaced by Michael Bonnaza who previously reported to Kevin.

He also told me membership at OPTrust Select is going well where they provide a DB plan for non-profit sector in Ontario which is made up mostly of women and as far a the current environment, he avoided talking about any potential tariff war and said they will continue taking a diversified approach focusing on the long run and using their total portfolio approach.

Anyway, it's late, I thank Peter once again for sharing his wise insights with my readers and recommend you all read OPTrust's 2024 Funded Status report here.

Below, Ontario Premier Doug Ford joins Meet the Press NOW to discuss his decisions to lift the 25% surcharge on electricity exports after speaking with Commerce Secretary Howard Lutnick. It comes after President Trump threatened to double the tariffs on Canadian steel and aluminum.

I'm glad there will be discussions on Thursday to hammer out details on a better trade deal which all parties agree to and I'm hoping President Trump publicly endorses it so we can move on from this madness once and for all.

Comments

Post a Comment