Is Trump Playing Global Investors For Fools?

The S&P 500 regained some ground on Friday, but the index still posted its worst week in several months as the salvo of trade policy actions unnerved investors.

The broad index rose 0.55% to 5,770.20, while the Nasdaq Composite gained 0.7% to 18,196.22. The Dow Jones Industrial Average added 222.64 points, or 0.52%, to end at 42,801.72.

Friday saw volatile trading, with the Dow falling more than 400 points at session lows before an afternoon rally. The S&P 500 and Nasdaq both fell more than 1% at their worst points in the trading day.

Despite Friday’s recovery, the S&P 500 notched its worst week since September with a loss of 3.1%. The Dow, meanwhile, fell 2.4% this week. The Nasdaq Composite slid 3.5% on the week, during which it had entered correction territory, which means the tech-heavy index finished a session 10% off its recent high.

Investors shook off a weaker-than-expected jobs report released Friday, which raised further concerns about an economic softening and briefly sent Treasury yields lower. Nonfarm payrolls increased by 151,000 jobs in February, less than the consensus forecast for 170,000 from economists polled by Dow Jones. The unemployment rate ticked higher to 4.1%.

That came as stocks have been on a roller-coaster ride this week with President Donald Trump’s tariff policies worrying investors about future U.S. growth and inflation. Trump said on Thursday that a swath of goods from Canada and Mexico that are covered by the North American trade agreement known as the USMCA would be exempt from the announced duties until April 2.

This move effectively walked back much of the original plan for levies on the two countries, along with China. But the market still sold off this week, with uncertainty mounting amid constant updates and a lack of clarity on what to expect longer term.

“The market does not like uncertainty,” said Glen Smith, chief investment officer at GDS Wealth Management. “While we expect the market to find its footing and recover from the tariff-driven selloff, investors should brace for continued choppiness until these uncertainties clear.”

Treasury Secretary Scott Bessent acknowledged to CNBC on Friday that the economy could be starting to “roll a bit.” However, he said that was due to a transition from the policies of the previous administration. Bessent said any tariffs implemented would be a “one-time price adjustment” and not spark lasting inflation.

Scott Bessent is a very smart macro trader but that statement wasn't one of his best.

My focus this week is on whether investors should be buying the Trump tariff tantrum.

Remember the taper tantrum? Well now we have the tariff tantrum and I'm starting to believe this is all manufactured nonsense so a few elite hedge funds can swoop in and buy a bunch of growth and other stocks that have been clobbered as uncertainty reigns on Wall Street:

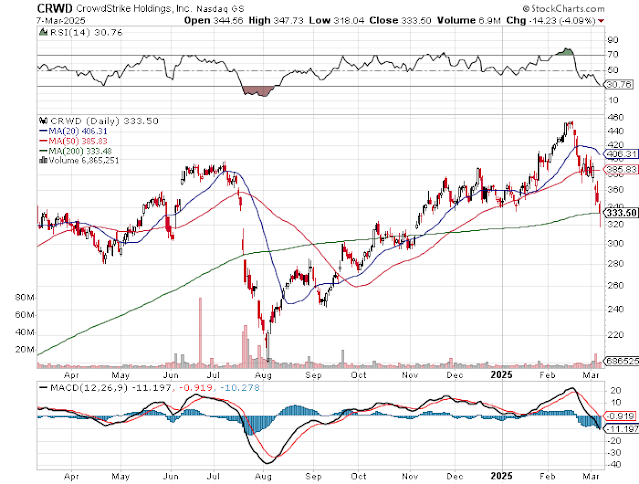

I'm just giving you a small sample of stocks above that I think will be bought hard if this tariff tantrum turns out to be another Trump posturing show that ends up going nowhere.

Think about it, he's already exempted some sectors and delayed implementing tariffs till April 2nd.

It just seems all too contrived, a big Trump show to instill fear in investors while the big elite funds scoop up shares they like on the cheap.

Meanwhile, he's blaming globalists for the stock market selloff but he knows exactly why stocks are selling off, investors hate chaos and uncertainty.

So, this Friday, March 7th, 2025, I want you to keep in mind this selloff might be manufactured nonsense so Trump's elite hedge fund buddies (some who even spoke publicly against tariffs) can capitalize on the selloff and scoop up shares on the cheap.

Of course I could be wrong but all this talk of "the end of American exceptionalism" and how the rest of the world will continue to outperform the US is complete and utter nonsense if you ask my opinion.

We will only find out what top funds are buying in Q1 on May 15th, but keep track of these large cap stocks that are down big this year:

Not all of them will bounce back but some of them will so keep them and the stocks I posted above on your watch list.

Today's action, especially in Tesla shares, tells me big funds are already looking past the Trump tariff tantrum.

That's my two cents, I just get the feeling Trump and his team are playing investors for fools and as always, it's the elite funds that will make off like bandits capitalizing on opportunities in momentum shares they trade.

If you don't believe me, check out this post by the Kobeissi Letter:

Trump Tariff War 1.0 vs 2.0:

— The Kobeissi Letter (@KobeissiLetter) March 6, 2025

The first Trump Trade War proved to be an exceptional buying opportunity, as shown below per ZeroHedge.

Markets are trading on nearly the SAME exact route right now.

Are you buying the dip in Trump Trade War 2.0? pic.twitter.com/KqYHqRs1HJ

Alright, not very scientific but just wanted to get this off my chest.

Below, Hightower’s Stephanie Link, Yardeni Research’s Ed Yardeni and BMO's Yung-Yu Ma, join 'Closing Bell' to discuss Fed Chair Powell's dovish comments, Trump's tariff wars and the overall market.

And President Trump told reporters there could be some economic disturbance amid tweaks to tariffs at the end of a tumultuous week in the markets. NBC News Correspondents Aaron Gilchrist, Brian Cheung and Garrett Haake join Meet the Press NOW to report on the impact of this week’s economic uncertainty. Former Labor Department Chief Economist Betsey Stevenson analyzes the latest jobs numbers.

Lastly, Mithra Warrier, Citi North America head of capital introduction, joins 'Closing Bell' to discuss investing in hedge funds, M&A's and IPOs and the tech trade. She says the market is in a good environment for hedge funds (she's right, especially for elite funds).

Comments

Post a Comment