Top Funds' Activity in Q4 2024

Warren Buffett’s Berkshire Hathaway Inc. continued whittling a longtime bet on Bank of America Corp. in last year’s final months, while keeping a stake in Apple Inc. intact following an earlier reduction.

The Omaha, Nebraska-based conglomerate cut its stake in the bank to 8.9% in the fourth quarter after selling 117.5 million shares, a regulatory filing on Friday shows. Bank of America executives and shareholders have waited months for the update after Berkshire’s prior sales left it with less than 10% and freed it from a requirement to quickly disclose transactions.

The remaining holding was worth $31.9 billion as of Friday’s close in trading. Buffett, 94, started whittling the investment in mid-July, without providing any explanation.

After slashing a holding in Apple earlier in 2024, Berkshire left the stake untouched in the year’s final months. The iPhone maker remains Berkshire’s largest stock holding, representing 28% of the conglomerate’s portfolio. The stake’s value rose by more than $5 billion in the quarter.

The firm also bought shares in SiriusXM and Occidental Petroleum during the quarter, while slashing a stake in Citigroup Inc. 73%, selling 40.6 million shares. And Buffett exited Ulta Beauty, a stock it started acquiring in the second quarter before paring back the position in the following period.

Berkshire is expected to release annual earnings, as well as Buffett’s traditional letter to shareholders, later this month.

Svea Herbst-Bayliss of Reuters also reports Ackman's firm boosts stake in Nike, cuts Chipotle during Q4:

Billionaire investor William Ackman increased his stake in sportswear company Nike by 15% and cut his investment in fast-casual food chain Chipotle Mexican Grill by 14%, during the fourth quarter, according to a regulatory filing made on Friday.

Ackman's firm Pershing Square Capital Management owned 18.8 million shares in Nike and 24.7 million shares in Chipotle, a name his firm has owned since 2016.

Once one of Wall Street's most voluble corporate agitators who pushed for changes at companies ranging from railroad Canadian Pacific Kansas City to industrial gases maker Air Products and Chemicals, Ackman adopted a quieter investment style a few years back but his picks are still closely followed.

The firm has been steadily cutting its investment in Chipotle, one of its big winners in recent years. On June 30, Pershing Square owned 28.8 million Chipotle shares.

The filing, known as a 13F filing, shows what fund managers owned at the end of the previous quarter.

The firm also cut its stake in Hilton Worldwide Holdings by 26% to 5.4 million shares.

Its biggest holding was investment firm Brookfield with roughly 35 million shares.

Carolina Mandl of Reuters also reports Bridgewater adds Tesla stake, reduces rest of 'Magnificent 7':

Hedge fund giant Bridgewater Associates added shares of Tesla to its portfolio in the fourth quarter, while it trimmed exposure to the rest of the "Magnificent Seven" group of U.S. tech and growth stocks, a regulatory filing showed.

The firm founded by investor Ray Dalio ended December with a small stake in Elon Musk's electric carmaker, comprised of 153,589 shares and worth $62 million, according to the filing late on Thursday.

Shares of Tesla are down roughly 13% this year and down more than 26% since their all-time closing high on December 17. However, the stock remains up well over 30% since the November 5 presidential election, with the company seen as benefiting from Musk's close association with President Donald Trump.

The billionaire entrepreneur is heading the Department of Government Efficiency, which is in charge of cutting waste from federal agencies.

Meanwhile, the macro hedge fund made sizeable cuts in the rest of its Magnificent Seven stocks. It slashed its stake in Apple by 40% to 617,203 shares, and reduced its position in Amazon by almost 35%.

Cuts in Nvidia, Microsoft, Meta and Alphabet ranged between 17.3% and 26.4%. However, those positions were still worth hundreds of millions of dollars.

In a recent letter to investors, Bridgewater's co-chief investment officer, Karen Karniol-Tambour, discussed the concentration of investors in AI stocks, saying it "creates significant portfolio diversification challenges."

The fund positions were revealed in quarterly securities filings known as 13Fs. While backward-looking, these snapshots show what funds owned on the last day of the quarter and are one of the few methods by which hedge funds and other institutional investors declare their positions. The filings do not indicate exact timing of purchases or sales and may not reflect current holdings.

The hedge fund did not immediately comment on the changes in its portfolio.

Meanwhile, Facebook-parent Meta Platforms Inc (META) closed higher for the 20th straight session Friday, its longest win streak ever.

The stock is up over 21% during the nearly 4-week stretch. It is now up 24.4% since the start of 2025 and up 55% over the last year.

And Andrew Kessell of Investopedia reports these tech stocks soared Friday after Nvidia disclosed stakes:

Shares of WeRide (WRD) soared Friday along with other tech stocks after Nvidia (NVDA) disclosed a stake in the Chinese autonomous driving company.

WeRide shares nearly doubled in value during Friday's session, rising more than 80$ after a filing Thursday showed Nvidia held 1.74 million shares as of Dec. 31. WeRide, which operates driverless vehicles in 30 cities across nine countries, made its debut on the Nasdaq in October.

The filing showed Nvidia added a stake in Nebius Group (NBIS), an AI infrastructure company, as well. Shares of Nebius were up nearly 7%. Nvidia rose almost 3%.

Shares of AI voice technology company SoundHound AI (SOUN), delivery robot developer Serve Robotics (SERV), and medical technology firm Nano-X Imaging (NNOX) tumbled as the filing showed Nvidia divested its holdings in those companies. SoundHound shares dropped almost 30%, Serve Robotics shares plunged 40%, and Nano-X fell 11%.

Nvidia also reduced its stake in chip designer Arm Holdings (ARM) to roughly 1.1 million shares from 1.96 million. Its shares finished Friday 5% down more than 3%.

Nvidia also kept its position in Recursion Pharmaceuticals (RXRX) which led to that stock soaring today.

Alright, it's Friday and it's Valentine's Day so let's keep this short and sweet.

It's that time of the year where we get a sneak peek into the holdings of the world's top money managers with a 45-day lag.

Why a 45-day lag and why do they report their holdings once a quarter and not every month?

Because that's the way it is, if it were up to me, they'd have to report their holdings every month with a 3 day lag max.

For the purposes of making this exercise easy, I'm going to use the latest quarterly filings of Bill Ackman's Pershing Square Capital Management which are available here:

His top position is Brookfield (BN) which is up more than 70% over the past five years:

Ackman increased his stake in Nike shares which might be bottoming out here:

But it's too early to make that call and fr an uptrend to take hold, I need to see that weekly MACD go positive (we're not there, stock remains below its 10-week exponential moving average; all charts can be accessed for free using stockcharts.com, all you need to do is use classic mode and enter parameters).

More recently, Ackman posted on X that he took a position in Uber and that 5-year weekly chart looks a lot better to me:

There are so many nice charts, for example look at Celestica (CLS) and Upstart (UPST):

Among the top holders of Celestica, you'll find Fidelity and Whale Rock Capital management which shed 30% of its position last quarter:

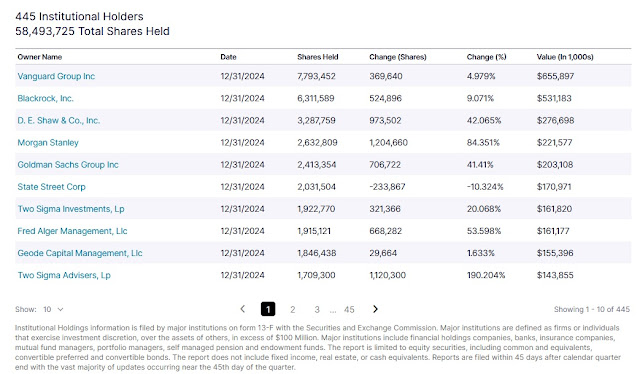

Among the top holders of Upstart, you see that D.E. Shaw and Two Sigma increased their stake last quarter:

Anyway, I'm just giving you a small taste of how to analyze the data quickly using what top funds bought and then using 5-year weekly chart with exponential 10, 50, 200-week moving averages.

There are a lot more tidbits in here so have fun looking at the data.

The links below take you straight to their top holdings and then click to see where they increased and decreased their holdings (see column headings and click on them).

Top multi-strategy, event driven hedge funds and large hedge fund managers

As the name implies, these hedge funds invest across a wide variety of

hedge fund strategies like L/S Equity, L/S credit, global macro,

convertible arbitrage, risk arbitrage, volatility arbitrage, merger

arbitrage, distressed debt and statistical pair trading. Below are links

to the holdings of some top multi-strategy hedge funds I track

closely:

1) Appaloosa LP

2) Citadel Advisors

3) Balyasny Asset Management

4) Point72 Asset Management (Steve Cohen)

5) Millennium Management

6) Farallon Capital Management

7) Shonfeld Strategic Partners

10) Peak6 Investments

11) Kingdon Capital Management

12) HBK Investments

13) Highbridge Capital Management

14) Highland Capital Management

15) Hudson Bay Capital Management

16) Pentwater Capital Management

17) Sculptor Capital Management (formerly known as Och-Ziff Capital Management)

18) ExodusPoint Capital Management

19) Carlson Capital Management

20) Magnetar Capital

21) Whitebox Advisors

22) QVT Financial

23) Paloma Partners

24) Weiss Multi-Strategy Advisors

25) York Capital Management

Top Global Macro Hedge Funds and Family Offices

These hedge funds gained notoriety because of George Soros, arguably the

best and most famous hedge fund manager. Global macros typically

invest across fixed income, currency, commodity and equity markets.

George Soros, Carl Icahn, Stanley Druckenmiller, Julian Robertson have

converted their hedge funds into family offices to manage their own

money.

1) Soros Fund Management

2) Icahn Associates

3) Duquesne Family Office (Stanley Druckenmiller)

4) Bridgewater Associates

5) Pointstate Capital Partners

6) Caxton Associates (Bruce Kovner)

7) Tudor Investment Corporation (Paul Tudor Jones)

8) Tiger Management (Julian Robertson)

9) Discovery Capital Management (Rob Citrone)

10 Moore Capital Management

11) Rokos Capital Management

12) Element Capital

13) Bill and Melinda Gates Foundation Trust (Michael Larson, the man behind Gates)

Top Quant and Market Neutral Hedge Funds

These funds use sophisticated mathematical algorithms to make their

returns, typically using high-frequency models so they churn their

portfolios often. A few of them have outstanding long-term track records

and many believe quants are taking over the world.

They typically only hire PhDs in mathematics, physics and computer

science to develop their algorithms. Market neutral funds will

engage in pair trading to remove market beta. Some are large asset

managers that specialize in factor investing.

1) Alyeska Investment Group

2) Renaissance Technologies

3) DE Shaw & Co.

4) Two Sigma Investments

5) Cubist Systematic Strategies (a quant division of Point72)

6) Man Group

7) Analytic Investors

8) AQR Capital Management

9) Dimensional Fund Advisors

10) Quantitative Investment Management

11) Oxford Asset Management

12) PDT Partners

13) TPG Angelo Gordon

14) Quantitative Systematic Strategies

15) Quantitative Investment Management

16) Bayesian Capital Management

17) SABA Capital Management

18) Quadrature Capital

19) Simplex Trading

Top Deep Value, Activist, Growth at a Reasonable Price, Event Driven and Distressed Debt Funds

These are among the top long-only funds that everyone tracks. They

include funds run by legendary investors like Warren Buffet, Seth

Klarman, Ron Baron and Ken Fisher. Activist investors like to make

investments in companies where management lacks the proper incentives to

maximize shareholder value. They differ from traditional L/S hedge

funds by having a more concentrated portfolio. Distressed debt funds

typically invest in debt of a company but sometimes take equity

positions.

1) Abrams Capital Management (the one-man wealth machine)

2) Berkshire Hathaway

3) TCI Fund Management

4) Baron Partners Fund (click here to view other Baron funds)

5) BHR Capital

6) Fisher Asset Management

7) Baupost Group

8) Fairfax Financial Holdings

9) Fairholme Capital

10) Gotham Asset Management

11) Fir Tree Partners

12) Elliott Investment Management (Paul Singer)

13) Jana Partners

14) Miller Value Partners (Bill Miller)

15) Highfields Capital Management

16) Eminence Capital

17) Pershing Square Capital Management

18) New Mountain Vantage Advisers

19) Atlantic Investment Management

20) Polaris Capital Management

21) Third Point

22) Marcato Capital Management

23) Glenview Capital Management

24) Apollo Management

25) Avenue Capital

26) Armistice Capital

27) Blue Harbor Group

28) Brigade Capital Management

29) Caspian Capital

30) Kerrisdale Advisers

31) Knighthead Capital Management

32) Relational Investors

33) Roystone Capital Management

34) Scopia Capital Management

35) Schneider Capital Management

36) ValueAct Capital

37) Vulcan Value Partners

38) Okumus Fund Management

39) Eagle Capital Management

40) Sasco Capital

41) Lyrical Asset Management

42) Gabelli Funds

43) Brave Warrior Advisors

44) Matrix Asset Advisors

45) Jet Capital

46) Conatus Capital Management

47) Starboard Value

48) Pzena Investment Management

49) Trian Fund Management

50) Oaktree Capital Management

52) Southeastern Asset Management

Top Long/Short Hedge Funds

These hedge funds go long shares they think will rise in value and short

those they think will fall. Along with global macro funds, they

command the bulk of hedge fund assets. There are many L/S funds but

here is a small sample of some well-known funds.

1) Adage Capital Management

2) Viking Global Investors

3) Greenlight Capital

4) Maverick Capital

5) Pointstate Capital Partners

6) Marathon Asset Management

7) Tiger Global Management (Chase Coleman)

8) Coatue Management

9) D1 Capital Partners

10) Artis Capital Management

11) Fox Point Capital Management

12) Jabre Capital Partners

13) Lone Pine Capital

14) Paulson & Co.

15) Bronson Point Management

16) Hoplite Capital Management

17) LSV Asset Management

18) Hussman Strategic Advisors

19) Cantillon Capital Management

20) Brookside Capital Management

21) Blue Ridge Capital

22) Iridian Asset Management

23) Clough Capital Partners

24) GLG Partners LP

25) Cadence Capital Management

26) Honeycomb Asset Management

27) New Mountain Vantage

28) Penserra Capital Management

29) Eminence Capital

30) Steadfast Capital Management

31) Brookside Capital Management

32) PAR Capital Capital Management

33) Gilder, Gagnon, Howe & Co

34) Brahman Capital

35) Bridger Management

36) Kensico Capital Management

37) Kynikos Associates

38) Soroban Capital Partners

39) Passport Capital

40) Pennant Capital Management

41) Mason Capital Management

42) Tide Point Capital Management

43) Sirios Capital Management

44) Hayman Capital Management

45) Highside Capital Management

46) Tremblant Capital Group

47) Decade Capital Management

48) Suvretta Capital Management

49) Bloom Tree Partners

50) Cadian Capital Management

51) Matrix Capital Management

52) Senvest Partners

53) Falcon Edge Capital Management

54) Park West Asset Management

55) Melvin Capital Partners (Plotkin shut down Melvin after reeling rom Redditor attack)

56) Owl Creek Asset Management

57) Portolan Capital Management

58) Proxima Capital Management

59) Tourbillon Capital Partners

60) Impala Asset Management

61) Valinor Management

62) Marshall Wace

63) Light Street Capital Management

64) Rock Springs Capital Management

65) Rubric Capital Management

66) Whale Rock Capital

67) Skye Global Management

68) York Capital Management

69) Zweig-Dimenna Associates

Top Sector and Specialized Funds

I like tracking activity funds that specialize in real estate, biotech,

healthcare, retail and other sectors like mid, small and micro caps.

Here are some funds worth tracking closely.

1) Avoro Capital Advisors (formerly Venbio Select Advisors)

2) Baker Brothers Advisors

3) Perceptive Advisors

4) RTW Investments

5) Healthcor Management

6) Orbimed Advisors

7) Deerfield Management

8) BB Biotech AG

9) Birchview Capital

10) Ghost Tree Capital

11) Soleus Capital Management

12) Oracle Investment Management

13) Palo Alto Investors

14) Consonance Capital Management

15) Camber Capital Management

16) Redmile Group

17) Casdin Capital

18) Bridger Capital Management

19) Boxer Capital

21) Bridgeway Capital Management

22) Cohen & Steers

23) Cardinal Capital Management

24) Munder Capital Management

25) Diamondhill Capital Management

26) Cortina Asset Management

27) Geneva Capital Management

28) Criterion Capital Management

29) Daruma Capital Management

30) 12 West Capital Management

31) RA Capital Management

32) Sarissa Capital Management

33) Rock Springs Capital Management

34) Senzar Asset Management

35) Paradigm Biocapital Advisors

36) Sphera Funds

37) Tang Capital Management

38) Thomson Horstmann & Bryant

39) Ecor1 Capital

40) Opaleye Management

41) NEA Management Company

42) Sofinnova Investments

43) Great Point Partners

44) Tekla Capital Management

45) Van Berkom and Associates

Mutual Funds and Asset Managers

Mutual funds and large asset managers are not hedge funds but their

sheer size makes them important players. Some asset managers have

excellent track records. Below, are a few funds investors track closely.

1) Fidelity

2) BlackRock Inc

3) Wellington Management

4) AQR Capital Management

5) Sands Capital Management

6) Brookfield Asset Management

7) Dodge & Cox

8) Eaton Vance Management

9) Grantham, Mayo, Van Otterloo & Co.

10) Geode Capital Management

11) Goldman Sachs Group

12) JP Morgan Chase & Co.

13) Morgan Stanley

14) Manulife Asset Management

15) UBS Asset Management

16) Barclays Global Investor

17) Epoch Investment Partners

18) Thornburg Investment Management

19) Kornitzer Capital Management

20) Batterymarch Financial Management

21) Tocqueville Asset Management

22) Neuberger Berman

23) Winslow Capital Management

24) Herndon Capital Management

25) Artisan Partners

26) Great West Life Insurance Management

27) Lazard Asset Management

28) Janus Capital Management

29) Franklin Resources

30) Capital Research Global Investors

31) T. Rowe Price

32) First Eagle Investment Management

33) Frontier Capital Management

34) Akre Capital Management

35) Brandywine Global

36) Brown Capital Management

37) Victory Capital Management

38) Orbis Allan Gray

39) Ariel Investments

40) ARK Investment Management

Canadian Asset Managers

Here are a few Canadian funds I track closely:

1) Addenda Capital

2) Letko, Brosseau and Associates

3) Fiera Capital Corporation

4) West Face Capital

5) Hexavest

6) 1832 Asset Management

7) Jarislowsky, Fraser

8) Connor, Clark & Lunn Investment Management

9) TD Asset Management

10) CIBC Asset Management

11) Beutel, Goodman & Co

12) Greystone Managed Investments

13) Mackenzie Financial Corporation

14) Great West Life Assurance Co

15) Guardian Capital

16) Scotia Capital

17) AGF Investments

18) Montrusco Bolton

19) CI Investments

20) Venator Capital Management

21) Van Berkom and Associates

22) Formula Growth

23) Hillsdale Investment Management

Pension Funds, Endowment Funds, Sovereign Wealth Funds and the Fed's Swiss Surrogate

Last but not least, I the track activity of some pension funds,

endowment, sovereign wealth funds and the Swiss National Bank (aka the Fed's Swiss surrogate). Below, a

sample of the funds I track closely:

1) Alberta Investment Management Corporation (AIMco)

2) Ontario Teachers' Pension Plan

3) Canada Pension Plan Investment Board

4) Caisse de dépôt et placement du Québec

5) OMERS Administration Corp.

6) Healthcare of Ontario Pension Plan (HOOPP)

7) British Columbia Investment Management Corporation (BCI)

8) Public Sector Pension Investment Board (PSP Investments)

9) PGGM Investments

10) APG All Pensions Group

11) California Public Employees Retirement System (CalPERS)

12) California State Teachers Retirement System (CalSTRS)

13) New York State Common Fund

14) New York State Teachers Retirement System

15) State Board of Administration of Florida Retirement System

16) State of Wisconsin Investment Board

17) State of New Jersey Common Pension Fund

18) Public Employees Retirement System of Ohio

19) STRS Ohio

20) Teacher Retirement System of Texas

21) Virginia Retirement Systems

22) TIAA CREF investment Management

23) Harvard Management Co.

24) Norges Bank

25) Nordea Investment Management

26) Korea Investment Corp.

27) Singapore Temasek Holdings

28) Yale Endowment Fund

29) Swiss National Bank (aka, the Fed's Swiss surrogate)

And JPMorgan’s Meera Pandit and Charles Schwab’s Kevin Gordon, join 'Closing Bell' to discuss the market rotation and frustration with the 'Mag 7'.

Lastly, Andrew Slimmon, Morgan Stanley Investment Management senior portfolio manager, joins 'Squawk Box' to discuss the latest market trends, why he believes we're in the later stages of a bull market, and more.

Comments

Post a Comment