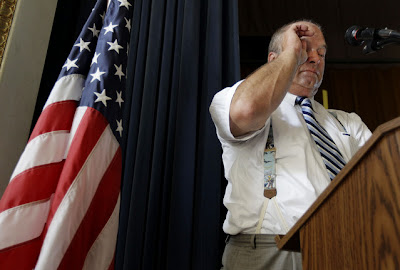

Did Pensions Get Clobbered in 2011?

William Selway of Bloomberg reports, U.S. State, Local Pensions Drop 8.5% : U.S. public pension-fund assets fell in the third quarter by the most since 2008 as stocks sank amid concern that Europe ’s debt crisis would curb economic growth, Census Bureau data showed. Assets of the 100 largest public-worker plans decreased $237 billion, or 8.5 percent, from the prior quarter to $2.53 trillion by Sept. 30, the bureau said today in a report. It marks the first decline since the second quarter of 2010 and the biggest since the last three months of 2008, when holdings slid 13 percent during Wall Street’s credit crisis. The setback may strain state and local governments that have set aside more money to cover retirement benefits. That’s pressured governments already coping with diminished tax collections and has propelled efforts to reduce benefit costs. The asset decline was driven by losses in stock holdings, which slipped $134.7 billion to $769.6 billion, the Census Bureau said. The va...