2011, The Year of Stasis?

Kip McDaniel of aiCIO wrote an editorial comment, 2011, The Year of Stasis:

Kip McDaniel of aiCIO wrote an editorial comment, 2011, The Year of Stasis:It is both cliché and seemingly essential in editorial circles to say that we (whoever ‘we’ are) are currently at an action-packed point in time where everything is changing and nothing is as it was 12 months ago. The reason for this is simple: Stasis does not move magazines off newsstands or entice advertisers to place ads in those magazines.

The people who run magazines, therefore, have a financial incentive to say capital is quickly changing hands (for every time capital changes hands, there is an opportunity for a magazine), regardless of the claim’s necessity or veracity—which makes the argument I’m about to force upon you somewhat at odds with my own self-interest.

The past year was essentially one of stasis in the pension/E&F/asset management industry. Yes, there were pockets of movement and change—Jeff Scott (formerly of the Alaska Permanent Fund) and Chris Ailman (of the California State Teachers’ Retirement System) changing the way their massive funds perceive asset allocation come to mind, as well as shifts towards tactical asset allocation strategies at some smaller pension funds and a slight increase in hedge fund usage industry-wide—but, by and large, 2011 was a year of “I know I should do it, I just can’t do it now.”

This is not the result of current chief investment officer/investment board laziness, lack of education, or poor judgment. This is a result of the remaining flotsam from the crisis of 2008. In November, I used the analogy of the Panama Canal to describe the current state of liability-driven investing (LDI). Here’s how it went:

On the Atlantic side of the Canal lays Colon, a port town known for violence and grit. Its coast is scattered with Panamax tankers waiting to make the Canal traverse. Three locks raise the ships up to the passage level—the Canal, although originally intended to be lock-less, was later created with locks due to the sheer scoop of such an undertaking. From there, the ships take eight hours to traverse the 48-mile stretch of windy waterway, their helm controlled by a special Canal pilot who knows the passage intimately. When it reaches Panama City—a rapidly modernizing town of 1.2 million—the ship descends another series of locks, exiting the Canal into the Pacific.

Applied to LDI, the analogy is simple. The ships bobbing in the Atlantic are those who failed to execute an LDI strategy before interest rates and assets fell in 2008; those in the Canal—and those lucky few who have passed fully into the Pacific—are those that extended duration and partially or fully immunized before the global economy was roiled. Extending the analogy, the ships in the Atlantic are exposed to rougher seas than those in the Canal, although those making the voyage are by no means safe from every danger; ships in the passage never turn around and exit the same locks they entered; and Canal ship captains can be equated to consultants, or specialized asset managers that aid those in passage.

Upon further reflection, this analogy can be applied to many issues beyond LDI. Whether it is pension buyins/buyouts, investment outsourcing, or moves into new strategies such as risk parity, there is a group of funds that made decisions before 2008, and, in this analogy, are either in the canal or have passed into the Pacific. For other funds—wracked by political upheaval (Think: San Diego County, many other public plans) and low funding ratios (across the board)—2011 saw them largely staying in the Pacific. Add in regulatory uncertainty, perhaps the largest contributor to stasis outside of low funding ratios, and you have multiple factors aligning against large, secular—and, I would argue, essential—changes in the institutional asset management space.

I will certainly take flak for claiming that stasis ruled the past year. Change is always happening, yes, but I would argue that right now it is happening only on the margin. We in the financial media have been arguing since the autumn of 2008 that the global financial crisis will fundamentally alter the way institutional assets are managed. We speak of LDI, general de-risking, investment outsourcing, risk parity, hedge-fund saviors, and a variety of other strategies that might amount to a secular alteration in this universe. But, I would argue, we have yet to really see large-scale movement. Funding levels are too low, markets are too flat, investment boards are too scarred by the crisis, and regulatory uncertainty is just too great.

For the sake of the institutional asset management world—and, it must be said, for the financial benefit of aiCIO and other industry publications—let’s hope I’m not writing the same column a year from now.

I agree with Kip, 2011 was mostly more of the same among large institutional investors. Most pension funds will claim they took "drastic actions" to curb risk and bolster asset allocation, but they're just tinkering at the margins.

What does more of the same mean for me? Piling into hedge funds and other alternatives, getting raped on fees, going for broke, claiming they are sophisticated when the opposite is true. Ultimately, these are losing strategies that won't make a difference in their severely underfunded plans. That's why all pension roads invariably lead to Rhode Island.

If pensions are going to seriously tackle their deficits, hard political choices need to be made, but above and beyond that, we need serious pension governance reforms to make pension fund managers and board of directors a lot more accountable for the decisions they take.

And pensions need to start thinking outside the box, rethink alpha and beta strategies. There are tons of opportunities for internal alpha and seeding external managers, especially in hot areas like commodities. Pension funds should fire their consultants and listen to me. I've seen it all, can smell bullshit from a mile away, if you want to keep sinking, stick to your losing strategies.

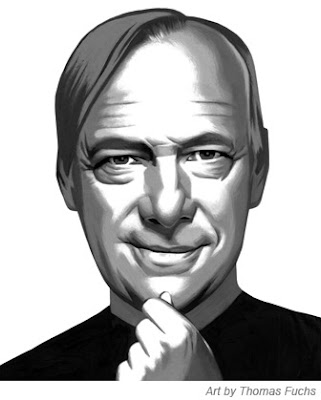

Finally, please read aiCIO's cover article, Is Ray Dalio the Steve Jobs of Investing? Large financial institutions need more Steve Jobs and Ray Dalios and less political weasels who practice cover-your-ass politics. This is the cancer destroying many institutions from within. I know this better than anyone else, which is why when I look at an organization, I look at the people first and foremost. People who are not afraid to be challenged, embrace and learn from failure, are what make the difference between an ordinary organization and an extraordinary one.

Below,

Comments

Post a Comment