Buffett Baffled by 30-Year Bonds?

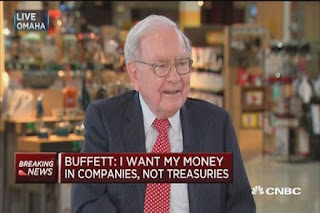

Matthew J. Belvedere of CNBC reports, Why anyone would buy a 30-year bond 'absolutely baffles me,' Warren Buffett says : Billionaire investor Warren Buffett told CNBC he can't see any reason for investors to buy 30-year bonds right now. "It absolutely baffles me who buys a 30-year bond, the chairman and CEO of Berkshire Hathaway said on "Squawk Box" on Monday. "I just don't understand it." "The idea of committing your money at roughly 3 percent for 30 years ... doesn't make any sense to me," he added . Buffett said he wants his money in companies, not Treasurys — making the case throughout CNBC's three-hour interview that he sees stocks outperforming fixed income. Buffett has a lot to say this time of year. In his widely read annual letter to shareholders of his Berkshire Hathaway holding company, the Oracle of Omaha blasted hedge funds and their high fees and urged average investors to buy regular index funds