CAAT Pension Gains 15.8% in 2017

At the end of March, I discussed how the Colleges of Applied Arts and Technology (CAAT) pension plan’s funded status reached 118%, the second largest funded position right behind the Healthcare of Ontario Pension Plan (HOOPP) which has a funded status of 122%.

At the time, CAAT's 2017 Annual Report wasn't available but it came out yesterday and it is available here. Take the time to read it, it's excellent, well written, concise and very transparent.

I have already covered CAAT's funded success and the success of the Plan is derived from the factors below (click to enlarge):

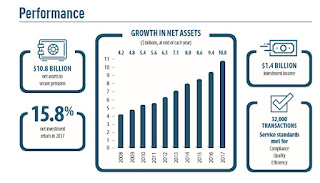

In this brief comment, I want to focus on CAAT Pension Plan's investment success. The CAAT Pension Plan’s assets reached $10.8 billion at December 31, 2017, compared with $9.4 billion at the end of 2016.

The Fund returned 15.8% net of investment management fees in 2017, outperforming its policy benchmark by 3.5% (click on image):

The Plan has experienced steady growth in assets over the last ten years (click on image):

I had a chance to briefly speak with Julie Cays, CAAT's CIO, on the sources of returns in 2017 (click on image):

Julie was sick and is home recovering but was kind enough to quickly go over some points. First, have a close look at the returns and benchmarks for each asset class (click on image):

As shown above, there was a strong performance in Emerging Market equities, Global equities (see footnote), Private Equity and Real Assets.

It was a solid performance all around and the overall results place CAAT at the top of the Canadian pensions I cover in terms of performance in 2017.

Julie shared a few points with me:

Julie told me they are in the process of gaining new members and I think this is a great plan to join.

I thank Julie for taking the time to speak with me and think she and her small team did an outstanding job delivering incredible results in 2017.

I recommend you all take the time to read CAAT's 2017 Annual Report here. Below, I embedded some of the highlights from the year in review.

At the time, CAAT's 2017 Annual Report wasn't available but it came out yesterday and it is available here. Take the time to read it, it's excellent, well written, concise and very transparent.

I have already covered CAAT's funded success and the success of the Plan is derived from the factors below (click to enlarge):

In this brief comment, I want to focus on CAAT Pension Plan's investment success. The CAAT Pension Plan’s assets reached $10.8 billion at December 31, 2017, compared with $9.4 billion at the end of 2016.

The Fund returned 15.8% net of investment management fees in 2017, outperforming its policy benchmark by 3.5% (click on image):

The Plan has experienced steady growth in assets over the last ten years (click on image):

I had a chance to briefly speak with Julie Cays, CAAT's CIO, on the sources of returns in 2017 (click on image):

Julie was sick and is home recovering but was kind enough to quickly go over some points. First, have a close look at the returns and benchmarks for each asset class (click on image):

As shown above, there was a strong performance in Emerging Market equities, Global equities (see footnote), Private Equity and Real Assets.

It was a solid performance all around and the overall results place CAAT at the top of the Canadian pensions I cover in terms of performance in 2017.

Julie shared a few points with me:

- They typically don't make big tactical calls. She told me they went overweight credit in 2009 and 2011 but rarely make big tactical decisions.

- They are increasing their co-investments in Infrastructure and Private Equity, cutting fees and leveraging off their relationships with external managers as much as possible.

- They use portable alpha in their US portfolio and invest in two big hedge funds, Bridgewater's Pure Alpha Fund and BlackRock's Fixed Income Fund. Again, they leverage off these relationships as much as possible.

- CAAT's governance is the key to taking active risk over a long investment horizon.

Julie told me they are in the process of gaining new members and I think this is a great plan to join.

I thank Julie for taking the time to speak with me and think she and her small team did an outstanding job delivering incredible results in 2017.

I recommend you all take the time to read CAAT's 2017 Annual Report here. Below, I embedded some of the highlights from the year in review.

Comments

Post a Comment