Are Global Stocks Cheap?

Akane Otani of the Wall Street Journal reports, Global Stocks Haven’t Looked This Cheap Since 2016:

The most important factor is the Fed. Barring a stock market crash, it's all but a given the Fed will increase rates in December and some think it will hike rates three times next year.

I highly doubt we will see three more Fed rate hikes next year, especially if global stocks keep selling off like they have this month.

By this time next year, I foresee a recession in the US and generalized global weakness. Instead of synchronized global growth, we're going to see a synchronized global downturn, and the Fed and other central banks will be in easing mode.

Getting back to the WSJ article above, Anastasios Avgeriou, Chief Equity Strategist at BCA Research, posted this on LinkedIN (click on image):

Yes, stocks are cheap but that's because we had a big drop in price. If we see a global economic downturn next year, you will see major downward revisions to those forward earnings (P/Es aren't only about price!) .

All this to say, be careful with valuations, global stocks are cheap for a reason, and the worst is yet to come.

Sure, bargain hunters will come in to buy the dips, but this isn't an easy environment for dip buyers, especially for those venturing into growth stocks.

On Monday, Amazon (AMZN) was down another 6% and like I told you on Friday, in the past, every time it dropped below its 50-week moving average, it was a big buying opportunity but with eight rate hikes and a global recession looming, you really need to be careful buying the dips on these growth superstars which ran up a lot this year.

These are not markets which will reward careless dip buyers and momentum players. They will get crushed in these markets because we are moving away from growth stocks as a defensive theme to stability to weather the global downturn.

This doesn't mean you can't trade big tech stocks, just be cognizant of the risks you're taking to play big bounces in this sector after a selloff.

Something else, an astute blog reader of mine noticed the Vanguard FTSE All-World Ex-US ETF (VEU) has been outperforming the S&P 500 (SPY) over the last week even though it's declining too and he wondered whether a big rotation is going on to non-US stocks.

I told him I noticed even though emerging markets (EEM) led by Chinese shares (FXI) continue to slide lower, Brazilian shares (EWZ) had a great month of October (click on image):

But this had more to do with the elections with far-right politician Jair Bolsonaro winning a sweeping victory in Brazil's presidential election on Sunday (and traders sold the news on Monday).

I wouldn't read too much into Brazil's outperformance of late nor do I think there is a major rotation going on out of US stocks into cheaper ex-US stocks.

Again, they're cheaper for a reason. Until I see the Fed showing signs of backing off its rate hike path, I would stick with US stocks over international stocks but as I stated plenty of times, you need to be defensive in this environment and overweight sectors like healthcare (XLV), utilities (XLU), consumer staples (XLP), REITs (IYR) and telecoms (IYZ). And I would hedge that stock exposure with good old US long bonds (TLT).

Given my outlook that a global synchronized downturn is headed our way, you want to play safe dividend stocks that got clobbered as rates backed up recently.

You can try buying the dips on big tech stocks (XLK) but be careful not to get your head handed to you. For expert traders, there will be great opportunities on the long and short side on these stocks in the months ahead but it will be very volatile.

Most investors with a low risk tolerance are better off getting defensive and staying defensive over the next year.

And for Pete's sake, the next time someone tells you "global stocks are cheap", tell them "yeah, they're cheap for a reason, earnings are about to get crushed over the next year."

Stop using valuations as a market-timing tool, you will get crushed just like those momentum chasers chasing growth stocks.

Anyway, I think I made my point. Be careful out there, stocks could come roaring back next month (in fact, I'm betting on it) but we're far from out of the woods. The danger is only beginning.

Lastly, I noticed Boeing shares (BA) plunged the most since 2016 after opening the day higher (click on image):

I'm on record stating Boeing shares are my number one short over the next two years among large cap Dow stocks and I stick by this call. It might not happen this year but when this stock really cracks, it's going to tumble hard (click on image):

Below, the Federal Reserve can reverse the damage by stepping away from its current interest rate hike policy, according to veteran investment strategist Ed Yardeni.

"We need the Fed to pause here and just take a breather," the Yardeni Research President said Friday on CNBC's "Trading Nation. "Let's see how the economy plays out, and that will help the stock market a lot."

Yardeni has been too bullish for my liking and the Fed won't pause unless a crisis erupts in or outside the US. Still, I agree with him on one point, inflation isn't a problem, it will subside over the next 12 months and not just for the reasons he states. The global unwind will lead to a global recession.

Global stocks are trading at their lowest valuations in more than two years as pessimism grows over the growth outlook, dangling the prospect of opportunity to some bargain-minded investors.On Friday, I discussed how this is the worst October for stocks since 2008. I highly recommend you read that comment carefully to get a good sense of the factors I'm looking at right now.

After a punishing October, major indexes in Europe, Japan, Shanghai, Hong Kong, Argentina and Canada are all languishing in correction territory—a decline of at least 10% from a recent high. The U.S. is teetering on the edge of joining its peers there after a selloff last week wiped out all of the S&P 500 and Dow Jones Industrial Average’s gains for the year.

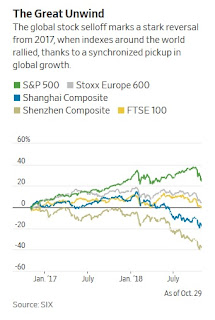

The breadth of the declines shows a remarkable reversal from 2017, when optimism about the global economy sent shares around the world to multiyear highs.

“The expectation at the start of the year was this story of synchronized global growth,” said Mark Heppenstall, chief investment officer at Penn Mutual Asset Management based in Horsham, Pa. “And it seems like that argument for investing in global equities faded pretty quickly out of the gates.”

These days, investors say they are grappling with myriad anxieties: a slowing Chinese economy, geopolitical hot spots ranging from Italy to Saudi Arabia to Turkey and the still unresolved trade dispute between the U.S. and China. Adding to those concerns, data last week showed the eurozone economy grew at the slowest pace in two years. And technology firms that had helped fuel the U.S. stock rally are stumbling, with companies such as Amazon.com Inc., Alphabet Inc. and Netflix Inc. down more than 10% apiece in October.

The laundry list of issues has chipped away at investors’ optimism, driving the share of fund managers who expect the global economy to decelerate over the next year to the highest level since November 2008, according to Bank of America Merrill Lynch. It has also pushed the forward price/earnings ratio of the MSCI All Country World Index—which tracks performance across 23 developed and 24 emerging markets—to around 18, its lowest since early 2016. That was when fears about a hard economic landing in China and a crash in the price of oil drove markets sharply lower.

So far in 2018, the index is down about 7%, on course for its biggest decline since 2011.

Few investors are ready to call it quits on stocks altogether. And most don’t see the U.S., which until recently had led the global stock rally, tipping into recession in the near term. The Commerce Department said Friday that gross domestic product rose at a 3.5% seasonally and inflation-adjusted annual rate in the third quarter, buoyed by strong consumer spending that helped offset a drop in U.S. exports.

Still, many say the market’s slide—which has wiped out the 2018 gains of technology titans such as China’s Tencent Holdings Ltd. , Facebook Inc. and South Korea’s Samsung Electronics Co. Ltd.—has forced them to take a second look at bets that had formerly been clear winners. Expectations that policy makers at the Federal Reserve will keep pressing ahead with plans to phase out stimulative policies have added to the sense that investors will have to search harder for growth that can fuel further price gains.

“For a while, just a couple of sectors were holding the whole market together,” said Anwiti Bahuguna, senior portfolio manager and head of multiasset strategy at Columbia Threadneedle Investments. “And now we’re finally seeing the beginnings of a rotation.”

Some investors see glimmers of opportunity ahead.

UBS Global Wealth Management’s chief investment officer, Mark Haefele, is recommending that clients put money in global equities, rather than focusing their portfolios in one region or another. He notes that the Fed is moving further away from policy makers at the European Central Bank, who are still holding rates low; the Bank of Japan, which still has a huge stimulus plan in place, and the People’s Bank of China, which is cutting some banks’ reserve requirements in one effort to stimulate growth.

“All of these policies are going in different directions, and they’re probably not all going to be winners,” Mr. Haefele said. “You don’t want to bet on just one of these central banks getting it right—you want to diversify it.”

Others say not to overlook emerging markets, which have been particularly hard hit in the recent global equity selloff.

After their drawdown, emerging markets carry attractive valuations, said BlackRock Inc., which has issued positive ratings for stocks in the U.S., emerging markets and Asia excluding Japan. The group could get a boost if economic data in the U.S. begin to show weakness, pushing the Fed to slow its pace of interest-rate increases, the firm added.

To these firms and other investors, the volatility that has upended markets hasn’t amounted to a big enough threat to pull out of stocks altogether. Instead, the drawdowns have made shares in many regions of the world look less frothy than they did in January, when global stocks roared to records.

The S&P 500 is trading at about 15.55 times the next 12 months of earnings, down from 18.32 at the end of last year and below its five-year average of 16.47, according to FactSet.

After the drops of the past few weeks, 93% of markets in the MSCI All Country World Index are trading below both their 200-day and 50-day moving averages, according to Bank of America Merrill Lynch. The firm’s analysts recommend buying stocks whenever that measure exceeds 88%.

The most important factor is the Fed. Barring a stock market crash, it's all but a given the Fed will increase rates in December and some think it will hike rates three times next year.

I highly doubt we will see three more Fed rate hikes next year, especially if global stocks keep selling off like they have this month.

By this time next year, I foresee a recession in the US and generalized global weakness. Instead of synchronized global growth, we're going to see a synchronized global downturn, and the Fed and other central banks will be in easing mode.

Getting back to the WSJ article above, Anastasios Avgeriou, Chief Equity Strategist at BCA Research, posted this on LinkedIN (click on image):

Yes, stocks are cheap but that's because we had a big drop in price. If we see a global economic downturn next year, you will see major downward revisions to those forward earnings (P/Es aren't only about price!) .

All this to say, be careful with valuations, global stocks are cheap for a reason, and the worst is yet to come.

Sure, bargain hunters will come in to buy the dips, but this isn't an easy environment for dip buyers, especially for those venturing into growth stocks.

On Monday, Amazon (AMZN) was down another 6% and like I told you on Friday, in the past, every time it dropped below its 50-week moving average, it was a big buying opportunity but with eight rate hikes and a global recession looming, you really need to be careful buying the dips on these growth superstars which ran up a lot this year.

These are not markets which will reward careless dip buyers and momentum players. They will get crushed in these markets because we are moving away from growth stocks as a defensive theme to stability to weather the global downturn.

This doesn't mean you can't trade big tech stocks, just be cognizant of the risks you're taking to play big bounces in this sector after a selloff.

Something else, an astute blog reader of mine noticed the Vanguard FTSE All-World Ex-US ETF (VEU) has been outperforming the S&P 500 (SPY) over the last week even though it's declining too and he wondered whether a big rotation is going on to non-US stocks.

I told him I noticed even though emerging markets (EEM) led by Chinese shares (FXI) continue to slide lower, Brazilian shares (EWZ) had a great month of October (click on image):

But this had more to do with the elections with far-right politician Jair Bolsonaro winning a sweeping victory in Brazil's presidential election on Sunday (and traders sold the news on Monday).

I wouldn't read too much into Brazil's outperformance of late nor do I think there is a major rotation going on out of US stocks into cheaper ex-US stocks.

Again, they're cheaper for a reason. Until I see the Fed showing signs of backing off its rate hike path, I would stick with US stocks over international stocks but as I stated plenty of times, you need to be defensive in this environment and overweight sectors like healthcare (XLV), utilities (XLU), consumer staples (XLP), REITs (IYR) and telecoms (IYZ). And I would hedge that stock exposure with good old US long bonds (TLT).

Given my outlook that a global synchronized downturn is headed our way, you want to play safe dividend stocks that got clobbered as rates backed up recently.

You can try buying the dips on big tech stocks (XLK) but be careful not to get your head handed to you. For expert traders, there will be great opportunities on the long and short side on these stocks in the months ahead but it will be very volatile.

Most investors with a low risk tolerance are better off getting defensive and staying defensive over the next year.

And for Pete's sake, the next time someone tells you "global stocks are cheap", tell them "yeah, they're cheap for a reason, earnings are about to get crushed over the next year."

Stop using valuations as a market-timing tool, you will get crushed just like those momentum chasers chasing growth stocks.

Anyway, I think I made my point. Be careful out there, stocks could come roaring back next month (in fact, I'm betting on it) but we're far from out of the woods. The danger is only beginning.

Lastly, I noticed Boeing shares (BA) plunged the most since 2016 after opening the day higher (click on image):

I'm on record stating Boeing shares are my number one short over the next two years among large cap Dow stocks and I stick by this call. It might not happen this year but when this stock really cracks, it's going to tumble hard (click on image):

Below, the Federal Reserve can reverse the damage by stepping away from its current interest rate hike policy, according to veteran investment strategist Ed Yardeni.

"We need the Fed to pause here and just take a breather," the Yardeni Research President said Friday on CNBC's "Trading Nation. "Let's see how the economy plays out, and that will help the stock market a lot."

Yardeni has been too bullish for my liking and the Fed won't pause unless a crisis erupts in or outside the US. Still, I agree with him on one point, inflation isn't a problem, it will subside over the next 12 months and not just for the reasons he states. The global unwind will lead to a global recession.

Comments

Post a Comment