Are US Stocks Set For a Major Reversal?

CNBC's Bob Pisani reports that the stock market goes from worried to rally mode on Friday:

First, let's briefly review the US jobs report. Anneken Tappe of CNN Business reports that the US unemployment dropped to its lowest level since 1969:

Importantly, earlier this week, the September manufacturing ISM showed a clear contraction is underway in the US manufacturing economy as important components all registered a reading below 50 (indicating contraction):

Moreover, I agree with David Rosenberg, the latest US Jobs report failed a crucial test and a recession is right around the corner. Both the truck transportation and durable goods manufacturing sectors lost jobs in September, even as the economy added jobs overall.

Rosenberg cites weakness in transport stocks (IYT) as a harbinger of things to come but looking at the weekly 5-year chart, I'm not alarmed just yet:

I need to see a meaningful and sustained break below its 200-week moving average before I start panicking on transport stocks.

Sure, some components of the iShares Transportation Average ETF (IYT) like FedEx (FDX) are showing clear signs of weakness ahead but this could be an idiosyncratic thing (like Amazon threatening to ship its own parcels) and have nothing to do with global weakness:

FedEx is actually on my watch list, not because I like this chart above (hate it), but because it's a very important company to track closely (the contrarian in me thinks it's a buy but I'm not catching this falling knife).

What else am I keeping an eye on? Well, following last month's "Quant Quake 2.0" and rumblings of QE Infinity unnerving investors, I'm paying close attention to the US Value Factor ETF (VLUE) and US Momentum Factor ETF (MTUM) to gauge if last month's momentum selloff was a temporary setback:

Again, it looks like there's some rotation out of growth into value going on but I'm not overly concerned and have a watch list of momentum favorites I track to let me know what is going on real time.

As far as the overall market, the S&P 500 (SPY) did pull back this week but it’s still in bullish mode:

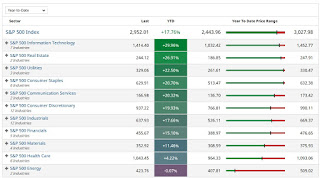

Interestingly, year-to-date, the S&P 500 is up 18% led by Technology (XLK), Real Estate (IYR), Utilities (XLU) and Consumer Staple (XLP):

This defensive theme is hardly surprising given the uncertainty and by the way, US long bonds (TLT) are also having a great year:

We are at an important juncture, either a trade deal will lead stocks higher and bonds lower or something is going to give over the last quarter of the year, much like it did in Q4 of last year.

The good news is markets typically don't repeat but you can't take anything for granted in these markets.

On a more sobering note, Martin Roberge of Canaccord Genuity sent this out in his weekly Portfolio Strategy Incubator:

Watch an interview with Danielle below on the US economy, she raises excellent points.

One last chart, a friend was asking me what I thought of biotech stocks (XBI) this year and I told him to stay away:

I told him biotech and less-so healthcare stocks (XLV) have been acting as if Bernie Sanders and Elizabeth Warren have won the next election.

Who knows, we might have another American biotech moment just as we did before the last US presidential elections where I was pounding the table to load up on biotech stocks (stay tuned, too early to make a biotech sector call here).

Alright, that's all from me, enjoy your weekend!

Below, watch CNBC's full interview with Cleveland Federal Reserve President Loretta Mester on "Closing Bell" where she discusses potential interest rate cuts, the state of the consumer and threats to the US economy. I really like Mester, she's very careful and balanced in her views.

Also, Danielle DiMartino Booth, CEO of Quill Intelligence, on the jobs report, ISM manufacturing and services index and what the figures say about the overall economy.

Third, Charles Bobrinskoy of Ariel Investments and Savita Subramanian of Bank of America Merrill Lynch join CNBC's "Closing Bell" to discuss the day's market action and what's been driving the rally.

Fourth, CNBC's "Power Lunch" team discusses markets after a week of important economic data with Larry Adam of Raymond James and Peter Boockvar of Bleakley Advisory.

Fifth, Mona Mahajan, Allianz Global Investors US investment strategist, joins "Squawk Box" to discuss her outlook for the fourth quarter trading period and the concerns weighing on the market, going over trade and other factors.

Lastly, a couple of days ago, Cam Harvey, Research Affiliates partner and Duke Fuqua School of Business professor of finance, explained why the inverted yield curve may portend a recession. He spoke with Bloomberg's Joe Weisenthal, Caroline Hyde, Sarah Ponczek and Romaine Bostick on "Bloomberg Markets: What'd You Miss?" Listen to Cam, he's the man! (great guy, met him years ago)

The market is in a slow melt-up mode on Friday.It's Friday, my time to kick back and do what I love most, analyze markets.

There was a volume spike at 11:30 a.m. as European markets closed and as the S&P 500 passed the earlier highs of the day at 10:00 a.m. ET, a technical move in-line with typical momentum action, JP Morgan’s Marko Kolanovic noted in remarks to clients: “If the market can move ~50bps higher during the day, it could spark a significant rally driven by the trend followers (CTAs) [Commodity Trading Advisors] and the same put options that helped push the market lower earlier in the week.”

Behind the rally: a jobs report sufficient to cool down some, but not all, of the talk about a recession in 2020.

The other big question: Did it cool the Fed’s likely path to cutting rates again at the end of October? Most feel it did not and the Fed will still likely cut for the third time this year.

“It’s not strong enough to allay fears that there isn’t a slowdown, but not weak enough to confirm the bear narrative,” Alec Young, managing director, global markets research at FTSE Russell told me. “We need stronger data to get the recession risk off the table.”

What’s next? Trade and tariffs. The president confirmed a China delegation will be in Washington next week to resume negotiations. Expectations are low, but there is an urgency due to the recent weaker economic stats.

After next week we get earnings reports, and there will be comments on how the fourth quarter is looking, beginning with J.P. Morgan Chase and Wells Fargo on October 15th.

In a note to clients this morning, Morgan Stanley’s bank analyst team, led by Betsy Graseck, noted that the third quarter was difficult for banks, marred by rate pressure, trade tensions, and a slowing global economic growth outlook. The team noted that a half-point decline in 10-year bond yields would weigh on bank results, though consumer loan growth and mortgage applications were strong.

Rounding out the first big week of earnings is Johnson & Johnson, also on October 15th, IBM on October 16th, and large global Industrial names Honeywell and Textron on the 17th.

First, let's briefly review the US jobs report. Anneken Tappe of CNN Business reports that the US unemployment dropped to its lowest level since 1969:

Amid signs that the global economy is slowing, America's labor market nonetheless remains strong.My hunch is despite the relatively strong US jobs report, the Fed will continue cutting rates later this month. Labor data is a coincident economic indicator, not a leading one, and most leading indicators have turned south.

In September, the unemployment rate fell to 3.5%, the lowest rate since December 1969, as employers added 136,000 jobs to the US economy. There were many signs of strength, including robust hiring in health care, transportation, professional services and state and local government.

But overall, the pace of hiring has slowed considerably since 2018, when the economy added an average of 223,000 jobs per month. The September jobs report comes in the same week as several other reports that showed the US economy is slowing.

Activity in American's factories has declined for two straight months, and the biggest piece of the economy, the services sector, is growing at its weakest pace in three years. Businesses expressed concern about tariffs, a shortage of workers and the direction of the economy.

Against that backdrop, economists and investors took the jobs report as a neutral sign. It was neither strong enough to disprove fears of a weakening economy, nor weak enough to confirm with certainty the Federal Reserve may have to cut interest rates at its October meeting, in a measure to boost growth, said Thomas Simons, an economist and senior vice president at Jefferies. Stocks nevertheless posted strong gains following the report, but overall, are still down for the week.

President Donald Trump noted the drop in the unemployment rate in a tweet shortly after the release, adding "wow America, lets impeach your President (even though he did nothing wrong!)"

This is not the first time Trump has violated the one-hour rule that says federal employees outside the Labor Department staff that issue the report cannot publicly comment on it in the first hour after the release.

Signs of strength

Despite cracks showing in the economy, hiring has long been a bright spot. As companies fight for talent, paychecks have grown, giving more spending power to consumers. Consumer spending has kept the economy growing even as the trade war hurts US manufacturing and farming.

This most recent report from the Labor Department showed some encouraging signs: July and August's jobs reports were revised higher by a combined 45,000 jobs. Hispanic unemployment fell to 3.9%, setting a record low, while black unemployment remained at a record low of 5.5%. Minority unemployment has been tracked by the Labor Department since the early 1970s.

The nation's underemployment rate, which looks at people who are unemployed as well as those who are working part time but would prefer full-time work, fell to 6.9%. That's the lowest reading for that measure since December 2000.

The unemployment rate for adults with less than a high school education fell to 4.8%, the first time that measure has ever been below 5% on data going back to 1992.

The economy also benefited from 1,000 new positions from the US Census. However, the massive GM strike, in which about 50,000 people joined picket lines, was not counted in this month's report.

Worries about wages

A bleaker point in the report came from wages.

Average hourly wages didn't grow between August and September. Over the past year, wage growth ticked up just 2.9%, which was lower than expected and the weakest annual growth since July 2018.

Still, on the whole, "this is not that weak of a report, despite the ebbing in job growth," Sal Guatieri, senior economist at BMO, wrote in a note to clients.

That said, weakening domestic and foreign demand in light of the trade war will add uncertainty for companies and increasingly weigh on job growth, Guatieri added.

The Federal Reserve's next meeting on interest rates is scheduled to conclude on October 30. In the meantime, investors are closely watching other economic indicators for clues as to whether the central bank will cut rates again.

Following the jobs report on Friday, Fed Chairman Jerome Powell said the economy is in "a good place."

"Our job is to keep it there," he added.

Importantly, earlier this week, the September manufacturing ISM showed a clear contraction is underway in the US manufacturing economy as important components all registered a reading below 50 (indicating contraction):

The September PMI® registered 47.8 percent, a decrease of 1.3 percentage points from the August reading of 49.1 percent. The New Orders Index registered 47.3 percent, an increase of 0.1 percentage point from the August reading of 47.2 percent. The Production Index registered 47.3 percent, a 2.2-percentage point decrease compared to the August reading of 49.5 percent. The Employment Index registered 46.3 percent, a decrease of 1.1 percentage points from the August reading of 47.4 percent. The Supplier Deliveries Index registered 51.1 percent, a 0.3-percentage point decrease from the August reading of 51.4 percent. The Inventories Index registered 46.9 percent, a decrease of 3 percentage points from the August reading of 49.9 percent. The Prices Index registered 49.7 percent, a 3.7-percentage point increase from the August reading of 46 percent. The New Export Orders Index registered 41 percent, a 2.3-percentage point decrease from the August reading of 43.3 percent. The Imports Index registered 48.1 percent, a 2.1-percentage point increase from the August reading of 46 percent.This is why I'm bracing for more negative US economic news ahead and believe the Fed has enough leeway (inflation expectations remain low) to continue cutting rates.

Moreover, I agree with David Rosenberg, the latest US Jobs report failed a crucial test and a recession is right around the corner. Both the truck transportation and durable goods manufacturing sectors lost jobs in September, even as the economy added jobs overall.

Rosenberg cites weakness in transport stocks (IYT) as a harbinger of things to come but looking at the weekly 5-year chart, I'm not alarmed just yet:

I need to see a meaningful and sustained break below its 200-week moving average before I start panicking on transport stocks.

Sure, some components of the iShares Transportation Average ETF (IYT) like FedEx (FDX) are showing clear signs of weakness ahead but this could be an idiosyncratic thing (like Amazon threatening to ship its own parcels) and have nothing to do with global weakness:

FedEx is actually on my watch list, not because I like this chart above (hate it), but because it's a very important company to track closely (the contrarian in me thinks it's a buy but I'm not catching this falling knife).

What else am I keeping an eye on? Well, following last month's "Quant Quake 2.0" and rumblings of QE Infinity unnerving investors, I'm paying close attention to the US Value Factor ETF (VLUE) and US Momentum Factor ETF (MTUM) to gauge if last month's momentum selloff was a temporary setback:

Again, it looks like there's some rotation out of growth into value going on but I'm not overly concerned and have a watch list of momentum favorites I track to let me know what is going on real time.

As far as the overall market, the S&P 500 (SPY) did pull back this week but it’s still in bullish mode:

Interestingly, year-to-date, the S&P 500 is up 18% led by Technology (XLK), Real Estate (IYR), Utilities (XLU) and Consumer Staple (XLP):

This defensive theme is hardly surprising given the uncertainty and by the way, US long bonds (TLT) are also having a great year:

We are at an important juncture, either a trade deal will lead stocks higher and bonds lower or something is going to give over the last quarter of the year, much like it did in Q4 of last year.

The good news is markets typically don't repeat but you can't take anything for granted in these markets.

On a more sobering note, Martin Roberge of Canaccord Genuity sent this out in his weekly Portfolio Strategy Incubator:

We have spent the last few months analyzing the impact and/or repercussions of US corporate buybacks on markets. We concluded that corporate buybacks have been a powerful force fueling this bull market. Also, as long as US corporations are net buyers of equities and non-US corporations net issuers, it is difficult to see the long-term uptrend in US equity market outperformance ending. Ditto for growth outperformance since growth companies are much larger buyers of their stocks than “value” companies. That being said, there should be short periods of time when US equities and growth underperform. As we highlighted in our recent reports, this should be when corporate buyback power wanes. In our view, this is where we are today. Indeed, as our Chart or the Week shows, last week, the Fed revealed that non-financial corporate equity repurchases dropped a whopping $34B in Q2 to $104B. On a YoY basis, buybacks are down 24%, which is consistent with corporate earnings and free cash flow growth turning flat. With the US fiscal boost fading and profitability expected to be sluggish over the next few quarters, it could well be that US corporate buybacks have peaked in this business cycle, a relative headwind for US equities and growth companies.Also worth noting, Danielle Dimartino Booth posted this on Twitter, stating corporate insiders are dumping shares as repurchases sink:

Companies and insiders are dumping stock, while share repurchases sink https://t.co/ZdwGqfmOH8 "Insiders unloaded $14.2 billion worth of their companies’ stock through September...the highest of any September in the past 10 years" HT @Tech_Qn— Danielle DiMartino (@DiMartinoBooth) October 2, 2019

Watch an interview with Danielle below on the US economy, she raises excellent points.

One last chart, a friend was asking me what I thought of biotech stocks (XBI) this year and I told him to stay away:

I told him biotech and less-so healthcare stocks (XLV) have been acting as if Bernie Sanders and Elizabeth Warren have won the next election.

Who knows, we might have another American biotech moment just as we did before the last US presidential elections where I was pounding the table to load up on biotech stocks (stay tuned, too early to make a biotech sector call here).

Alright, that's all from me, enjoy your weekend!

Below, watch CNBC's full interview with Cleveland Federal Reserve President Loretta Mester on "Closing Bell" where she discusses potential interest rate cuts, the state of the consumer and threats to the US economy. I really like Mester, she's very careful and balanced in her views.

Also, Danielle DiMartino Booth, CEO of Quill Intelligence, on the jobs report, ISM manufacturing and services index and what the figures say about the overall economy.

Third, Charles Bobrinskoy of Ariel Investments and Savita Subramanian of Bank of America Merrill Lynch join CNBC's "Closing Bell" to discuss the day's market action and what's been driving the rally.

Fourth, CNBC's "Power Lunch" team discusses markets after a week of important economic data with Larry Adam of Raymond James and Peter Boockvar of Bleakley Advisory.

Fifth, Mona Mahajan, Allianz Global Investors US investment strategist, joins "Squawk Box" to discuss her outlook for the fourth quarter trading period and the concerns weighing on the market, going over trade and other factors.

Lastly, a couple of days ago, Cam Harvey, Research Affiliates partner and Duke Fuqua School of Business professor of finance, explained why the inverted yield curve may portend a recession. He spoke with Bloomberg's Joe Weisenthal, Caroline Hyde, Sarah Ponczek and Romaine Bostick on "Bloomberg Markets: What'd You Miss?" Listen to Cam, he's the man! (great guy, met him years ago)

Comments

Post a Comment