Another Stock Market Crash Looming?

Stocks fell on Friday, led by major tech shares, as Wall Street wrapped up a difficult week in which coronavirus cases rose, U.S. fiscal stimulus talks broke down and traders braced for next week’s presidential election.

The Dow Jones Industrial Average closed 157.51 points lower, or 0.6%, at 26,501.60. At one point, the Dow was down more than 500 points. The S&P 500 dropped 1.2% to 3,269.96 and the Nasdaq Composite pulled back 2.5% to 10,911.59.

The Dow and S&P 500 fell 6.5% and 5.6%, respectively, and posted their biggest weekly losses since March. The Nasdaq lost more than 5% over that time period and also had its worst one-week performance since March.

Those weekly losses came as the seven-day average of new coronavirus cases in the U.S. hit an all-time high this week, according to data from Johns Hopkins University. In Europe, Germany and France announced new lockdown measures to curb the virus’ spread.“Massive policy stimulus, positive medical developments and high hopes for a return to pre-pandemic economic activity levels have provided a solid boost to equity markets,” strategists at MRB Partners wrote in a note. “However, mounting new economic restrictions, particularly in Europe, despite being forecastable and in lagged response to the re-acceleration in COVID-19 infections, only caught investors’ attention this week, triggering sharp losses.”

In Washington, Senate Majority Leader Mitch McConnell adjourned the Senate until Nov. 9, making it highly unlikely for Democrats and Republicans to reach a deal on new fiscal stimulus before the election on Tuesday. Treasury Secretary Steven Mnuchin, meanwhile, accused House Speaker Nancy Pelosi of miscasting the state of the stalled negotiations, calling it a “political stunt.”

Traders had been betting on both sides reaching a stimulus deal before Tuesday’s vote as some recent data shows the economic recovery could stall without new aid. This is all taking place as traders prepare for choppy market moves next week amid the U.S. presidential election.

Data compiled by RealClearPolitics showed former Vice President Joe Biden holding an average lead of more than 7 percentage points over President Donald Trump. However, that lead has narrowed since early October.

Gina Bolvin Bernarduci, president of Bolvin Wealth Management, said several of her clients were concerned about the election outcome and how it would impact their investments.

“We have had more calls about the election recently than we had during the big sell-off in March,” said Bernarduci. “I think it’s going to be a few volatile days, but there are factors that affect the market more than who wins the election.”

“Investors should also keep in mind what happened four years ago. Everybody thought that if Trump won, that would have been bad for the market, yet we made [more than 100 new highs] in four years,” Bernarduci said.

The Dow, S&P 500 and Nasdaq all posted their first back-to-back monthly losses since March. The Dow lost more than 6% this month while the S&P 500 and Nasdaq each declined by more than 5% in October.Apple and Amazon fall on earnings, Alphabet gains

Shares of Apple fell 6.4% after the tech giant reported a 20% decline in iPhone sales and failed to offer investors any guidance for the quarter ahead. Amazon dropped 5.9% even after the e-commerce giant reported blowout third-quarter results with a big beat on the top line.

Meanwhile, Twitter lost more than 21% after the social media company reported user growth that fell short of expectations. Facebook was off by 7.6% amid a surprise decline in active users in Canada and the U.S.

Shares of Alphabet bucked the negative trend for tech stocks, rising 3% after the Google parent company posted quarterly results that topped Wall Street expectations.

Alright, it was a terrible week for stocks -- the worst weekly selloff since June -- so let's jump into it by looking at the performance of the top S&P sectors this week:

As shown above, Tech stocks (XLK) led the rout this week, down 7%, followed by Industrials (XLI), Consumer Discretionary (XLY, mostly Amazon), down 6.9% and 6.6% respectively. Healthcare (XLV) and Energy (XLE) were both down 6.1% and the best performing sector was Utilities (XLU) which was also down 4%.

Any way you slice it, it was a terrible week for stocks and would have been even worse if the Fed's Plunge Protection Team didn't come in Friday afternoon at 3:30 when the Dow was down over 500 points to buy stocks (sneaky little devils, aren't they?).

Still, even the Fed's PPT couldn't stem the onslaught of selling that took place as investors hunker down waiting to see who wins the elections next week.

A few observations on what led to this week's selloff:

- There was no October stimulus surprise. Republicans and Democrats couldn't or didn't want to set their differences aside to come up with a much needed stimulus package to help millions of Americans living on the edge.

- Global coronavirus cases rose by more than 500,000 for the first time on Wednesday, a record one-day increase as countries across the Northern Hemisphere reported daily spikes. In fact, global daily COVID-19 cases have risen by nearly 25% in less than two weeks, with Europe being hit particularly hard (the US isn't far behind).

- Investors are fretting over a "Blue Sweep" which will hit wealthy Americans hard. Under Biden's proposal, unrealized capital gains would be taxed at 43.4% at death -- a rate that includes taxing those gains at ordinary income tax rates, which he's vowed to raise to 39.6%. It also includes a 3.8% net investment income tax.

- Big Tech stocks are selling off despite reporting strong numbers because the outlook remains uncertain and a lot of them ran up a lot going into earnings, so they were due for a major pullback. It also didn't help that Big Tech CEOs clashed with Congress this week in a pre-election showdown, making investors jittery that antitrust legislation is coming and can potentially break up tech giants and the monopoly they enjoy.

- Hedge fund manager David Einhorn who runs Greenlight Capital, wrote in a letter “we are in the midst of an enormous tech bubble,” but noted “September 2, 2020 was the top and the bubble has already popped.” Reuters saw a copy of the letter. Einhorn said he’s “adjusted” his portfolio’s short-book with bets that stock prices will fall by “adding a fresh bubble basket” of mostly second-tier companies and “recent IPOs trading at remarkable valuations.”

Now, I don't know if David Einhorn is right, he's made these big proclamations in the past and has been wrong, but I'm totally with him on this call and think a lot of "new tech darlings" are cruising for a bruising here.

And let me be specific, I'd be actively shorting shares of Zoom (ZM), Zscaler (ZS), Fastly (FSLY), Docusign (DOCU), Square (SQ), Snowflake (SNOW), Twilio (TWLO), Overstock (OSTK), and of course Tesla (TSLA), Einhorn's favorite short (and that of Jim Chanos, they both lost big on this short position).

But shorting these and other high flyers that ran up a lot this year isn't easy, you need nerves of steel and it can easily backfire on you.

Any day now, we can expect some news on one or more of the vaccines in trials. Hopefully it's good news and that can send the market soaring, at least initially, then reality will set in (if it's bad, the market will tank).

The Fed and other central banks might announce fresh new liquidity in the form of more QE and speculators will use it to buy more risk assets.

The amount of central bank intervention is unprecedented, they're literally trying to keep the entire system afloat by injecting massive liquidity into it, but it seems to be backfiring.

Interestingly, private equity titan Henry Kravis told Bloomberg there’s more turmoil in the markets than any time in his half-century career as investors react to pandemic news:

“I’ve been investing for over 50 years, I don’t remember a time when I’ve seen such volatility as we see today,” Kravis, the co-founder of KKR & Co., said Friday on the Bloomberg Invest Talks webcast. “Just look at our markets in the U.S., we’re up one day 300, 400 points and then the next day, for almost no reason, we’re down 400 to 500 points.”

While he praised global stimulus efforts for keeping economies from collapse, he said markets remain unnerved by the Covid-19 pandemic, especially on the prospects for a vaccine. “Any news coming out of the pharmaceutical industry on progress with a therapeutic or with a vaccine is changing sympathy in the markets,” he said.

“I’ve been investing for over 50 years, I don’t remember a time when I’ve seen such volatility as we see today.” https://t.co/nPRR3IsxkB

— Lisa Abramowicz (@lisaabramowicz1) October 30, 2020

Here's what I replied on Twitter:

Interest rates at record low levels, central banks trying to save capitalism (more like tech moguls, corporate titans, elite PE funds and hedge funds) from prolonged debt deflation are actively engaged in QE infinity, and Mr. Kravis is shocked that volatility is off the charts?

It's crucial to understand we are living in unprecedented times, debt levels are at record highs, interest rates at record lows, central banks are trying to push everyone out on the risk curve, so expect extreme volatility to persist as long as this situation persists.

Add to this mix more geopolitical and pandemic uncertainty and you'll see more volatility in markets.

Why am I sharing this with you? Because every time stocks sell off hard, someone warns that another stock market crash is looming.

Maybe but with rates at record low levels and global pensions and sovereign wealth funds rebalancing every month and quarter, and central banks actively interfering in markets, it's very hard making these one-way doomsday calls.

What was interesting today, and one pension fund manager pointed this out to me late today, is both stocks and bonds sold off, and that can lead to a lot more volatility ahead:

Now, I believe the backup in long bond yields won't persist because bonds will be bid hard, but who knows, there may be more of a backup in yields.

Will the Fed step in to save the day? Most likely but not before we see more weakness in the overall market led by tech shares, especially if financials sell off hard:

Remember, the Fed doesn't really care about tech bubbles and busts, it cares a lot more if bank stocks start cratering and another credit crisis develops (see a comment I wrote earlier this week on a secular shift in real estate).

That's what we need to pay attention to but so far, while high yield debt is rolling over, it remains strong (backed up by the Fed):

If for any reason credit markets start seizing up again, then you can be sure another stock market crash is coming.

Right now, chalk October up to a very bad month in stocks, especially many of the "Fastly" type stocks which are getting roiled:

This one is actually on my watch list as it's due for a big bounce but trade it very tightly or risk getting your head handed to you as it can sink a lot lower from these levels.

Lastly, here is the best hedge fund trade of the year:

Steve Cohen officially owns the New York Mets after MLB approves deal https://t.co/HRsqprf3KN

— Leo Kolivakis (@PensionPulse) October 30, 2020

Love him or hate him, Steve Cohen knows how to invest in winners, and he'll enjoy being the new owner of the Mets.

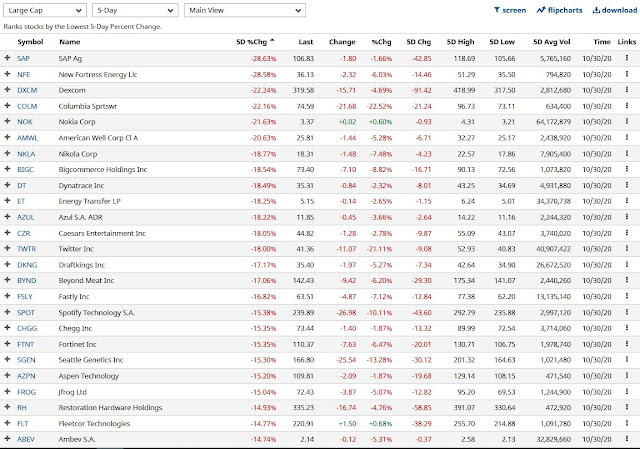

Alright, that is it from me, here are this week's large cap winners and losers:

Below, earlier this week, Financial Post’s Larysa Harapyn spoke with Rosenberg Research’s David Rosenberg and BMO Capital Markets’ Brian Belski about the the US election results might mean for the market.

Earlier today, CNBC's "Halftime Report" team discussed how they're investing amid the market sell-off as fears accelerate over increasing coronavirus cases.

Ed Yardeni of Yardeni Research also joined CNBC's "Halftime Report" team earlier today to discuss how he views the market selloff and how factors like tech valuations, the upcoming election and surging virus cases play into his strategy.

Lastly, earlier this week, Mikio Kumada, Asia executive director and global strategist at LGT Capital Partners, discussed David Einhorn’s comments that markets are in an bubble. He spoke on “Bloomberg Daybreak: Middle East.”

Comments

Post a Comment