The Mad Dash For Trash?

The S&P 500 fell on Friday, wrapping up a losing week, as the outlook for additional fiscal stimulus remained uncertain.

The broader market index pulled back by 0.1% to close at 3,683.46, and the Nasdaq Composite dipped 0.2% to 12,377.87. The Dow Jones Industrial Average eked out a gain of 47.11 points, or 0.2%, to 30,046.37 as shares of Disney rallied.

Both the Dow and S&P 500 posted their first weekly declines in three weeks, losing 0.6% and 1%, respectively. The Nasdaq dropped 0.7% this week.

Friday’s moves came as negotiations over a coronavirus relief deal dragged on. Lawmakers seek to pass a bill before the end of 2020, but disagreements over state and local stimulus, unemployment assistance and stimulus checks still exist.

“Optimism surrounding a near-term fiscal stimulus deal are fading despite reports of a bipartisan deal, as the sides can agree on the size of a deal, but not the details,” wrote Mark Hackett, chief of investment research at Nationwide.

Democrats have also pushed back against the White House’s latest $916 billion aid offer, noting it doesn’t include any additional federal unemployment insurance money. The bill, however, was blessed by GOP congressional leaders.

The House and Senate passed a one-week federal spending extension to avoid a shutdown through Dec. 18 to buy more time to reach a stimulus agreement.

“The inability for Washington to enact more fiscal aid is a complete failure. We know where the differences lie,” wrote Gregory Faranello, head of U.S. rates trading at AmeriVet Securities. “Right now this is about cashflow and saving businesses and helping keep individuals afloat while we rollout the vaccine.”

Share of companies hardest hit by the pandemic recession fell on Friday. Carnival dropped 4.5%, United Airlines slipped 2.6%, and Gap lost 3.6%. Hyatt Hotels traded lower by about 1.4%.

Tesla shares, meanwhile, fell 2.7% after a surprise downgrade by Jefferies.

Without fresh stimulus, millions of Americans could lose unemployment benefits in the new year. Meanwhile, weekly jobless claims jumped last week to 853,000, the highest total since Sept. 19, as new lockdown restrictions weighed on businesses amid rising coronavirus cases.

Sentiment was downbeat on Friday even as a key Food and Drug Administration advisory panel recommended the approval of Pfizer and BioNTech’s coronavirus vaccine for emergency use. The recommendation marked the last step before the FDA gives the final approval to broadly distribute the first doses throughout the U.S.

Bucking the negative trend was Disney. On Thursday, the company said its Disney+ service has 86.8 million subscribers and expects have between 230 million to 260 million subscribers by 2024. The stock rose 13.6% on Friday.

Alright, it's Friday, there is a lot to cover on markets so let me get right to it.

First, fiscal stimulus, it's coming, we are approaching Christmas and mark my words, neither the Democrats nor the Republicans can afford not to pass something before Christmas.

And once the Biden administration settles in, expect another massive fiscal stimulus package in the first quarter of next year, especially if Democrats win the Senate runoff elections in Georgia in three weeks.

More fiscal stimulus will help push these markets higher because it will bolster value stocks (VTV) which have been making a nice comeback in the last few weeks as growth stocks (VUG) stagnate:

Of course, some hyper growth stocks have registered monster gains this year and it's only to be expected that large funds are booking some profits here and that analysts are flashing the yellow sign.

Earlier this week, J.P. Morgan analyst Sterling Auty said time has come to take profits in super-pricey software stocks like Zoom Video Communications (ZM), Okta (OKTA), and DocuSign (DOCU)—and to find bargains elsewhere:

In a 151-page report, Auty lays out a case for shifting strategies on the sector heading into a post-pandemic economic recovery in 2021. He suggests moving into cyclically sensitive software shares—those that do better when the economy is expanding—and out of the premium-priced stocks that have thrived in the Covid-19 era. He notes that J.P. Morgan economists see the economy starting to turn around in the second quarter.

“Last year at this time, we were saying that the economic outlook really hinged on the outcome of China trade negotiations and that we wanted to stay cautious on cyclical names,” he writes in this morning’s report. “That turned out beneficial because of Covid 19. Now we believe that the economic outlook hinges on Covid-19 vaccine efficacy and availability, but we are turning bullish on cyclically sensitive software.”

Auty notes that the stocks he covers rallied on average 62% for the year through the end of November, versus a 12% gain for the S&P 500.

“It has been another tremendous year for software, as demand held strong throughout the pandemic and valuations expanded significantly with capital coming in from other sectors,” he writes. “Looking ahead, there is a scenario where improving economic expansion could motivate capital to rotate back out of software in favor of lower valuation cyclical segments that will benefit from economic improvement. Much of that will hinge on the success of vaccines to effectively open up the economy more broadly.”

Auty advises investors to snap up cyclically sensitive software stocks, and upgraded seven stocks on that basis, including Altair Engineering (ALTR), Autodesk (ADSK), Cadence Design Systems (CDNS), PTC (PTC), VeriSign (VRSN), Wix.com (WIX), and Intuit (INTU).

“The economic expansion is expected to be driven by the manufacturing sector, and that should favor the design software names in our coverage,” like Altair, Autodesk, Cadence and PTC, he says. “On the SMB front, we have already started to see increasing business starts that could continue into 2021 on the back of favorable interest rates and the potential for a more open economy post COVID-19,” and he sees that boosting stocks like VeriSign, Wix and Intuit.

His top two picks, meanwhile, are Varonis (VRNS), a data security and threat detection company, and RingCentral (RNG), which provides cloud-based unified communications services. “Both companies have the potential to show accelerating revenue growth, Varonis on the back of its subscription transition and healthy demand for data protection solutions and Ring from the increasing contribution of the partnership agreements signed over the last 12 to 15 months,” he writes.

I don't know if Auty will turn out to be right but I respect an analyst who is able to come out and state that some of the stocks he covers have run up too much and that maybe investors should focus their attention elsewhere.

But he warns that his recommendations hinge on the success of vaccines to effectively open up the economy more broadly.

That remains to be seen but one thing is for sure, the dark winter is upon us, COVID cases and deaths are surging all over the world, and the US just suffered its worst week of cases, deaths and hospitalizations since the start of the pandemic.

Still, this market doesn't care about COVID, it's not only turning the page, there are increasing signs of market manias developing out there.

This week, for example, food delivery startup DoorDash (DASH) raised its US initial public offering after boosting its price range on frenzied investor interest in technology stocks that have been boosted by the Covid-19 pandemic.

As you can see below, the stock IPOed at $90 Tuesday and settled the week at $175 a share:

On Thursday, Airbnb Inc. (ABNB) shares more than doubled in their trading debut, propelling the home-rental company to about a US$100 billion valuation and one of the biggest first-day rallies on record.

The stock IPOed at $68 and was immediately snapped up, after an increase in price, finally settling the week at $139 but only after it topped $160 a share yesterday when it IPOed:

The mania we are witnessing in IPOs is unprecedented, a by-product of record low rates and investors’ insatiable appetite for growth stocks.

I'm not saying all stocks that IPOed recently are overvalued but most are and there are a few that I really like QuantumScape Corporation (QS), C3ai Inc (AI) and Certara (CERT) which IPOed on Friday:

I'm actually looking at companies like this which are not garnering all the IPO attention but it's very hard justifying some of the valuations of these new tech darlings that IPOed recently, like Snowflake (SNOW):

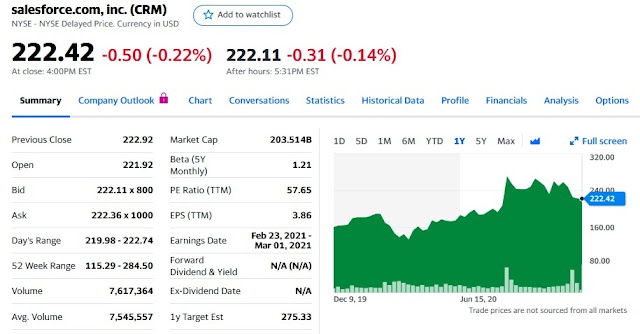

I know, it's a great company, but if you ask me what is safer to buy and hold at these levels, no doubt in my mind I'd recommend Salesforce (CRM) over any of the new tech darlings:

But Salesforce is in the penalty box after it acquired Slack Technologies (WORK) and the stock might consolidate here for a while but never bet against Marc Benioff, you will always lose (don't be surprised if one of Buffett's lieutenants at Berkshire is buying it here).

What else? This week we saw insane speculation is microcap biotech stocks with low float.

I kept a snapshot of Greenwich LifeSciences (GLSI) on my desktop from Wednesday after the company announced a poster presentation of five year data for its GP2 Phase IIb clinical trial, showing 0% recurrence of breast cancer:

The stock skyrocketed up on much larger than normal volume and since it has a low float, and people were convinced it had a cure for breast cancer, it was an absolute feeding frenzy.

At one point, the stock was up 2,400% -- in one day!! -- before settling up 1,000% on Wednesday.

Of course, my antennas were up immediately, why didn't any of the top biotech funds or other top funds I track own any shares prior to this announcement?

Anyway, a lot of that speculative frenzy disappeared by Friday and I'm afraid fortunes were made but mostly lost here:

Don't get me wrong, I hope Greenwich LifeSciences does have a great treatment for breast cancer but too many people were getting caught up in the hype and that led to a speculative frenzy in its stock and to other similar stocks with low float (IMMP, SLS and others).

Are there great biotechs? You bet, earlier this week, TG Therapeutics, Inc. (TGTX), announced positive topline results from two global, active-controlled, Phase 3 studies, called ULTIMATE I & II, evaluating ublituximab, the Company’s investigational novel, glycoengineered anti-CD20 monoclonal antibody, compared to teriflunomide in patients with relapsing forms of multiple sclerosis (RMS).

The results were fantastic and the stock took off, capping a great week:

But the difference here is the top holders are Fidelity, RA Capital, Maverick Capital and other top funds and the science is unquestionable and led by top scientists in the field:

Lawrence Steinman, MD, Zimmermann Professor of Neurology & Neurological Sciences, and Pediatrics at Stanford University and Global Study Chair for the ULTIMATE I & II studies commented, “B-cell targeted therapy with anti-CD20 monoclonal antibodies has dramatically shifted the treatment paradigm for patients with MS and has shown to be very effective in reducing relapses in patients. I am pleased to see such positive results from this important trial exploring a one-hour infusion of ublituximab every six months and believe, if approved, the unique attributes of ublituximab, particularly that it has been glycoengineered for enhanced antibody dependent cellular cytotoxicity, may offer benefits to patients in the RMS treatment paradigm.” Dr. Steinman continued, “MS is a chronic demyelinating disease where having a variety of treatment options within the same class has shown to be important for patients. I look forward to the full data from the ULTIMATE studies to further understand the potential of ublituximab in MS.”

A biotech like this has a very strong future and might potentially be bought out by Biogen (BIIB) which is losing its reign as the leader for MS drugs.

Anyway, all the IPO and microcap biotech frenzy this week got me to lash out on LinkedIn yesterday:

Forget the tech bubble of 1999. We are witnessing the biggest IPO bubble in history, giving new meaning to "extraordinary popular delusions and the madness of crowds." Yesterday, DoorDash (DASH) shot up in its IPO debut to ridiculous levels.

Today, we are seeing more silliness in microcap biotech stocks with low float surging on pure speculation (GLSI, SLS, IMMP), but check out the IPO of Airbnb (ABNB), totally ridiculous what's going on, and I might add totally predictable given the speculative mania engulfing these crazy markets.

A couple of weeks ago, I wrote that central banks are backstopping and encouraging this madness but I wonder if Mr. Powell will throw some cold water on this insanely speculative market next week. He won't raise rates but he might talk about irrational exuberance like Greenspan did in 1996. Of course, the quant funds will buy that dip hard too, just like they did back then...welcome to insanity!!

Even if Powell says something regarding speculative activity this week (doubt it), the Fed has already unleashed a liquidity tsunami and all that liquidity coupled with ultra low rates leads to massive speculation as funds borrow for nothing to speculate on growth stocks.

And my biggest fear is things are only starting to get nutty out there, we will see a lot more nonsense and incredible volatility in these markets before it all ends in tears, but for now, enjoy this nothing matters market and the mad dash for trash (as cash is literally trash, for now).

Alright, let me wrap it up there. Before I do, here are this week's top large and small cap top performing stocks (no, your eyes aren't deceiving you!):

As always, I remind all my readers this blog runs on donations. If you like what you're reading, please kindly subscribe or donate using the PayPal options at the top left hand side of this blog under my picture. I thank all of you who take the time to show your support.

Below, 2020 has been a monster year for new public offerings. Plantir has gained 273% since going public, Snowflake is up 211% and Airbnb more than doubled in its debut Thursday. CNBC's Leslie Picker joins "Squawk Box" with more on the wild IPO market.

Also, Steve Cakebread, who served as a CFO at Salesforce, Yext and Pandora when those companies went public, and Chip Conley, former Airbnb head of global hospitality and strategy, joined "Squawk Box" on Friday to discuss what could be next for Airbnb and DoorDash after their big public debuts.

Third, listen to CNBC's Leslie Picker and Michael Santoli from 'The Exchange' discuss Airbnb which has started to trade priced at $146. Santoli said the hysteria were so bad, people mixed it up with another company with a similar ticker.

Fourth, "There's a lot of people talking about stocks now like you haven't seen," CNBC's Jim Cramer said Friday. "Then there are a lot of people who don't have jobs and they're not talking about stocks. It's that so-called 'K' recovery."

Lastly, Kynikos Founder & President Jim Chanos says people are doing really dumb things with their money, driving up share prices of companies based on narratives that are too good to be true. He also discusses his "painful" short in Tesla Inc. before the electric vehicle maker is added to the S&P 500, as well as his bet against IBM, which is his highest conviction short. He adds the Biden administration will not be anti-markets. Chanos speaks exclusively with Scarlet Fu on “Bloomberg Front Row.”

Comments

Post a Comment