CPP Investments Gains 5.1% Net in Q3 Fiscal 2021

The Canada Pension Plan Investment Board (CPPIB) said on Thursday it ended the third quarter with net assets of C$475.7 billion ($375.63 billion), compared with C$456.7 billion at the end of the previous quarter.

Net income for the quarter ended Dec. 31 rose to C$23.00 billion, from C$14.55 billion a year ago.

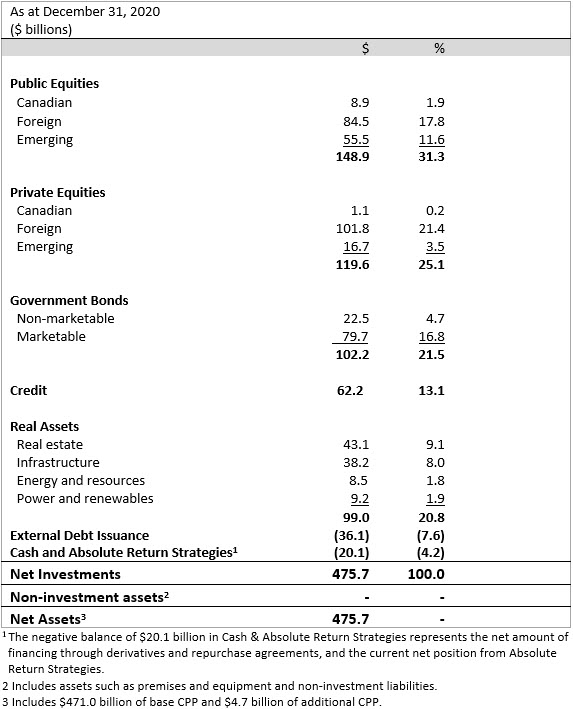

The CPPIB, which manages Canada’s national pension fund and invests on behalf of 20 million Canadians, has diversified to become one of the world’s biggest investors in infrastructure, real estate and private equity to reduce its reliance on volatile global stock markets and low-yielding government bonds.

Investment in private equities stood at 25.1% of the total in the quarter, up from 24.9% a year ago. Spending on public equities was up to 31.3% from 30.7% a year ago.

Spending on government bonds rose to 21.5% of the total, the statement said.

Last month, Brazilian sanitation company Igua Saneamento SA said CPPIB had delivered a non-binding offer to buy stake in the company. No more details on the potential deal were disclosed.

Canada Pension Plan Investment Board (CPP Investments) put out a press release stating it ended its third quarter of fiscal 2021 on December 31, 2020, with net assets of $475.7 billion, compared to $456.7 billion at the end of the previous quarter:

Third-Quarter Highlights:

- $23.0 billion in net income generated for the Fund

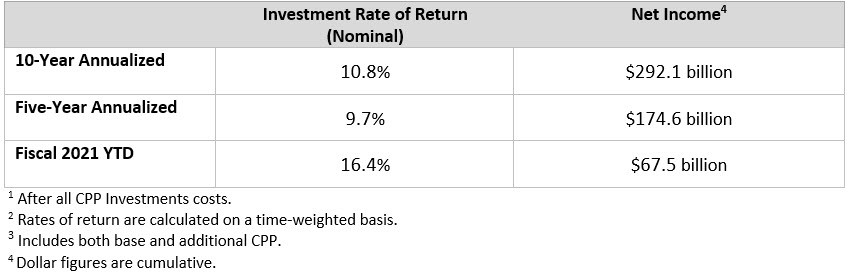

- 10-year annualized net return of 10.8%

TORONTO, ON (February 11, 2021): Canada Pension Plan Investment Board (CPP Investments) ended its third quarter of fiscal 2021 on December 31, 2020, with net assets of $475.7 billion, compared to $456.7 billion at the end of the previous quarter.

The $19.0 billion increase in net assets for the quarter consisted of $23.0 billion in net income after all CPP Investments costs less $4.0 billion in net Canada Pension Plan (CPP) outflows. CPP Investments routinely receives more CPP contributions than required to pay benefits during the first part of the calendar year, partially offset by benefit payments exceeding contributions in the final months of the year.

The Fund, which includes the combination of the base CPP and additional CPP accounts, achieved 10-year and five-year annualized net nominal returns of 10.8% and 9.7%, respectively. For the quarter, the Fund returned 5.1% net of all CPP Investments costs.

For the nine-month fiscal year-to-date period, the Fund increased by $66.1 billion consisting of $67.5 billion in net income after all CPP Investments costs, less $1.4 billion in net CPP outflows. For the period, the Fund returned 16.4% net of all CPP Investments costs.

“A number of factors lifted the Fund’s overall strong performance during the quarter with soaring equity markets as the leading contributor,” said Mark Machin, President & Chief Executive Officer, CPP Investments. “Despite the ongoing challenges caused by the global pandemic, all of our teams continue to collaborate seamlessly across the enterprise to achieve strong results. The commitment to operational excellence among all our employees is critical in seizing opportunities to create long-term value for the Fund. The long-term results are the most important for the Fund and we are pleased to be sustaining double-digit 10-year returns.”

The Fund’s solid results in the third quarter were driven by strong returns in both public and private equity assets. Global public equity markets were propelled higher by a series of vaccine breakthroughs during the quarter, as well as the prospect of a recovery in the global economy. While all investment departments reported positive quarterly results before foreign exchange impact, the weakening of the U.S. dollar against the Canadian dollar tempered some of the Fund’s gains.

CPP Investments continues to build a portfolio designed to achieve a maximum rate of return without undue risk of loss, taking into account the factors that may affect the funding of the CPP and the CPP’s ability to meet its financial obligations. The CPP is designed to serve today’s contributors and beneficiaries while looking ahead to future decades and across multiple generations. Accordingly, long-term results are a more appropriate measure of CPP Investments’ performance compared to quarterly or annual cycles.

Fund 10- and Five-Year Returns1, 2, 3

(For the period ending December 31, 2020)

Performance of the Base and Additional CPP Accounts

The base CPP account ended its third quarter of fiscal 2021 on December 31, 2020, with net assets of $471.0 billion, compared to $452.6 billion at the end of the previous quarter. The $18.4 billion increase in assets consisted of $22.9 billion in net income after all costs, less $4.5 billion in net base CPP outflows. The base CPP account achieved a 5.1% net return for the quarter.

The additional CPP account ended its third quarter of fiscal 2021 on December 31, 2020, with net assets of $4.7 billion, compared to $4.1 billion at the end of the previous quarter. The $0.6 billion increase in assets consisted of $0.1 billion in net income after all costs and $0.5 billion in net additional CPP contributions. The additional CPP account achieved a 3.1% net return for the quarter.

The base and additional CPP differ in contributions, investment incomes and risk targets. We expect the investment performance of each account to be different.

Long-Term Sustainability

Every three years, the Office of the Chief Actuary of Canada conducts an independent review of the sustainability of the CPP over the next 75 years. In the most recent triennial review published in December 2019, the Chief Actuary reaffirmed that, as at December 31, 2018, both the base and additional CPP continue to be sustainable over the 75-year projection period at the legislated contribution rates.

The Chief Actuary’s projections are based on the assumption that, over the 75 years following 2018, the base CPP account will earn an average annual rate of return of 3.95% above the rate of Canadian consumer price inflation, after all costs. The corresponding assumption is that the additional CPP account will earn an average annual real rate of return of 3.38%.

The Fund, combining both the base CPP and additional CPP accounts, achieved 10-year and five-year annualized net real returns of 9.0% and 7.9%, respectively.

Diversified Asset Mix

Operational Highlights:

Corporate developments

- Mark Machin, together with the CEOs of Canada’s leading pension plan investment managers, signed a joint statement calling on companies and investors to provide consistent and comprehensive environmental, social, and governance (ESG) information to strengthen investment decision-making and better assess and manage their collective ESG risk exposures.

- Thinking Ahead, a signature platform at CPP Investments, issued two reports in the quarter: Our 2021 Economic and Financial Outlook highlights the continuing ripple effects of COVID-19 and considers possible long-term outcomes; and Women, COVID-19 – and the threat to gender equity and diversity explores the potential for the pandemic to reverse the progress corporate Canada has made in diversity and inclusion, identifying seven steps companies and policy makers can take to protect the gains to date and assure future progress.

Executive announcement

- Appointed Frank Ieraci as Senior Managing Director & Global Head of Active Equities. In this role, Frank leads the Active Equities department, which invests globally in public and soon-to be public companies, as well as securities focused on long-horizon structural changes, which can include earlier-stage private companies. The department also includes CPP Investments’ Sustainable Investing group. Frank was most recently Managing Director, Head of Research and Portfolio Strategy at CPP Investments.

Third-Quarter Investment Highlights:

Active Equities

- Entered into an agreement to vote in favour of the planned strategic combination of TORC Oil & Gas and Whitecap Resources valued at approximately C$900 million. Our first investment in TORC was made in 2013 and grew to a 29.3% equity ownership position. We will continue to have an approximate 6.3% ownership stake in the combined company.

- Closed a US$100 million investment in Hutchison China MediTech Limited (Chi-Med) through a private placement. Chi-Med is an innovative biopharmaceutical company with a portfolio of nine cancer drug candidates currently in clinical studies or early stages of commercialization around the world.

- Entered into an agreement to invest C$1.2 billion in Intact Financial Corporation (Intact) to support Intact’s potential offer for RSA Insurance Group plc. Intact is one of the largest providers of property and casualty insurance in Canada.

- Invested an additional C$58 million, through a private placement of common shares, in Premium Brands Holdings Corporation, a Canadian specialty food manufacturing and differentiated food distribution business, to support its joint acquisition of Clearwater Seafoods Incorporated with a Mi’kmaq First Nations coalition.

- Invested US$315 million for an approximate 5% ownership stake in SolarWinds Corporation through a secondary transaction. SolarWinds is a provider of IT infrastructure management software.

- Invested an additional US$350 million in Viking Holdings Ltd, the parent company of Viking Cruises, alongside TPG Capital. Viking Cruises is a leading provider of worldwide river and ocean cruises and this investment will support its continued development. The transaction is subject to customary closing conditions, including regulatory approvals.

- Invested in a combination of secondary offerings and market purchases of Avantor Inc., a leading global provider of products and services to customers in the biopharma, healthcare, education and government, and advanced technologies and applied materials industries, holding total ownership in the company at 2.0% with a combined investment of US$285 million.

- Invested €200 million in Embracer Group, a Sweden-listed developer and publisher active in the global video game industry, for a 3% stake.

Credit Investments

- Acquired the ownership of a prime shopping centre, the Trafford Centre in Manchester, United Kingdom, as the principal secured creditor after the previous owner was placed into administration.

- Committed US$125 million as a cornerstone investor to Baring Private Equity Asia’s India Credit Fund III, and US$125 million to a Fund III overflow vehicle. The fund strategy is focused on Indian Rupee-denominated secured lending to performing mid-market Indian companies.

- Committed INR 7,250,000,000 (US$98 million) to a bilateral financing transaction to support a strategic investment in BMM Ispat Ltd., the second largest iron ore pellets producer in southern India, by India-based JSW Projects Ltd., part of the diversified JSW Group.

Private Equity

- Committed to invest approximately US$160 million in CITIC aiBank, an internet-based consumer finance bank in China, representing an approximate 8.3% equity stake in the company.

Real Assets

- Formed a new joint venture with Greystar Real Estate Partners to pursue multifamily real estate development opportunities in target markets in the United States, with an equity allocation of US$350 million for a 90% stake in the joint venture. Greystar has allocated US$39 million for the remaining 10% and will manage and operate the portfolio on behalf of the joint venture.

- Established a new Indonesia venture to invest US$200 million to acquire and develop a portfolio of institutional-grade facilities with logistics real estate specialist LOGOS.

- Signed an agreement to acquire a 15% interest in Transurban Chesapeake for US$624 million, a toll-road business comprising the 495, 95 and 395 Express Lanes located in the Greater Washington Area in the U.S., alongside other investors collectively acquiring a 50% interest. The transaction is subject to customary closing conditions and regulatory approvals.

- Established a new, U.K.-based platform, Renewable Power Capital Limited (RPC) to invest in solar, onshore wind and battery storage, among other technologies, across Europe. The business is a majority-owned, but independently operated portfolio company. RPC announced its first investment in January 2021, for which we committed €245 million to support RPC’s acquisition of a portfolio of onshore wind projects in Finland.

- Acquired 1918 8th Avenue, a 668,000-square-foot office tower in Seattle, Washington, for US$625 million, through a 45%/55% joint venture with Hudson Pacific Properties, Inc.

- Allocated an additional £300 million of equity to investment vehicles in the U.K. targeting the logistics sector, alongside Goodman Group and APG Asset Management N.V. The expansion follows the success of the Goodman UK Partnership established in 2015.

Asset Dispositions:

- Sold our 12.5% ownership interest in Grosvenor Place, an office tower in Sydney, Australia, held through the Dexus Office Partnership. Net proceeds from the sale are expected to be approximately A$230 million, with completion in early 2021 subject to regulatory approval. Our ownership interest was initially acquired in 2014.

- Exited our 18% ownership stake in Advanced Disposal Services Inc., a solid waste services company in the U.S., through its acquisition by Waste Management Inc. Net proceeds from the sale were US$502 million. Our ownership stake was originally acquired in 2016.

- Converted and sold our convertible debt position in Bloom Energy, a manufacturer of solid oxide fuel cells in the U.S. Net proceeds from the sales and an April 2020 partial repayment from the company were approximately US$452 million. Our position was initially acquired in 2015, followed by two further investments in 2016 and 2017.

- Sold our 50% interest in Phase One of Nova, an office-led mixed-use development in London Victoria, U.K. Net proceeds from the sale are expected to be approximately C$720 million. Our ownership interest was initially acquired in 2012.

Transaction Highlights Following the Quarter:

- Sold our 45% interest in the Bayonne Property, a logistics project consisting of two warehouses in New Jersey, U.S. Net proceeds from the sale were approximately C$34 million. Our ownership interest was initially acquired in 2019.

- Committed US$110 million of equity as the lead investor to Harbor Group International’s multifamily whole loan platform, which provides senior mortgage bridge financing on multifamily assets throughout the U.S.

About Canada Pension Plan Investment Board

Canada Pension Plan Investment Board (CPP Investments™) is a professional investment management organization that manages the Fund in the best interest of the more than 20 million contributors and beneficiaries of the Canada Pension Plan. In order to build diversified portfolios of assets, investments are made around the world in public equities, private equities, real estate, infrastructure and fixed income. Headquartered in Toronto, with offices in Hong Kong, London, Luxembourg, Mumbai, New York City, San Francisco, São Paulo and Sydney, CPP Investments is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At December 31, 2020, the Fund totalled $475.7 billion. For more information, please visit www.cppinvestments.com or follow us on LinkedIn, Facebook or Twitter.

As you can read, the people at CPP Investments were very busy in Q3 of fiscal 2021.

I don't typically cover these quarterly results but I am amazed at the volume of transactions and the complexity, all in the midst of a global pandemic.

In particular, the activity in Real Assets is what I find noteworthy, but everywhere, all departments are firing on all cylinders.

CPP Investments put out a quarterly results presentation which I encourage you to read here.

Below, the first few slides of the presentation which are critical:

I suspect the weak US dollar last year will detract from the results of all of Canada's large pensions because the really big ones do not hedge currency risk (I believe only HOOPP fully hedges F/X now).

Still, the performance last quarter was phenomenal, the highest quarterly net income since inception, and the returns came from both public and private equity assets.

It s also worth noting an executive appointment. Frank Ieraci was appointed to the role of Senior Managing Director & Global Head of Active Equities. In this role, Frank leads the Active Equities department, which invests globally in public and soon-to be public companies, as well as securities focused on long-horizon structural changes, which can include earlier-stage private companies. The department also includes CPP Investments’ Sustainable Investing group.

Frank was most recently Managing Director, Head of Research and Portfolio Strategy at CPP Investments and I congratulate him on this well deserved nomination.

Alright, let me wrap it up there.

Below, CPP Investments President and CEO Mark Machin talks about how to ensure we don't regress on gender equity. This is a really important issue, listen to Mark's comments.

And CPP Investments held a series of public meetings throughout Canada, I embedded the one from Ontario and recommend you take the time to listen to the Chair, Dr. Heather Munroe-Blum, Mark Machin and a Q&A featuring Michel Leduc and Tara Perkins of CPP Investments' Communications.

Around minute 25, Tara and Michel tackle the thorny issue of divesting from fossil fuels, listen to Michel's insights. They answer a lot of other important questions.

Comments

Post a Comment