AIMCo Beefs Up its UK Build-to-Rent Portfolio, Selects Singapore For Asia HQ

Alberta Investment Management Corporation, (“AIMCo”), on behalf of certain of its clients, and Ridgeback Group (“Ridgeback”) have acquired a portfolio of UK build-to-rent (“BTR") assets from Angelo Gordon for a price of £283 million.

The transaction, which nearly doubles the size of AIMCo and Ridgeback’s UK BTR portfolio, places the joint venture among the largest UK BTR landlords, providing the opportunity to realise significant growth anticipated from this segment of the real estate market.

AIMCo and Ridgeback commenced their portfolio aggregation strategy in the second quarter of 2020 with the acquisition of five properties, totalling more than 1,650 apartments under construction in cities including Manchester, Birmingham, Leeds and Liverpool. With the addition of these most recently acquired properties, AIMCo’s UK BTR portfolio now comprises ten city centre assets, with over 3,100 units.

The five properties acquired from Angelo Gordon are located in gateway cities throughout the UK – Cardiff, Birmingham, Sheffield – and include two assets in Greater London – Hayes and the Isle of Dogs. The properties are at different stages of the construction process, ranging from Sherborne Wharf in Birmingham, which is up and let, through to Isle of Dogs, London, which is still in the planning stage. When construction is completed, the portfolio will consist of 1,452 apartments.

Rupert Wingfield, Head of European Real Estate at AIMCo, commented: “We are very pleased to be scaling up our UK build-to-rent joint venture with the acquisition of these five assets, which complement our existing portfolio in the sector. We are committed to delivering high quality, amenitised accommodation in which our residents can live, work and play whilst limiting the impact on the environment. From an investment perspective, we particularly like the inflation protection attributes of the BTR sector in the current economic climate.”

George Bossom, Partner of Ridgeback Group, commented: “We are delighted to be continuing our long-term, strategic partnership with AIMCo. This investment further enhances our portfolio of best-in-class BTR assets across the UK and is a strong endorsement of our fully integrated capabilities. We believe the UK BTR sector continues to demonstrate the strength of its underlying fundamentals as demand for high quality homes in the UK continues to grow.”

Mike Diana, Managing Director, Europe Real Estate at Angelo Gordon, commented: “We are pleased to realise our initial vision for this BTR portfolio, from working with Ridgeback since their inception through to completing this sale to a long-term owner in AIMCo. We believe the opportunity set in the residential sector in the UK remains highly compelling and, moving forward, expect the asset class will continue to be an area where we deploy substantial capital.”

About Alberta Investment Management Corporation

AIMCo is one of Canada’s largest and most diversified institutional investment managers with $168.3 billion of assets under management as at December 31, 2021. AIMCo was established on January 1, 2008, with a mandate to provide superior long-term investment results for its clients. AIMCo operates at arms-length from the Government of Alberta and invests globally on behalf of 32 pension, endowment, and government funds in the Province of Alberta.

For more information on AIMCo please visit www.aimco.ca or follow us on LinkedIn.

About Ridgeback Group

Ridgeback Group is a fully integrated investor, developer and operator with a UK Build-to-Rent residential portfolio of over 3,900 homes with a GDV in excess of £1.3 billion.

About Angelo Gordon

Angelo Gordon is a privately held alternative investment firm founded in November 1988. The firm currently manages approximately $50 billion with a primary focus on credit and real estate strategies. Angelo Gordon has over 600 employees, including more than 200 investment professionals, and is headquartered in New York, with associated offices elsewhere in the U.S., Europe, and Asia. For more information, visit www.angelogordon.com.

Commenting on this deal on Linkedin, Paul Mouchakkaa, Senior Managing Director and Global Head of Real Estate at AIMCo states this:

Over the past two years, Alberta Investment Management Corporation (AIMCo)'s European Real Estate team has acquired an impressive Build to Rent (BTR) portfolio with Ridgeback Group, on behalf of our clients, placing the organization among the largest landlords in the UK. Today we expanded our BTR portfolio.

The UK Build to Rent market is burgeoning as rates rise and inflation soars, and AIMCo and other large Canadian pensions have been active in this area, especially over the last couple of years.

Last year, I wrote a comment on how PSP Investments and Cadillac Fairview, invested £1.5 billion in a joint venture managed by Long Harbour to create a build to rent platform and noted this:

Stéphane Jalbert, Managing Director, Real Estate Investments – Europe and Asia Pacific at PSP Investments, said: “We are pleased to continue growing our established and successful partnership with Long Harbour and now Cadillac Fairview, accelerating the scale and diversification potential of the venture. UK Build to Rent is a conviction sector for PSP and complements our global residential portfolio. Together, we aim to provide high quality housing that will have a positive impact on local communities while providing stable investment returns.”

Jenny Hammarlund, Head of Europe, Managing Director at Cadillac Fairview, said: “The residential sector is a key area of focus for Cadillac Fairview globally, and we are pleased to be investing in the sector at scale in the UK alongside Long Harbour, an innovative Build to Rent operator, and PSP Investments, a strong JV partner with a shared vision. This investment aligns with our strategic objective of expanding our investment portfolio in Europe by forming partnerships with best-in-class operators and developers in attractive asset classes, such as residential, life sciences, office and logistics. It also complements our global residential portfolio, which includes, large active pipelines across the US and Canada.”

AIMCo's strategic partner, Ridgeback Group is a fully integrated investor, developer and operator with a UK Build-to-Rent residential portfolio of over 3,900 homes with a GDV in excess of £1.3 billion.

The statement says that this transaction, which nearly doubles the size of AIMCo and Ridgeback’s UK BTR portfolio, places the joint venture among the largest UK BTR landlords, providing the opportunity to realize significant growth anticipated from this segment of the real estate market.

The UK Build to Rent market continues to show impressive growth, especially in the gateway cities like Cardiff, Birmingham and Sheffield.

BNP Paribas Real Estate notes the demand for homes to rent continued to

increase in Q1 2022 and this led to significant rental growth across the

whole of the UK:

Investment volumes in Q1 highlighted the continued appetite for both the Build to Rent and Single Family Homes sector.

Whilst the rising cost of living is impacting on discretionary spending, BTR is expected to weather the high inflationary environment better than other sectors.

At the start of the year, Savills also noted this in its Q4 2021 update:

Nearly every local authority in the UK is currently in need of new rental supply. This is fuelling rental growth, far in excess of average annual growth since 2011. The Buy-to-Let sector is likely responsible for falling rental supply, with a growing number of mortgaged landlords selling up and exiting the market. New rental supply is not plugging the current supply gap and there is considerable scope for investors to deliver Build to Rent across all locations and price points.

Widespread stock shortages fuelling rental growth

At a national level, the number of properties available to rent during Q4 2021 was -39% lower than the 2017 to 2019 average. Stock shortages were most acute in the North East with the number of listings on Rightmove running at just under half the 2017-19 average.

This lack of stock has fuelled strong rental growth in nearly all locations (Figure 1). In fact, national annual rental growth of 7.4% per annum in the year to November 2021 has far outpaced the annualised rate of growth seen between 2011 and 2019 of 2.1% per annum.

You can read more on their analysis here.

My point is simply there are strong fundamentals underpinning the UK's Build to Rent market and Canada's large pensions have been wisely beefing up their investments in this sector over the last few years.

AIMCo has a solid best-in-class partner in Ridgeback to develop, manage and rent these properties.

I recommend you read AIMCo's 2021 Annual Report which was released at the end of June for more details on its real estate and other holdings (highlights are mine):

In other related news, Bloomberg reports AIMCo's private equity head, Peter Teti, says slow fundraising giving investors a breather:

Buyout firms facing a slower fundraising environment are giving investors much needed respite, according to the head of private equity for Alberta Investment Management Co.

“We have seen a slowdown in fundraising a little bit and I think a lot of LPs (investors) are welcoming a bit of a breather,” said Peter Teti. The firm managed $168.3 billion at the end of 2021.

Rock-bottom interest rates prompted yield-hungry investors to pile into private equity in the last decade and encouraged buyout firms to make deals and set ever-larger fundraising goals. The industry may be facing a reckoning now as rising inflation and soaring rates trigger anxiety about a protracted recession.

Even so, Aimco will continue to commit to some existing fund managers and selectively add new ones, Teti said in an interview. At the same time, he expects a decline in capital deployment and distributions.

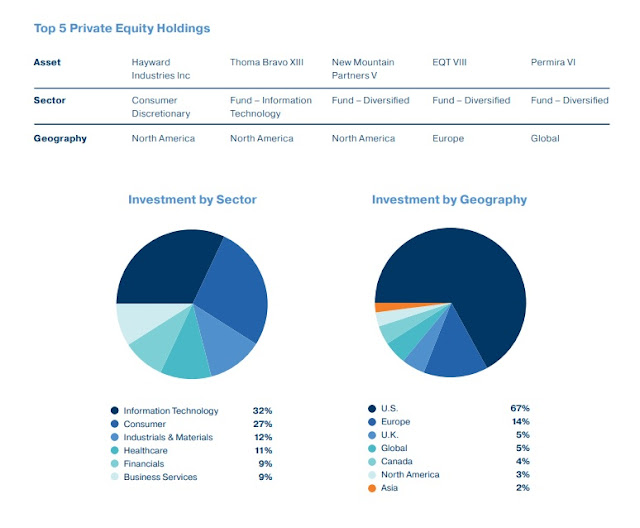

Private equity makes up around 8 per cent of Aimco’s total assets under management. The firm, which invests for pension plans, endowments and government funds in Alberta, plans to increase such holdings in the coming years with the expectation that the asset class will continue to outperform other investments, Teti said.

'Critical Lens'

Aimco’s private equity holdings returned 66 per cent in 2021, boosted by unloading some investments during a period of frothy valuations. The asset manager also wagered on technology stocks in the last two years -- one of the worst hit sectors in the recent market selloff -- investing in software companies including Medallia Inc., RealPage Inc. and Visma AS.

Public markets “painted certain technology companies” with “one brush,” but Aimco’s investments have strong underlying operating metrics, Teti said. Even so, investors are approaching private equity with more caution, he said.

“I think people want to be mindful of making investments in this environment,” Teti said.

Peter Teti is absolutely right, people want to be mindful of making investments in this environment.

You can read more about AIMCo's private equity strategy and performance from the 2021 Annual Report below (highlights are mine):

Interestingly, Mr. Teti also explained to Bloomberg this week why AIMCo chose Singapore instead of Hong Kong to establish its Asia headquarters:

Alberta’s $129 billion investment manager is looking at Singapore rather than Hong Kong for its first office in Asia as it plots an international expansion of its private equity group.

Alberta Investment Management Corp., known as AIMCo, plans to increase its allocation to Asia-based investments and will need staff on the ground to do that, said Peter Teti, head of private equity and international. Singapore has clear advantages, he said.

AIMCo “will have a pan-Asian strategy as opposed to just, for example, a Chinese strategy,” Teti said in an interview. “Singapore seems to be a potentially logical place to have a base through which you can invest across Asia and that will include Australia, New Zealand as well.”

Singapore is gaining capital and finance jobs thanks in part to tensions over China’s regulatory crackdown and its handling of Hong Kong. BlackRock Inc., the world’s largest asset manager, is in talks to double its floorspace at an office block in Singapore, people familiar with the matter said last month.

AIMCo hopes to learn from Canadian peers that have established offices in the city-state, Teti said. Ontario Teachers’ Pension Plan opened a Singapore office in 2020. The Caisse de Dépot et Placement du Québec is also established there as is Omers, an Ontario pension fund.

“Singapore is increasingly attractive relative to other places like Hong Kong that are close to China and that have experienced some geopolitical issues,” Teti said.

Just 2 per cent of AIMCo’s $8.2 billion in private equity assets were in Asia last year, according to the firm’s 2021 annual report. The group invests in private deals directly and through funds, including those managed by Baring Private Equity Asia and FountainVest Partners Co.

Aimco handles money for a number of pension plans and other government funds from its base in Edmonton.

Singapore is a wise choice and AIMCo surely looked at where its Canadian peers are based in Asia before making this decision.

In order to expand its private market investments (not just private equity) in its "pan-Asian strategy", it makes sense to open up an office in Singapore and start building the right relationships.

This takes time and it will pay off for AIMCo's clients over the long run.

Lastly, David Milstead of the Globe and Mail wrote an article yesterday on how AIMCo and OMERS lost big on the bankruptcy of Vue, Europe's largest movie theater chain which they invested in back in 2013.

I don't know why Mr. Milstead is harping on this latest development but it’s not pertinent as I clearly remember OMERS took a full writedown on this investment in 2020 (publicly disclosed this) and I am quite certain AIMCo did too. This bankruptcy will not result in losses to their private equity portfolios at this time.

As you can read above, AIMCo's private equity was on fire last year (+66%) and OMERS Private Equity also posted big gains (+26%), so they both turned the corner after 2020.

I understand why reporters love harping on bad news but it's also good to report good news and track the total performance of our large Canadian pensions over the long run.

On that note, please take the time to read AIMCo’s 2021 Annual Report which was released at the end of June here. I went over AIMCo’s record 14.7% gain back in April when I talked to its co-CIOs here.

Below, Mark Wiseman, chair of the Alberta Investment Management Corp. (AIMCo), joins BNN Bloomberg stating that despite the Bank of Canada raising rates aggressively, it will have minimal impact on taming inflation. He says the real risk is stagflation and that pensions funds can benefit at this time by taking a long-term view on quality assets.

Take the time to listen to his views below or here, he raises excellent points and provides a great global context about what is happening across Europe and China right now.

Mark is also right, the chances of engineering a soft landing in this environment are remote, central banks are cornered and the risk of a policy error is rising.

Comments

Post a Comment