Putting CPP Investments' Fiscal Q1 Loss In Proper Context

First-Quarter Performance:

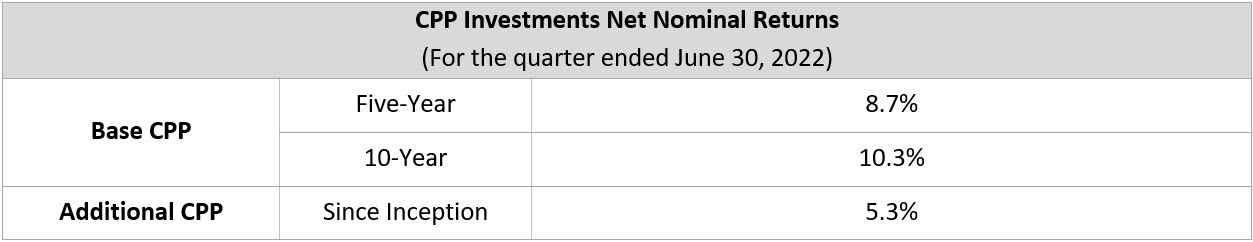

- Negative 4.2% net return demonstrates resilience compared to performance of global markets

- Five-year net return of 8.7%

- 10-year net return of 10.3%

TORONTO, ON (August 11, 2022): Canada Pension Plan Investment Board (CPP Investments) ended its first quarter of fiscal 2023 on June 30, 2022, with net assets of $523 billion, compared to $539 billion at the end of the previous quarter.

The $16 billion decrease in net assets for the quarter consisted of a net loss of $23 billion and $7 billion in net transfers from the Canada Pension Plan (CPP).

In the five-year period up to and including the first quarter of fiscal 2023, CPP Investments has contributed $171 billion in cumulative net income to the Fund, and over a 10-year period it contributed $305 billion to the Fund on a net basis.

The Fund, which includes the combination of the base CPP and additional CPP accounts, achieved five-year and 10-year annualized net returns of 8.7% and 10.3%, respectively. For the quarter, the Fund returned negative 4.2%, outperforming returns for leading global indices that declined, on average, well into double-digit territory.

“Financial markets experienced the most challenging first six months of the year in the last half century, and the Fund’s first fiscal quarter was not immune to such widespread decline. However, our active management strategy – diversified across asset classes and geographies – moderated the impact on the Fund, preserving investment value,” said John Graham, President & CEO. “The uncertain business and investment conditions we noted in the previous quarter continue, and we expect to see this turbulence persist throughout the fiscal year. Our resilient portfolio was designed to create value over the very long term as demonstrated by our continued strong 10-year net return, even as we expect to experience double-digit percentage losses one year in twenty.”

The Fund’s quarterly results were driven by losses in public equity strategies, due to the broad decline in global equity markets. Investments in private equity, credit and real estate contributed modestly to the losses this quarter. Gains by external portfolio managers, quantitative trading strategies and investments in energy and infrastructure contributed positively to this quarter’s results. The Fund also experienced losses in fixed income due to higher interest rates imposed by central banks to fight inflation. These losses were offset by foreign exchange gains of $3.1 billion as the Canadian dollar weakened against the U.S. dollar.

“We know Canadians are concerned about the impact of market volatility on their retirement plans, and they can take comfort in the fact that the Fund is expected to deliver solid performance over the long term, even with periodic turbulence such as we are witnessing this year,” Graham said. “Looking ahead, I remain cautiously optimistic – cautious on the markets but optimistic and confident about CPP Investments’ ability to navigate markets and add value in the best interests of 21 million CPP contributors and beneficiaries.”

Performance of the Base and Additional CPP Accounts

The base CPP account ended its first quarter of fiscal 2023 on June 30, 2022 with net assets of $509 billion, compared to $527 billion at the end of the previous quarter. The $18 billion decrease in assets consisted of $22 billion in net losses and $4 billion in net transfers from CPP. The base CPP account achieved a negative 4.2% net return for the quarter, and a five-year annualized return of 8.7%.

The additional CPP account ended its first quarter of fiscal 2023 on June 30, 2022 with net assets of $14 billion, compared to $12 billion at the end of the previous quarter. The $2 billion increase in assets consisted of $647 million in net losses and $3 billion in net transfers from CPP. The additional CPP account achieved a negative 4.8% net return for the quarter, and an annualized return of 5.3% since inception in 2019.

The additional CPP was designed with a different legislative funding profile and contribution rate compared to the base CPP. Given the differences in their design, the additional CPP has had a different market risk target and investment profile since its inception in 2019. As a result of these differences, we expect the performance of the additional CPP to generally differ from that of the base CPP.

Furthermore, due to the differences in their net contribution profiles, the assets in the additional CPP account are also expected to grow at a much faster rate than those in the base CPP account.

Long-Term Sustainability

Every three years, the Office of the Chief Actuary of Canada (OCA) conducts an independent review on the sustainability of the CPP over the long term. In the most recent triennial review published in December 2019, the Chief Actuary reaffirmed that, as at December 31, 2018, both the base and additional CPP continue to be sustainable over the 75-year projection period at the legislated contribution rates.

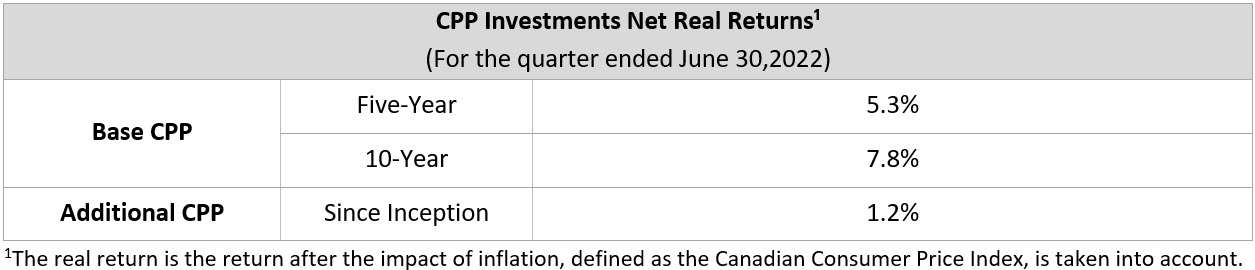

The Chief Actuary’s projections are based on the assumption that, over the 75 years following 2018, the base CPP account will earn an average annual rate of return of 3.95% above the rate of Canadian consumer price inflation. The corresponding assumption is that the additional CPP account will earn an average annual real rate of return of 3.38%.

CPP Investments continues to build a portfolio designed to achieve a maximum rate of return without undue risk of loss, while considering the factors that may affect the funding of the CPP and its ability to pay current benefits. The CPP is designed to serve today’s contributors and beneficiaries while looking ahead to future decades and across multiple generations. Accordingly, long-term results are a more appropriate measure of CPP Investments’ performance and plan sustainability.

Operational Highlights

Corporate developments

- CPP Investments is the world’s most transparent pension fund, according to the global pension transparency benchmark, a collaboration between Top1000funds.com and CEM Benchmarking Inc. The benchmark, launched in 2021, measures the transparency of disclosures of 15 pension systems around the world across measurements such as cost, governance, performance and responsible investing.

Executive announcements

- The current role of Senior Managing Director & Chief Financial and Risk Officer (CFRO) will be divided into two distinct senior management positions, a Chief Risk Officer (CRO) and a Chief Financial Officer (CFO), as the organization continues to position itself for future growth. After serving five years as CFRO, Neil Beaumont left the role at the end of July. During his tenure, Mr. Beaumont built a strong team and helped to strengthen CPP Investments’ approach to risk management, with a foundational new Risk Policy, and to enhance the organization’s financial disclosure.

- Deborah Orida, Senior Managing Director, Global Head of Real Assets & Chief Sustainability Officer (CSO), left the organization in mid-August to become CEO of a Canadian pension fund. During her 13-year career at CPP Investments, Ms. Orida played a significant role in the organization’s success, leading Private Equity Asia, Active Equities and Real Assets before adding the role of CSO.

First-Quarter Investment Highlights

Credit Investments

- Invested US$100 million in the unitranche loan for IGT Solutions. IGT Solutions is a business process outsourcing company specialized in airlines, online ticket agencies and hospitality, with operations primarily in India and the Philippines and clients in North America and Europe.

- Committed US$160 million to Lumina Strategic Solutions Fund. Lumina is a Brazil-focused special situations credit investment manager.

- Closed a C$230 million investment in the term loans of Legal Search, a provider of property and corporate-related search services in Australia, the U.K., and the U.S.

Private Equity

- Closed on a US$50 million commitment to Radical Fund III, after previously committing to Fund II as an anchor investor. Radical is an early-stage manager based in Toronto focusing on AI opportunities in Canada and the U.S.

- Committed US$100 million to Trustar Capital V. Trustar Capital Partners is the private equity affiliate of CITIC Capital focused on control-oriented buyouts in Greater China.

- Invested US$50 million in a co-investment alongside Silver Lake in Entrata for a 4% stake. Entrata is a developer of property management software that focuses on multi-family residential apartments.

- Committed €400 million to EQT X. EQT is a global investment organization with €77 billion in assets under management across 36 active funds.

- Committed to a US$120 million co-investment alongside CVC Capital into Sajjan India Limited, a specialized agrochemical manufacturer in India, for up to a 17% stake.

- Committed to a US$50 million co-investment alongside Multiples into Acko Tech & Services, India’s only pure-play digital insurance platform focused on retail customers. Once all funding is deployed, we will hold an approximate 5% stake.

- Closed a US$35 million co-investment alongside CVC Capital into Razer Inc., a global lifestyle brand for gamers, providing gaming peripherals, gaming laptops and desktops, gaming accessories and software solutions worldwide.

- Made a US$34 million investment alongside Multiples into Kogta Financial Limited, a non-banking financial company focusing on new and used vehicle financing and lending to micro, small and medium enterprises in semi-rural areas in India, for an approximate 9% stake.

- Closed a US$50 million co-investment in Anaplan alongside Thoma Bravo for an approximate 0.5% stake. Anaplan is a U.S.-based provider of cloud-based planning and analytics software.

- Invested US$65 million alongside Anchor Equity Partners into Fresheasy, a home meal kit distributor in South Korea, for an approximate 9% stake.

Real Assets

- Acquired 100% of four onshore wind farms in central Sweden through Renewable Power Capital (RPC), our European onshore renewables platform. As part of the transaction, we are committing a further €803 million to RPC.

- Committed US$300 million to the Hillhouse Real Asset Opportunities Fund (HRAOF). HRAOF aims to invest in the new economy real estate sectors in China focusing on life science, data centres and logistics.

Asset Dispositions

- Agreed to sell six logistics warehouses in Western China in the Goodman China Logistics Partnership (GCLP). Net proceeds from the sale will be approximately C$320 million. GCLP was established with Goodman Group to own and develop logistics assets in mainland China in 2009 and we have an 80% ownership interest in GCLP.

- Exited Canterra Farmland Holdings LP, which sold its diversified portfolio of farmland, with net proceeds of approximately C$390 million. We originally acquired our 99% stake in 2014.

Transaction Highlights Following the Quarter

- Increased our commitment to BAI, a global communications infrastructure provider, alongside partners Manulife and AIMCo to support BAI’s ongoing growth strategy, including the agreed acquisition of ZenFi Networks. We have committed approximately C$3 billion towards BAI since 2009 and hold an 86% ownership stake.

- Acquired an additional 33.3% stake in Bullring Shopping Centre in Birmingham, U.K., bringing our stake to 50% for a total equity exposure of C$439 million.

- Invested an additional US$150 million to Octopus Energy to support its global expansion and renewables strategy. Octopus is a global clean energy technology pioneer based in the U.K.

- Committed a further US$225 million to expand our strategic partnership with Octopus Energy, and directly support the business’ efforts to accelerate and enhance the development and integration of renewables in the power system.

- Closed on a €200 million commitment to TDR Capital V. TDR Capital is a private equity firm based in London and focuses on mid-market buyout investments headquartered in or with significant operations in Europe.

- Committed US$150 million to NewQuest Asia Fund V. NewQuest Capital Partners is a specialized secondaries manager focused on transactions involving middle-market companies and General Partners within emerging Asian markets.

- Closed on a US$150 million commitment to Oak Hill Capital Partners VI. Oak Hill is a U.S.-based fund manager focused on investing across the industrials, media & communications, business services and consumer sectors in the U.S.

- Closed on a US$400 million commitment to Apax XI. Apax Partners is a global private equity firm focused on upper middle-market and large-cap buyout opportunities.

- Committed a further C$700 million to our Indian toll roads portfolio company IndInfravit Trust as part of a transaction to acquire five operating road concessions from Brookfield Asset Management for C$875 million.

- Closed on an aggregate commitment of US$333 million to Sequoia Capital’s 2022 APAC fundraise, comprising commitments to the Sequoia China funds and the Sequoia India/South East Asia funds.

- Closed on a US$100 million commitment to Kimmeridge Fund VI. Kimmeridge is a U.S.-based alternative asset manager focused exclusively on the energy sector.

- Committed an additional US$225 million to KDV II, our second development joint venture with partners ESR and APG. KDV II invests in and develops a best-in-class industrial and warehouse logistics portfolio in the Seoul and Busan metropolitan areas in South Korea. We hold a 45% stake in the joint venture.

About CPP Investments

Canada Pension Plan Investment Board (CPP Investments™) is a professional investment management organization that manages the Fund in the best interest of the 21 million contributors and beneficiaries of the Canada Pension Plan. In order to build diversified portfolios of assets, investments are made around the world in public equities, private equities, real estate, infrastructure and fixed income. Headquartered in Toronto, with offices in Hong Kong, London, Luxembourg, Mumbai, New York City, San Francisco, São Paulo and Sydney, CPP Investments is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At June 30, 2022, the Fund totalled $523 billion. For more information, please visit www.cppinvestments.com or follow us on LinkedIn, Facebook or Twitter.

You can download fiscal 2023's Q1 report here and the highlights are available here (all performance reports and highlights are available here).

I want to thank Frank Switzer, Managing Director, Investor Relations at CPP Investments for sending me this last week.

Now, I don't typically cover CPP Investments' quarterly results as it's too short of a time horizon. Even mid-year results aren't long enough as far as I am concerned but these have been volatile times and that is why I think it's worth looking into these results.

The most critical part to keep in mind when viewing these results is the context and what exactly they show.

Fiscal Q1 was terrible for global stocks and bonds so it's not surprising that the CPP Fund experienced a loss. But the loss was a lot less than its Reference Portfolio as active management helped them preserve investment value:

In other words, if it wasn't for active management and proper diversification across private and public markets all over the world, that Q1 loss would have been far greater investing in global stocks and bonds.

Interestingly, CPP Investments is expecting further market turmoil in Fiscal 2023 but if you look at the 10-year annualized performance, it remains very strong at 10.3%:

In terms of performance drivers in fiscal Q1:

- The Fund’s quarterly results were driven by losses in public equity strategies, due to the broad decline in global equity markets. Investments in private equity, credit and real estate contributed modestly to the losses this quarter.

- Gains by external portfolio managers, quantitative trading strategies and investments in energy and infrastructure contributed positively to this quarter’s results.

- Losses in fixed income due to higher interest rates imposed by central banks to fight inflation were offset by foreign exchange gains of $3.1 billion as the Canadian dollar weakened against the U.S. dollar.

I also show you net investments by investment department:

Again, the key slide is this one at the very end:

The Fund's active management across public and private markets outperformed market indices and the focus must remain on long-term performance.

Importantly, the Fund is well positioned to navigate market turbulence and benefit from any dislocations in several asset classes to create long-term value.

This is why looking at quarterly results is meaningless but given the unprecedented volatility in public markets we saw in the first half of the year as inflation reached a multi-decade high, it's only normal that some people are concerned about Canada's largest pension fund experiencing a loss in fiscal Q1.

I'm not concerned in the least and think CPP Investments is in great shape to confront any market environment, especially a difficult one.

In fact, if we do see continued weakness throughout F2023, there will be plenty of opportunities to invest across public and private markets, and this is where active management will play a critical role in generating long-term value.

The key passage in the press release most people skim through is this one:

The Chief Actuary’s projections are based on the assumption that, over the 75 years following 2018, the base CPP account will earn an average annual rate of return of 3.95% above the rate of Canadian consumer price inflation. The corresponding assumption is that the additional CPP account will earn an average annual real rate of return of 3.38%.

As long as the Fund delivers an annualized real return rate of 3.95% for base CPP and 3.38% for additional CPP over the long run, then it is in good shape.

Obviously, CPP Investments' active management strategy is delivering much higher real rates than this over a long period without taking undue risks, so both CPP accounts are in excellent shape.

In terms of major investments across all strategies, there are too many to go over here but you can read the press releases here.

One deal that stood out to me was the investment in IndInfravit with OMERS to expand its India toll road platform but there are plenty of other great deals mentioned in the press release above.

Given its size and reputation, CPP Investments is a partner of choice for many funds and other strategic partners.

In terms of corporate and executive news, I did note this:

- CPP Investments is the world’s most transparent pension fund, according to the global pension transparency benchmark, a collaboration between Top1000funds.com and CEM Benchmarking Inc. The benchmark, launched in 2021, measures the transparency of disclosures of 15 pension systems around the world across measurements such as cost, governance, performance and responsible investing.

- Deborah Orida, Senior Managing Director, Global Head of Real Assets & Chief Sustainability Officer (CSO), left the organization in mid-August to become CEO of a Canadian pension fund. During her 13-year career at CPP Investments, Ms. Orida played a significant role in the organization’s success, leading Private Equity Asia, Active Equities and Real Assets before adding the role of CSO.

CPP Investments was named the world’s most transparent pension fund, according to the global pension transparency benchmark and so were many other large Canadian pension investment managers.

In my opinion, CPP Investments sets the bar in terms of transparency and that is exactly what you would expect from Canada's largest pension fund serving millions of Canadians.

Michel Leduc, Senior Managing Director & Global Head of Public Affairs and Communications, told me that "after financial performance, transparency is arguably the most important attribute" and he's absolutely right.

I also thought it was appropriate and classy to mention the valuable contributions that Deborah Orida made during her 13-year career there. Ms. Orida left quite a mark at CPP Investments and she will soon be heading up PSP Investments here in Montreal, another major Canadian pension fund.

The experience, knowledge and network she brings to PSP will be incredible and she will hit the ground running there leaning on a very experienced management team.

Who will replace Deb Orida at CPP Investments? There are so many talented people there (men and women) I wouldn't know where to begin but I trust John Graham will make the right choices to replace her and he will have the full backing of CPP Investments' Board.

We talk a lot about transparency but there is another area where CPP Investments excels, namely, in succession planning. They are always training the new generation and thinking ahead to replace people if they depart, and that's across all levels of the organization, from the CEO down.

Admittedly, replacing a very talented and experienced lady like Deb Orida is not going to be easy but it's going to happen and I trust the process and judgment of the people making these critical decisions.

Lastly, CPP Investments is a global powerhouse, it is a Fund like very few others in terms of its size, scope, breadth, depth and ability to engage in very complex deals across many asset classes and strategies.

It is led by a very experienced and talented senior management team which has seen it all and that's why it will continue to provide great long-term results for millions of Canadians counting on them.

So, as stock markets keep climbing the wall of worry since the June 14th inflation scare lows, rest assured that no matter what happens over the next three fiscal quarters, the people at CPP Investments are working hard to add value across all assets and strategies, building on a very resilient and diversified global portfolio.

Those are my quick thoughts putting CPP Investments' fiscal Q1 loss in proper context.

It's meaningless over the long run and despite the loss, it actually shows you very clearly that their active management strategy is working well because if it wasn't, the loss would be more in line with the losses exhibited in public stock and bond indices during calendar year Q2 (if you don't believe me look at the grim performance of the much touted 60/40 portfolio during the first half of the year).

Below, CPP Investments' President & CEO, John Graham, spoke at the Canadian Club Toronto about the Fund’s F2022 results, as well as their approach to investing in the energy evolution and how diversity & inclusion plays into the Fund’s strategy.

Take the time to watch this and listen to his comments carefully. In his speech at the beginning, he clearly states the following:

We were specifically designed to create value over the very long term, and to be resilient in the face of wide-ranging market and economic conditions. CPP Investments was created to expose the CPP funds to capital markets.

Capital markets can give but they can also take. Over the past decade, markets have been robust. Valuations have increased around the globe and simply exposing capital to the markets was a winning strategy.

Over the past few months, the markets have been taking back, and resetting levels and expectations. We built CPP Investments to both expose the funds to the capital markets and to also deliver value added through active management.

That doesn’t mean we’re immune to volatility in the markets, it means we’re well-positioned to weather the storm over the long term.

To be clear, this also means we might have a tough year, or two. But as a generational investor, we’re here to invest for our 21 million contributors and beneficiaries today and for decades to come.

The key is active management and diversification. We diversify across various asset classes and geographies, to mitigate concentrated risk and to deliver a stronger and more resilient portfolio. We invest across a wide range of asset classes expecting them, to perform differently throughout the economic cycle.

John Graham covers a lot here which is why I keep referring to this clip, it is well worth listening to his views. I also love the story about his daughter doing a history project on the creation of CPP (unbeknown to him) and how it helped alleviate poverty among Canada's seniors.

Comments

Post a Comment