CDPQ to Pump $11.2 Billion Into European Private Markets

The fund's focus is on themes such as business services, health care, technology, financial services, real estate, social mobility and transition to a low carbon economy.

You can read more about David Morley here. He has the experience and knowledge to run this team properly.

CDPQ isn't the only large institution setting its sights on European private equity.

Tamara Djurickovic of tech.eu reports that the Invest in Europe report shows record fundraising in 2022 as long-term investors step up support for European private equity and venture capital:

The “Investing in Europe: Private Equity Activity 2022” report covered over 1,750 companies and showed a new high level of commitment from long-term investors who seek strong returns to support European pensions and savings.

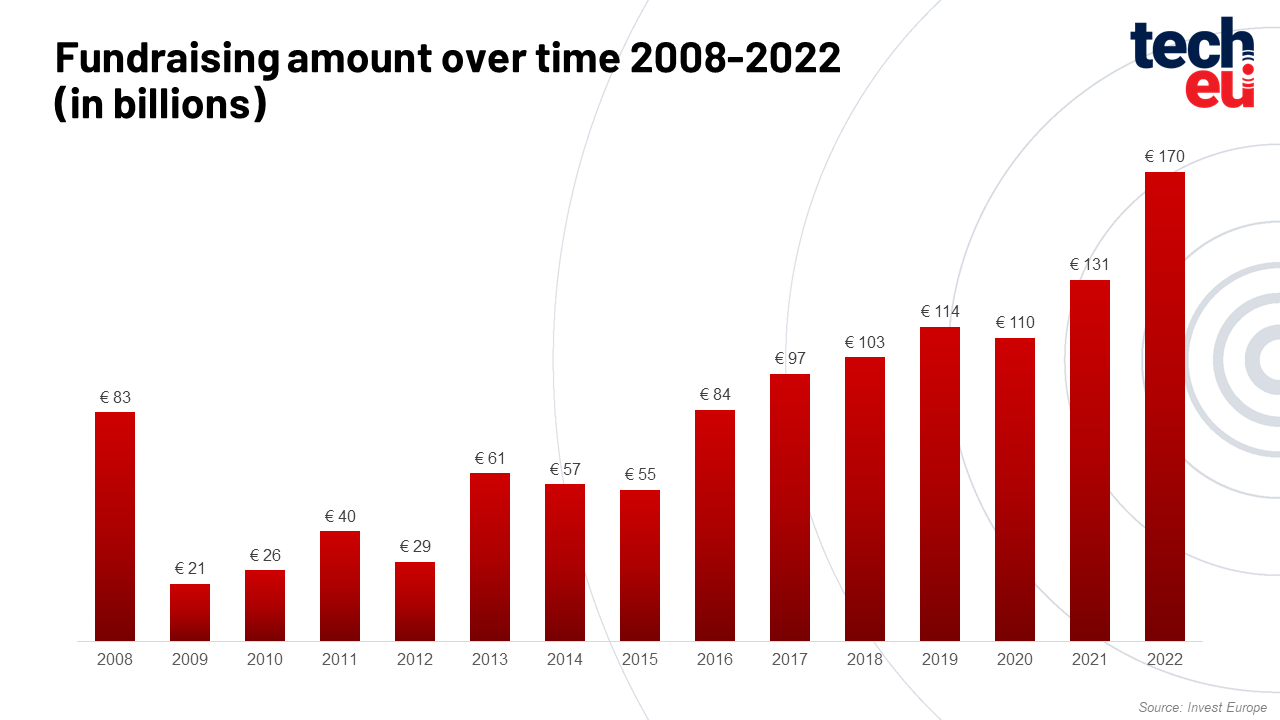

Invest in Europe's “Investing in Europe: Private Equity Activity 2022” research has shown that 801 European private equity, venture capital, and growth funds raised 30% more in 2022 compared to 2021 (€170 billion in 2022 compared to €131 billion achieved in 2021).

Analyzed separately, Venture capital funds raised a record €23 billion, while buyout funds reached a new high of €111 billion, and growth funds had their second-best year with €21 billion raised.

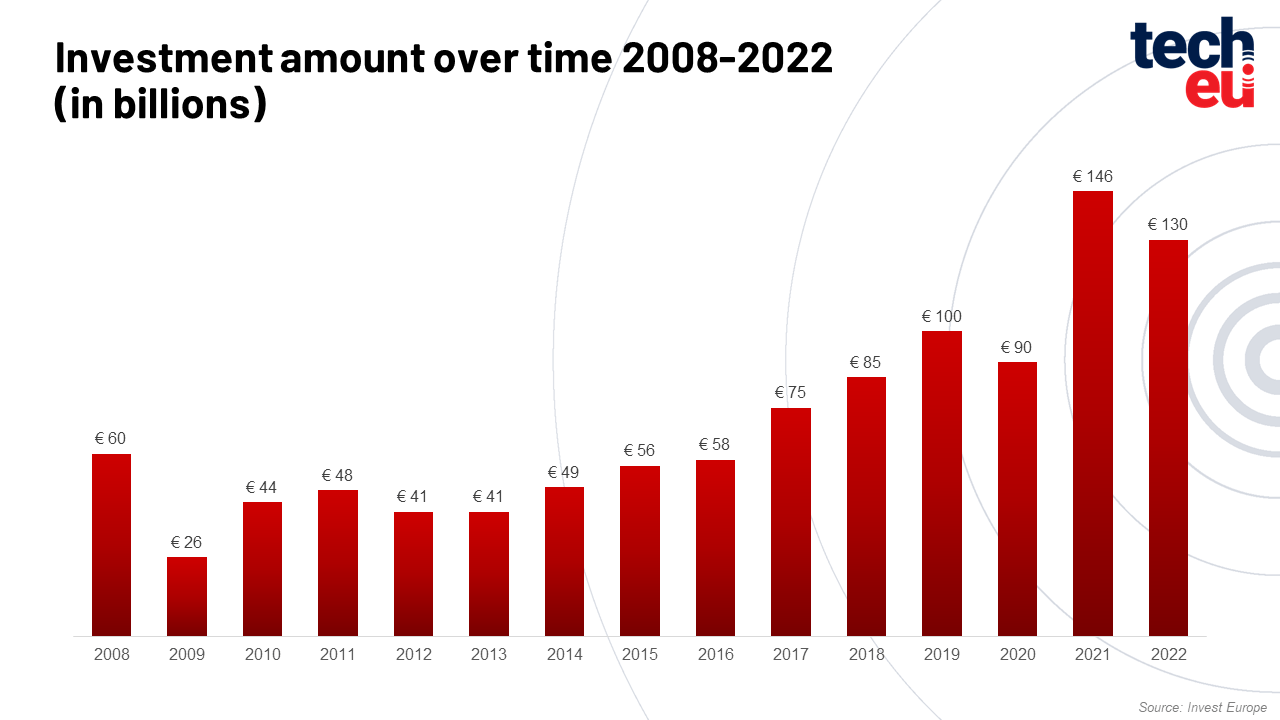

Speaking of investments, with €130 billion in 2022 a decrease was recorded compared to 2021. However, these results also represent a 30% growth compared to the average of the previous five years. Such data emphasize the step-change in private capital investment taking place across Europe.

Alongside insurers, long-term institutional investors contributed to almost two-thirds of all capital raised in 2022, as follows:

- pension funds committed 27% of the total fundraising

- sovereign wealth funds significantly stepped up investment, achieving 15% of the total fundraising and

- funds of funds accounting for 11% of the total fundraising.

The report states that over 50% of fundraising came from domestic and cross-border investors within Europe. As it is highlighted, Europe becomes more interesting to international investors looking to back leading companies and ground-breaking innovation.

To confirm this, the report states that capital from North America reached 24% of total fundraising (over €41 billion), while commitments from Australia and Asia also reached 22% of the total funds raised.

With the €130 billion invested by European private equity and venture capital, 2022 is the second-highest year for investment with over 9,000 companies backed. Among different industries, Information Communications Technology is still the largest sector by equity invested (€43 billion). It was followed by Consumer Goods & Services (16% of all companies), and Biotech & Healthcare (15% of all companies). This way innovation, job creation, stronger growth, and development are encouraged, but also the transition to a greener and more sustainable European economy.

"After reaching the high-water mark for investment in 2021, the European private equity and venture capital industry continues to reach new heights. Strong support from both inside and outside Europe demonstrates the confidence that long-term investors are placing in managers to deliver returns that can grow the pensions and savings of citizens globally."

"Rather than sitting on the sidelines, this capital - along with operational expertise - is going into European companies to transform mature businesses and get start-ups and growing SMEs off the ground." Eric de Montgolfier, CEO of Invest Europe

For more details and numbers, the full report can be downloaded here.

Not surprisingly, the very best private equity funds are garnering most of the assets.

A month ago, Reuters reported that KKR closed its largest ever European buyout fund at $8 billion:

KKR & Co Inc (KKR) said on Tuesday it had closed its sixth and largest European private equity fund at $8 billion, a significant boost for the investment firm at a time of market volatility and sinking interest in major acquisitions.

The fund will target investments into developed economies in Western Europe, capitalising on "structural trends" transforming the local economy including digitisation, sustainability and healthcare, KKR said in a statement.

Private equity firms have been forced to write larger equity cheques for their deals as debt financing for global mergers and acquisitions (M&A) dried up amid rising interest rates, high inflation and fears of a recession in major economies.

Last year, KKR chose to pay for its acquisition of French insurance broker April Group using only equity, with a view to arranging debt financing down the line.

Of the money raised for its latest fund, $1 billion was committed by KKR from its own balance sheet and employee commitments.

KKR said it is currently managing a little over $28 billion in assets on its European private equity platform.

"Raising this fund in the current market environment demonstrates the strong investor confidence in our European team and platform, and our long track record of delivering value and outstanding results," said KKR partner Alisa Amarosa Wood.

Global private equity fundraising shrank last year, with the impact particularly felt in Europe, where there was a 30% decline from 2021, according to Preqin data.

Investor capital has flowed towards better-known names, with the 25 largest private equity managers concentrating 42% of global fundraising last year, the highest annual share since 2013, research by consultancy McKinsey & Company showed.

KKR's fundraising also comes at a challenging time for buyout funds looking to realise existing investments, amid a scarcity of debt funding and pressure on valuations. The value of European private equity exits plummeted 51% in 2022 to $78 billion, according to Preqin.

Law firm Debevoise & Plimpton LLP represented KKR as primary fund counsel for the fundraising.

More recently, Will Louch and Ivan Levingston of the Financial Times report deals between European private equity firms halve year-on-year as rising rates hit:

Deals between private equity firms in Europe have plunged to their lowest levels since the Covid-19 pandemic as the buyout game of pass-the-parcel is hit by rising debt costs and investors’ concerns about the economic outlook.

In the first three months of this year the value of deals struck between rival private equity firms in Europe fell to its lowest point since the second quarter of 2020, according to data provider PitchBook, as buyout houses seeking to exit investments struggled to agree on prices.

Just €16.8bn worth of companies were traded between investment firms — less than half the value of deals struck over the same period last year. Initial public offerings had their second worst quarter over the same time period, PitchBook data shows.

“It’s a very tough time to exit anything and sponsor to sponsor deals are the most acutely impacted,” Hugh MacArthur, global chair of Bain & Co’s private equity team said. “You have the macro uncertainty and, by the way, debt costs a lot more, so unless you are willing to ignore that then it is very difficult to get these deals done.”

The practice of private equity firms selling assets to one another has boomed over the past decade as the era of low interest rates let firms raise record sums which they were under pressure to deploy.

The peak for intra-PE deals came in 2021 when, buoyed by the economic rebound of reopening after pandemic lockdowns, €173bn of companies were traded between buyout firms.

Some companies passed between PE hands four or five times at ever higher valuations. Vincent Mortier of asset manager Amundi likened the practice to a Ponzi scheme. Last June, Mortier warned that firms would face a reckoning in the coming years.

With PE firms now baulking at buying assets from each other, deals are at risk of falling apart as sellers are unwilling to compromise on price. In recent weeks, two prominent auction processes for private equity-owned companies — veterinary clinic chain VetPartners and biometrics technology company IDEMIA — have attracted muted interest from rival firms, according to people familiar with the matter.

Both companies received fewer offers than expected as potential private equity buyers were put off by high pricing expectations and increased borrowing costs, the people said. Talks were ongoing with at least one prospective buyer of VetPartners, one of the people added. Both groups declined to comment.

Eurazeo’s sale of French insurance company Groupe Premium is facing similar difficulties, other people said. Eurazeo declined to comment. Groupe Premium did not reply to a request for comment. Line chart of Transaction value (€bn) showing Deals in Europe between private equity firms hit post-pandemic low.

The slowdown means buyout groups are struggling to cash in on their bets. As a consequence, firms seeking to raise new funds from their backers are having difficulty as investors typically like to have cash returned to them before backing managers again.

Investors in private equity funds have also been hit by the so-called denominator effect whereby publicly traded assets fall in value in real time but private assets are not marked down as much — so an increasing proportion of investors’ portfolios is held in private markets.

This phenomenon has amplified the need for investors to receive cash back from the firms they invest with, before they are able to make fresh commitments.

“There is no equilibrium on valuation,” said Simona Maellare, global co-head of the alternative capital group at UBS. “What limited partners are caring about is distributions and the easiest deals to do are deals to sell to another PE.”

“One of the biggest problems for sponsors now is the LBO math doesn’t work — valuations remain inflated and the cost of borrowing has gone up,” said Saba Nazar, co-head of global financial sponsors at Bank of America.

The need to return money to investors is forcing firms to get creative.

One tactic is so-called “continuation funds”. These enable firms to move assets from one fund they manage to another, without having to sell or list the asset.

Swedish firm EQT, for example, is building out an in-house team to help do these types of deals.This week European buyout firm Triton announced it had sold four portfolio companies it owned to a continuation fund in a €1.6 billion deal.

Private equity firms have also found some success in selling assets to corporate buyers or cash-rich sovereign wealth funds. Last month Bridgepoint sold its dialysis clinic chain Diaverum to a health venture backed by an Abu Dhabi sovereign wealth fund.

“A lot of sovereign wealth funds are awash with cash and they are keen to deploy it in the right businesses where they can make a clear return,” Nazar said.

Those without access to those pools of capital hope that the world’s leading central banks stop raising rates sooner rather than later, so that they can avoid crystallising losses by selling at lower valuations or losing out on deals completely.

“Everybody can survive a year without doing too much but [18 months] or two years is a long period of time,” MacArthur said.

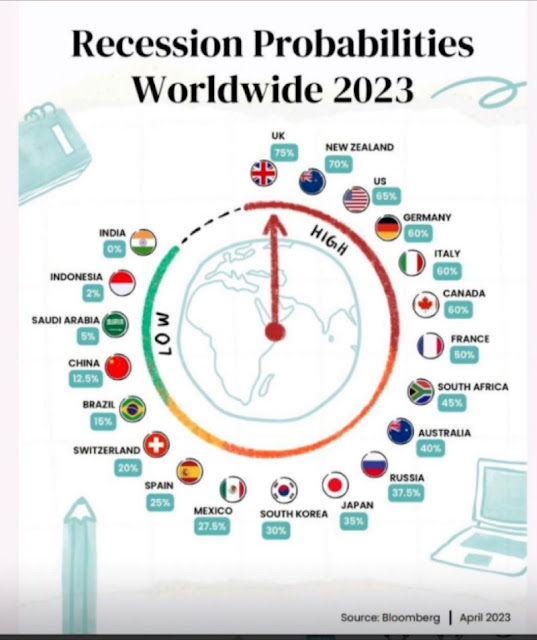

I'm afraid private equity firms are in for a long, tough slug as a nasty and prolonged global recession materializes.

In my opinion, the UK and Eurozone will face the toughest recession and that's why investors are clamoring to give KKR, EQT, Apax, BC Partners, Permira, Partners Group, and other top funds money to be prepared to strike when opportunities arise.

That's why CDPQ is pumping $11.2 billion into European private markets although this includes real estate and infrastructure.

If you're unconvinced that Europe will go through a nasty recession, keep these Bloomberg charts that Francois Trahan posted on LinkedIn this week in mind:

All those interest rate hikes are working their way through the real economy and when the Big Kahuna hits, brace yourselves.

And it's not over.

This morning the ECB said that consumer inflation expectations have risen significantly:

ECB Says Consumer Inflation Expectations Rose Significantly https://t.co/X5gYoDh7Sb

— Leo Kolivakis (@PensionPulse) May 11, 2023

That means the ECB will have to keep hiking.

Meanwhile, the Bank of England just raised interest rates to their highest level since late 2008 as it continues to combat stubbornly high inflation in the United Kingdom:

The decision on Thursday by the bank’s nine-member Monetary Policy Committee to lift its main interest rate by a quarter of a percentage point to 4.5 percent was widely anticipated in financial markets.

Bank of England Governor Andrew Bailey told reporters in London after the rate changed: “The rise in bank rates since December 2021 will weigh more on the economy in the coming quarters and the [Monetary Policy Committee] factors this into its policy decisions.”

Like other central banks around the world, the Bank of England has sought to keep a lid on inflation, which over the past year has been fuelled by Russia’s invasion of Ukraine.

That sent energy prices soaring, a development that then led to price increases across a wide array of goods and services.

The Bank of England started raising interest rates in late 2021 from a low of 0.1 percent in order to keep a lid on price rises that were first largely stoked by bottlenecks resulting from the lifting of coronavirus lockdown restrictions and subsequently by the war in Ukraine.

Tasked with keeping inflation at about 2 percent, the bank said inflation would likely fall to about 5 percent by the end of this year.

But it warned there were “considerable uncertainties” over when inflation would return to its target, citing “significant” upside risks.

“If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required,” the bank said.

Inflation currently stands at just over 10 percent. In documents accompanying its decision, the bank said food prices have stayed higher for longer than expected. As a result, it said, consumer price inflation is expected to decline less rapidly than previously thought.

The interest rate hike will pile more pressure on borrowers, particularly those who have mortgages that track the bank’s headline rate.

Many homeowners will be cushioned from the recent increases because they fixed their mortgages when interest rates were ultra-low during the coronavirus pandemic.

However, those whose fixed-rate terms expire over the coming months will face much higher borrowing rates when they look to lock in new deals.

I see huge opportunities developing in the UK and Europe in general, including Germany which is becoming the sick man of Europe again:

Germany becoming the sick man of Europe again 👇 Instead of investing in our future we prefer to focus on climate „activism“ and gender neutral speech at the moment. Chart @DanielKral1 pic.twitter.com/FfV0BdfQ2w

— Michael A. Arouet (@MichaelAArouet) May 9, 2023

30 years ago each major US player had a German and/or French counterpart. Today counterparts of US giants sit in China while Europe is discussing plastic drinking straws and gender neutral speech. Apple alone is worth twice as much as the entire German market. pic.twitter.com/PvZG5yuW79

— Michael A. Arouet (@MichaelAArouet) May 10, 2023

But these opportunities will take time to pan out, I see them developing over the next two years.

We need more dislocations in private markets and once that happens, these private equity firms will go to work buying up assets at attractive levels.

And Canada's large pension funds will be co-investing right alongside them.

Not just CDPQ, all of them are preparing for the Big Kahuna.

Below, back in December, BC Partners Europe Chairman Nikos Stathopoulos said the private equity firm is preparing for a recession in the region, leading to some difficult conversations with the companies it owns. “We are bracing ourselves, especially on the European side,” he said on "Bloomberg Surveillance: Early Edition."

And earlier today, Bank of England Governor Andrew Bailey spoke to CNBC's Joumanna Bercetche after the central bank's rate decision and growth upgrade.

Third, Paul Donovan, chief economist at UBS Global Wealth Management, discusses new German industrial data, the path ahead for European monetary policy, and the U.S. economy.

Comments

Post a Comment