Norway's Sovereign Fund Tops Global Transparency Ranking

TORONTO — Norway’s sovereign wealth fund, Government Pension Fund Global, has topped the list of the most transparent funds according to the Global Pension Transparency Benchmark’s 2023 findings.

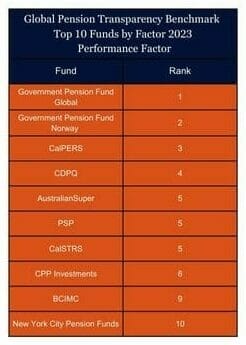

Reflecting the heightened focus on transparency and improved practices, the race was tight among the top funds with the first three funds separated by only one point each. CPP Investments and AustralianSuper came in second and third overall.

The Global Pension Transparency Benchmark, a collaboration between Top1000funds.com and CEM Benchmarking, is a world first global benchmark measuring the transparency of disclosures of 15 pension systems across the value generating measures of cost, governance, performance and responsible investments.

It ranks countries on public disclosures of key value generation elements for the five largest pension fund organisations within each country. The country rankings are now in their third year, with the scores of the 75 underlying funds published for the second time this year.

The results this year revealed a jump in the overall quality of pension fund disclosures with 77 per cent of funds making improvements in their scores.

Government Pension Fund Global made significant improvements to move from second to first place this year. CPP Investments dropped from first to second by a small margin, and AustralianSuper jumped from seventh to third spot in the year.

Canada was a clear winner in the country rankings for the third year, with all five of the Canadian funds featuring in the top 10 global funds.

The Dutch fund, Stichting Pensioenfonds Zorg en Welzijn, topped the list for the transparency of disclosures around cost. In the governance factor three funds ranked equal first, with all three achieving the extraordinary result of full marks in their scores: AustralianSuper, CDPQ and CPP Investments. Government Pension Fund Global was the best fund for transparency of disclosures related to performance and also took equal top spot with bpfBOUW for responsible investment.

Edsart Heuberger, CEM Benchmarking’s product lead for transparency benchmarking, says: “It is heartening that the Global Pension Transparency Benchmark is stimulating discussions on transparency and driving organisations globally to improve their public disclosures. Transparency matters. Congratulations to the top-ranking funds on the GPTB for leading the way on transparency and communication quality.”

Amanda White, editor of Top1000funds.com, said revealing the scores of the underlying funds emphasised the importance of clarity and openness in pension fund disclosures.

“Through the benchmark we offer a standard for global pension systems and funds to aspire to. We think transparency of these factors – cost, governance, performance and responsible investment – is important to drive improvement of outcomes for pension funds around the world, and the improvements in the scores this year demonstrates the power of the benchmark to improve practices.”

The Global Pension Transparency Benchmark is a world first global standard for pension disclosure, bringing a focus to transparency in a bid to improve pension outcomes for members.

The GPTB focuses on the transparency and quality of public disclosures with quality relating to the completeness, clarity, information value and comparability of disclosures. The overall scores and rankings are measured by assessing hundreds of underlying components and analysing more than 14,000 data points.

This year the process was refined with additional governance measures to ensure better data and assessment.

The results – for both country and funds – can be found by clicking here.

The Global Pension Transparency Benchmark advisory board:

- Keith Ambachtsheer, president, KPA Advisory Services; co-founder and board member, CEM

- Fiona Dunsire, not for profit board member

- Lorelei Graye, founder, Adopting Data Standards Initiative

- Angélique Laskewitz, director, Association of Investors for Sustainable Development

- Neil Murphy, vice-president, communications, Investment Management Corporation of Ontario

- David Atkin, chief executive, PRI – independent arbiter

About CEM Benchmarking

CEM Benchmarking is the leading, independent provider of cost and performance benchmarking information for fiduciaries and managers of asset pools: defined benefit, defined contribution, sovereign wealth, and other managed assets worldwide. CEM is deeply committed to helping clients, whether directly or through advisors/consultants, run cost-effective operations that generate value for their stakeholders. With vast industry knowledge and a robust database spanning 30 years and $14+ trillion in AUM, CEM helps more than half of the world’s top 300 pension schemes understand and manage their costs and performance. CEM also facilitates better pension outcomes by both sharing cutting edge research derived from its proprietary databases and hosting annual conferences.

About Top1000funds.com

Top1000funds.com is the market leading news and analysis site for the world’s largest institutional investors. It focuses on leading the global investment industry to continuous improvement through case studies of best practice in governance and decision making, portfolio construction and efficient portfolio management, fees and costs, and sustainable investing. The publication pushes the industry to question whether status quo processes and behaviours to tackle risks and opportunities will be sufficient in the future, and actively campaigns for diversity, sustainability, transparency, innovation and better alignment of fees in the investment industry. Top1000funds.com is read by investment professionals in more than 40 countries.

Amanda White of Top1000funds also reports on transparency improvements but more work needed on cost disclosure:

Funds around the world improved their scores on responsible investment disclosure by more than on any of the three other factors assessed in the 2023 Global Pension Transparency Benchmark.

The GPTB measures the transparency of disclosures of 15 pension systems across the value-generating measures of cost, governance, performance and responsible investment. Scores of all four factors improved this year compared to last year.

Responsible investment disclosures showed the most improvement, with the average score improving by 20 per cent, from an average score of 49 to 59 year-on-year.

This was followed by the governance factor, which achieved the highest average score this year of 65 out of a possible 100, an improvement of 11 per cent for the year. The gain was driven by 92 per cent of funds improving their governance disclosure.

Average scores for performance disclosures declined slightly, from 64 to 62 year on year.

Cost scores improved from an average of 48 to 51; however, with the stark improvement of the responsible investment factor, cost disclosures now rate as the lowest average score of all the four factors. Only 45 per cent of funds improved their public reporting on costs.

CEM Benchmarking product lead for transparency benchmarking Edsart Heuberger says that funds would generally gain the most by improving their external investment cost and responsible investing disclosures.

In terms of individual fund scores, the Dutch fund Stichting Pensioenfonds Zorg en Welzijn topped the list for cost. In the governance factor, three funds ranked equal first, all achieving the extraordinary result of full marks in their scores: Australia’s AustralianSuper, and Canada’s CDPQ and CPP Investments.

Norway’s Government Pension Fund Global was the best fund for transparency of disclosures related to performance and also took equal top spot with Dutch fund bpfBOUW for responsible investment.

In last year’s review it was noted that governance scores were most closely correlated with the overall score, and that perhaps it was the case that as good governance produces positive results, it creates greater incentive (or perhaps less disincentive) to be transparent with stakeholders.

CEM observes this year that responsible investing disclosures showed an equal correlation with governance and that good governance allows funds to move beyond simply managing assets and towards addressing wider environmental and social issues.

Cost factor

The average country cost factor score was 51 but there was huge variation between individual funds, with scores ranging from 7 to 93. Heuberger says as the dispersion in scores suggest, cost disclosures varied considerably in completeness, and he urges funds to pay more attention to this factor.

CEM’s asset-owner performance database clearly shows that net returns are materially impacted by investment management costs, with about 75 per cent of gross returns above benchmarks going to pay related investment expenses.

But paying more does not necessarily get you more: CEM says cost-effective investment management strategies generally outperform high-cost approaches over the long-term. Costs matter, and they should be understood, managed, and disclosed.

Barriers to comparing costs around the globe include differences in tax treatment, organisation/plan types, and accounting and regulatory standards, which all mean it is difficult to find common ground for assessment.

“Cost reporting seems to be the area where funds flounder a little bit,” Heuberger says. “It takes considerable effort internally, and also requires external managers to report to you. It could take five to 10 years to see the change required.”

Governance factor

The average country score for governance was 71 out of a possible 100. This represented an increase of seven from last year’s average score of 64, and makes it the best rated of the four factors.

The governance factor was one of the standout results in this year’s GPTB, with three funds ranked equal first and all three achieving the extraordinary result of full marks: AustralianSuper, CDPQ and CPP Investments all scored 100.

The biggest Canadian public funds continued to be the leaders in governance disclosures, consistent with their reputation of excellent governance. All five Canadian funds included in the benchmark featured in the top 10 funds for governance disclosures, and were all in the top 10 funds overall.

Performance factor

The overall average score for performance was 62, a slight decline from 64 last year. Average country scores ranged from 21 to 95.

The US and Canadian funds lead the way, with an average country score of 87 and 89 respectively.

These funds typically had extensive and good quality reporting across all performance components.

Responsible investing factor

Funds were scored based on 54 questions across three major components. The average country score was 49 out of 100 up from 42 in last year’s review, marking the biggest relative improvement among any of the four factors.

Improvements to disclosures were seen across all components and most countries, however this factor still has the greatest dispersion of scores reflecting that countries are at different stages of implementing responsible investing within their investing framework. Average country scores ranged from 0 to 94.

The Netherlands stole Sweden’s crown in this factor with a score of 77, besting the Swedish funds by a single point. Both countries had improved disclosures over the past year. The Nordic countries – Sweden, Denmark, Finland, and Norway – continued to do very well as a region on responsible investing, with all countries receiving scores well above average.

CEM’s Heuberger notes that funds were more likely to provide quantification of their responsible investing initiatives and this year, and that more funds went a step further and provided context by laying out longer-term goals.

“Several funds started producing stand-alone reports focused exclusively on responsible investing which provided comprehensive, holistic overviews of their programs,” he said.

While overall in the past three years there has been positive momentum in the advancement of transparency across all the factors, there is still room for improvement.

“Leading countries excel in different areas,” Heuberger said.

“Canadians have terrific reporting on governance and investment performance. The Dutch are world-class on costs. The Nordics excel in responsible investing.

“Generally, funds would gain the most by improving their external investment cost and responsible investing disclosures.”

For all the scores and rankings by country, fund and factor click here

Norges Bank Investment Management (NBIM) which manages Norway's sovereign wealth fund put out a press release on the world's most transparent investment fund:

The Government Pension Fund Global has reached the top of the Global Pension Transparency Benchmark. The ranking is published by CEM Benchmarking and Top1000funds.com."I am so proud of all my great colleagues in Norges Bank Investment Management. We aim to be the most transparent investment fund in the world, and we work really hard every day for it. This result is an important milestone and will inspire us to work even harder towards even greater transparency," says Nicolai Tangen, CEO of Norges Bank Investment Management.

The benchmark focuses on the transparency and quality of public disclosures, with quality relating to the completeness, clarity, information value, and comparability of disclosures.

"We truly believe in transparency. Our owners are the Norwegian people, and they deserve and expect to have access to information about what we do and how we do it," says Marthe Skaar, Chief Communications and External Relations Officer at Norges Bank Investment Management.

The Global Pension Transparency Benchmark is the world's first global standard for transparency among pension and institutional investment funds. It ranks 75 investment funds from 15 different countries. The overall scores look at four factors: governance and organization, performance, costs, and responsible investing.

The Government Pension Fund Global is ranked number one in both performance and responsible investing.

On LinkedIn, Nicolai Tangen, CEO of Norges Bank Investment Management posted a brief statement:

World Champions in transparency for the first time ever! Winning the Global Pension Transparency Benchmark just makes me so proud of my great colleagues! With a special thanks to Marit Kristine Bjøntegård who has coordinated our firm wide effort!

I posted this comment on his post:

Having conducted a special report on the governance of the Canadian public sector pension plan back in 2007 when I looked at international pension funds, I can confirm that Norway’s pension managed by NBIM deserves this honour. In many ways, you set the bar on transparency. Well done!

In many ways, NBIM does set the bar on transparency and just like CPP Investments, it has to as this is Norway's fund that belongs to all Norwegians just like the Canada Pension Plan belongs to all Canadians.

The contributors and beneficiaries of these large national pensions deserve to know everything about their plan, from costs to benchmarks to compensation to responsible investing.

One area where I believe Canada's Maple Eight need to do more is disclosure of their performance benchmarks in private markets.

It's great to say "we are putting 50% of our assets in private markets where we add significant value add over benchmarks and our senior executives deserve to get millions in compensation" but be transparent on what exactly those benchmarks are and explain in detail how they reflect the underlying risk of the portfolio.

Yes, Canada's large pension investment managers are transparent on compensation (for the most part) but a lot of work remains to be done to independently verify their benchmarks across public and private markets and whether they reflect the risks being taken in the underlying portfolio.

It is my contention -- and I speak with great authority on this -- that not all value add at Canada's large pension investment managers is created equal.

But you will not see CEM Benchmarking or Top1000funds cover this topic in detail for obvious reasons (it's a sensitive topic and relates back to compensation where everyone wants more every year).

Sure, Canada's large pension investment managers score high on governance but that's not enough to impress me (I know, it's really, really hard to impress me).

As far as responsible investing, CDPQ continues to be a global leader and you should read my last comment on adopting a Green IRR at their real estate subsidiary, Ivanhoé Cambridge.

Alright, let me wrap it up there and just state the obvious: transparency matters and it's a work in progress.

When these large funds are managing multi-billions from captive clients, they need to be very transparent about everything including benchmarks, costs and compensation.

Trust me, there's a lot of work that still needs to get done to raise the standards of transparency everywhere, including here in Canada.

Below, the Norwegian Government Pension Fund Global, commonly known as “the oil fund” owns more than 1,5 % of the worlds listed companies, managing around 11 trillion NOK (around 1 trillion USD) on behalf of the Norwegian population. The fund is based on the idea that the wealth from natural resources belong to everyone. In this talk at TEDxArendal 2021 the fund's CEO Nicolai Tangen gives insights into the core ideas behind the fund, and its purpose of securing generations to come. Tangen has broad experience in asset management and previously ran a hedge fund which he founded in 2005.

Tangen holds a bachelor’s degree in

finance from the Wharton School, a Master’s degree in the History of

Art from the Courtauld Institute of Art and in Social Psychology from

the London School of Economics. He has also studied Russian at the

Norwegian Armed Forces’ School of Intelligence and Security.

And back in February, Bill Gates was interviewed today by Nicolai Tangen, the CEO of the Norwegian Sovereign Wealth Fund, the largest investment fund in the world. In the interview, Bill Gates shared his opinion about the current AI development and the success of ChatGPT. He think ChatGPT is a threat to Google, and will also "reshuffle" Amazon, Microsoft and Apple's markets.

The full podcast with Gates is available here and al podcasts are available here.

Comments

Post a Comment