Forget The S&P 5,000 Milestone, Enjoy The Super Bowl!

Stocks rose on Friday after December’s revised inflation reading 2 came in lower than first reported, and the S&P 500 closed above the 3 key 5,000 level as strong earnings and economic news chugged on.

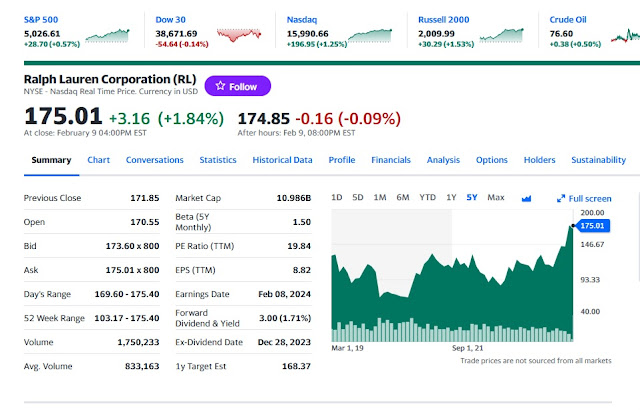

The S&P 500 rose 0.57% to end at 5,026.61, while the Nasdaq Composite rallied 1.25% to close at 15,990.66. The Dow Jones Industrial Average slipped 54.64 points, or 0.14%, to settle at 38,671.69.

For 4 the week, the S&P added 1.4%, while the Nasdaq gained 2.3%. The Dow 5 finished flat. All three major averages notched their fifth straight 6 winning week and 14th positive week in 15.

“At the end of the day, 7 we’re still seeing whopping good news on an economic front, and the 8 market is reacting to that,” said Dana D’Auria, co-chief investment 9 officer at Envestnet. “The longer that story plays out, the more likely 10 it seems to the market that we actually are sticking a landing here.”

A 11 solid earnings season, easing inflation data and a resilient economy 12 have charged 2024′s market rally. It’s also propelled the S&P to 13 close above the 5,000 level after first touching the milestone during 14 Thursday’s session. The index first crossed 4,000 in April 2021.

“A close above this closely watched level will undoubtedly create 15 headlines and further feed fear of missing out (FOMO) emotions,” said 16 Adam Turnquist, chief technical strategist at LPL Financial. “Outside of 17 a potential sentiment boost, round numbers such as 5,000 often provide a 18 psychological area of support or resistance for the market.”

A revision lower 19 in December’s consumer price index also helped sentiment. The 20 government adjusted the figure to a 0.2% increase, down from a 0.3% 21 increase initially reported. Core inflation figures, excluding food and 22 energy, were the same. January’s CPI figures are due out next week.

Megacap technology stocks gained again on Friday, contributing to the S&P’s march above 5,000. Nvidia jumped 3.6%, and Alphabet added more than 2%. Cloudflare skyrocketed 19.5% on strong earnings, boosting the broader cloud sector in tandem. Semiconductor stocks also rose, with the VanEck Semiconductor ETF (SMH) edging up 2.2%.

The back half of the fourth-quarter earnings reporting period pressed on, with PepsiCo falling 3.6% on mixed results. Take-Two Interactive slumped 8.7% on a disappointing outlook, while Pinterest dropped 9.5% after issuing a weaker-than-expected forecast and missing revenue estimates.

Despite 23 these negative prints, earnings have so far proven more robust than 24 expected. A total of 332 S&P companies have reported results, with 25 about 81% of them reporting earnings above analyst expectations, 26 according to LSEG. That compares to a 67% beat rate in a typical quarter 27 since 1994.

There's no doubt that companies are reporting strong earnings and beating expectations.

To wit, just a few I tracked this week:

There were plenty of other winners and losers this week. IBD did a good weekly earnings roundup here.

When you see stocks popping 15, 20, 30% or more after earnings, you know there's still plenty of liquidity out there chasing stocks.

It's actually incredible because the macro backdrop remains poor and yet earnings keep forging ahead, for now.

And if earnings remain relatively strong, then companies will not shed labor to cut costs.

But all this will not last. We are already seeing signs of slowing and major tech companies are starting to shed jobs, Cisco being the latest one:

BREAKING: Cisco, $CSCO, is planning to cut "thousands of employees" in a massive corporate restructuring, according to Reuters.

— The Kobeissi Letter (@KobeissiLetter) February 9, 2024

The company is looking to focus on high-growth areas in its restructuring initiatives.

An announcement could come next week as the company prepares… pic.twitter.com/9XcGlbW8cv

And as Francois Trahan reminds us, earnings still drive the show when it comes to labor markets and many companies are struggling:

One thing that seems clear from Q4 EPS reporting season thus far is that some companies are struggling to keep up with expectations. Surely, the Magnificent 7 are fine (sorry, meant to say Magnificent 6), but numerous large companies have disappointed. pic.twitter.com/Y6BrRnwEAj

— Francois Trahan (@FrancoisTrahan) February 7, 2024

Still, overall earnings remain robust which is why the S&P 500 closed over the 5,000 mark.

I don't get too excited with these milestones because as Martin Roberge of Canaccord Genuity reminds us in his latest weekly wrap-up, market risks rise considerably once stocks rise 5% above a milestone:

With the S&P 500 potentially closing above 5,000, our Chart of the Week shows the S&P 500 performance after the index cleared similar milestones at 1,000, 2,000, 3,000, and 4,000. One key takeaway from our chart is that, historically, a milestone tends to act as an anchor rather than as a springboard for stocks. We can see that more often than not, at one point, gains past the milestone are lost within the next year. In fact, each episode contains an interim peak-to-through drawdown of at least 12% (min. 12.4% in 2015 and max. 33.9% in 2020). These corrections, however, tend to occur in the second 6-month tranche of the 12-month window. Last, with the S&P 500 up ~23% Y/Y at the 5,000 milestone, the current episode may compare more to the 1,000 and 2,000 milestones, in our view, two episodes showing that market risk rises considerably if the S&P 500 jumps > 5% above the milestone. This would equate to SPX > 5,250. In all, though one-year returns after previous milestones are skewed positively, we believe investors must adopt a more tactical approach to markets and be wary of a 10%+ drawdown, which has been the norm rather than the exception.

What this tells me is we are cruising for a bruising and I'm expecting something will hit markets by the end of Q1 or Q2, and it's not going to be good.

And again, if you look closely at companies that reported, the S&P 5000 cannot mask the chaos beneath the calm:

The calm, however, is only surface deep. Nowhere is that more true than in shares of companies that have reported their fourth-quarter results. Yes, we know that earnings are supposed to cause stocks to have big moves. But the recent responses have been larger than normal: As of Thursday, the median S&P 500 stock has moved 3.6% after reporting, according to Dow Jones market data, nearly a point higher than the 2.7% median over the past 10 years.

These large swings are happening because the outlook for companies is far less certain than what it appears to be for the overall market. It also reflects the uncertainty many investors feel as they watch an expensive market—the S&P 500 trades at 20.4 times 12-month forward earnings—make its way higher while seeming to ignore the possibility that economic growth could decelerate, disinflation could peter out short of the Fed’s target, or that rates could remain right where they are.

“You’ve got investors on edge, so they’re reacting somewhat more intensely to these results,” says Sevens Report’s Tom Essaye.

For now, that volatility isn’t reflected in the Cboe Volatility Index, or VIX, which sits near 12.8, well below its 20-year average of 17.7 and down from 21.7 on Oct. 20, a level that seems too low given the S&P 500’s 21% gain since bottoming in October—and given the risks that are lurking. Those risks include high valuations, sticky inflation, a cautious Fed, and even a mild recession, according to Evercore ISI strategist Julian Emanuel, who thinks the next big move in the S&P 500 could be 10% to the downside. “Volatility is the baseline, not the outlier,” he writes.

And something investors should start preparing for now.

Indeed, the cost of protection hasn't been this low for a while and vol sellers are picking dimes in front of a steamroller, but they remain on the right side of that trade, for now.

As far as the S&P 500 reaching the 5,000 milestone, be prepared for anything here and no Nvidia will not save your portfolio when it hits the fan:

For those wondering how NVDA can continue going higher every day, consider that the top performing ETF year-to-date is a 2x futures-levered single stock ETF (NVDX). Combined with record call option volume.

— Mac10 (@SuburbanDrone) February 9, 2024

Making Nvidia the most juiced stock in market history. pic.twitter.com/8P5IWrDoT5

Lastly, my former boss now Canadian senator, Clement Gignac, posted this on LinkedIn:

Superbowl advertising indicator:

Still too much liquidity in the economy …or just the Taylor Swift effect?

The cost for a 30-second commercial during the Super Bowl has reached a record high this year: $7 million. Some advertisers are even paying $4 million for a pregame ad.

Since the first Super Bowl in 1967, the cost of a 30-second ad has gone up 185x, according to a research paper from BofA Securities that was published on Thursday. An ad back in 1967 cost $37,500.

A 185x jump since 1967, even considering the higher-than-normal recent inflation environment, is huge. If some Super Bowl-watching favorites kept pace with that type of inflation, chicken wings would cost $43 a pound today (23 cents a pound in 1967), and a six-pack of beer would be $340.

Non-football items like a gallon of gas would cost $61 today if they inflated as much as the price of a Super Bowl commercial, the S&P 500 index would be trading at 16,374, and the average price of a house would be $4.2 million.

Hum! Hard to believe that US economy needs Fed rate cuts before summer!

There's way too much money out there (average Super Bowl ticket sold on StubHub was $8,600, down from about $9,300 on Monday) and I too wonder if the Fed will cut rates in May or later if this silliness keeps going on (unless something breaks).

Alright, enjoy the Super Bowl, it will be a great game and I can't wait to see it and the Halftime show featuring Usher and his special guests (Beyonce? Taylor Swift?).

All I know is come Monday, either the Chiefs or 49ers will be the Super Bowl champions and while that's exciting, the S&P reaching 5,000 shouldn't excite you too much, start preparing for the worst.

Below, Jeremy Siegel, Wharton School professor, joins 'Closing Bell' to discuss the S&P 500 closing in on the 5,000 level and what it means for the markets.

Next, Mark Newton, Global Head of Technical Strategy at Fundstrat, and Stephanie Link, Chief Investment Strategist at Hightower, discuss the S&P breaking above the 5,000 mark for the first time ever.

Third, Katie Stockton, Fairlead Strategies founder and managing partner, joins 'Squawk Box' to discuss the latest market trends, how far the S&P 500 can go, consumer sentiment, the Fed's rate path outlook, and more.

Fourth, Doug Clinton, Deepwater Asset Management managing partner, joins 'Closing Bell' to discuss the sustainability of mega cap gains.

Fifth, Ed Clissold, Ned Davis Research chief U.S. strategist, joins 'Closing Bell' to discuss the economy and his Fed expectations.

Sixth, Komal Sri-Kumar, president of Sri-Kumar Global Strategies, joins 'Squawk Box' to discuss the latest market trends, the looming commercial real estate crisis, impact on the Fed's rate path outlook, and more.

Seventh, China's overreliance on real estate has sent its economy tumbling toward 2008-era financial conditions, Kyle Bass of Hayman Capital told CNBC on Tuesday.

Lastly, a little Usher to get you into the Super Bowl this weekend. Yeah!!

Comments

Post a Comment