IMCO's CIO on Why They're Betting Big on Private Assets

The Investment Management Corp. of Ontario is looking at private assets as an opportunity to support investment returns across various Ontario-based pension plans.

“We believe in private assets,” says Rossitsa Stoyanova, the IMCO’s chief investment officer. “They allow us to use some of our advantages like having a long-term horizon, our [in-house] expertise and taking a view on different trends and picking opportunities to invest in those trends.”

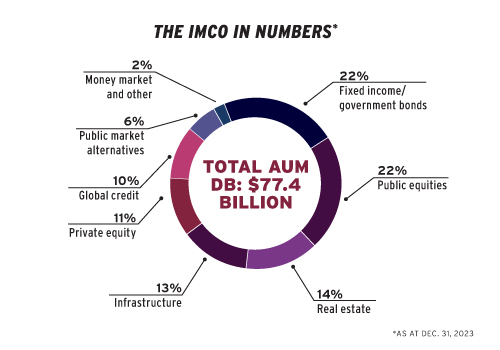

In 2023, the IMCO added two private asset pools to its portfolio, one for global credit and another for private equity, which, as of Dec. 31, 2023, totalled $7 billion and $7.8 billion, respectively. Across the overall portfolio, private equity accounts for 11 per cent of its total assets under management with an allocation of $8.2 billion.

The strategy capitalizes on opportunities that may not easily fit into traditional asset classes, says Stoyanova. Last year, the investment organization’s infrastructure team and fundamental equities division joined forces to close a deal with Swedish battery developer and manufacturer Northvolt.

“Sometimes the mandates of asset classes can overlap. [Rather than] being so distinct that you’re missing opportunities, I think [our approach] allows for a balance.”

The IMCO is pursuing private asset investments exclusively through collaboration deals with general partners, she says, adding these arrangements require increased speed and nimbleness on the part of institutional investors. To meet this challenge, the IMCO is prioritizing a streamlined due-diligence process to assess the viability of a deal presented by a GP. The IMCO seeks partnerships with investors that share a similar vision on a variety of investment trends, she says, noting investments in private assets can also allow institutional investors to influence concepts like sustainability.

“We pick partners who think the same way because that means the relationship will outlast the fads.”

The IMCO has committed to invest $5 billion in energy transition investments by 2027. While this commitment has primarily focused on infrastructure investments, the organization is expanding this approach to other parts of its portfolio.

As plan sponsors continue to post negative returns in real estate — the IMCO saw a negative 13 per cent return from the asset class in 2023 — Stoyanova says it’s important to remember the role of leverage and just how critical diversification can be when weathering economic storms.

“Diversification is important — [particularly] diversification beyond retail and office into logistics, life sciences, multi-residential properties [and] data centres.”

While increasing volatility is pushing demand for faster investment results, Stoyanova believes organizations with a long-term horizon need to stay the course, adding she’s worried about diminishing patience among institutional investors.

“I just worry about people being impatient and saying, ‘It’s not working, let’s change course.’ I think it requires time to see whether it’s working, whether you’re on the right path.”

As one of the few women CIOs working at a large Canadian pension fund, she wants to see more investment organizations consider the voices of women inside their organizational structures when updating internal policy. Instead of relying on one-size-fits-all policies built on assumptions like parental concession requirements, she argues for more inclusive dialogue to truly help uplift women working in the institutional investment sector.

“I think we should stop assuming and just ask people what works for them and really listen and be flexible. I think that will help.”

Alright, it's Wednesday, aka Fed day, so I'm not going to spend too much time on this article but cover some important things in this post.

First, it's a bit of an oxymoron saying "IMCO is betting big on private assets" since the bulk of its assets (55% to 60% depending how much Private Credit figures into Global Credit) are in Public Markets.

It is true that IMCO has hired a lot of people to ramp up Private Markets over the last five years and that's where their focus clearly is, adopting a strong co-investment approach with general partners (GPs).

And in order to co-invest with top GPs, reducing fee drag and maintaining a healthy allocation to PE, they need an experienced team that can evaluate co-investments quickly and speed up turnaround time not to miss out on great opportunities.

It's pretty much the same at all of Canada's Maple Eight, maybe a bit different at OMERS Private Equity which does more direct deals, but the name of the game is invest in top GPs and make sure you secure co-investments with them on larger transactions to reduce fee drag.

In that regard, IMCO isn't doing anything new here.

As I explained on Monday when I went over a fireside chat with BCI's Head of PE Jim Pittman, in private equity, it's all about maintaining those strategic relationships, especially with the larger PE funds as they feed your program and ensure you gain access to meaningful co-investments.

In Real Estate, IMCO has the same problems others have but it's in a bigger pickle there as Office and Retail still make up over 50% of the assets in that portfolio (taken from 2022 and 2023 annual reports):

Yes, they are slowly diversifying away from Office and Retail which they inherited from their two anchor investors into logistics, multifamily, life sciences and other sectors but it takes time and that portfolio will continue to weigh on overall returns.

I also noticed that Andrew Garrett, former Senior Principal of Real Estate at IMCO, left the organization which is too bad because I liked him and thought he was adding value there.

Another person who is missing from IMCO's now beefed up investment team is Christian Hensley, the former Senior Managing Director, Public Equities and Credit who was appointed to that position back in April, 2019 (maybe he left last year, can't remember).

The turnover at IMCO since it began operating in 2017 is staggering, a lot of big talent has come and gone in that organization.

Hopefully the team in place now is here to stay because they need to focus on their long-term strategy in privates and make sure they keep talented people there to support that effort.

Overall, IMCO is heading in the right direction and I think CIO Rossitsa Stoyanova is doing a decent job but there's more work to be done there.

Take the time to read IMCO's 2023 Annual Report here for more details on all its asset classes and more.

Below, Jeffrey Gundlach, DoubleLine Capital CEO, joins 'Closing Bell' to discuss the Federal Reserve's decision to cut rates by 50 basis-points, the impact to treasury markets, and more.

Also, David Kelly, JPMorgan Asset Management chief global strategist; Claudia Sahm, New Century chief economist; and Jim Caron, CIO of cross-asset solutions at Morgan Stanley Investment Management, join CNBC's 'Power Lunch' to break down the Fed's decision to cut interest rates by 50 basis points and what it means for markets.

Lastly, Federal Reserve Chair Jerome Powell details why the FOMC cut interest rates by 50 basis points to a new range of 4.75% to 5%. He says the Fed is still squarely focused on its dual mandate and that there was a notable step down in payroll gains. He speaks in Washington.

My take: the Fed is way behind the curve but I was surprised it cut by 50 basis points given many stocks like Walmart are at an all-time high and the economy seems to be humming along so far (I expect unemployment rate will soar over next 12 months).

The only thing that crossed my mind today after the Fed cut by 50 is Powell is a former private equity executive and that industry is struggling and needs lower rates to get transactions going. Maybe some of his former colleagues convinced him to start lowering rates drastically as soon as possible.

Whatever the case, the global easing cycle has begun and a major recession lies ahead. Buckle up!

Comments

Post a Comment