Stocks Recover All Losses Since Liberation Day

Stocks rose on Friday as Wall Street digested a better-than-expected nonfarm payrolls report for April, which eased recession fears and lifted the S&P 500 for its longest winning streak in just over two decades.

The S&P 500 advanced 1.47% and closed at 5,686.67. This marked the broad market index’s ninth consecutive day of gains and its longest winning run since November 2004. The Dow Jones Industrial Average jumped 564.47 points, or 1.39%, to end at 41,317.43. The Nasdaq Composite gained 1.51% and settled at 17,977.73.

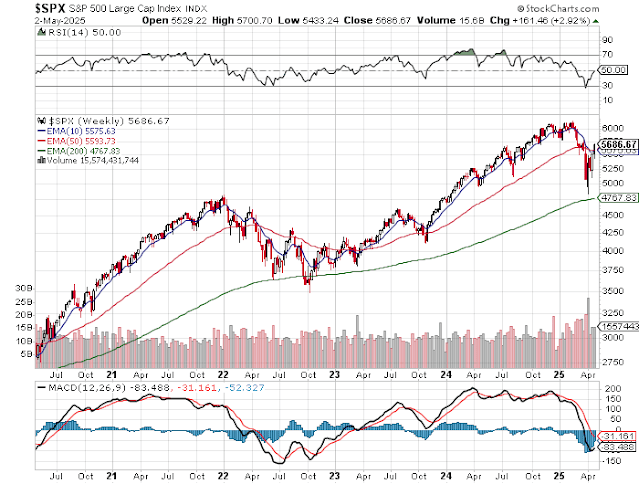

With Friday’s surge, the S&P 500 has now recovered its losses since April 2, when President Donald Trump announced his “reciprocal” tariffs. This comes a day after the tech-heavy Nasdaq accomplished the same feat.

Payrolls grew by 177,000 in April, above the 133,000 that economists polled by Dow Jones had anticipated. That figure was still down sharply from the 228,000 added in March but much better than feared after recession worries ramped up last month. The unemployment rate stood at 4.2%, in line with expectations.

“Markets breathed a sigh of relief this morning as the jobs data came in better than expected,” said Chris Zaccarelli, chief investment officer at Northlight Asset Management. “While recession fears are still simmering on the back burner, the buy-the-dip dynamic can continue – at least until the tariff pause runs out.”

Investors were already upbeat prior to the strong jobs report after China said that it is evaluating the possibility of starting trade negotiations with the U.S. Still, Chinese authorities reaffirmed their belief that the U.S. should remove all unilateral tariffs, saying in a statement that “if the U.S. wants to talk, it should show its sincerity and be prepared to correct its wrong practices and cancel the unilateral tariffs.” Later in the day, a report from The Wall Street Journal suggested that Beijing is open to trade talks.

The Street was also mulling over earnings reports from two “Magnificent Seven” members. Apple slid 3.7% after posting fiscal second-quarter revenue from its services division that fell short against analyst estimates. Additionally, the iPhone maker said it expects to add $900 million in costs in the current quarter due to tariffs. Amazon shares, meanwhile, were marginally lower after the company issued light guidance, highlighting “tariffs and trade policies” as factors.

“We’ve already seen how financial markets will react if the administration moves forward with their initial tariff plan, so unless they take a different tack in July when the 90-day pause expires, we will see market action similar to the first week of April,” Zaccarelli also said.

Stocks have made an incredible comeback since Trump announced last month that’s he’s temporarily reducing his new tariff rates for most countries to 10% for 90 days. The market has especially picked up steam lately, leading to the S&P 500′s winning streak, as solid earnings have come out.

All three major averages posted their second positive week in a row. The S&P 500 added 2.9%, sitting more than 7% below its February high after at one point being down nearly 20%. The Dow posted a 3% advance on the week, while the Nasdaq added 3.4%.

‘We’ve passed peak tariff tantrum,’ InfraCap’s Jay Hatfield says

The recent sell-off spurred by worries around President Donald Trump’s tariff plans may be over, said Jay Hatfield of Infrastructure Capital Advisors.

“We think we’ve passed peak tariff tantrum,” the firm’s chief executive said in an interview with CNBC, adding that he has a year-end target on the S&P 500 of 6,600. That implies nearly 18% upside from Thursday’s close.

Hatfield also thinks there’s going to be a summer rally once the market gets through a “seasonally weak” May-to-June period. That said, he doesn’t believe the S&P 500 will rally past the 6,000 level until most concerns among investors have been resolved.

“We think there’s three areas of uncertainties, not just tariffs but also Fed policy and tax policy,” he added. “We don’t think we’re going to bust significantly above 6,000 until we get at least two of those three pretty well defined.”

It was a very strong week in the stock market led by mega cap tech stocks like Microsoft and Meta which posted solid earnings:

But the real story again this year is Palantir which was up over 300% last year and is flying high once again this year:

Incredibly, Palantir shares hit a low of $66 on April 7th and have since ripped higher and are right on the cusp of making a new 52-week high.

All this action spurred the Nasdaq higher this week but it's still off its 52-week high:

Nonetheless, all the talk of tariffs, recession, the end of American exceptionalism looks silly when you look at the S&P 500 which has now recovered all its losses since Liberation Day (April 2nd).More worrisome, long maturity US Treasuries are also struggling to rally as investors weigh the real possibility of stagflation ahead:

Also, despite the recent selloff which I foresaw, gold shares remain in a solid uptrend:

Not surprisingly, when you look at the top performing US large cap stocks, gold shares figure prominently (a few Canadian gold companies there) but it's a mixed bag with Palantir and biotechs I track closely like Verona Pharma, Summit therapeutics and TG Therapeutics.

Apart from a few stocks however, biotech shares remain well off their 52-week high even after rallying massively the last couple of weeks:

Still, I see a few great opportunities in biotech as long as RISK ON markets gain traction but you really need to dig deep, pick your spots and know the companies and risks very well.

The big question that still persists is whether there is a slowdown in the US economy and are we in a recession.

This week, the US economy contracted for first time since 2022 as imports surged but today's US jobs report showed defied expectations as nonfarm payrolls increased a seasonally adjusted 177,000 for the month, slightly below the downwardly revised 185,000 in March but above the Dow Jones estimate for 133,000.

The unemployment rate, however, stayed at 4.2%, as expected, indicating that the labor market is holding relatively stable.

The jury is still out in terms of recession but some indicators like housing activity are already pointing to one and I would encourage my institutional readers to listen to Francois Trahan's latest conference call entitled "It's Different This Time...Legitimately!".

Francois thinks all roads lead to stagflation and things will come to fruition in the second half of the year.

Alright, let me wrap this up and post some great interviews below.

First, Nicolai Tangen, the head of Norway’s $1.8 trillion sovereign wealth fund, discusses the outlook for global markets amid recent trade policy upheaval and what that means for the fund's US investments. He talks with Bloomberg's Francine Lacqua in Oslo.

Tangen also spoke to CNBC International discussing investments in the US at the Norwegian sovereign wealth fund's annual investment conference.

Third, Mike Wilson, Morgan Stanley, joined 'Closing Bell' on Thursday to discuss what markets need to see to indicate a more sustained recovery from April's lows, if the equity rally is sustainable, and much more.

Fourth, Adam Parker, Trivariate Research founder, joins 'Closing Bell' to discuss the most recent news that sticks out to Parker the most, investor's attitude towards equity markets, and much more.

Fifth, David Zervos, Jefferies chief market strategist, joins CNBC's 'Squawk on the Street' to discuss outlooks on tech.

Sixth, Bob Elliott, Unlimited CEO and Adam Kobeissi, The Kobeissi Letter editor-in-chief, join 'Closing Bell: Overtime' to discuss market rally, their outlook for stocks and Fed day.

Seventh, Jeremy Siegel, Wharton School professor of finance, joins CNBC's 'Closing Bell' to discuss market outlooks.

Lastly, Bill Smead, Smead Capital Management, joins 'The Exchange' to discuss the mood in Omaha ahead of Berkshire Hathaway's annual investor meeting, the market opportunities, and much more.

Comments

Post a Comment