CPP Investments Returns 1% in Fiscal Q1

The Canada Pension Plan Investment Board says it earned a net return of one per cent for its first quarter.

CPP Investments chief executive John Graham says shifting trade dynamics and broader geopolitical uncertainty fuelled renewed volatility in global markets during the quarter.

“Through these events, the fund remained resilient, supported by our diversified investment strategy, including broad geographic exposure that helps offset shifts in the employment, wage and demographic trends that determine CPP contributions,” Graham said in a statement Thursday.

“We remain focused on creating long-term value for the benefit of CPP contributors and beneficiaries.”

The fund noted that while markets declined early in the period, public equities rebounded by quarter end, contributing to overall performance.

It said energy assets and strong results from its external manager programs also contributed to returns, however it faced headwinds from a weakening U.S. dollar relative to the loonie amid tariff-related uncertainty.

The investment manager said its net assets stood at $731.7-billion at June 30, up from $714.4-billion at the end of the previous quarter.

It said the increase included $7.5-billion in net income and $9.8-billion in net transfers from the Canada Pension Plan.

The fund noted it routinely receives more CPP contributions than required to pay benefits during the first part of the calendar year, partially offset by benefit payments exceeding contributions in the final months of the year.

The fund’s 10-year annualized net return was 8.4 per cent.

Earlier today, CPP Investments released its quarterly results stating its net assets total $731.7 billion as at the end of the first quarter fiscal 2026:

- Net assets increase by $17.3 billion

- 10-year net return of 8.4%

- Added $500 billion in cumulative net income since inception

TORONTO, ON (August 14, 2025): Canada Pension Plan Investment Board (CPP Investments) ended its first quarter of fiscal 2026 on June 30, 2025, with net assets of $731.7 billion, compared to $714.4 billion at the end of the previous quarter.The $17.3 billion increase in net assets for the quarter consisted of $7.5 billion in net income and $9.8 billion in net transfers from the Canada Pension Plan (CPP). CPP Investments routinely receives more CPP contributions than required to pay benefits during the first part of the calendar year, partially offset by benefit payments exceeding contributions in the final months of the year.

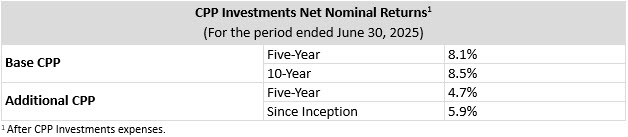

The Fund, composed of the base CPP and additional CPP accounts, generated a 10-year annualized net return of 8.4%. For the quarter, the Fund’s net return was 1.0%. Since CPP Investments first started investing the Fund in 1999, and including the first quarter of fiscal 2026, it has contributed $499.6 billion in cumulative net income.

“Shifting trade dynamics and broader geopolitical uncertainty fueled renewed volatility in global markets during the first quarter of our fiscal year,” said John Graham, President & CEO. “Through these events, the Fund remained resilient, supported by our diversified investment strategy, including broad geographic exposure that helps offset shifts in the employment, wage and demographic trends that determine CPP contributions. We remain focused on creating long-term value for the benefit of CPP contributors and beneficiaries.”

The Fund delivered positive results in the first quarter, despite considerable market volatility. While markets declined early in the period, public equities rebounded by quarter end, contributing to overall Fund performance. Energy assets and strong results from our external manager programs also contributed positively to returns. These gains were largely offset by the weakening of the U.S. dollar relative to the Canadian dollar amid tariff-related uncertainty. While foreign exchange fluctuations may impact returns in the short term, maintaining a well-diversified global currency composition helps to mitigate overall return volatility over longer time horizons.

Performance of the Base and Additional CPP Accounts

The base CPP account ended its first quarter of fiscal 2026 on June 30, 2025, with net assets of $668.0 billion, compared to $655.8 billion at the end of the previous quarter. The $12.2 billion increase in net assets consisted of $7.3 billion in net income and $4.9 billion in net transfers from the base CPP. The base CPP account’s net return for the quarter was 1.1% and the 10-year annualized net return was 8.5%.

The additional CPP account ended its first quarter of fiscal 2026 on June 30, 2025, with net assets of $63.7 billion, compared to $58.6 billion at the end of the previous quarter. The $5.1 billion increase in assets consisted of $0.2 billion in net income and $4.9 billion in net transfers from the additional CPP. The additional CPP account’s net return for the quarter was 0.2% and the annualized net return since inception was 5.9%.

The additional CPP was designed with a different legislative funding profile and contribution rate compared to the base CPP. Given the differences in its design, the additional CPP has had a different market risk target and investment profile since its inception in 2019. As a result of these differences, we expect the performance of the additional CPP to generally differ from that of the base CPP.

Furthermore, due to the differences in its net contribution profile, the additional CPP account’s assets are also expected to grow at a much faster rate than those in the base CPP account.

Long-Term Financial Sustainability

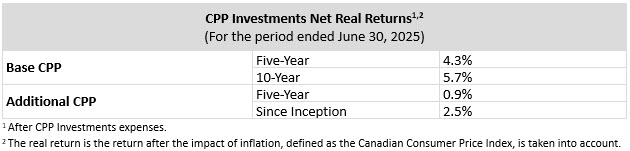

Every three years, the Office of the Chief Actuary of Canada, an independent federal body that provides checks and balances on the future costs of the CPP, evaluates the financial sustainability of the CPP over a long period. In the most recent triennial review published in December 2022, the Chief Actuary reaffirmed that, as at December 31, 2021, both the base and additional CPP continue to be sustainable over the long term at the legislated contribution rates.

The Chief Actuary’s projections are based on the assumption that, over the 75 years following 2021, the base CPP account will earn an average annual rate of return of 3.69% above the rate of Canadian consumer price inflation. The corresponding assumption is that the additional CPP account will earn an average annual real rate of return of 3.27%.

CPP Investments continues to build a portfolio designed to achieve a maximum rate of return without undue risk of loss, while considering the factors that may affect the funding of the CPP and its ability to meet its financial obligations on any given day. The CPP is designed to serve today’s contributors and beneficiaries while looking ahead to future decades and across multiple generations. Accordingly, long-term results are a more appropriate measure of CPP Investments’ performance and plan sustainability.

Operational Highlights

Corporate developments

- Recognized by the 2025 GlobalCapital Bond Awards in the Sovereign, Supranational and Agency (SSA) category, winning the award for Most Impressive SSA Issuer in Australian dollars. The awards celebrate excellence across the global bond markets and the winners were selected by market participants.

- CPP Investments Insights Institute contributed perspectives on two significant themes affecting capital markets participants: Investing in a changing world explores how we and other institutional investors are responding to climate-related physical risks; and Investing in Talent, Unlocking Value: The Potential of Gen Z Women reviews how investors can unlock value by empowering Gen Z women in the workforce.

First Quarter Investment HighlightsCapital Markets and Factor Investing

- Completed eight co-investments alongside external fund managers, committing approximately C$525 million to macro-themed strategies in addition to equity trades in health care and consumer discretionary sectors.

Credit Investments

- Invested US$100 million into a syndicated credit-linked note with Deutsche Bank, a leading global financial institution, for a diversified portfolio of corporate loans across geographic markets.

- Invested A$300 million (C$264 million) in an Australian commercial real estate debt strategy managed by Nuveen, a global investment manager. The strategy will focus on institutional senior and junior loans secured by prime real estate across major cities in Australia.

- Committed financing to support TA Associates’ strategic investment in Craigs Investment Partners, a leading New Zealand-based wealth management advisory firm.

- Invested US$300 million into xAI’s debt issuance as part of a broader capital raise to finance the construction of the company’s second data centre in Memphis, Tennessee. Headquartered in the U.S., xAI develops artificial intelligence technology systems.

- Invested US$300 million in the partial royalty monetization of Leqvio, a cardiovascular drug for the treatment of hyperlipidemia.

- Invested in the loan facilities of Waste Services Group, a waste management solution provider in Australia.

- Completed the investment in a new wireless network infrastructure subsidiary of Rogers Communications Inc. through a Blackstone-led acquisition of a non-controlling interest in the business unit.

Private Equity

- Invested US$50 million for an approximate 1.6% stake in Acronis alongside EQT. Acronis is a global cybersecurity, data back-up and IT operations software company.

- Invested €50 million for a minority stake in Applus, a Spanish global leader in testing, inspection and certification services in more than 70 countries, alongside TDR Capital.

- Invested A$75 million (C$66 million) for an approximate 10% stake in the take-private of SG Fleet, a leading fleet management organization in Australia and New Zealand, alongside Pacific Equity Partners.

- Committed US$193 million to a single-asset continuation fund managed by New Mountain Capital for Real Chemistry, a global provider of commercialization solutions to pharmaceutical and health care companies.

- Invested approximately €275 million in IFS, acquiring shares from EQT alongside other investors. Headquartered in Sweden, IFS is a leading global provider of cloud enterprise software and industrial AI applications.

- Committed A$150 million (C$135 million) to Pacific Equity Partners PE Fund VII, which focuses on upper mid-market buyout opportunities in Australia and New Zealand.

- Committed US$75 million to Radical Fund IV, managed by Radical Ventures, a Canadian-headquartered AI-focused venture and growth manager with offices in Toronto, San Francisco and London, bringing our total commitment to approximately US$280 million across various fundraising cycles since the initial investment in 2019.

- Invested US$75 million in the growth equity funding round of OpenAI, an artificial intelligence research and deployment company focused on building AI applications, hardware and infrastructure, including ChatGPT, alongside Sands Capital.

- Invested US$25 million in the partial recapitalization of LogicMonitor, a software-as-a-service based platform for AI-powered data centres based in the U.S., alongside PSG.

- Invested an additional US$20 million in the Series J funding of Databricks, a data, analytics and AI company based in the U.S., alongside Sands Capital, bringing our stake to just under 1%. We first invested in Databricks in 2021.

- Agreed to support Salesforce’s proposed acquisition of Informatica, an AI-powered enterprise cloud data management company, in which we have been a major investor since 2015. Net proceeds from the sale of our current stake of approximately 36% are expected to be US$2.7 billion upon the completion of the transaction.

- Sold a diversified portfolio of 25 limited partnership fund interests in North American and European buyout funds to Ares Management Private Equity Secondaries funds and CVC Secondary Partners for net proceeds of approximately C$1.2 billion. The portfolio of interests represents various primary commitments and secondary purchases made in funds over 10 years old.

Real Assets

- Committed up to an additional €460 million to support Nido Living, a European student housing operator, in its acquisition of Livensa Living, a student housing platform operating across Iberia. Upon closing, Nido will become one of the largest student housing operators in Europe with approximately 13,000 beds. We acquired Nido Living in 2024.

- Committed JPY192.5 billion (C$1.8 billion) in Japan DC Partners I LP, a data centre development partnership managed by Ares Management following its acquisition of GCP. The partnership will support the development of three large-scale campuses in Greater Tokyo to meet growing demand for scalable computing and AI solutions.

- Sold a net 5.81% stake in 407 Express Toll Route (ETR), a 108-km toll highway spanning the Greater Toronto Area in Canada, for net proceeds of approximately C$2.39 billion. We continue to hold a significant interest in 407 ETR.

- Sold our 50% interest in a portfolio of seven high-quality office properties in Western Canada to Oxford Properties for C$730 million. Our original investments were made in 2005 and 2016.

- Sold our stake in Encino Acquisition Partners (EAP), a leading oil and gas producer in the U.S., to EOG Resources, which acquired 100% of EAP for US$5.6 billion, inclusive of EAP’s net debt. We held our 98% ownership position since 2017.

Transaction Highlights Following the Quarter

- Entered into a definitive agreement to sell our 49.87% stake in Transportadora de Gas del Peru S.A., which operates Peru’s main natural gas and natural gas liquids pipelines under a long-term concession, to vehicles managed by EIG. Our original investment was made in 2013. The transaction is subject to customary closing conditions and regulatory approvals.

- Expanded the Build-For-Rent joint venture with Greystar, a global leader in property management, investment management, and development, to a total equity commitment of US$1.4 billion for our 95% stake. The joint venture will develop a mix of residential properties across the U.S. including detached single-family homes, duplexes, and townhomes.

- Invested C$225 million in a loan to construct a hyperscale expansion to a data center in Cambridge, Ontario, Canada, funding 50% of the total construction cost, alongside Deutsche Bank.

- Sold our 50% stake in each of two real estate assets located in Birmingham U.K., the Bullring and Grand Central Shopping Centres, to joint-venture partner Hammerson Plc. Net proceeds from the sales were approximately C$615 million. We first invested in the Bullring in 2013 and in Grand Central in 2016.

- Invested approximately US$700 million for a minority position in NEOGOV, a leading provider of HR and compliance software, alongside EQT.

- Entered into a definitive agreement to sell our 49% stake in Island Star Mall Developers Private Limited, a real-estate investment program in India, to joint venture partner The Phoenix Mills Limited and affiliates. Net proceeds will be approximately INR 54.5 billion (C$871 million). The joint venture was established in 2017.

- Sold our 50% stake in 100 Regent St, a mixed-use office building in London, U.K., alongside our partner, Hermes Real Estate Investment Management. Net proceeds from the sale were £46 million. Our original investment was made in 2013.

- Committed US$100 million to Glenwood Korea Private Equity Fund III, managed by Glenwood Private Equity, which will target mid-market control carve-out opportunities in South Korea.

- Invested US$100 million in ModMed, a leading provider of specialty-specific SaaS solutions for ambulatory medical practices, alongside Clearlake Capital.

- Committed US$50 million to TPG Growth VI, which will invest in mid-market growth buyout and growth equity opportunities primarily in health care, software, digital media & communications, and business services, and invested US$40 million alongside TPG Growth in Cliffwater LLC, a U.S.-based provider of retail-focused alternative investments products.

- Invested US$75 million in Aavas Financiers Limited, one of India’s leading affordable housing finance companies serving borrowers from low-to-middle-income households across 14 states, alongside CVC Capital Partners Asia.

- Received an approximate 13% equity stake in Bunge, a global agribusiness and food company, and received approximately US$0.7 billion in cash as part of Bunge’s completed merger with Viterra. Our original investment in Viterra was made in 2016.

- Committed US$125 million to TPG Emerging Companies Asia Fund I, managed by TPG Capital Asia, which will invest in middle-market opportunities across Asia Pacific.

About CPP InvestmentsCanada Pension Plan Investment Board (CPP Investments™) is a professional investment management organization that manages the Canada Pension Plan Fund in the best interest of the more than 22 million contributors and beneficiaries. In order to build diversified portfolios of assets, we make investments around the world in public equities, private equities, real estate, infrastructure, fixed income and alternative strategies including in partnership with funds. Headquartered in Toronto, with offices in Hong Kong, London, Mumbai, New York City, San Francisco, São Paulo and Sydney, CPP Investments is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At June 30, 2025, the Fund totalled C$731.7 billion. For more information, please visit www.cppinvestments.com or follow us on LinkedIn, Instagram or on X @CPPInvestments.

Alright, CPP Investments reported a net quarterly return of 1% for fiscal Q1 (Q2 for calendar year) and while it might not seem much, it was a very volatile period especially post-Liberation Day.

Importantly, as you read the press release, pay attention to all the transactions I highlighted, both investments and distributions.

It's also worth noting this fiscal quarter's activities and transactions.

Again, most important thing to note is the 10-year net return of 8.4% and the Fund added $500 billion in cumulative net income since inception.

I typically do not cover CPP Investments' quarterly results and nor does the Fund provide interviews for quarterly results.

Still, it's been a volatile first half so I am reporting on it.

Overall, this is what is worth noting:

The Fund delivered positive results in the first quarter, despite considerable market volatility. While markets declined early in the period, public equities rebounded by quarter end, contributing to overall Fund performance. Energy assets and strong results from our external manager programs also contributed positively to returns. These gains were largely offset by the weakening of the U.S. dollar relative to the Canadian dollar amid tariff-related uncertainty. While foreign exchange fluctuations may impact returns in the short term, maintaining a well-diversified global currency composition helps to mitigate overall return volatility over longer time horizons.

Energy assets and external hedge funds led the way higher last fiscal quarter.

On the energy side, note this transaction:

Sold our stake in Encino Acquisition Partners (EAP), a leading oil and gas producer in the U.S., to EOG Resources, which acquired 100% of EAP for US$5.6 billion, inclusive of EAP’s net debt. We held our 98% ownership position since 2017.

When you're selling an asset for US$5.6 billion in a quarter, that's a huge chunk of change.

I can say the same about the sale of a stake in Highway 407, their most important infrastructure asset:

Sold a net 5.81% stake in 407 Express Toll Route (ETR), a 108-km toll highway spanning the Greater Toronto Area in Canada, for net proceeds of approximately C$2.39 billion. We continue to hold a significant interest in 407 ETR.

These two sales along with the performance of external hedge funds helped the Fund offset losses elsewhere in fiscal Q1 and deliver another positive return despite huge volatility in markets.

You can read more about fiscal Q1 performance by downloading the highlights here but I just told you the main sources of returns. As far as losses, the drag came from the US dollar which they don't hedge didn't help (not sure what their hedging policy is now so I have to verify this).

The most important slide in the deck is investment highlights of Real Assets:

A small technical note, OTPP, La Caisse and OMERS report half year results because they use leverage and are rated by credit agencies.

Thus, they need to be transparent about their performance more than once a year because they are issuing bonds based on their credit rating.

All of Canada's Maple Eight use leverage and are rated by credit agencies.

Only CPP Investments and AIMCo offer quarterly results as they are mandated by the laws that govern them.Given that CPP Investments is bigger, it discloses a lot more transactions each quarter.

And only OMERS and La Caisse offers mid-year performance by asset class.

BCI doesn't provide mid-year or quarterly results but you can read its credit reports here.

I know that what counts is full year results but I'm pointing this out as a technical note.

Just remember, mid-year and quarterly results are because of credit rating agencies demands and legislative requirements.

Alright, let me wrap it up there

Below, Norges Bank Investment Management CEO Nicolai Tangen says he’s surprised markets have done so well as he discusses Norway’s sovereign wealth fund enjoying its best quarter since late 2023, returning 6.4% in the second quarter. Tangen also talks about the diversification of the fund’s portfolio and his concerns about US inflation.

The reason why Norway's sovereign wealth fund outperformed the CPP Fund in Q2 (CPP Fund's fiscal Q1) is because it's primarily invested in global equities so it has outperformed in the last couple of years and its returns are a lot more volatile (different mandate, different objectives).

[Note: In H1 2025, the Norwegian fund returned 5.7%]

Also, in this enlightening episode of the Leaders podcast, host Joe Cass engages with industry stalwarts Malin Norberg and Dan Yergin.

Together, they explore the evolving landscape of global energy, the implications of geopolitical shifts, and the critical role of innovation in driving sustainable development. Tune in to gain valuable insights on the challenges and opportunities that lie ahead, as well as the leadership strategies that can guide us through an ever-changing world.

Great discussion, take the time to listen to their insights.

Lastly, Tom Lee, Fundstrat, joins 'Closing Bell' to discuss Lee's thoughts on equity markets, how the latest PPI data changed the economic outlook and much more.

Comments

Post a Comment