Commodities In the Pits?

Ianthe Jeanne Dugan of the WSJ reports, Pension Funds Cut Back On Commodity Indexes:

A few board members were arguing for an allocation to commodities but managed to convince them that the diversification benefits were wildly exaggerated, especially for a Canadian pension fund that is heavily invested in resource companies.

My recommendation then and now is to stick to active strategies in commodities as well as private equity funds that specialize in resource and energy plays.

The truth is investors have been pulling out of hedge funds and commodities since the last quarter of 2012. There are a lot of reasons why. Part of it is reputation risk as pensions don't want to be seen as gambling on hunger. But an even bigger reason is just the lousy and volatile performance of these long-only commodity indexes.

Of course, even active managers of commodities have struggled lately. The Barclay CTA Index gained a mere 0.48% in 2012, hardly anything to write home about. And in a surprising move, one of the best quant funds that actively trades in this space have decided to chop its fees in half, believing investors are being overcharged by large CTAs.

I believe that some of the top quant funds that struggled in the last couple of years will come back in 2013 and 2014 as the global economy recovers and markets get back to normal. Of course, macro headlines still dominate and their performance is still vulnerable to news coming out of Italy, Spain, Greece and other troubled spots.

Still, there are plenty of trades out there for CTAs and global macros -- just look at the move in the yen following the seismic shift in Japan. And now that Japan's great rotation is underway, some are wondering who will be the buyer of last resort of JGBs.

Finally, one commodity that I'm paying close attention to is coal. According to Frik Els of Mining.com, China is burning coal at an insane rate:

But also warned that it will be a very volatile ride up -- just look at shares of Arch Coal (ACI) which plunged on unusually high volume after posting a loss yesterday. Some think it's the end of coal, I say bullocks!

Below, Ole Sloth Hansen, head of commodity strategy at Saxobank, discusses where the growth is coming from in the commodities market and gives his outlook for 2013. He speaks on Bloomberg Television's "Countdown.

And Barclays Commodities Research VP Suki Cooper discusses the price of platinum, whose supply fell to a 13-year low. She speaks on Bloomberg Television's "Lunch Money."

Pension funds and other institutions are retreating from popular investments linked to commodities after finding they did little to protect their portfolios against inflation risk and the unpredictable returns of stocks.Another asset class pumped and manipulated by big banks bites the dust! It's funny how I predicted much of this back in 2005 at a board meeting for PSP Investments where I recommended against investing in these long-only commodity indexes.

Investors have yanked nearly $10 billion from tradable indexes tied to energy, food, metals and other commodities after two years of record outflows. That leaves about $133 billion, said Kevin Norrish, a managing director at Barclays PLC.

The trend is accelerating this year, analysts and investors said, driven by lackluster returns and looming U.S. regulations that could make these investments more complicated and costly. The reversal could affect the way commodities are traded and temper price swings in everything from cereal to gasoline to gold, some economists said.

Among those scaling back is the California Public Employees' Retirement System. Calpers, the nation's largest pension fund, pulled out 55% of its holdings in commodities indexes in October, after losing about 8% annually over five years, according to the fund's most recent financial statement. That left $1.5 billion of Calpers's assets in commodities indexes, 0.6% of the fund's total. The money was switched to inflation-linked bonds, under a policy that allows Calpers to make quick moves within investment areas based on market conditions, a spokesman said.

Calpers helped pioneer pension funds' push into indexes that track metals, wheat, energy and other commodities. Unheard of a decade ago, the indexes held $155 billion at the end of 2010, up from $65 billion in 2008, according to Barclays.

The money mainly flooded in from big institutions, such as pension funds and college endowments, embracing commodities as a diversification tool and a hedge against inflation risk. Commodities traditionally have delivered modest returns, in line with inflation, and are disconnected from the gyrations of stocks and bonds.

But the new money turned the market on its head. Many commodities seesawed beyond traditional supply-and-demand patterns, and some economists blamed these new "index speculators," who had no stake in the underlying commodities.

Farmers, airlines, oil companies and other producers and users found it more difficult to use futures contracts for their original purpose—to protect themselves against price swings.

The government has been wrestling with limiting investments by speculators. Separately, the financial-regulatory-overhaul law could increase costs and add complications by requiring Wall Street dealers to use a clearinghouse to settle derivatives transactions, including those connected to commodities indexes.

The indexes, meanwhile, have produced smaller returns and the wild price swings that investors were trying to avoid. In May, the Teachers Retirement System of the State of Illinois cited "volatility of commodity investments" in deciding to move $800 million in a $3.5 billion portfolio to "strategies that better protect TRS from inflation."

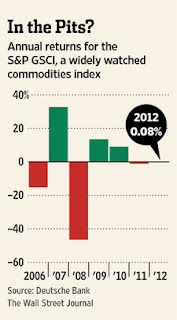

The performance troubles are evident in the S&P GSCI—formerly known as the Goldman Sachs Commodity Index—a benchmark that tracks a basket of contracts linked to energy products, precious and industrial metals as well as agricultural and livestock products. That index lost about 33% over five years, compared with inflation of more than 6%. Those who invested in another popular index, the Dow Jones-UBS Commodity Index, lost a total of about 25% overall over five years. The declines stem partly from the way commodities contracts work. Unlike stocks, commodities contracts expire, typically monthly or quarterly, and then need to be rolled over into new contracts.

Speculators account for more than half of futures contracts in certain commodities, according to the Commodity Futures Trading Commission. But signs of cooling abound. In April 2012, for example, investors held 225,869 contracts for a wheat traded in Chicago, a record. Now, they are down to 144,487 "Chicago wheat" contracts, the lowest point in several years.

"Calpers turning around and getting out is sending this signal to other institutions," said David Frenk, research director for Better Markets Inc., a Washington-based advocate of financial change. "There is a huge transformation starting to take place."

The group has been a critic of index investing, arguing that pension funds are risking losing money and influencing prices of underlying assets.

Mr. Frenk flew to California in November 2010 to urge the California State Teachers' Retirement System to reconsider an investment of about $2.5 billion it was considering making in commodities, including the DJ-UBS, minutes of the meeting show. The pension fund allocated just $150 million but hasn't invested the money. Given that the index has lost 13% since the meeting, Mr. Frenk estimated, "they saved about $300 million."

Also on the sidelines is the Los Angeles Fire and Police Pensions, which put aside 5% of its $15.2 billion for commodities. So far, though, it has invested only in publicly traded commodities companies. "We haven't gone into indexes," said Tom Lopez, chief investment officer, "but the plan is to be there."

Index investing continued slowing this year, said Michael Lewis, a Deutsche Bank analyst. "The role of commodities as a diversification strategy is being questioned because of an extreme market distress."

A few board members were arguing for an allocation to commodities but managed to convince them that the diversification benefits were wildly exaggerated, especially for a Canadian pension fund that is heavily invested in resource companies.

My recommendation then and now is to stick to active strategies in commodities as well as private equity funds that specialize in resource and energy plays.

The truth is investors have been pulling out of hedge funds and commodities since the last quarter of 2012. There are a lot of reasons why. Part of it is reputation risk as pensions don't want to be seen as gambling on hunger. But an even bigger reason is just the lousy and volatile performance of these long-only commodity indexes.

Of course, even active managers of commodities have struggled lately. The Barclay CTA Index gained a mere 0.48% in 2012, hardly anything to write home about. And in a surprising move, one of the best quant funds that actively trades in this space have decided to chop its fees in half, believing investors are being overcharged by large CTAs.

I believe that some of the top quant funds that struggled in the last couple of years will come back in 2013 and 2014 as the global economy recovers and markets get back to normal. Of course, macro headlines still dominate and their performance is still vulnerable to news coming out of Italy, Spain, Greece and other troubled spots.

Still, there are plenty of trades out there for CTAs and global macros -- just look at the move in the yen following the seismic shift in Japan. And now that Japan's great rotation is underway, some are wondering who will be the buyer of last resort of JGBs.

Finally, one commodity that I'm paying close attention to is coal. According to Frik Els of Mining.com, China is burning coal at an insane rate:

Chinese financial website Finet quotes Phil Ren, chief of the China Coal Importers Association, as saying at an industry conference in Singapore, China's coal imports may reach 400 million – 500 million tonnes within three years.As I stated on Boxing Day 2012, one of the themes I'm playing in 2013 is a strong rebound in China, focusing on coal, copper and steel. I stated that investors who received a lump of coal for Christmas shouldn't fret as it may turn out to be black gold.

That would constitute massive growth from current levels. China imported 234.3 million tonnes of coal in 2012, which constituted a huge jump – 28.7% – over the year before.

Ren said that the Chinese market is highly sensitive to price movements and would import coal even when it is able to satisfy coal demand from domestic sources.

The China National Coal Association announced yesterday that production in the country reached 3.66 billion tonnes in 2012, up by 4% compared to the year before.

Growth in coal consumption in China has been even more spectacular than its output growth – growing for 12 years in a row – according to newly released international data from the US Energy Information Administration (EIA):

China's coal use grew by 325 million tons in 2011, accounting for 87% of the 374 million ton global increase in coal use. Of the 2.9 billion tons of global coal demand growth since 2000, China accounted for 2.3 billion tons (82%). China now accounts for 47% of global coal consumption—almost as much as the entire rest of the world combined.

Robust coal demand growth in China is the result of a more than 200% increase in Chinese electric generation since 2000, fueled primarily by coal. China's coal demand growth averaged 9% per year from 2000 to 2010, more than double the global growth rate of 4% and significantly higher than global growth excluding China, which averaged only 1%.

While Australian and Indonesian coal miners have been the main beneficiaries of Chinese growth, the US coal industry – struggling to compete with cheap natural gas at home – has been thrown a lifeline by upping exports (click on image below).

US exports are on track for a record year in 2012 of more than 125 million tonnes. That is up from just 40 million tonnes a decade ago and in line with the all-time record set in 1981.

While metallurgical coal used in steel-making still constitutes the bulk of US exports, all the growth has come from increased steam coal exports.

But also warned that it will be a very volatile ride up -- just look at shares of Arch Coal (ACI) which plunged on unusually high volume after posting a loss yesterday. Some think it's the end of coal, I say bullocks!

Below, Ole Sloth Hansen, head of commodity strategy at Saxobank, discusses where the growth is coming from in the commodities market and gives his outlook for 2013. He speaks on Bloomberg Television's "Countdown.

And Barclays Commodities Research VP Suki Cooper discusses the price of platinum, whose supply fell to a 13-year low. She speaks on Bloomberg Television's "Lunch Money."