CPP Investments Updates its Policy on Sustainable Investing

Canada Pension Plan Investment Board (CPP Investments) has published an updated Policy on Sustainable Investing, reflecting its increased conviction in the importance of considering environmental, social and governance (ESG) risks and opportunities amid an increasingly competitive corporate operating environment:

Integrating ESG factors, including climate change, into investment analysis and asset management activities supports the organization’s clear legislative objective: to maximize long-term investment returns without undue risk of loss.You can read about how CPP Investments tackles sustainable investing here:

“ESG considerations are inextricably linked to our ability to successfully achieve our investment objectives,” said Richard Manley, Managing Director, Head of Sustainable Investing, CPP Investments. “Our Policy reflects the growing body of evidence showing that companies that integrate consideration of ESG-related business risks and opportunities are more likely to preserve and create long-term value.”

The new Policy on Sustainable Investing specifically outlines CPP Investments’ support for companies aligning their reporting with the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD).

As an investor to whom boards are accountable, CPP Investments asks that companies report material ESG risks and opportunities relevant to their industries and business models, with a clear preference for this disclosure to focus on performance and targets. When issuers seek input, the organization now indicates its preference for companies to align their reporting with the SASB and TCFD standards.

The Policy also reiterates the importance of asset owners like CPP Investments engaging with the companies in their portfolios, noting employees, customers, suppliers, governments and the community at large have a vested interest in forward-thinking corporate conduct and long-term business performance.

“We believe active ownership through constructive engagement can enhance and sustain returns over time and significantly reduce investment risks,” Mr. Manley said. “As a supplier of patient, engaged and productive capital, we are able to work with companies to bring about change, helping them deliver enduring value-building growth.”

About CPP Investments

Canada Pension Plan Investment Board (CPP Investments™) is a professional investment management organization that invests around the world in the best interests of the more than 20 million contributors and beneficiaries of the Canada Pension Plan. In order to build diversified portfolios of assets, investments in public equities, private equities, real estate, infrastructure and fixed income instruments are made by CPP Investments. Headquartered in Toronto, with offices in Hong Kong, London, Luxembourg, Mumbai, New York City, San Francisco, São Paulo and Sydney, CPP Investments is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. As of March 31, 2020, the Fund totalled C$409.6 billion. For more information about CPP Investments, please visit www.cppinvestments.com or follow us on LinkedIn, Facebook or Twitter.

At CPP Investments we consider responsible investing simply as intelligent long-term investing. Over the exceptionally long investment-horizon over which we invest, ESG factors have the potential to be significant drivers – or barriers – to profitability and shareholder value. For these reasons we refer to what many call ‘Responsible Investing’ activities simply as Sustainable Investing.Now, I read their Policy on Sustainable Investing but it is dated June 2020, so I'm not sure if it's the new Policy on Sustainable Investing which specifically outlines CPP Investments’ support for companies aligning their reporting with the Sustainability Accounting Standards Board (SASB) and the Task Force on Climate-related Financial Disclosures (TCFD).

Given our legislated investment-only mandate, we consider and integrate both ESG risks and opportunities into our investment analysis, rather than eliminating investments based on ESG factors alone. As an owner, we monitor ESG factors and actively engage with companies to promote improved management of ESG, ultimately leading to enhanced long-term outcomes in the companies and assets in which 20 million CPP contributors and beneficiaries have a stake.

CPP Investments has established governing policies, approved by our Board of Directors, to guide our ESG activities. Our Policy on Sustainable Investing establishes how CPP Investments approaches ESG factors within the context of our sole mandate to maximize long-term investment returns without undue risk of loss. Our Proxy Voting Principles and Guidelines provide guidance on how CPP Investments is likely to vote on matters put to shareholders and communicate CPP Investments’ views on governance matters.

In any case, ESG considerations are important for CPP Investments and all of Canada's large pensions and for good reason, the world is changing, many companies are looking at climate change as an existential risk and they're trying to address it with their own long-term plan.

Yesterday, I wrote about how QuadReal Property Group, BCI's real estate subsidiary, launched its Green Bond Framework and stated this:

Amazon recently launched a $2 billion fund to advance technologies that will cut down greenhouse gases. The fund will help Amazon and other companies adhere to The Climate Pledge initiative it started in September 2019. That pledge committed the company, and others that sign onto it, to becoming carbon neutral by 2040.Today, OPTrust posted on LinkedIn a Wall Street Journal article written by Sanford Cockrell III and Kristen Sullivan of Deloitte & Touche on why ESG is more important than ever.

In order for Amazon and other large corporations which signed that pledge to become carbon neutral by 2040, they need to make sure they are leaqsing office space at green-certified by BOMA BEST or LEED buildings.

Now you're understanding a little why QuadReal and other real estate divisions at Canada's large pensions are focusing on sustainability so much. Those that don't will be left behind, it's that simple.

The demand for green-certified buildings is only going to grow as companies look to reduce their carbon footprint, so pensions that are not doing enough to focus on sustainability will face major risks going forward.

That being said, QuadReal is taking a proactive stance and has done a great job explaining this Green Bond Framework. Kudos to Dennis Lopez and the entire team at QuadReal for launching this framework and having Sustainalytics review it and give its opinion. That's the right way to do it.

I note the following:

In January, Deloitte Global’s 2020 Readiness Report found that 90% of surveyed C-suite executives agree the impacts of climate change will negatively affect their organizations, and 59% already have sustainability initiatives in place. Many companies are rapidly ramping up sustainability efforts—listening to internal and external stakeholders, aligning with clients and partners, and integrating sustainability efforts into their business models. As businesses grapple with an unprecedented situation and work toward recovery, many are acutely aware that long-term sustainability challenges remain. Similar to prior economic disruptions, companies will be evaluated on how effectively the short-term measures they take align with critical stakeholder expectations.No doubt, companies are ramping up on their sustainability efforts and integrating them into their business models.

And asset owners like CPP Investments will be engaging with these companies in their portfolios, both public and private companies.

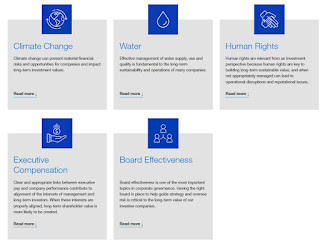

Below, you can see CPP Investments' focus areas:

Take the time to read CPP Investments' 2019 Report Sustainable Investing here.

By the way, CPP Investments got a second opinion on its Green Bond Framework which you can read here. Take the time to read this second opinion, it's very informative.

Lastly, Ontario Teachers' also published its 2019 Report Sustainable Investing which you can read here.

Below, BlackRock Chairman and CEO Larry Fink joins "Squawk Box" to discuss the asset manager's position on environmental, social and governance (ESG) issues when making investment decisions.

Comments

Post a Comment