Pensions' Love-Hate Relationship With Private Debt?

Fola Akinnibi and Kelsey Butler of Bloomberg News report on why pension managers love or hate private credit:

Why? As I write this, the yield on the 10-year US Treasury note is 58 basis points (0.58%) and investors looking for alternative yield are looking at private debt as a way to generate more returns in their credit portfolio.

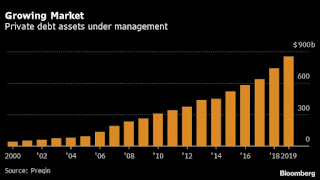

Private debt flourished as an asset class after the 2008 great financial crisis:

CPPIB, for example, has roughly C$40 billion in credit investments, with around 80% of that speculative grade. This includes corporate, real estate and structured deals.

John Graham is in charge of CPPIB's giant credit portfolio and he stated this to Bloomberg last year:

You can see this by looking at the iShares high yield bond ETF (HYG):

High yield bond prices rallied (spreads tightened) beginning at the end of March which spurred the big rally in US and global stock markets.

The snapback happened so fast that investors weren't able to take advantage of opportunities in private debt markets.

Note what Stephen Sexauer, chief investment officer at San Diego County Employees Retirement Association stated at the top of the article above:

And even sophisticated Canadian pensions invest with top private equity funds to take advantage of credit opportunities. IMCO took a big stake in Apollo's new fund to take advantage of dislocations in the market.

Like I keep warning my readers, we are living the Alice in Wonderland phase of the COVID crisis in markets but when the stimulus stops, there will be economic hardship and the insolvency phase of the crisis will roil credit markets and stock markets.

And that's when all these credit funds will swoop in to buy debt at deep discounts.

By the way, why do you think Goldman Sachs had stellar second quarter earnings results?

It basically lent money to cash strapped companies at huge spreads and made a killing in fixed income and equities trading.

You also understand why it became a bank holding company back in 2008, it wanted to enjoy the Fed's balance sheet so it can borrow at nothing and lend out at a nice spread.

It's not just Goldman, all the big banks are all about spread, getting money for nothing and risk for free.

But banks don't lend out in the middle market past three year terms so that's where pensions and their private equity partners invest to make their spread.

Lastly, go back to see my notes on private debt from the CAIP Quebec & Atlantic conference last September:

Pensions are increasingly investing in it directly or through partners.

There are a lot of opportunities which will present themselves as we move into the insolvency phase but be careful, there's a lot of hype and risks in private debt which investors should be made aware of.

Institutional investors with big budgets should take the time to read Prequin's 2020 Global Private Debt Report (sample pages are available here).

It's definitely worth keeping your eye on these private debt megatrends:

Below, Real Vision Managing Editor Ed Harrison talks to Richard Koo, Chief Economist at Nomura Research Institute. Koo is famous for his work on balance sheet recessions, a rare type of recession where drastic liquidity injections fail to increase the money supply because they remain trapped in the financial system, as there's no low demand for loans since companies focus on minimizing debt rather than maximizing profits. He and Harrison discuss this framework in detail, and use it to analyze our current economic crisis the world faces.

With some $4 trillion to invest—and returns depressed by ultralow interest rates—U.S. public pension funds have been dipping their toes into private credit. The relatively new asset class had grown quickly, attracting almost $1 trillion, before it was hit by March’s pandemic-driven collapse.Very interesting article. By now, private debt is a hot asset class at all pensions.

So how do pension fund managers feel about this burgeoning asset class now? Bloomberg Markets talked to officials at nine pension systems of different sizes and in different parts of the country to get their views on how these investments are working out. We heard a wide range of reactions, presented here from the smallest fund to the largest:

San Diego County Employees Retirement Association

Stephen Sexauer, chief investment officer

Size: $11.9 billion Serves: More than 44,000 members

Private credit allocation: Less than 0.5%

Performance in the lockdown: Too soon to judge

Target allocation: Unchanged

LOOKING BACK: “Why would pension plans get in the banking business and start making loans to corporations?” asks Sexauer, who inherited the private credit allocation from his predecessor. He says the first quarter market sell-off showed him there were more opportunities in the traditional fixed-income markets that don’t involve signing a multiyear contract with a private investment firm and paying the fees that come with such an arrangement.

LOOKING AHEAD: “Our allocation is under a half a percent. We don’t see a lot out there that would change that. Our takeaway right now is it’s a bull market strategy that’s a medieval marriage to generate fees for the private debt managers.” There are likely fewer than a dozen pensions in the U.S. and Canada with the in-house expertise to do the sort of credit work necessary to analyze these deals, Sexauer says. “It doesn’t sound like a scalable business to me. You’re not going to know what the results are for a long time. We’ll see how the returns are in six or seven years.”

School Employees Retirement System of Ohio (SERS)

Farouki Majeed, chief investment officer

Size: $14.5 billion

Serves: More than 200,000 non teacher school employees

Private credit allocation: 1.3%

Performance in the lockdown: Performed well

Target allocation: 5%

LOOKING BACK: “We have for the most part avoided the sectors most impacted, including hospitality, retail, and energy. Our managers were able to opportunistically deploy capital during the depths of the crisis in March and early April.”

LOOKING AHEAD: “The Covid pandemic has heightened the risks in this space but also presented new opportunities. Since we will be increasing our exposure post-Covid, we feel good about the entry point for new commitments. SERS has committed several hundred million dollars to new funds that are expected to take advantage of the prolonged recovery. We are expecting that new commitments in this period will generate higher returns.”

OTHER STRATEGIES: “Currently we have a small exposure to asset-based leasing/lending strategies in the opportunistic portfolio. We have no plans to increase that exposure at this time.”

Connecticut Retirement Plans & Funds

Shawn Wooden, state treasurer

Size: $36 billion

Serves: 212,000 state and municipal employees

Private credit allocation: 0.4%

Performance in the lockdown: As expected

Target allocation: 5%

LOOKING BACK: “Our view is that private credit is an attractive asset class for us. An important point was trying to expand our access to a wider credit opportunity set that would be more complementary to the more liquid fixed-income strategies. That was our view prior to this; that remains our view today. In February we created the 5% bucket [for private credit], and the crisis hit. The crisis is obviously bad and terrible, but with respect to our greater focus on private credit [the timing] was in many respects perfect. Those private credit opportunities did perform as expected, and we’re pleased with the performance.”

LOOKING AHEAD: “We’ve found that there’s tremendous opportunity.”

OTHER STRATEGIES: “Some of these more niche strategies, such as pharmaceutical royalty, are attractive due to the lower correlation of the exposure and return factors vs. other asset classes. In addition, some of these strategies provide the opportunity to generate attractive absolute and relative returns due to the more niche market opportunity and expertise required by the best investment managers pursuing these strategies. While we do not expect these will be a core component of the allocation, we do have the flexibility to invest in these strategies.”

Arizona State Retirement System

Al Alaimo, senior fixed-income portfolio manager

Size: $41 billion

Serves: More than 500,000 current and retired employees

Private credit allocation: About 15%

Performance in the lockdown: Down less than 1%

LOOKING BACK: “We’re very pleased with how it performed. It helped that our portfolio was well-diversified—with multiple strategies targeting different markets in the U.S. and Europe. We also had very little exposure to energy and retail, two industries particularly hard hit in the economic downturn.”

LOOKING AHEAD: “Since Covid-19, all of the credit markets—both public and private—have repriced, so everything has gotten more attractive, and every new dollar a manager can put to work has higher expected returns today than at the end of last year.”

OTHER STRATEGIES: “In 2019, we really built out our credit asset class and added a number of new managers. Several were in what we call ‘other credit,’ which are private strategies. They include litigation finance, life settlements, risk-sharing transactions, and leasing. Those are niche strategies, but they tend to be very attractive. They also tend to be relatively limited in terms of being able to deploy capital.”

Los Angeles County Retirement Association

Jon Grabel, chief investment officer

Size: $56.8 billion

Serves: More than 165,000 members

Private credit allocation: 2%

Performance in the lockdown: 1.8% net for illiquid credit in the quarter ended in March

Target allocation: Up to 5%

LOOKING BACK: “Some may view illiquid credit or private credit as very distressed-oriented—that, in effect, you use debt securities to get equitylike returns. That is not our strategy. We are not looking for this to be a private equity replacement.

“We made some recent commitments over the last several months. Those commitments have been more single-investment, separate-account-type structures as opposed to drawdown vehicles.”

LOOKING AHEAD: “We are under target. We will continue to evaluate opportunities, but we’re sensitive to markets. The stimulus and intervention from the Fed has impacted credit dramatically.”

Pennsylvania Public School Employees Retirement System

Steve Esack, press secretary

Size: $55.8 billion

Serves: 256,000 active and 234,000 retired school employees

Private credit allocation: 8.5%

Performance in the lockdown: Down 11.3% in first quarter

Target allocation: 10%

LOOKING BACK: “While the portfolio outperformed its benchmark on a relative basis, absolute performance was worse than expected, driven by a couple of outliers. For example, energy investments within the real assets credit allocation were heavily impacted by negative supply-demand dynamics given the uncertainty of OPEC+ production cuts and the collapse of demand due to the global pandemic.”

LOOKING AHEAD: “While there are benefits and drawbacks of private credit vs. other asset classes, we continue to believe the benefits prevail. Compared to public high yield for example, private credit should benefit from its seniority in the capital structure, yield pickup from illiquidity premium, less price volatility, technical-driven selling, and covenant protection. We view private credit as a long-term asset class that shouldn’t be evaluated quarter over quarter.”

OTHER STRATEGIES: “Our current private credit [investment policy statement] provides ample flexibility to consider numerous private credit substrategies. [These include] direct lending, mezzanine, distressed [and] special situations, specialty finance, structured credit, real assets credit, and real estate credit.”

State of Wisconsin Investment Board

Chris Prestigiacomo, portfolio manager

Size: $101.5 billion

Serves: 642,000 participants

Performance in the lockdown: As expected

LOOKING BACK: “There was some volatility in mid-March when things started to unravel a little bit, but that started to come back in early Q2. It was really the Fed’s actions that allowed the credit markets and equity markets to snap back very, very quickly.”

LOOKING AHEAD: “There are a lot of plans out there that, when they see a big downdraft, have to sell at unfortunate times. We don’t have to do that. We can play a volatile cycle. I would say today we’re still very interested in private credit. The spreads haven’t returned to pre-Covid levels, which is good. I think there’s some consensus within our shop that the back half of this year, there will be some more volatility, which we think will bring some good opportunities for us.”

OTHER STRATEGIES: “Within our privates group, excluding hedge funds, we’re predominantly lending to operating businesses across various industries. If you look in our hedge fund book as well as our multiasset book, they participate more in some of the newer strategies: asset-backed, royalty lending, distressed credits—those areas. So we are looking at those kind of ‘niche-y’ areas. As the risks subside and strategies become more developed, that’s when you would see other participants come in and bid up pricing and lower returns. And that’s probably a time where we would be a seller, if we had the ability to exit.”

North Carolina Total Retirement Plans

Dale Folwell, state treasurer

Size: $103.9 billion for the defined benefit plan

Serves: More than 332,000 payees

Allocation: 7% for opportunistic fixed income

LOOKING BACK: “We were finding [credit] more appealing until a big competitor showed up: the Federal Reserve. I’m not criticizing the Fed’s actions, I’m just saying that when they come in and make these multitrillion announcements, obviously spreads narrowed tremendously. It takes time to analyze these deals and in some instances, there wasn’t enough time to analyze them before spreads started tightening.”

LOOKING AHEAD: “I don’t think we have fully witnessed some of the timeless impacts that this virus is going to have on the credit markets.”

State Board of Administration of Florida

Trent Webster, senior investment officer in charge of alternative investments

Size: $160.7 billion in defined benefit retirement assets

Serves: Almost 648,000 active members

Private credit allocation: 2% to 2.25%

Performance in the lockdown: As expected

Target allocation: Likely to grow

LOOKING BACK: “For a couple of years we had gotten quite cautious on credit. We thought spreads had gotten too tight for the most part. We thought the lack of covenants was very unappealing. A lot of money had flowed into the market searching for yield. In March and April, we saw spreads blow out, and we put money to work pretty aggressively where we could.”

LOOKING AHEAD: “The amounts that we have been looking to commit over the first and second quarter of this year are greater than we have committed in the past. We’re watching to see if this rally is justified based on the future economic fundamentals. We do think that in certain parts of the economy there will be very interesting opportunities on the stressed and distressed side, regardless of what the market does.”

Why? As I write this, the yield on the 10-year US Treasury note is 58 basis points (0.58%) and investors looking for alternative yield are looking at private debt as a way to generate more returns in their credit portfolio.

Private debt flourished as an asset class after the 2008 great financial crisis:

The post-crisis era has seen private debt become an established asset class in its own right, matching the needs of yield-seeking institutional investors and companies looking for capital to grow. We look at some of the drivers for this growth and assess how firms can build on further opportunities in the market.This TIAA paper explains the attractiveness of private debt to institutional investors:

- Private debt has emerged as an asset class addressing institutional investors’ search for yield and lower volatility amid record-low interest rates and market uncertainty.

- Structural changes in fixed-income markets—decreased liquidity and rising asset correlations—are increasing investors’ willingness to trade liquidity for yield.

- Banks pulling back from the middle market have created opportunity for non-bank asset managers to issue direct loans to below-investment-grade companies at higher interest rates.

- Among private debt categories, middle market senior loans and mezzanine debt historically have offered particularly attractive risk-adjusted returns as potential substitutes for traditional assets, including high-yield bonds and equity.

- The private debt market’s complexity requires due diligence in selecting experienced asset managers with a record of success in creating diversified private loan portfolios.

CPPIB, for example, has roughly C$40 billion in credit investments, with around 80% of that speculative grade. This includes corporate, real estate and structured deals.

John Graham is in charge of CPPIB's giant credit portfolio and he stated this to Bloomberg last year:

CPPIB remains bullish on the U.S. middle-market, where it invests through Antares Capital, which has about $24 billion in assets. Antares is prepared to swoop in to buy assets from cash-strapped lenders when the cycle turns, its chief executive officer said in July.No doubt the COVID crisis presented great opportunities to CPPIB and others but the problem which was stated in the article at the top is the Fed and US government came in to quickly calm markets and spreads tightened again very quickly.

“We really do try to get deep diligence on every single deal,” Graham said. He added that CPPIB sees good opportunities to invest in companies that will survive a downturn in the credit cycle.

You can see this by looking at the iShares high yield bond ETF (HYG):

High yield bond prices rallied (spreads tightened) beginning at the end of March which spurred the big rally in US and global stock markets.

The snapback happened so fast that investors weren't able to take advantage of opportunities in private debt markets.

Note what Stephen Sexauer, chief investment officer at San Diego County Employees Retirement Association stated at the top of the article above:

LOOKING BACK: “Why would pension plans get in the banking business and start making loans to corporations?” asks Sexauer, who inherited the private credit allocation from his predecessor. He says the first quarter market sell-off showed him there were more opportunities in the traditional fixed-income markets that don’t involve signing a multiyear contract with a private investment firm and paying the fees that come with such an arrangement.Sexauer is right, there's a lot of hype in private debt and unless you're a sophisticated Canadian pension with in-house expertise, good luck analyzing these deals.

LOOKING AHEAD: “Our allocation is under a half a percent. We don’t see a lot out there that would change that. Our takeaway right now is it’s a bull market strategy that’s a medieval marriage to generate fees for the private debt managers.” There are likely fewer than a dozen pensions in the U.S. and Canada with the in-house expertise to do the sort of credit work necessary to analyze these deals, Sexauer says. “It doesn’t sound like a scalable business to me. You’re not going to know what the results are for a long time. We’ll see how the returns are in six or seven years.”

And even sophisticated Canadian pensions invest with top private equity funds to take advantage of credit opportunities. IMCO took a big stake in Apollo's new fund to take advantage of dislocations in the market.

Like I keep warning my readers, we are living the Alice in Wonderland phase of the COVID crisis in markets but when the stimulus stops, there will be economic hardship and the insolvency phase of the crisis will roil credit markets and stock markets.

And that's when all these credit funds will swoop in to buy debt at deep discounts.

By the way, why do you think Goldman Sachs had stellar second quarter earnings results?

It basically lent money to cash strapped companies at huge spreads and made a killing in fixed income and equities trading.

You also understand why it became a bank holding company back in 2008, it wanted to enjoy the Fed's balance sheet so it can borrow at nothing and lend out at a nice spread.

It's not just Goldman, all the big banks are all about spread, getting money for nothing and risk for free.

But banks don't lend out in the middle market past three year terms so that's where pensions and their private equity partners invest to make their spread.

Lastly, go back to see my notes on private debt from the CAIP Quebec & Atlantic conference last September:

There are enormous opportunities to be found in private debt and alternative credit growth. In 2018, assets under management globally by private debt funds reached $638 billion, with aggregate capital raised surpassing the $110 billion mark. Hear about the latest developments in asset-back debt, direct lending, and alternative credit. Access the full spectrum of credit instruments to deliver absolute performance while limiting your duration risk and interest rate sensitivity.Private debt is an important and established asset class which is here to stay.

Moderator: Vishnu Mohanan, Manager, Private Investments - Halifax Regional Municipality Pension Plan

Speakers:

Theresa Shutt, Chief Investment Officer - Fiera Private Debt

Ian Fowler, Co-Head North America Global Private Finance & President, Barings BDC - Barings

Larry Zimmerman, Managing Director, Corporate Credit, Benefit Street Partners

Synopsis: This morning, we all listened to an interesting panel on private debt, one of the hottest asset classes right now. I came a tad late when they were going over the pros and cons of sponsored versus non-sponsored deals.

In non-sponsored deals, you rely on third party data on quality of earnings and other data.

Theresa Shutt said they focus on corporate credit and companies with audited statements. "If there is trouble, we want to see how management behaves in a downturn, we have good covenants."

She said to ask private debt managers a simple question: "Tell me about your bad months." She added: "Our recovery has been quite high".

I like that, asked Theresa to write a guest comment for my blog on this hot asset class.

Ian Fowler focused a lot of alignment of interests and said to look at two things:

He warned "investors are overpaying for beta" and said you can expect 6-8% unlevered return but as the market gets hot, spreads are being compressed, managers are making higher risk loans to meet targeted return, and skimming is occurring where they are using investors' money to generate income on their platform."

- Target return

- Fee structure

Larry Zimmerman also warned investors to beware of private debt managers "building syndication deals".

Theresa Shutt warned not to just talk to principals, "ask about compensation, focus on culture". She said they use ESG in all their underwriting criteria.

I asked the panel how to prepare for another 2008 crisis and they told me to "focus on first not second lien loans" and remain highly diversified, avoiding deep cyclical sectors.

Interestingly, in the US, non bank private debt funds have been very active in the middle market and act to stabilize the market in case of a downturn.

Ian Fowler told us to look at average debt spread, style drift, and leverage.

I need to cover private debt in a lot more detail but Ian told me after that average PE multiples are priced at 12x so there is no room for error. "It's the same thing in private debt, you need to see how deals are being priced and beware of alignment of interests as spreads get compressed and managers try to fulfill their target return".

Pensions are increasingly investing in it directly or through partners.

There are a lot of opportunities which will present themselves as we move into the insolvency phase but be careful, there's a lot of hype and risks in private debt which investors should be made aware of.

Institutional investors with big budgets should take the time to read Prequin's 2020 Global Private Debt Report (sample pages are available here).

It's definitely worth keeping your eye on these private debt megatrends:

Below, Real Vision Managing Editor Ed Harrison talks to Richard Koo, Chief Economist at Nomura Research Institute. Koo is famous for his work on balance sheet recessions, a rare type of recession where drastic liquidity injections fail to increase the money supply because they remain trapped in the financial system, as there's no low demand for loans since companies focus on minimizing debt rather than maximizing profits. He and Harrison discuss this framework in detail, and use it to analyze our current economic crisis the world faces.

Comments

Post a Comment