Respect the Rotation in Equity Markets?

Stocks rose on Friday and the S&P 500 hit another record high after the June jobs report showed an accelerating recovery for the U.S. labor market.

The broad market index rose 0.7%, while the tech-heavy Nasdaq Composite climbed 0.8% to notch its own record. The Dow Jones Industrial Average added about 160 points. The S&P 500 has now risen for seven consecutive sessions, its longest winning streak since August.

Solid moves by major tech stocks helped support the overall market on Friday, with shares of Apple and Salesforce rising by nearly 2% and 1.3%, respectively. Microsoft jumped 2.2%.

For the week, the Nasdaq Composite rose 2%, while the S&P 500 and Dow climbed 1.7% and 1.1%, respectively.

The strong week on Wall Street was spurred by a string of solid economic reports, capped by a better-than-expected jobs report on Friday morning.

The economy added 850,000 jobs last month, according to the Bureau of Labor Statistics. Economists surveyed by Dow Jones were expecting an addition of 706,000. The print topped the 583,000 jobs created in May.

“This is a strong report and should be taken as a sign of things to come for an accelerating labor market,” Aberdeen Standard Investments deputy chief economist James McCann said in a note.

Angelo Kourkafas, an investment strategist at Edward Jones, said that the report showed solid growth but wouldn’t change the Fed’s policy path, hitting a sweet spot for markets.

“I think it was one of these goldilocks-type of reports, because hiring accelerated -- which is a positive sign for the second half and the recovery -- but not so much that it would trigger a reaction of an accelerated timeline for the Federal Reserve to start tapering,” Kourkafas said.

In addition to the job gains, average hourly wages rose 0.3% for the month and are up 3.6% year over year, matching expectations.

Goldman Sachs chief economist Jan Hatzius said that the report eased concerns about a labor shortage.

“I think we also learned that the explanations for the weaker numbers from April and May -- namely that seasonal probably weighing on job growth and probably some impact from the unemployment benefits on labor supply -- that those were pretty good explanations. So I think it was reassuring, in that sense,” Hatzius said on CNBC’s “Squawk on the Street,” adding that the unemployment rate coming in higher than expected showed that the recovery still had a long way to go.

Even with the recent strength for stocks, market strategists say that uncertainty about the Fed and the upcoming earnings season could keep stocks from making major gains in the near term.

“I think there’s less major catalysts now. The market is still very much concerned about the Fed’s reaction function,” said Max Gokhman, head of asset allocation at Pacific Life Fund Advisors, adding that he thought there was still a lot of slack in the labor market.

On Friday, shares of Boeing fell 1.3%, weighing on the Dow, after a 737 cargo plane made an emergency landing off the coast of Honolulu. IBM’s stock fell 4.6% after the company announced that president and former Red Hat CEO Jim Whitehurst was stepping down.

The U.S. markets will be closed on Monday for the July 4 holiday.

Patti Domm of CNBC also reports the Fed could be a surprise catalyst for the markets in holiday week:

The quiet holiday week ahead could hold some fireworks for investors if the Federal Reserve reveals its thinking on its bond buying program.

The four-day trading week could see stocks drift along the record levels reached recently. The closely watched 10-year Treasury yield has held under 1.5%, a positive for tech which outperformed with a more than 2.9% gain for the week.

There are very few economic reports of note, aside from ISM services data on Tuesday. But the Fed’s minutes from its last meeting will be released Wednesday afternoon, and there is potential for the market to learn more about the central bank’s behind-the-scenes discussions on winding down its quantitative easing program.

“Our base case is that rates drift higher, but in order to that get that move higher you need a catalyst to get there,” said Brian Daingerfield, head of G10 FX strategy Americas at NatWest Markets. “Either the Fed has to move forward aggressively on tapering, or you have to get the data really rocking, and you don’t have either.”

Friday’s report that 850,000 jobs were added in June was better than expected. However, the unemployment rate missed expectations after rising by 0.1 percentage points to 5.9%. Economists expected the rate to fall to 5.6%. The report was not seen as strong enough to encourage the Fed to step away sooner from its easy policies. It was, however, seen as a positive — yet largely incomplete — picture of the labor market.

Daingerfield said there is the potential for the Fed’s June meeting minutes to surprise the market, similar to the way April minutes did.

“Remember, Powell said they were not talking about talking about tapering,” he said, referring to Fed Chairman Jerome Powell’s comments right after the April meeting. “Remember, Powell was very dismissive, and then the minutes revealed a kind of drift to the committee.”

The April meeting minutes did surprise investors when they noted that “a number of participants” said it would be appropriate to begin discussing tapering bond purchases at upcoming meetings if the economy continues to make rapid progress. After the June meeting, Powell revealed early stage discussions about paring back bond buying. The Fed also presented a new forecast that included two rate hikes in 2023, where there were none indicated before.

The market is highly sensitive to details about the Fed’s bond purchase program since the ending to that measure would be open the door for the central bank to raise interest rates. The low-rate environment has been the kindling behind the stock market’s robust gains since the Fed went all out to help the economy get through the pandemic. Cutting back on the monthly $120 billion bond purchases would be the first rollback of those extraordinary measures.

“There’s a lot we don’t know about the Fed’s thinking about tapering,” Daingerfield said. He said key information would be when it plans to start, how rapidly it will move to wind down the program and how it decides to break down its current monthly purchases of $80 billion in Treasurys and $40 billion in mortgage securities.

“These details really do matter. Did they get into that conversation at all about details? The more detail they discussed, the more likely it is they are looking to move forward sooner,” Daingerfield said. Fed watchers widely expect more details about tapering the bond program around its annual symposium in Jackson Hole, Wyoming in late August, and then start slowing purchases later this year or early in 2022.

For now, the positive tone in the bond market has helped stocks. The 10-year yield, which moves opposite price, has fallen from its high of the year of about 1.75%. At that level, technology and growth shares were under pressure.

But they’ve been making a comeback as rates drift around in a range below 1.6%. The 10-year was at 1.43% Friday, and while the lower rate may help tech stocks, the yield level is a sharp contrast to an economy that was expected to grow at more than 10% in the second quarter.

That pace is expected to slow, but growth for the year is expected to be robust at more than 7%.

Tech transition

Citi Private Bank chief investment strategist Steven Wieting said that, with the economy peaking, the time is right for investors to begin transitioning to tech and growth shares from the popular cyclical trade.

“We’re seeing this as all a temporary period of massive distortions, and within a year from now, we’ll be on steadier water,” he said. “I think this is giving people a reason, including us, to move away from just cyclical rebound trades and into some sustainable growth opportunities.”

Year to date, cyclicals have been some of the better performers. Energy shares are up 44% with the rebound in oil prices, and financials have bounced by nearly 25%. In contrast, S&P 500 growth stocks are up 14.4%, lagging slightly the S&P 500′s 15.5% gain. Tech stocks are up just 14.3% year-to-date.

One area Wieting now likes is global health care. The S&P 500 health care sector was up 12.5% for the year so far.

“Health care is a mid-cycle outperformer. Health care is a part of the economy that didn’t fall as hard,” he said. “Earnings and revenues have grown moderately every year since the mid-1980s.” He said the sector has lagged the S&P 500 since the end of 2019 by 10 percentage points, and has a cheap valuation. Big pharma stocks are among the best dividend payers.

For the major sectors, on a 12-month basis, the cyclical sectors of industrials, materials, and energy have all risen more than 40%, and tech has had a similar 42% gain.

“The growth stocks have stayed rich. The value stocks have completely caught up with growth stocks in 12-month performance, but the valuation hasn’t been beaten down in growth stocks,” he said. “Gradually we’re going to get more sustained performance out of tech after this period where it flatlined.”

Wieting said one area that is particularly attractive is cybersecurity, where demand is strong as a “tech spending essential,” but the sector has gone nowhere.

For instance, the iShares Cybersecurity and Tech ETF IHAK is just below its 52 week high set in January, and the Global X Cybersecurity ETF BUG is trading about a dollar below its February high.

Wieting said he likes some alternative energy names and companies that are involved in digitization, including fintech.

He expects the overall stock market to move higher but not at the same rapid clip.

“We want to start transitioning portfolios away from just rebound plays. ... We’re transitioning knowing we’ve captured significant outperformance over the past year with cyclical value. It made people comfortable investing in equities when we could show how cheap they were,” he said.

Week ahead calendar

Monday

Independence Day holiday observed

Tuesday

9:45 a.m. Services PMI

10:00 a.m. ISM Services

Wednesday

10:00 a.m. JOLTS

2:00 p.m. FOMC minutes

Thursday

8:30 a.m. Jobless claims

3:00 p.m. Consumer credit

Friday

10:00 a.m. Wholesale trade

It was a somewhat quiet week in markets, most people were preparing for the long weekend, but stocks posted solid gains.

Last week, I discussed whether the summer rally is just getting underway, and that's what it looks like so far.

Interestingly, over the past month, cyclical shares have been underperforming and tech shares outperforming:

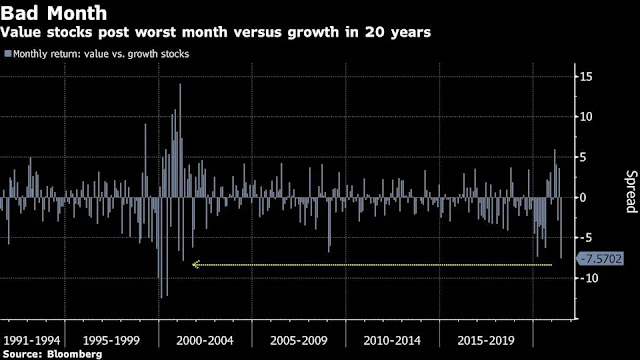

In fact, value stocks which are cyclical in nature posted their worst month in 20 years, prompting one well-known strategist to defend his call to stick with value:

Investors who sold less expensive, economically sensitive stocks amid resurgent Covid fears are misjudging the risk, according to JPMorgan Chase & Co. chief global markets strategist Marko Kolanovic.Value and cyclical shares have come under pressure as the spread of the Delta variant added to concern over the economic outlook at a time when the Federal Reserve showed a hawkish shift in monetary policy.

After a brief uptick mid-month, yields on long-dated Treasuries have retreated, helping ease pressure on richly-valued equities such as technology, while energy and financial stocks surrendered their 2021 leadership. The Russell 1000 Value Index has trailed its growth counterpart by roughly 8 percentage points this month, the most since 2000.

To Kolanovic, worries over the threat of a new wave of Covid outbreaks are misplaced. After looking at the progression of cases and fatalities in the top 15 countries most affected by the Delta variant over the past month, he noted that vaccinations appeared to be curbing the severity of outcomes, a sign of an improvement in the overall Covid situation.

The “current market positioning is not justified,” Kolanovic said in a note to clients, adding that it will lead to “a move higher in bond yields, value and cyclical stocks.”

Kolanovic has been a steadfast bull on value shares in recent years. Last month, he warned that money managers who’ve spent the bulk of their careers profiting from deflationary trends need to quickly switch gears or risk an “inflation shock” to their portfolios.

The latest retreat in the so-called reflation trade, exemplified by cyclical and value stocks, reminded Kolanovic of a similar episode in February, when another variant, known as B.1.1.7, triggered a risk-off move.

“When the market properly assessed the risk of B.1.1.7, yields and value staged a strong rally from mid-February to mid-March, while growth stocks (often perceived as beneficiaries of lockdowns) sold off,” he said. “There is a similar setup now with the so-called Delta Covid-19 variant fears.

Kolanivic isn't the only one warning of inflation and sticking with cyclical shares.

In his latest weekly report, Francois Trahan warns that investors are conditioned for only temporary spikes in inflation, but he thinks this is more than transitory:

Inflation continues to dominate the financial news cycle. The Fed went from barely mentioning it in the first part of this year to acting like it had always expected inflation to rise when it surged in the Spring, and then labelled it "transitory". We are seeing the first signs of cracks in this story with Boston Fed President Rosengren now saying "it might last a little longer than originally expected".

I think our views are fairly clear at this point – we believe inflation will be higher than the Fed expects and more resilient than the word "transitory" permits. In hindsight, however, there really was no way for Fed officials to spin this surge in inflation with any term other than "transitory". After all, they just missed the largest acceleration in inflation in almost 30 years. Few people in this industry would ever fess up to that big of a mistake.

It's not just the Fed though that missed the surge in inflation, it's the entire economics community. That much is clear from the Inflation Surprise Index. One element we explore in this week's report is the behavioral aspect behind this episode. Every single person in the industry today got trained to see inflation as a non-issue over the last several decades. It's hard to deviate from that type of training. Behavioral biases are real and very much in effect in 2021.

No doubt, most people are trained to see inflation as a non-issue but there are good reasons.

Importantly, the structural deflationary headwinds I've long been writing about are still around, and while the world is awash with liquidity, it hasn't changed the structural anchors weighing down inflation.

Also, as I warned last month, investors need to beware of US-centric inflation hysteria, there's a whole world out there outside the US which is definitely not suffering from any inflation pressures.

Still, some portfolio managers like Hightower's Stephanie Link, think you need to respect the rotation going on in equity markets:

As the U.S. economy continues to reopen and pick up steam, we have seen a notable rotation in the market. Late last year and into the second quarter, investors were favoring value stocks to gain exposure to economically sensitive sectors. In the last couple of weeks, however, we have witnessed massive movements under the surface of the market, back to growth.

As we head into the second half of the year, Federal Reserve Chairman Jerome Powell is taking a balanced tone when it comes to inflation. As the economy strengthens, the Fed now sees inflation hitting 3.4% this year, significantly above its previous target of 2.4%. The Fed has insinuated that inflation is transitory, but in my view, since the bulk of inflation is wages, it is not all transitory and will continue to climb. I expect a tapering announcement at the August Jackson Hole Fed meeting, or in the fall.

The Fed also signaled that it expects to raise interest rates in 2023, but based on the data we’re seeing, that increase could come as early as mid-2022.

Inflation Is Creeping Up, Particularly Wages

We’ve seen several economic indicators to support this, including the recent Philly Fed Manufacturing Prices Paid Index, which hit a level not seen since 1979 — currently 80.70, up from 76.80 last month and up from 11.10 one year ago. Other signs of inflation rising faster than expected are the U.S. consumer price index, which rose 5% year-over-year, the fastest pace since August 2008, and the producer price index, up 6.6% year-over-year and the largest annual increase on record.

Employment, meanwhile, continues to recover. The May non-farm payroll number was up, increasing by 559,000; the unemployment rate fell to 5.8% from 6.1%. Notably, the wage inflation indicator in the report showed that in 11 of the last 12 months, average hourly earnings have risen, according to a Marion Capital analysis of Bureau of Labor Statistics data.

The Job Openings and Labor Turnover Survey (JOLTS), which tracks data on job openings, hires and separations, showed that job openings hit a record 9.3 million in April. With many enterprises struggling to attract staff, we will likely continue to see upward pressure on wages to fill those job openings.

With above-trendline growth, I see inflation being persistent. The Fed will methodically and purposefully address this by slowing its bond purchases, and this tapering will keep markets calm ahead of a likely rate increase.

Market Rotation Underway: Adjusting Portfolios

With consumers venturing out and resuming their demand for services, the Institute for Supply Management Services PMI registered 64% in May — a 1.3-percentage point increase versus the April number of 62.7% — with year-on-year growth for the 12th consecutive month.

We are still looking at significant pent-up demand: The consumer savings rate was last recorded at 14.9% in April. Compare this with a historical rate in “normal” times of just 5%, and you have a recipe for robust spending moving forward.

The renewed demand for services — such as restaurants, hair salons, flights and hotels — is an exciting theme, as services represent a larger portion of the economy than consumer goods. We can expect strong Q2 earnings growth, which is why I’m seeking exposure to these themes in my portfolio.

Looking at specific rotations, the financial, technology and communication sectors are up, while industrials, metals/mining and materials have seen a notable pause.

For now, I’m looking at a little more growth than value, while maintaining a barbell. While I have no major changes to my portfolio on the margin, I’ve been adjusting in line with recent economic indicators, and taking profits where I can, such as cyclicals and economically sensitive stocks. I’ve been trimming some industrial and materials companies, while looking for names that have been lagging in technology.

I’m pairing reopening names with secular growers, while steering clear of high-multiple stocks — and always on the lookout for businesses with stable cash flow and good operating leverage.

Financials are particularly interesting right now, ahead of the Fed’s next Comprehensive Capital Analysis and Review. In the next CCAR report, we can expect to hear that financials are flush with cash — making them attractive buys with potential for returns in the coming months.

To keep the markets on a positive trajectory, the Fed appears ready to address inflation pressures in a slow and steady fashion, with a goal of getting us to a “Goldilocks economy” of steady economic growth. Bond yields are artificially low right now, but the imminent tapering, combined with continued economic growth and transitory inflation, are the right mix for risk assets.

There’s still a significant amount of stimulus in the system, which puts us at a crossroads. Investors should respect the change of tone in the market: Now is the time to trim a few winners and look for bargains. And given the recent volatility and rotational shifts, we may have a shot at doing so.

Well, while the US June payrolls topped expectations, wage growth looks on the moderate side, and it's hard to see wage inflation picking up significantly.

All this to say, I'm hardly convinced that bond yields are artificially low, so I'm really not sure if financials are a buy here or technology is where you want to be as yields stay low.

Alright, enjoy the 4th of July weekend.

Below, CNBC's "Halftime Report" team discusses the June jobs report, outlook for the U.S. economy and more.

Also, yesterday, 'Halftime Report' traders discussed whether they think the Fed's taper could be a negative for the market and what it means for its future outlook.

Comments

Post a Comment