OTPP's Karen Frank on Navigating the Current Market Environment

This is an excellent interview with Karen Frank, OTPP's Global Head of Equity. You can download this Buyout interview on OTPP's website here.

I just want to clarify something, if you look at OTPP's asset mix as at the end of last year from its 2021 Annual Report, you will see Private Equity made up 23% of the asset mix and Public Equity 11%, so together they make up up a third of total assets (34%) which Karen Frank and her team are managing:

Still, at 23% of total assets, Private Equity at OTPP is an extremely important asset class.

I recently discussed why OTPP"s CEO Jo Taylor said they are looking hard at private equity, making sure their funds are delivering and offering them good co-investment opportunities.

He also explained why having more control allows OTPP to deliver on their responsible investing approach because they have a seat at the table and can engage with their portfolio companies on all aspects of ESG, from climate targets to governance to Diversity, Equity and Inclusion.

But Jo also shared this with me after reading this comment:

If I were to emphasize anything it would be to say that we still partner with many PE funds regularly around the world. As well as providing us with excellent returns to compliment those of our own Equities team, we find that in addition to securing co-invest opportunities we can learn from them (Teachers’ has always had a strong learning culture). This tends to be primarily in thematic sourcing, and navigation in countries or sub sectors less familiar to us.

On governance and other social/environmental issues, it is really about having a voice and influence - so that we can shape a better future for the business and its ecosystem. If you have a small equity holding that is really challenging to execute.

He made the point because OTPP isn't looking to bypass its fund relationships altogether, it wants to solidify these relationships to gain access to important co-investment opportunities (a form of direct investing where they pay no fees and maintain scale in private equity).

On governance, he's right, OTPP usually has a board seat and is able to influence the way their portfolio companies are executing on ESG issues.

Back to Karen Frank's interview. She makes it clear that OTPP's private capital team has long specialized in six sectors: consumer, diversified industrials and business services, financial services, healthcare, sustainability and energy transition and tech, media and telecom.

She even states "we make sure we have deep sector expertise" and remain disciplined and are always thinking ahead trying to invest in the best places not just for this year but over the next five and ten years.

That long-term focus is a competitive advantage for OTPP and other large Canadian pensions.

It also allows them to deal with more uncertain times ahead but they are agile enough to pivot the portfolio to prepare for more challenging times ahead:

"We've been cautious. We've pivoted from last year in the things we're focused on. We're now leaning into sectors like financial services and healthcare services, parts of industries we feel are more resilient."

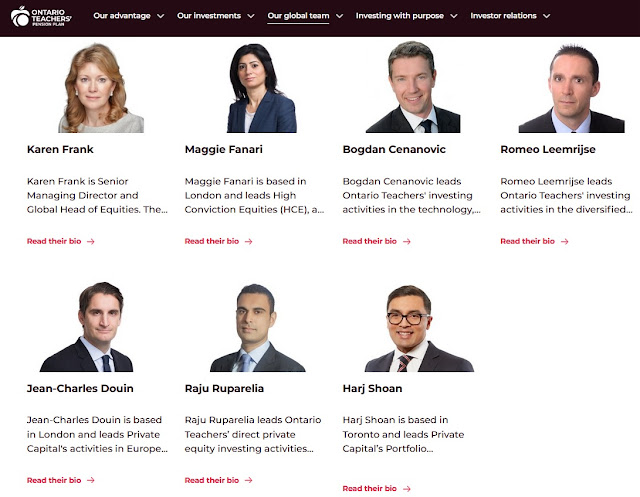

The article states her team is now 140 investment professionals (across public and private equity) situated in global offices like Toronto, London, Hong Kong and Singapore. They might also open up an office in India.

If you look at Karen Frank's bio, you'll understand she has great credentials and experience to lead this global team:

This is why I tell people when you're hiring top talent like this, you need to compensate them properly.Karen Frank is Senior Managing Director and Global Head of Equities. The Equities team manages $70 billion in net assets, including a portfolio of more than 60 private companies, significant investments in public companies, and relationships with more than 30 private equity funds. Karen will be based in London, where she has been living for over 20 years.

Prior to joining Ontario Teachers’, Karen was CEO of Barclays Global Private Bank, and sat on Barclays International Executive Committee. She joined Barclays in 2012 and was Co-Head of the European Financial Sponsors group before taking responsibility for the Private Bank.

Karen started her career in private equity in 1992, working in Goldman Sachs’ Principal Investment Area in New York and London, and continued working in private equity with AEA Investors and Compass Partners International. In 2005, Karen rejoined Goldman Sachs’ to build the firm’s middle market Financial Sponsors business.

She earned her MBA from Harvard Business School and graduated from Georgetown University with a degree in Economics.

OTPP's Private Capital has one of the largest and most sophisticated pools of private equity capital in the world and the entire Global Equities team is very focused on searching the world for the most attractive opportunities across public and private equity markets:

For example, in a recent deal, OTPP led a €250M Series C extension to Trade Republic, Europe’s largest savings platform.

“We are passionate about organisations that are using technology to tackle some of the world’s most pressing challenges,” says Maggie Fanari, Managing Director and Global Group Head, High Conviction Equities, at Ontario Teachers'. “Through their savings platform, Trade Republic democratises access to financial markets for millions of Europeans, providing the tools for wealth accumulation and empowering them to have brighter financial futures.”

To change the financial system, Trade Republic has built a bank from scratch since 2015 with an easy-to-use product everybody can afford. The company has seen fast growth across continental Europe with innovative, secure and commission-free financial products and already approaches over 280m people in six European countries.

“The funding extension puts us in the best potential position to deliver on our mission within a changing market environment” adds Christian Hecker. “In recent years, we have successfully grown the company to multiple products in many countries. We will focus all our energy to build products our customers love and invest strongly into technology to run the most efficient banking platform.”

And last year, and over the last four years, OTPP's private equity portfolio outperformed very nicely:

The private equity portfolio produced a return of 29.0% (local return 31.1%), outpacing its benchmark return of 17.5% (19.5% local benchmark). This outperformance was driven by solid financial performance across the private equity portfolio including funds, as well as increased valuations for private companies. Portfolio companies demonstrated a stronger than expected recovery from the pandemic due to an increased demand for products and services. The four-year annualized rate of return is 17.6%, compared to a benchmark of 12.5%.

Private equity net investments totaled $55.1 billion at December 31, 2021, compared to $41.8 billion at the end of 2020. Assets increased primarily because of high acquisition volumes and higher asset valuation across sectors

To be sure, with public markets getting hit hard this year, and rates going up as inflation becomes more ingrained, it will be more challenging in private equity.

Everyone is hunkering down but they remain committed to the asset class.

For example, the Wall Street Journal reports that pensions and endowments that find themselves overexposed to private equity after two years of near-record fundraising are looking for ways to lighten the load so they can continue investing.

The Financial Times recently reported that private equity chiefs fear waking up with ‘a terrible hangover’:

The massive government stimulus packages and central bank crisis measures that had enabled them to keep companies afloat — and use cheap debt to strike new deals and pay themselves dividends — are a thing of the past.

“This is a time of reckoning for our industry,” said Philipp Freise, the European private equity co-head at KKR, which went on an aggressive dealmaking spree during the pandemic-era boom.

The Federal Reserve and Bank of England both raised rates while the dealmakers were gathering. Listed buyout groups’ share prices have tumbled this year. Investors are struggling to commit cash to new buyout funds after pouring money into the industry last year.

The enormous flood of deals struck at high valuations during the boom of the past two years are at risk of turning into what at least four senior dealmakers privately referred to as a “bad vintage” — the private equity industry’s wine-driven euphemism of choice, which means pension funds and other investors would make less money than they hoped when they committed cash to buyout groups’ funds.

...

Four main determinants of how much money the industry makes — companies’ earnings growth, rising multiples, and the amount and cost of debt — are “fundamentally challenged”, said Ares’ chief executive Mike Arougheti from the conference’s main stage. Please use the sharing tools found via the share button at the top or side of articles.

Still, he was optimistic. Private credit was in a stronger position, he said, and the fall in private companies’ valuations “won’t be nearly as severe as what we’re seeing in public markets.” Private market valuations are set by a process of sophisticated guesswork based only partly on the value of comparable listed businesses.

“For those that have liquidity and [can support the companies they own], this will present more opportunity than risk,” he said.

Others also made positive noises, perhaps not least because the conference is largely an opportunity to raise money from the pension funds and other investors who are given free passes for a conference that costs private equity executives more than £4,000 to attend.

“In the good times, how do you argue that you have a return advantage over the public markets? It’s difficult,” Freise said. “Now, if we do our job in a time of crisis . . . we ought to be able” to beat the markets.

Questions of economic inequality and the real-world impact of a cost of living crisis received a brief mention. “The teachers, the labourers, of course with the food and energy prices we have, they are suffering,” said Jan Ståhlberg, founder of Trill Impact.

“None of us here is really suffering, I mean let’s face it. All of our companies are doing well, we’re getting debt,” he added.

Dealmakers and private equity investors were torn about how long a looming downturn could last. In private meetings at the InterContinental hotel, the industry’s senior figures predicted everything from an 18-month “blip” to a difficult decade.

We have had plenty of bad vintages in the past and the industry always bounces back nicely. I'm not sure if this time will be worse but clearly you need the right partners with the right discipline to navigate what could turn out to be a very tough environment.

Like I stated above, OTPP and other large Canadian pensions aren't immune to a private equity downturn but their focus always remains on the long run and they can ride out any bad vintage. If this downturn lasts longer than previous ones (nobody really knows), they have the liquidity and long investment horizon to capitalize on opportunities as they arise.

Below, Philipp Freise, co-head of European private equity at Kohlberg Kravis Roberts, speaks with Bloomberg's Dani Burger on "Bloomberg Surveillance: Early Edition."

And Nikos Stathopoulos, BC Partners chairman of Europe, discusses navigating portfolio companies through an inflationary rising-rate environment. He speaks with Dani Burger and Matt Miller on "Bloomberg Surveillance: Early Edition." This is also available here. Well worth watching both interviews.

Comments

Post a Comment