Charles Emond on Why CDPQ Remains Focused on Sustainable Investments

In 2006, the eminent British economist Nicholas Stern concluded, in his famous report on the effect of climate change on the economy, that if nothing is done today, the cost will be much higher tomorrow. Since 2017, the Caisse de dépôt et placement du Québec has deployed a climate strategy that puts it into action. The Caisse has set itself the goal of reducing the carbon intensity of its portfolio by 60% by 2030.

According to Mr. Charles Emond, President and Chief Executive Officer of the Caisse de dépôt et placement du Québec, it is now in the Caisse's DNA to choose initiatives that are already green or to be greened. For this reason, the Caisse is investing an envelope of 10 billion dollars in companies that still use a lot of oil in order to green them. “The climate transition is perhaps the greatest investment opportunity of the last decades,” he underlines.

The Caisse, which has a net zero objective by 2050, invests in sectors which will really need a green shift and which will still be essential to our way of life in the future, such as agriculture, cement, mines and metals. Not only will these sectors be profitable for the Caisse, but they will also benefit from a green overhaul that will further increase the value of their assets. Mr. Emond recalls that the climate transition is the source of one of the biggest movements of capital of our time.

When your financial advisor builds your portfolio, he will mainly look at the return, but, according to Mr. Emond, you also have to look at the risk. “Climate change is a risk that can lower the value of assets. But you shouldn't just invest in renewable energy because the climate risk is low, you have to realize that it's also a profitable investment." He predicts that one day investors will no longer want to put funds into certain sectors. Especially since, in many cases, insurers will no longer want to cover them because of the climate risk.

One of the great prides of the Caisse de dépôt et placement du Québec is to be one of the founding members of the Net Zero Alliance. This group of 70 institutional investors manages assets of 10,000 billion dollars worldwide. The organization aims to influence societies in their actions, behaviors and climate strategies. "Compared to five years ago, each dollar invested by the Caisse emits 50% less greenhouse gases." The Caisse de dépôt was the first in the world to link the compensation of its managers to the achievement of these climate objectives, says Mr. Emond.

The Caisse is betting that investing in a company that uses fossil fuels and then converts them will increase the value of this company and, therefore, of the investment.

This is a good short interview which I embedded below.

CDPQ's CEO, Charles Emond, packs a lot in this interview and it's worth going over it.

I recommend you read my earlier comment going over CDPQ's 2021 Sustainable Investing Report.

On the environment, the key points are:

- In September 2021, CDPQ announced its new and ambitious climate strategy to achieve its net-zero objective by 2050 and strengthen its leadership in climate matters. This strategy is based on four pillars:

- Hold $54 billion in low-carbon assets by 2050

- Achieve a 60% reduction in the carbon intensity of the total portfolio by 2030 compared to 2017

- Create a $10-billion transition envelope to decarbonize the heaviest-emitting sectors

- Complete our exit from oil production by the end of 2022

- $39 billion in low-carbon investments, up 120% from 2017 ($18 billion)

- Total portfolio carbon intensity down 49% from our 2017 starting point, putting us on track to reach our 2030 target

I have stated many times CDPQ is considered a world leader in sustainable investing and consistently ranks high in global surveys. The organization takes its commitment to ESG very seriously and it shows in its initiatives to tackle "E", "S" and "G" issues both within the organization and outside it.

On the environment, achieving a 60% reduction in the carbon intensity of the total portfolio by 2030 compared to 2017 might not sound like a big deal but it's a huge deal and one that CDPQ is well on its way to fulfilling.

In the transition economy, they created a $10-billion transition envelope to decarbonize the heaviest-emitting sectors. This is where I think the most interesting opportunities and risks will present themselves for CDPQ and all of Canada's large pension investment managers.

The three sectors CDPQ is focusing on to lower its carbon footprint are real estate, mobility and renewable energy. This makes sense since real estate contributes up to 40% of global greenhouse gas emissions.

CDPQ's massive real estate subsidiary, Ivanhoé Cambridge, is doing its part to achieve its ESG and carbon neutrality objectives, while emphasizing the role that financial actors must play to better understand the carbon footprint of their assets.

In May, it announced its pledge to reduce the carbon footprint of its Montreal properties by 55% by 2030, building on its commitment made last year to achieve carbon neutrality by 2040 for its global portfolio of assets.

On mobility, apart from several investments, CDPQ Infra's REM project is moving along nicely (with some minor delays) and this too will help the organization lower its carbon footprint.

The one controversial area of CDPQ's climate strategy remains its fourth objective, namely, to exit from oil production by the end of this year.

Controversial in the sense that CDPQ's large Canadian peers do not believe in blanket divestment, preferring engagement as the right approach as divesting only transfers the risk onto a fund that likely doesn't care about ESG.

But one senior executive at CDPQ told me a while ago that engaging with

Big Oil is "extremely challenging" and since their oil & gas assets didn't

represent a big slice of their overall portfolio (less than 3%, I believe), they decided to exit these assets and focus on profitable transition and renewable assets.

There are long-term risks with traditional energy assets but there is also a cost to divesting out of them, especially in a high inflationary environment:

Over the past year, Energy stocks were on fire but with global recession winds picking up force, they've been getting dinged hard lately and these assets are volatile.

All this to say, unlike its large peers, CDPQ is exiting out of oil production at the end of this year and it's not the end of the world, it's part of its climate strategy and they may be proven right over the long run.

My personal belief is the world still needs traditional energy for many years to come and the transition to a low-carbon economy will take a very long time, full of ups and downs (like John Graham, CPP Investments' CEO told me, "it won't be linear").

Again, no matter where they stand on divestment, the big opportunities and risks for all large investors lie in this transition to a low-carbon economy. This is where astute long-term investors can really take advantage of their comparative advantages.

In related news, Marc-André Blanchard, Executive Vice-President and Head of CDPQ Global and Global Head of Sustainability, posted this on LinkedIn yesterday:

Apart from sustainability, Mr. Blanchard has huge responsibilities at CDPQ (and an impressive resume), including coordinating the organization’s international operations.

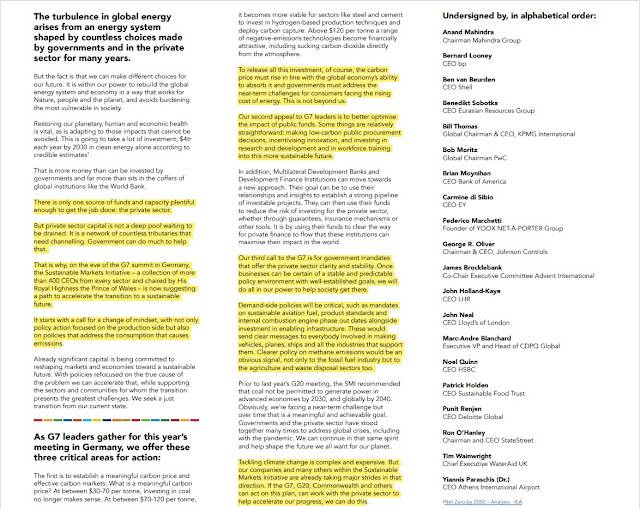

I read the op-ed from the Sustainable Markets Initiative, Flipping the Switch, which he signed along with other CEOs, and embedded it below (yellow highlights are mine):

The turbulence in global energy arises from an energy system shaped by countless choices made by governments and in the private sector for many years. But the fact is that we can make different choices for our future. It is within our power to rebuild the global energy system and economy in a way that works for Nature, people and the planet, and avoids burdening the most vulnerable in society.

Restoring our planetary, human and economic health is vital, as is adapting to those impacts that cannot be avoided. This is going to require trillions of dollars, much of which can be met by the private sector. We call on governments to put in place the market signals that will stimulate and channel this investment.

It isn't a long statement but one which clearly outlines what needs to get done, including creating the right policies and conditions to attract deep pools of private capital to invest in the transition and green economy.

The letter ends on this note:

Tackling climate change is complex and expensive. But our companies and many others within the Sustainable Markets Initiative are already taking major strides in that direction. If the G7, G20, Commonwealth and others can act on this plan, can work with the private sector to help accelerate our progress, we can do this.

Let's hope so because if we don't utilize the private sector in the right way, across all countries, we won't see material gains in the fight against climate change.

By the way, since I am on this topic, GFANZ, a global coalition of leading financial institutions committed to accelerating the decarbonization of the economy recently released a draft framework for financial institutions to catalyze action and specify concrete steps and holistic business strategy changes as part of the transition to a net-zero future:

15 June 2022 – Today, the Glasgow Financial Alliance for Net Zero (GFANZ), a practitioner-led, global coalition of financial institutions working to accelerate the world’s transition to net-zero greenhouse gas (GHG) emissions by 2050, invited public comment on its draft Net-zero Transition Plan (NZTP) framework for the financial sector. This common framework will enable a financial institution to demonstrate, and stakeholders to judge, the credibility of its plan to accelerate and scale clean energy and transition-related finance to levels consistent with limiting global warming to 1.5 degrees C.

Around 130 countries, representing 90% of global GDP, have made a net-zero commitment. More than 10,000 companies, organizations, or subnational governments have joined the UN Race to Zero campaign, committing to achieve net-zero carbon emissions by 2050 at the latest. Net-zero transition plans catalyze action, operationalize commitments, and demonstrate credibility. GFANZ defines a net-zero transition plan as a set of goals, actions, and accountability mechanisms to align an organization’s business activities with a pathway for net-zero GHG emissions that delivers real-economy emissions reductions in line with achieving global net zero.

Michael R. Bloomberg, Co-Chair, GFANZ and UN Special Envoy for Climate Ambition and Solutions

“The climate crisis requires ambitious action and the biggest changes must happen without delay. Businesses require clear guidance from governments to meaningfully address climate change—and GFANZ is taking the lead by providing this information to the global financial industry.”Mark Carney, Co-Chair, GFANZ and UN Special Envoy on Climate Action and Finance

“The GFANZ common framework for net-zero transition will help ensure that capital will flow to companies that have robust and credible plans to reduce their emissions while growing jobs and our economies. The supporting tools will promote the responsible and transparent phaseout of stranded assets as part of an orderly transition. Together, these tools, frameworks, and resources will guide the financial sector to support real-world decarbonisation, not the false comfort of portfolio decarbonisation. In the process, they will reveal the contribution of financial institutions to solving one of humanity’s greatest challenges.”Mary Schapiro, Vice Chair, GFANZ

“To cut global emissions in half by 2030 and meet the goal of net-zero emissions by 2050, we need to significantly scale up private capital to companies and assets that are enabling the net-zero transition. But without a clear framework for the transition, progress will be difficult to achieve. Filling the gaps of ambitious climate public policies and regulation, GFANZ has developed a global baseline for financial institutions to turn their commitments into immediate action.”Delivering on net-zero commitments is only possible if transition planning aligns financial institutions’ core businesses with the reduction of GHG emissions in the real economy.

As part of the recommendations and guidance published, GFANZ has identified four essential approaches for financial institutions to support the real-economy transition to net-zero emissions:

- Finance the development and scaling of net-zero technologies or services to replace high-emitting sources

- Increase support for companies that are already aligned to a 1.5 degrees C pathway

- Enable high and low-emitting real-economy companies to align business activity consistent with a 1.5 degrees C pathway for their sector

- Accelerate managed phaseout of high-emitting assets through early retirement

In addition to the Net-zero Transition Plan framework for financial institutions, which is now open for public consultation, GFANZ has published a set of connected tools, frameworks, and resources to enable the extensive collaboration between financial institutions, real-economy companies, the public sector, and civil society to support a global whole-economy transition to net-zero. The resources include:

- Guidance on Use of Sectoral Pathways for Financial Institutions

- Concept note on Portfolio Alignment Measurement

- Introductory note on Expectations for Real-economy Transition Plans

- Report on the Managed Phaseout of High-emitting Assets

While the focus is on providing guidance for financial institutions’ implementation of transition strategies, the recommendations and guidance also aim to provide clear, consistent, and decision-useful information needed by companies, regulators, governments, and other stakeholders.

To participate in the consultation, please use this link. To view the set of tools, frameworks and resources, please visit www.gfanzero.com/publications.

Nigel Topping and Mahmoud Mohieldin, High-level Climate Champions for COP26 & COP27

“We welcome GFANZ’s pan-sector Net-Zero Transition Plan (NZTP) guidance and accompanying frameworks as important tools for helping the financial institutions in the UN Climate Champions’ Race to Zero to translate their net zero commitments into actionable plans with real-economy impact. The consultation process is an opportunity for financial institutions to demonstrate leadership in helping to shape the best practices that will drive the ambitious climate action we need to achieve the Paris goals.”Nili Gilbert, Chair, GFANZ Advisory Panel, and Vice Chairwoman, Carbon Direct

“As we move further into the net zero transition, companies that have made pledges are acting on implementation, and companies which have yet to make pledges are seeking to understand their own starting approach. The clarity offered in the Net Zero Transition Plan for Financial Institutions report will support institutions at all stages of the process, and represent a critical step in the accountability, action and ambition of the finance sector’s push towards net zero.”Oliver Bäte, Chief Executive Officer, Allianz SE

“The net-zero transition is an opportunity for global finance to lead. Financial institutions need to be able to translate climate science into tools that help align their businesses to the transition. In turn, these institutions can operationalize decarbonization pathways for all the industries they finance.”Amanda Blanc, Group Chief Executive Officer, Aviva

“Ambition is not enough – a net-zero transition plan lays out the steps for financial institutions to generate a plan and execute against it. We cannot wait for all the answers – the time is now.”David Blood, Senior Partner, Generation IM

“For financial institutions to transition successfully to net zero, we need a forward-looking approach to measure how portfolios align to the transition. While the financial sector has started to develop these tools, we aim for further enhancements to ensure that they are robust and easy to use.”Thomas Buberl, Chief Executive Officer, Axa

“Because the financial sector is interconnected and truly global, all institutions must take responsibility for their transition to net-zero. GFANZ supports ambitious, concrete net-zero goals and transparent intermediate targets from all actors in the economy so that our actions can help put the world on the right course to tackle climate change.”Jane Fraser, Chief Executive Officer, Citi

“Now is the time for the financial sector to deliver on our commitments, and having a common framework for action will help ensure there is an immediate and collective response to climate change. Reaching net zero will be one of our generation’s biggest challenges and will require that we finance the transition responsibly across every high-carbon sector and asset class.”Noel Quinn, Group Chief Executive, HSBC

“We have a coalition of the willing in the financial sector to reach net zero, but now is the time to put the detail into the plans that will get us there – we need to explain the journey and how we will deliver our commitments. This must be informed by experts both within and outside our industry, so I encourage all interested parties to contribute to this consultation.”Alison Rose, Chief Executive Officer, NatWest

“If we are to limit global warming below 1.5 degrees Celsius and stay on track to meet the ambitious goals set out in the Paris Agreement, we need to make a collective effort as a sector to accelerate the transition of the global economy to net zero. This framework provides practical and tangible guidance to help financial institutions and the real economy play their part in tackling this critical global challenge.”David Schwimmer, Chief Executive Officer, LSEG

“The financial sector has an essential role in enabling real-economy emissions reductions, and the only way to do that is through companies producing credible transition plans setting out how they will achieve their net zero targets. GFANZ is working on developing the financial sector’s expectations of real-economy companies to make that a reality.”About GFANZ

The Glasgow Financial Alliance for Net Zero (GFANZ) is a practitioner-led, global coalition of financial sector institutions and their sector-specific alliances working together to accelerate the world’s transition to net-zero greenhouse gas emissions by 2050 and achieve the objective of the Paris Agreement to limit global warming to no more than 1.5 degrees C. GFANZ has united over 500 member firms from across the financial sector, including banks, insurers, asset owners, asset managers, financial service providers and investment consultants, spanning 45 countries and representing around 40% of global private financial assets.

Further details can be found on https://www.gfanzero.com.

I thank Joy Williams of GFANZ for bringing this up to my attention and for those who want to participate in the consultation, please use this link. To view the set of tools, frameworks and resources, please visit www.gfanzero.com/publications.

Alright, let me wrap it up there, tomorrow I look forward to covering IMCO's Inaugural ESG report which you can read here.

Below, take the time to watch Patrick de Bellefeuille of Méteo Média interview CDPQ's CEO Charles Emond on why their focus remains on sustainable investments (in French).

Also, CBA President Stephen Rotstein in conversation with Marc-André Blanchard, Head of CDPQ Global and Global Head of Sustainability on how to find solutions when confronted with the ever-changing realities of the 21st Century world we live in, from climate change to the hybrid model.

I embedded it below and you can listen to it here.

Lastly, Brookfield’s Mark Carney on the firm’s new $15 billion bet on the clean energy transition.

I note this part:

Carney: Brookfield is huge in clean energy. We’ve got 21 gigawatts existing, we’ve got 60 gigawatts in the pipeline all around the world. So, we’re very active in that. But what we’re focusing on just as much is going to where the emissions are, and getting capital to steelmakers, to auto companies, to people in utilities, people in the energy sector so that they can make the investments to get their emissions down. That’s where you find a huge amount of value, returns for our investors - ultimately, pensioners, teachers, fire, firefighters, others, pensioners around the world - that’s where we create value for them. You also do good by the environment because you get emissions actually down across the economy and that’s what we need.

Picker: And is that also the same goal with the Net Zero Asset Managers initiative? I think it’s $130 trillion worth of AUM behind this idea of having a net zero portfolio by 2050.

Carney: Yeah, and it’s very much about transition. So again, yes, a lot of it’s going to go to clean energy. I mean, clean energy needs are about $3 trillion a year. So, this is a huge investment opportunity, but again, going to where the emissions are, getting those down and helping to wind down emissions in sectors that aren’t going to run to their whole economic life. Look, we’re here in Europe, we’re here in Germany. Germany has put out a number of things. So, they’re going to have a clean energy system by 2035. They’re going to accelerate the approval process for these projects from six years to one year. They’re putting legislation in place across Europe. They’re tripling the pace of solar, they’re quadrupling the pace of hydrogen all this decade. Huge opportunity here in Europe, that’s being replicated elsewhere. But what comes with that is industrial decarbonization, if I can put it that way, and so Brookfield can play on both sides on the clean energy, but again, really going from everyone from tech to automakers to steel, to helping those companies move.

Picker: Interesting, because it’s industrial emissions that are the biggest chunk of the pie, not necessarily how you drive your car.

Carney: Well, yeah, it’s industrial emissions. Some of it is some of its autos, but some commercial real estate. We’re big in commercial real estate, we [have] got to get that down as a whole. And what this does is provide - we were talking moments ago about the macro economy, there’s some challenges with inflation. There’s actually some big positives with the scale of investment that’s required right at the heart of this economy. If I were to roll back the clock 25 years, the level of investment was about two percentage points higher around the world relative to GDP. Actually, we’re going to get that back through this process of transition that has big multipliers for growth and of course for jobs.

Mark Carney is a very smart man and a great addition to Brookfield where he acts as Vice Chair and Head of Transition Investing. He's also Co-Chair, GFANZ and UN Special Envoy on Climate Action and Finance.

Several large Canadian pension investment managers including IMCO, OTPP and PSP Investments invested in Brookfield's inaugural global transition fund which just closed and you can't help but wish them a lot of success and many more to come!

Comments

Post a Comment