PSP Investments Discloses Investcorp Acquires a Majority Stake in CrossCountry Consulting

The transaction is expected to accelerate CrossCountry's growth as it expands geographically and adds new service line offerings

New York, NY and McLean, VA — December 6, 2022 – Investcorp, a leading global alternative investment firm, today announced its acquisition of a majority stake in CrossCountry Consulting (“CrossCountry,” or “the Company”), a leading business advisory firm. In addition, Public Sector Pension Investment Board (PSP Investments) invested, and RLH Equity Partners will continue as an investor. CrossCountry founders, Dave Kay and Erik Linn, continue to be significant shareholders.

Founded in 2011, CrossCountry provides accounting, finance, risk, operations, cyber, and technology-enabled transformation solutions for the Office of the CFO in public and private organizations. The Company has over 700 professionals and currently represents clients in the private equity, financial services, life sciences, real estate and hospitality sectors, among others. Its footprint has grown significantly over the past 10 years with professionals located across the United States and globally in Ireland, South Africa and the Philippines.

"We are excited to partner with the CrossCountry team who have driven strong organic growth and profitability since inception," said Dave Tayeh, Head of Private Equity – North America at Investcorp. "CrossCountry's relentless focus on exceptional client service has enabled this sustained track record of growth. There are several macro themes driving continued opportunity in accounting advisory, including the rise of outsourcing and the evolving role of the finance function to involve technology as businesses digitize their operations. We believe that our long history of working with professional services companies, and the potential synergies across our current portfolio in this space, will help CrossCountry achieve its next phase of growth."

"As we continue to expand our reach, our partnership with Investcorp puts us in the best position to solve new, complex challenges for our clients, while growing our exceptional team," said Erik Linn, Co-Founder and Managing Partner of CrossCountry Consulting. "We owe much of our success over the years to our incredible clients and employees; we believe Investcorp is the right partner with whom we can expand our capabilities, and we look forward to a new, exciting chapter of growth together."

"CrossCountry's co-founders and management team have built a leading financial advisory firm with a differentiated culture over the last decade," said Philippe Bouchard, Senior Director at PSP Investments. "As a provider of long-term strategic capital, PSP Investments is pleased to back this transaction alongside Investcorp. We believe CrossCountry is strategically positioned in its industry and we look forward to working with all shareholders to support the company's growth prospects over the coming years."

"The boutique accounting advisory serviceable market is estimated to be nearly $10 billion and projected to grow double digits over the coming years. Having looked at many opportunities in the space, what attracted us most to CrossCountry is its best-in-class culture and remarkable employee engagement metrics. We believe that bodes well for their ability to continue to recruit and retain the best talent in the industry and grow above market," added Steve Miller, Managing Director, Private Equity – North America at Investcorp.

Investcorp has a long history of investing in professional and tech-enabled services with notable investments including AlixPartners, ICR, PRO Unlimited (now Magnit), Resultant and United Talent Agency.

Guggenheim Securities, LLC acted as the financial advisor to CrossCountry Consulting, Clearsight Advisors advised RLH Equity Partners, and Houlihan Lokey acted as the advisor to Investcorp and PSP Investments.

Terms of the acquisition were not disclosed.

About InvestcorpInvestcorp is a global investment manager, specializing in alternative investments across private equity, real estate, credit, absolute return strategies, GP stakes, infrastructure, and insurance asset management. Since our inception in 1982, we have focused on generating attractive returns for our clients while creating long-term value in our investee companies and for our shareholders as a prudent and responsible investor.

We invest a meaningful portion of our own capital in products we offer to our clients, ensuring that our interests are aligned with our stakeholders, including the communities that we operate within, towards driving sustainable value creation. We take pride in partnering with our clients to deliver tailored solutions for their needs, utilizing a disciplined investment process, employing world-class talent and combining the resources of a global institution with an innovative, entrepreneurial approach. In January 2022, Investcorp issued its 2021 Responsible Business Report which outlines its Environmental, Social, and Governance (ESG) highlights for 2021 and specific initiatives the Firm implemented to meet its goals: https://www.investcorp.com/esg/.

Investcorp has today 13 offices across the US, Europe, GCC and Asia, including India, China and Singapore. As of June 30, 2022, Investcorp Group had US $42.7 billion in total AUM, including assets managed by third party managers, and employed approximately 480 people from 50 nationalities globally across its offices.

For further information, visit www.investcorp.com and follow us @Investcorp on LinkedIn, Twitter and Instagram.

About PSP InvestmentsThe Public Sector Pension Investment Board (PSP Investments) is one of Canada's largest pension investment managers with $230.5 billion of net assets under management as of March 31, 2022. It manages a diversified global portfolio composed of investments in capital markets, private equity, real estate, infrastructure, natural resources and credit investments. Established in 1999, PSP Investments manages and invests amounts transferred to it by the Government of Canada for the pension plans of the federal Public Service, the Canadian Forces, the Royal Canadian Mounted Police and the Reserve Force. Headquartered in Ottawa, PSP Investments has its principal business office in Montréal and offices in New York, London and Hong Kong. For more information, visit investpsp.com or follow us on Twitter and LinkedIn.

About CrossCountry ConsultingCrossCountry Consulting is a trusted business advisory firm that provides customized finance, accounting, human capital management, risk, operations, and technology consulting services to leading organizations facing complex change. We partner with our clients to help them navigate pressing business challenges and achieve goals related to improving operations, minimizing risks, and enabling future growth.

For further information, visit www.crosscountry-consulting.com and follow us @CrossCountry-Consulting on LinkedIn and @crosscountryconsulting on Instagram.

A little more on CrossCountry Consulting.

In late April, the company announced a spin-off of its Workday Practice into standalone technology company CrossVue:

CrossVue's functional and industry expertise will enable organizations to achieve long-term strategic objectives and improve day-to-day efficiencies

MCLEAN, Va. and CHICAGO, April 26, 2022 /PRNewswire/ -- CrossCountry Consulting, a leading business advisory firm, today announced a spin-off of its Workday practice into a standalone company, CrossVue, dedicated exclusively to the Workday ecosystem.

As a full-service Workday deployment partner, CrossVue will remain committed to providing exceptional Workday services and solutions to drive business transformation. CrossCountry will continue to deliver business advisory and technology solutions that enable companies to transform operations, minimize risks, and achieve future growth.

Backed by RLH Equity Partners, CrossVue will further develop its position in the industry with a powerful go-to-market strategy led by CEO Jill Jones, CrossCountry's former Workday Practice Lead. As a contemporary consulting firm that provides the blueprint for modernizing client operations and processes through Workday, CrossVue will continue to provide advisory, deployment, and post-production support to clients throughout a wide range of industries including medium to large enterprise, healthcare, financial services, private equity, and nonprofit.

"Over the past 11 years, we've built a strong reputation for being fast and nimble in order to reach our goals and to serve our customers," said Erik Linn, Co-Founder and Managing Partner of CrossCountry Consulting. "Today's announcement clearly marks another significant accomplishment in our firm's history, and we look forward to continued growth and success across our advisory services and technology solutions."

He added: "Both CrossCountry and CrossVue will continue our strategic relationship and partnership as we utilize the complementary strengths of both firms to support our clients."

"This is a unique opportunity to combine the legacy, scale, and scope of a well-established business while capturing the entrepreneurial energy of a new firm to better serve clients," Jones said. "Our culture, core values, and people-centric approach are anchored on the foundation that was built at CrossCountry."

"I am excited about the future of CrossVue as its own independent company," she added. "We will continue to strategically partner with Workday and forge a new path of innovation and services for our clients."

CrossCountry's Advisory business has a demonstrated record of excellence and performance over the past 11-years. The strategic focus on advisory and technology-enabled solutions will position CrossCountry to continue to capitalize on favorable industry trends, better serve its clients, and enhance its growth.

CrossCountry Consulting is a trusted business advisory firm that provides comprehensive solutions encompassing business transformation, technology, accounting, risk, and cybersecurity. We partner with our clients to help them navigate complex business challenges and achieve goals related to improving operations, minimizing risks, and enabling future growth. For more information, visit www.crosscountry-consulting.com.

CrossVue is a contemporary consulting firm providing the blueprint for modernizing client operations and processes through Workday. As a leading Workday advisory, deployment, and post-production support firm, we drive critical results for our clients and help them reach their transformation goals through the Workday platform. For more information, visit www.crossvue.com.

In mid-August,

The Inc. 5000 list represents an unparalleled look at the nation's most successful private companies and is revered as the hallmark of U.S. entrepreneurial success. The companies on the 2022 Inc. 5000 have all remained competitive within their markets, but this year's list also showcases companies who have continued to adapt and demonstrate resilience amid the economic challenges defined by the past three years. Companies are ranked according to percentage of revenue growth over a three-year period, comparing 2018 to 2021. They must also be an independent, for-profit, privately held company based in the U.S. in order to qualify.

“We are thrilled to be recognized on the Inc. 5000 list for seven years running. It is a true testament to our team’s hard work and the ongoing commitment to serving our clients and helping them reach their goals,” said Erik Linn, Co-Founder and Managing Partner of CrossCountry Consulting. “We also remain focused on nurturing and cultivating a culture that ultimately translates into a world-class client experience; our continued growth is attributed to each of our clients, who are the cornerstone of our success. We look forward to continuing our upward trajectory and continued successes for years to come.”

“The accomplishment of building one of the fastest-growing companies in the U.S., in light of recent economic roadblocks, cannot be overstated,” says Scott Omelianuk, Editor-in-Chief of Inc. “Inc. is thrilled to honor the companies that have established themselves through innovation, hard work, and rising to the challenges of today.”

Since opening its doors in 2011, CrossCountry has seen remarkable and sustained growth. With offices in Washington, D.C., New York, San Francisco, Boston, and Seattle, the firm has grown to become one of the industry’s most reputable and competitive business advisors serving the evolving needs of the modern CFO. The CrossCountry team works to ensure organizations and businesses are future ready, and offers an integrated suite of solutions around transformation, finance, transactions, technology, and risk.

In mid-September, CrossCountry Consulting appointed i

In his new role, Jackson will work closely with private equity firms and their portfolio companies to deliver best-in-class outcomes tied to business and fund performance. He will also work alongside firm leadership to help develop and lead growth strategies for the practice. Jackson brings more than two decades of experience and practical perspectives that will aid in the design and implementation of pragmatic, scalable solutions that simultaneously mitigate risk and drive enterprise value creation.

"It’s critical in today’s world for private equity to successfully deliver on value creation strategies across the portfolio in order to generate their desired investment returns,” said Chris Clapp, Private Equity Lead at CrossCountry Consulting. “Jackson’s proven experience delivering operational enhancements across the investment lifecycle of portfolio companies will make him an invaluable partner to our private equity clients."

“Competition for deals remains strong as PE sponsors look to put capital to use,” Jackson said. “There has never been a more exciting time to build upon this momentum and I’m thrilled to continue meaningful work with the CrossCountry team as we seek to exceed the expectations of our clients by providing an unparalleled and comprehensive experience.”

Jackson has more than 20 years of public accounting and PE industry experience across a wide range of sectors. Prior to joining CrossCountry, he was a Portfolio Support Executive at Transom Capital Group where he partnered with executive leadership across the portfolio on financial reporting and compliance, cashflow management, execution of strategic initiatives, and delivery of cross-functional operating efficiencies. Jackson began his career at PwC before serving in various executive-level finance and strategic roles at private equity portfolio companies in the United States and United Kingdom. He is a registered accountant in the United States, South Africa, England, and Wales.

More recently, CrossCountry Consulting appointed a new Chief Financial Officer:

Steve Boyce to assume role of CFO, leading the development of corporate finance strategy and overseeing financial operations

MCLEAN, VA, November 9, 2022 — CrossCountry Consulting, a leading business advisory firm, today announced the appointment of Steve Boyce as Chief Financial Officer. He is taking over for Amy Seibel, who is retiring due to health reasons. Boyce brings with him decades of experience leading finance and cross-functional teams through periods of growth. He will lead the development of corporate finance strategy and oversee all financial operations, including financial planning, treasury, operational metrics and analytics, accounting, tax, and reporting.

Boyce has more than 25 years of financial management and professional services experience within publicly and privately held technology and service companies. He has a demonstrated ability to work effectively with multiple stakeholders including public and private equity investors, lenders, debtholders, and vendors. His extensive experience in financial operations will further support CrossCountry’s continued growth.

“Steve Boyce is a highly effective senior executive and strategic partner to the executive management team as well as a trusted advisor to the Board of Directors,” said Erik Linn, Co-Founder and Managing Partner of CrossCountry Consulting. “His track record of successful leadership and diversified background with the Big Four, pre-IPO, venture-backed, and privately held companies will prove to be invaluable in developing effective corporate finances strategies.”

He added: “Amy has been a tremendous contributor to CrossCountry, and we are so grateful to have had her with us these past few years. I am so thankful for the leadership she provided as the firm’s first CFO. Steve is a perfect fit to take over, and we’re thrilled that he will be at the financial helm of this exciting new chapter for us.”

"CrossCountry has an excellent reputation for providing best-in-class solutions to a growing client base,” said Steve Boyce, CFO, CrossCountry Consulting. “I’m impressed by the team’s dedication to solid strategic growth, and their devotion to their employees and customers. On top of that, it’s a pivotal time at CrossCountry; the team is growing rapidly and I’m excited to make an immediate impact on that momentum.”

Most recently, Boyce served as the Principal of Boyce Advisory Services which provides finance and accounting consulting to start-ups and growth-oriented companies. Previously, he served as the Chief Financial Officer of RRD Capital, LLC, a SPAC sponsor of RRD I Acquisition Corp. There, he led all RRD Capital finance functions, including accounting, financial planning, treasury, tax, and financial operations. His professional experience also includes time as Managing Director and Chief Financial Officer of MorganFranklin Consulting, LLC, and more than a decade at NeuStar, Inc. in a variety of roles including Vice President, Finance & Treasurer and Vice President, Finance & Corporate Controller.

I invite my readers to read the latest news on CrossCountry here and learn more about the company on its website.

It is a very impressive company which is committed to to diversity, equity, and inclusion and states on its website that these initiatives must be demonstrated through not only our words, but also our actions:

In an effort to be more intentional and focused on creating and nurturing an environment where every employee feels respected, valued, and appreciated, we established a clear set of objectives to measure our progress and infuse it into the fabric of our company. These objectives guide our strategy and ability to achieve greater diversity through building communities, awareness, and training.

I love this except I am disappointed that people with disabilities aren't even mentioned (to be rectified).

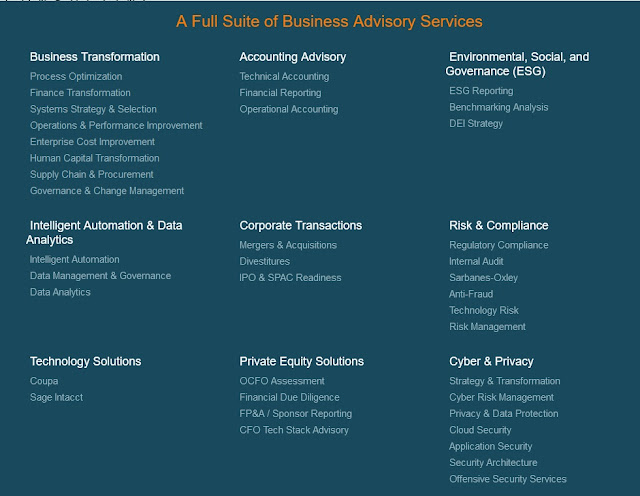

The company offers a full suite of advisory services across six industries:Financial Services, Technology, Media & Telecommunications, Healthcare, Real Estate & Hospitality, Life Sciences and Government Contracting:

In short, it's a very impressive private company which is growing very fast and that's why Investcorp announced it is acquiring a majority stake and PSP Investments and RLH Equity Partners will continue as an investor.

CrossCountry founders, Dave Kay and Erik Linn, will continue to be significant shareholders.

These are the type of private businesses you want to own as a global recession looms large, niche advisory services that will be in high demand.

PSP Investments and RLH Equity Partners will realize nice returns and remain significant minority equity shareholders.

Lastly, let me end by congratulating Simon Marc, PSP's Senior Managing Director and Global Head of Private Equity, who ranks among the European senior executives featured in Private Equity News “Fifty Most Influential in Private Equity 2022”.

The list recognizes investors, dealmakers, business leaders and advisers who are shaping the European private equity market and have a significant impact on the industry and its future.

I think Simon and his team have done an outstanding job executing on their strategy, investing and co-investing with top PE funds and delivering great long-term returns.

The environment for private equity, real estate and infrastructure is becoming more challenging as rates rise and inflation persists, but I think PSP and other top LPs are doing what it takes to prepare for the storm ahead (I hope so).

Below, CrossCountry founders Dave Kay and Erik Linn share with us their vision for the company's future and culture when they started CrossCountry Consulting back in 2011.

Also, "We will always remember them," says a University of Montreal Student as

she remembers the 14 women who were tragically killed in the 1989

Polytechnique massacre 33 years ago. CityNews' Felisha Adam reports on this National Day of Remembrance and Action on Violence Against Women.

Comments

Post a Comment