Much Ado About Wage Inflation?

Stocks cut much of their earlier losses Friday as investors looked past hotter-than-expected labor data to the upcoming Federal Reserve meeting.

The Dow Jones Industrial Average closed up just 34.87 points, or 0.1%, to 34,429.88 points after hitting a session low of more than 350 points down. The S&P 500 dipped 0.1% to 4,071.70, rebounding from an earlier loss of 1.2%. The Nasdaq Composite also made up ground to end nearly 0.2% lower at 11,461.50 points. The tech-heavy index dropped as much as 1.6% earlier in the day.

All three indexes set weekly gains, with the Nasdaq posting the largest increase at nearly 2.1%. The S&P 500 added 1.1%, and the Dow ticked up by 0.2%. Friday’s close marked the first time the three major indexes notched back-to-back weekly gains since October.

Stocks dipped after labor data released Friday morning showed payrolls rose by 263,000 in November, a bigger gain than the 200,000 increase expected by economists polled by Dow Jones. Average hourly earnings also came in above expectations, jumping 0.6% compared with the prior month and 5.1% against the same month a year ago. The unemployment rate held steady at 3.7%.

The market quelled much of those losses as the trading day went on. Market observers attributed the move to investors being increasingly able to shake off concerning individual economic indicators following remarks on Wednesday from Fed Chair Jerome Powell that appeared to confirm slowing rate hikes starting as early as December.

“Just one strong labor data point is not going to be enough after Powell’s speech,” said Anna Han, vice president at Wells Fargo Securities. “He’s confirming that we are seeing the trend that we are having an impact on inflation, so I think that sort of soothes the market and takes pressure off.”

It was the final monthly employment report before the Fed’s two-day meeting Dec. 13-14, in which the central bank is expected to slow to a 50 basis point interest rate hike from the 75 basis point hikes seen in recent months.

It's Friday, we had another volatile session in stocks, bonds and currencies today:

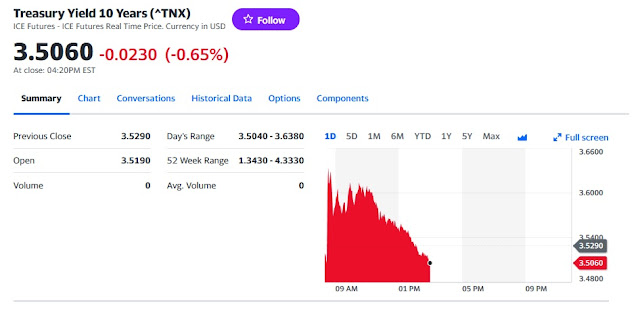

What you see above is as soon as the US nonfarm payroll report for November was released at 8:30 this morning, coming in stronger than expected, the yield on the 10-year Treasury note jumped to 3.638%, equity futures fell and the US dollar jumped in a huge move up.

That was the initial reaction, then people started analyzing the numbers carefully and long bond yields came back down, stocks rebounded and the US dollar sold off again.

Here are some tweets covering the US jobs report:

BREAKING: November jobs added 263K beating expectations. pic.twitter.com/HaVL7Qcqhn

— Squawk Box (@SquawkCNBC) December 2, 2022

"This is a hot number. It gives the Fed permission to keep increases interest rates and elongates that pause and moves out of pivot," says Saira Malik on the recent jobs report. "The longer the Fed raises rates and keeps them high, the greater chance of a recession." pic.twitter.com/BsDMGpwck3

— Squawk Box (@SquawkCNBC) December 2, 2022

"We're seeing interest rates in certain sectors feel the brunt of the Fed policy. It's not playing out in service sectors yet but it is in goods," says @NelaRichardson. "The problem with Fed policy now in regards to the housing market is it not only hits demand, it hits supply." pic.twitter.com/k8satjBYe0

— Squawk Box (@SquawkCNBC) December 2, 2022

Payrolls rose by 263,000 in November, more than expected despite Fed rate hikes https://t.co/JegcWf6JC8

— CNBC (@CNBC) December 2, 2022

Here's where the jobs are for November 2022 — in one chart https://t.co/xPH3KCX2Xa

— CNBC (@CNBC) December 2, 2022

Hotter November nonfarm payrolls, +263k vs. +200k est. & +284k in prior month pic.twitter.com/eLU12ei7BG

— Liz Ann Sonders (@LizAnnSonders) December 2, 2022

Labor force participation rate continues to dip, down to 62.1% in November vs. 62.3% est. & 62.2% prior pic.twitter.com/R4I9zS76Xv

— Liz Ann Sonders (@LizAnnSonders) December 2, 2022

Unemployment rate unchanged in November at 3.7% pic.twitter.com/iBRxTXjDpf

— Liz Ann Sonders (@LizAnnSonders) December 2, 2022

A move higher in permanent job losses (blue) while temporary unemployment (orange) ticked down pic.twitter.com/K0j7UcTgME

— Liz Ann Sonders (@LizAnnSonders) December 2, 2022

Worth watching: number of individuals unemployed for >27 weeks (“long-term unemployment”) continues to tick higher pic.twitter.com/KDGwP2MmGW

— Liz Ann Sonders (@LizAnnSonders) December 2, 2022

Problem for Fed? November average hourly earnings +0.6% m/m vs. +0.3% est. & +0.5% in prior month (rev up from +0.4%) … strongest gain since January pic.twitter.com/Pp7pLUgDND

— Liz Ann Sonders (@LizAnnSonders) December 2, 2022

The biggest news in this release is large upward revisions in wage growth for September and October and a big number for November.

— Jason Furman (@jasonfurman) December 2, 2022

This is the second time this year we've seen AHE revisions like this dashing the hopes that maybe nominal wages growth was cooling. pic.twitter.com/gRxGnv5e3B

Fade the "no recession" narrative. Tack on the shrinking workweek, and payrolls fell 117k. The Household survey sagged 138k after -328k in Oct, the sharpest decline since March-April 2020.#RosenbergResearch

— David Rosenberg (@EconguyRosie) December 2, 2022

Adding to the insanity of this payroll report, the birth-death model added 110k jobs. Sure thing. So net this out and adjust for the shrinking workweek, and the real NFP number was -227K — and aligned with the recession message from the Household survey.#RosenbergResearch

— David Rosenberg (@EconguyRosie) December 2, 2022

Oh, and as for that hot U.S. wage number. If not for the slide in hours worked (the denominator!), average hourly earnings would actually have come in below expected, at +0.26% MoM. Quick, Mortimer — buy those bonds back!#RosenbergResearch

— David Rosenberg (@EconguyRosie) December 2, 2022

November employment data beat expectations. So what? Labor market changes show up first in the construction industry. IF rates have peaked then expect a peak in layoffs Spring '24. If you think rates have further to go (I do) then it's too early to discuss a labor market trough. pic.twitter.com/sOCK0BinxL

— Francois Trahan (@FrancoisTrahan) December 2, 2022

Interestingly, Francois Trahan doesn't think rates have peaked yet and neither do I so I was surprised how bonds rallied hard after the report.

Importantly, I listened to Chairman Powell's comments on Wednesday afternoon and he clearly stated going forward, wage inflation will be a much bigger factor on inflation.

Powell knew about this report, he didn't mince his words but stock traders only hear what they want to hear, namely, the Fed will raise by 50 instead of 75 basis points at its next meeting and the Nasdaq took off and rallied 4.5% on Wednesday, all in the afternoon following Powell's comments.

Now, the bond market is another story. Following the very weak ISM report yesterday, bond traders were bracing for more weakness today:

U.S. manufacturing activity contracted for the first time in 2-1/2 years in November as higher borrowing costs weighed on demand for goods, but a measure of prices paid by factories for inputs fell for a second straight month, supporting views that inflation could continue trending lower.

The Institute for Supply Management (ISM) said on Thursday that its manufacturing PMI fell to 49.0 last month. That was the first contraction and also the weakest reading since May 2020, when the economy was reeling from the initial wave of COVID-19 infections, and followed 50.2 in October.

A reading below 50 indicates contraction in manufacturing, which accounts for 11.3% of the U.S. economy. Still, the index remains above the level that is typically associated with a recession in the broader U.S. economy. Economists polled by Reuters had forecast the index sliding to 49.8.

The Federal Reserve is in the midst of what has become the fastest rate-hiking cycle since the 1980s, as it battles inflation, raising the risks of a recession next year.

Fed Chair Jerome Powell said on Wednesday the U.S. central bank could scale back the pace of its rate increases "as soon as December." The Fed has raised its policy rate by 375 basis points this year from near zero to a 3.75%-4.00% range.

Manufacturing is also being pressured by the rotation of spending back to services from goods as the nation moves away from the pandemic.

The ISM survey's forward-looking new orders sub-index dropped to 47.2, remaining in contraction territory for a third straight month. Order backlogs also dwindled further also a function of improving supply chains.

The survey's measure of supplier deliveries rose to 47.2 from 46.8 in September, which was the first decline below the 50 threshold since February 2016. A reading below 50 indicates faster deliveries to factories.

With supply chain bottlenecks easing, the outlook for inflation is improving. A measure of prices paid by manufacturers fell to a 2-1/2 year low of 43.0 from 46.6 in October. The drop, which also reflected a moderation in commodity prices, offers hope that inflation has already peaked.

Annual consumer prices increased below 8% in October for the first time in eight months.

The ISM survey's measure of factory employment decreased to 48.4 from 50.0 in October. The decline is likely because of slowing demand for labor as manufacturers brace for economic turbulence.

The government reported on Wednesday that nondurable manufacturing job openings decreased by 95,000 at the end of October, contributing to a drop in overall vacancies in the economy. Still job openings remain considerably high and there were 1.7 openings for every unemployed person in October.

But the jobs report came in hotter than expected and so did wage inflation, so I was stunned to see long bonds rally after the report was released.

Recall, however, in late October I discussed why CDPQ and other large Canadian pension funds are long bonds, and it makes sense that bonds rally as the US economy slows and inflation pressures ease.

I'm just not sure inflation pressures are easing as much as people think and if wage inflation picks up, which it clearly is, the Fed will be stuck maintaining higher rates for longer.

Anyway, there's no question US long bonds have rallied nicely since late October but this sharp rally might be coming to an end soon:

As far as the US dollar, I remain long and think the recent weakness is another big buying opportunity:

On a positive note, high yield bonds have rallied since October which is why US stocks have rallied but this rally looks like it's coming to abrupt end soon:

And that means this rally in stocks is also coming to an abrupt end very soon:

Yeah, I know, it was a great week for some tech stocks like Netflix, hyper-growth stocks like Okta and Chinese tech shares like Alibaba, Bidu, JD.com, NIO, etc., but I remain very cautious here:

One thing I'm convinced of, the algos are not done crushing volatility but this too will come to an abrupt end:

The $VIX closed below 20 yesterday for the first time since August. It's been a year of oscillation for the $VIX with brief periods of calm followed by a return to higher volatility with an average $VIX around 26 (historical average is 19.7).

— Charlie Bilello (@charliebilello) December 2, 2022

Charting via @ycharts pic.twitter.com/39vJcdTfFm

Algos are not done crushing vol.

— Mac10 (@SuburbanDrone) December 2, 2022

Yet. pic.twitter.com/uwK3EDK7Ls

These are the types of rallies that make people forget.

— Mac10 (@SuburbanDrone) December 2, 2022

The trend is down. pic.twitter.com/VoPxuxHK3f

There's the week.

— Mac10 (@SuburbanDrone) December 2, 2022

Cramer says that Powell gave bulls the green light to own stocks in December:https://t.co/LE5o9xB1an

SOLD. pic.twitter.com/G3yonsV4ka

I also agree with Bank of America, sell the rally in equities before the unemployment shock of 2023:

BofA Says Sell Equities Rally Before 2023 Unemployment Shock https://t.co/roEhC7NccN via @YahooFinance

— Leo Kolivakis (@PensionPulse) December 2, 2022

I foresee US unemployment spiking in the second half of next year and wouldn't be surprised if it peaks at 9% when it peaks.

Alright, on that cheery note, let me wrap it up here and wish everyone a nice weekend.

Below, CNBC's Rick Santelli joins 'Squawk Box' to break down the November US jobs report and latest unemployment rate data.

Next, David Kelly, JP Morgan Asset Management chief global strategist, and Mona Mahajan, Edward Jones senior investment strategist, join 'Squawk on the Street' to discuss if Friday's jobs data alters Kelly's soft landing picture, what next year holds for equity markets and more.

Third, Jason Snipe, Steve Weiss, Jenny Harrington, Jim Lebenthal join the 'Halftime Report' to discuss the labor market, the Fed agenda and how the markets are responding to the jobs report.

Fourth, Wharton Professor Jeremy Siegel joins 'Closing Bell: Overtime' to discuss today's jobs report and how the Fed may actually interpret the numbers heading into their December meeting.

Fifth, Morgan Stanley Chief US Equity Strategist Mike Wilson says the recent rally in equities will continue through the end of the year, while cautioning that stocks face a significant downturn in the coming quarter. "This rally will go further and it will probably drag people back into thinking that the bear market is over," Wilson says on Bloomberg Surveillance."

Sixth, Eric Johnston, head of equity derivatives and cross asset at Cantor Fitzgerald, joins 'Closing Bell: Overtime' to discuss today's jobs report and whether the stronger-than-expected number has dashed any hopes for a year-end rally.

Lastly, Federal Reserve Chair Jerome Powell speaks at The Brookings Institute Hutchins Center on Fiscal and Monetary Policy in Washington, DC, on economic outlook, inflation and the changing labor market.

Update:Summers told Bloomberg Television’s “Wall Street Week” with David Westin that the economy has a “long way to go” before inflation is under control.

“My sense is that inflation is going to be a little more sustained than what people are looking for,” he said. You can read more here.

Also, the Wall Street Journal's Nick Timiraos, aka the Fed whisperer, reports that elevated wage pressures could force the Fed to stay higher for longer:

Fed officials have clearly signaled plans to raise rates by 50 basis points at their meeting next week

— Nick Timiraos (@NickTimiraos) December 5, 2022

Elevated wage pressures could muddy the debate over 50 v 25 in February and lead officials to pencil in more hikes next year https://t.co/TXl2N6wOO3

Stay tuned, 2023 is shaping up to be very interesting!

Comments

Post a Comment