PSP Investments Will Run New $15-Billion Canada Growth Fund

- The federal government has chosen PSP Investments to manage its $15-billion Canada Growth Fund

- Ottawa hopes outsourcing the program will allow it to start backing green megaprojects and firms faster and crowd in private capital, taking advantage of the pension fund’s expertise and connections

The federal government is outsourcing the running of its new $15-billion Canada Growth Fund (CGF) to one of the country’s largest pension managers, relying on the organization’s expertise and connections to bring megaprojects to these shores and find private capital to fill them out.

Ottawa announced plans for the program in last year’s budget, noting that green spending in the Canadian economy needs to rise by $125 billion annually for the country to reach net-zero by 2050. The government hoped the CGF’s pot of money would attract at least three times as much private-sector cash to the projects it financed.

The November 2022 Fall Economic Statement positioned it as a down payment on Canada’s response to the US$369-billion U.S. Inflation Reduction Act, promising that it would finance emissions-reducing projects that were commercializing green products and deploying novel technologies like carbon capture, utilization and storage (CCUS).

At the time, Finance Canada emphasized the need for a quick rollout and clear separation from the political sphere. The CGF “must be stood up quickly in order to keep pace with other jurisdictions—especially the U.S.,” it noted. It would need to choose which projects and firms to back “independent of government and political influence” so as to maintain the “market credibility” to attract private capital.

Tuesday’s budget offloads that decision-making to the Public Sector Pension Plan Investment Board (PSP Investments). The Crown corporation already manages over $225 billion in assets, mostly the retirement savings of federal civil servants. Canadian pension funds are “globally admired, and they’ve been globally successful,” a senior government official told reporters in the budget lockup Tuesday. “What we’re doing is hitching the wagon of the [CGF] to a high-quality organization that functions independently of government.” Finance Canada routinely conducts such briefings on the condition that participating bureaucrats not be named.

PSP will set up a team of investment managers to handle the CGF, but won’t mix Ottawa’s money with its own.

The pension fund’s current portfolio includes solar- and wind-power installations in Canada as well as Asia and Europe. In April 2022, it launched a climate strategy, including committing to grow its green assets to $70 billion and low-carbon transition assets to $7.5 billion. (It now classes 20.2 per cent of its assets in the first category and 2.8 per cent in the second). That July, the firm named Deborah Orida as its new CEO; she’d previously been the first-ever chief sustainability officer for the Canada Pension Plan Investment Board (CPP Investments), and oversaw its infrastructure and green-energy portfolios.

The new setup ensures that “highly-skilled investors working against commercial incentives” will be the ones making deal choices, which Ottawa hopes will “accelerate the development of domestic industries in the world of clean tech that will help decarbonize the economy,” the senior government official said. They cited “contracts for difference,” in which a government or investor promises to make up the shortfall if the market price for a project’s emissions reductions or gas falls below set targets.

The Liberal government has long hoped to attract private capital to domestic megaprojects. The $35-billion Canada Infrastructure Bank, established with that objective, has backed sewage plants, university building retrofits and municipal utility expansions; its record of bringing institutional investors into those projects has been mixed.

Ottawa is targeting similar sources of funding to meet its net-zero goals. It sees a “significant opportunity to drive investments from Canadian pension funds into Canadian clean technology firms and projects to help anchor the headquarters of these firms in Canada and achieve widespread decarbonization,” according to a December 2021 briefing note prepared by officials at Innovation, Science and Economic Development Canada, which The Logic obtained via an access-to-information request. The CGF will try to bring in that money by making less of a return than its private-sector partners.

The new setup ensures that “highly-skilled investors working against commercial incentives” will be the ones making deal choices, which Ottawa hopes will “accelerate the development of domestic industries in the world of clean tech that will help decarbonize the economy,” the senior government official said. They cited “contracts for difference,” in which a government or investor promises to make up the shortfall if the market price for a project’s emissions reductions or gas falls below set targets.

The Liberal government has long hoped to attract private capital to domestic megaprojects. The $35-billion Canada Infrastructure Bank, established with that objective, has backed sewage plants, university building retrofits and municipal utility expansions; its record of bringing institutional investors into those projects has been mixed.

Ottawa is targeting similar sources of funding to meet its net-zero goals. It sees a “significant opportunity to drive investments from Canadian pension funds into Canadian clean technology firms and projects to help anchor the headquarters of these firms in Canada and achieve widespread decarbonization,” according to a December 2021 briefing note prepared by officials at Innovation, Science and Economic Development Canada, which The Logic obtained via an access-to-information request. The CGF will try to bring in that money by making less of a return than its private-sector partners.

Outsourcing the fund’s management to PSP allows Ottawa to tap into relatively scarce—and in-demand—expertise and experience in green-project financing. Canada-based institutional investors like Brookfield Asset Management, CPP Investments and Caisse de dépôt et placement du Québec have allocated billions to climate and transition funds. There’s a limited number of dealmakers to staff them, noted Sahir Khan, vice-president at the University of Ottawa’s Institute for Fiscal Studies and Democracy, who used to work in finance on Wall Street.

Outsourcing its management to PSP helps Ottawa avoid that talent competition. It would have been “quite difficult” for the government to build the CGF from scratch, Khan said. “Leveraging an organization [like PSP] with an existing track record … means they plug into their business model, their HR model and presumably that’s a huge head start.”

CGF and PSP will sign an investment management agreement laying out the types of projects the public cash should be used to back, and what form that financing will take. PSP won’t charge the government the fees that typically accompany such outsourcing, but will be able to take the costs of operating the CGF from its kitty.

While their bank accounts will be separate, the agreement isn’t risk-free for PSP. “It becomes challenging for institutional investors when they have to account for several different investment mandates within their portfolio,” noted Randall Bartlett, senior director of Canadian economics at Desjardins. While PSP should be able to balance the CGF while serving its own members’ needs, he said, “it’s not necessarily what it’s designed to do.”

Tuesday’s budget marked an evolution of Ottawa’s programming in support of growth and green-economy objectives, rolling out a buffet of tax credits for clean energy and manufacturing. While the CGF will offer targeted funding to specific projects and companies, Khan said it fits a similar theme. In its effort to green the economy, “the government seems to have taken itself out of the business of direct delivery,” he said. “We’re seeing a little more farming out, or using the tax code, or direct transfers to people and companies in order to achieve their objectives.”

That could provide companies faster access to funding, both Bartlett and Khan said.

A big thank you to the nice person who sent me this comment tonight.

André Dubuc of La Presse also reports, PSP gérera un fonds pour la transition énergétique:

Le gestionnaire d’actif de la caisse de retraite des fonctionnaires fédéraux Investissements PSP, dont le bureau principal est situé à Montréal, hérite du mandat de gérer l’enveloppe de 15 milliards consacrée au financement des investissements des entreprises dans l’économie propre.

Le fonds a d’abord été annoncé lors de l’Énoncé économique de l’automne 2022. Une capitalisation initiale de 2 milliards a été autorisée.

Ce fonds est l’un des outils créés par le gouvernement fédéral pour financer les investissements des entreprises canadiennes dans la décarbonation de leurs activités.

Le fonds de croissance disposera d’une panoplie de moyens pour financer les sociétés canadiennes. Il pourra, par exemple, investir dans leur capital-actions. Il aura aussi la possibilité de proposer des contrats sur différence.

Ce type de contrat consiste à garantir un prix au client. Au Royaume-Uni, qui sert d’exemple au ministère des Finances du Canada, des contrats sur différence dans le prix de l’électricité sont offerts. En vertu de ce contrat, un producteur d’énergies propres renouvelables peut se prémunir contre les fluctuations de prix. L’entreprise peut mieux planifier ses investissements en s’assurant que les projets propres soient plus rentables que les projets polluants, lit-on dans le budget.

Le budget annonce la volonté du Canada d’offrir ce type de contrat sur le prix du carbone « afin de rendre la tarification du carbone encore plus prévisible ». Des consultations seront menées. À ce moment-ci, précise-t-on aux Finances, les sommes allouées pour les contrats sur différence en regard du prix du carbone ne sont pas connues.

Le Canada impose une taxe sur les émissions de gaz à effet de serre. La taxe est appelée à augmenter considérablement à l’avenir, bien que les hausses attendues ne soient pas fixées par une loi. Un prochain gouvernement peut toujours modifier la hauteur des hausses prévues. Le contrat viendrait annihiler ce risque.

La même logique s’applique au Québec, où le prix du carbone est établi par une bourse et non pas par une taxe. Son prix est appelé à augmenter, de manière encore moins prévisible qu’une taxe.

Plateforme sophistiquée d’investissement

C’est Investissements PSP, gestionnaire de la caisse de retraite des fonctionnaires fédéraux ayant un actif sous gestion de plus de 225 milliards, qui obtient le mandat d’investir le capital du fonds.

Ces sommes seront gérées séparément et indépendamment des actifs des caisses de retraite des employés fédéraux.

Un haut fonctionnaire des Finances a justifié ce choix par les avantages, en matière d’efficacité et de rapidité, à utiliser une plateforme existante d’investissement très sophistiquée, ce qu’est PSP, selon lui.

Les premiers investissements doivent se faire en 2023.

Le gouvernement profite du budget pour annoncer que les représentants syndicaux des fonctionnaires fédéraux auront dorénavant deux sièges au conseil d’administration de PSP.

Banque d’investissement des infrastructures

Le Fonds de croissance du Canada vient compléter l’offre de financement du fédéral aux entreprises, offre qui repose aussi sur la Banque de l’infrastructure du Canada.

Le budget 2023 vient doubler les cibles d’investissement de la banque dans les énergies propres et les infrastructures vertes. La cible était de 5 milliards dans chacune des deux catégories ; elle passe à 10 milliards.

La banque a engagé 8,5 milliards dans 37 projets depuis sa création en 2017.

« Ces investissements feront de la banque d’investissement le principal instrument de financement gouvernemental appuyant les projets de production, de transmission et de stockage d’électricité propre », est-il écrit dans le budget.

It's late and I'm too lazy to translate this French article and if you're Canadian and can't speak or write French, shame on you! (rest of you Americans and Brits can use Google translate).

My quick takeaways on the articles above:

- First, this is BY FAR the smartest thing this Liberal government has done and it has Michael Sabia's footprint all over it. Sabia, the former President and CEO of CDPQ? Yes, that Michael Sabia, he's now the highest ranking civil servant in Trudeau's government, appointed deputy minister of finance back in December 2020. He was hired to make sure our federal finance minister/ deputy PM Chrystia Freeland doesn't do any more damage (he's coaching her and making sure Finance Canada implements all the right policies when it comes to the transition economy/ infrastructure but it's a long, tough slug dealing with government bureaucrats).

- Notice the federal government tapped PSP Investments and not CPP Investments to run this new $15 billion Canada Growth Fund. That's because you need to get approval from all provincial governments when you make changes to CPP Investment's mandate whereas the Treasury Board has close ties with PSP and can easily ask them to run this new fund. Both PSP and CPP Investments have amazing internal expertise and the right incentive plans and governance to run this new fund but for expeditious reasons, PSP was chosen which is just fine by me.

- Also notice it wasn't the BDC or the Canada Infrastructure Bank chosen to run this new fund. This too was done on purpose. As far as BDC is concerned, it has major governance issues and my sources tell me it's getting worse: "Isabelle Hudon is starting new funds to give goodies to all her friends, it's a disaster waiting to happen and I'm very concerned about the BDC." (I told him let them crash and burn, that will knock some sense in this government to completely revamp BDC’s governance). As far as the Canada Infrastructure Bank, let's just say it's a huge disappointment and hasn't done any major project with Canada's large pension funds since being asked to help out with CDPQ's REM project ("Sabia's baby").

- The Times Hill recently wrote a critical comment on how skeptics are wary of exemption from typical oversight requirement for the Canada Growth Fund. Well, this move shuts those skeptics up because PSP and CPP Investments have the best governance from all of Canada's Crown corporations.

- With all due respect to Randall Bartlett, senior director of Canadian economics at Desjardins, PSP can easily manage this mandate without sacrificing its principal mandate of managing the funding of benefits earned from April 1, 2000 by members of the public sector pension plans of the federal Public Service, the Canadian Forces, the Royal Canadian Mounted Police and, since March 1, 2007, the Reserve Force.

- In my opinion PSP has the talent and governance to do this properly BUT a word of advice for Deb Orida and her senior executive team: don't bungle this up! I would immediately hire someone senior to manage this new Canada Growth Fund and I'm thinking of someone who was a senior executive at CDPQ Infra and now works in Ottawa for another Crown corporation. His ethics, judgement and experience working with Crown corporations are irreproachable, he has an incredible resume of project finance and doing major infrastructure projects and Michael Sabia and Macky Tall know him well (Sabia was sitting on CDPQ's Infra board). Whoever PSP hires or places to run this new fund, don't bungle it up!!

- The La Presse article states that PSP board will now have 2 new members, representatives from the public sector unions in Ottawa. This is fantastic news, it's about time they get representation on that board and ask some very tough questions (email me if you have no idea about what they're doing internally across all their operations).

Please note the technical backgrounder to this new Canada Growth Fund is available here.

When you read it, you will understand why PSP was tasked to run this new fund.

Lastly, there is the Budget 2023. CBC has a long article going over it which you can read here.

I will just say that there are some good things in there like dental care for low income Canadians which just like medicare should be absolutely free in Canada for all Canadians (we get taxed enough to afford it!).

One little governance note on dental care. Someone emailed me to state this:

Per my prior comments on Stephen Smith. Isn’t it convenient that the Canadian government just announced billions in dental spending right after Peloton announced a big merger last year of their portfolio company 123Dental and Altima forming an even larger entity.

From CBC:The program will continue to roll out this year, extending dental services to lower income Canadians who don't already have access to a dentist.

The program's price tag is steep: $13 billion over five years.

When the program is fully operational in 2025, nine million uninsured Canadians with an annual family income of less than $90,000 will qualify for coverage. There will be no co-pays for those with a family income under $70,000.

The program will be run by Health Canada with a "third-party benefits administrator" charged with actually managing program benefits — a structure that essentially leaves the provinces and territories out of the mix.

This is the stuff I’m talking about, you will also notice they are trying to change a bunch of lobbying rules as well right now.Crony capitalism is repulsive.

Well, I'm not sure Stephen Smith and Peloton Capital Management are benefiting from this new proposed dental program but given some prior comments made on my blog, it's worth keeping in mind as Mr. Smith has enormous influence in Ottawa (like George Carlin noted long ago: "it's a Big Club, you and I aren't part of the Big Club").

Some other thoughts on Budget 2023? Rosie summed up my thoughts perfectly in this tweet:

Canada’s budget gets a big fat F. The tax bite expands. Spending out of control – an added $42bn in the next 5 yrs brings the cumulative burst since 2021 to $345bn! FY24 deficit’s to balloon to $40bn from last Fall’s estimate of $30.6bn and debt/GDP ratio up to 43.5% from 42.4%.

— David Rosenberg (@EconguyRosie) March 28, 2023

It's also worth reading John Pasalis's tweet:

Today's Federal budget confirmed that banks have a lot of flexibility in restructuring mortgages to ensure owners aren't forced to sell due to today's much higher interest rateshttps://t.co/fhGodB6C4h pic.twitter.com/BXXXougMpL

— John Pasalis (@JohnPasalis) March 28, 2023

Alright, let me wrap it up with some other related news from PSP.

Benefits Canada reports PSP Investments focusing on climate change in updated proxy voting guidelines:

The Public Sector Pension Investment Board is updating its proxy voting guidelines to communicate its views on sound corporate governance practices and climate change.

According to the guidelines, boards of directors at the companies in which PSP Investments invests, are expected to ensure climate risks and opportunities are integrated into their strategy and operations. They also encourage companies to increase the credibility of their transition efforts through measures such as climate-related governance structure, accountability for oversight of climate commitments and a transition plan aligned with climate science.

On a case-by-case basis dependent on a company’s ownership position, PSP Investments will prioritize engagements to articulate its views on the global transition to net-zero emissions and to determine if management has the capacity and willingness to improve their climate-related management practices.

Where boards fail to demonstrate adequate consideration of physical and transition-related impacts from climate change and to develop and disclose effective management plans in response to these risks, PSP Investments will vote against directors for accountability purposes to preserve long-term sustainable value, according to a press release.

“Our climate strategy roadmap guides us to using our capital and influence to support the transition to net-zero global emissions by 2050,” said Herman Bril, managing director and head of sustainability and climate innovation at PSP Investments, in the release. “In updating our principles, we are executing on our strategy, using proxy voting to promote corporate practices that address climate change, support transition plans and contribute to the long-term performance of the companies in which we invest.”

You can read more on PSP’s website here.

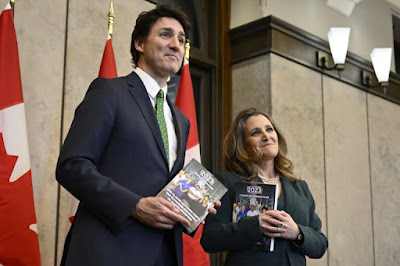

Below, Finance Minister Chrystia Freeland tables a federal budget projecting a deficit about $10 billion higher than initially forecast — an increase driven by a worsening economy and new spending on initiatives like a national dental care program.

And Pedro Antunes, chief economist for the Conference Board of Canada, and Angella MacEwen, a senior economist with the Canadian Union of Public Employees, join CPAC's Michael Serapio to discuss the 2023 federal budget.

Third, tax expert Tim Cestnick explains how the federal budget will impact affordability for food costs, housing and RESP savings.

Lastly, and most importantly, former Bank of Canada governor Stephen Poloz and former federal finance minister John Manley discuss what they will be looking out for in the budget.

Poloz who I had the pleasure of working with at BCA Research gets it, we are heading into hard times and this government is ill-prepared to deal with what is coming our way, jeopardizing our future (my words, not his).

On a personal note, I wanted to see more targeted benefits and job programs for Canadians with disabilities but I am also worried the government isn't prepared for the global economic slowdown which is headed our way and will last at least two years (you heard me right, nobody is prepared for what is heading our way!).

Update: Someone from the Public Service Alliance of Canada emailed me this on Wednesday morning:

Thank-you very much for your coverage of this issue from yesterday’s federal budget. I know it was late yesterday and now it is early today, however I have a few preliminary comments to share.

Firstly, in regards to the Canada Growth Fund, my immediate reaction tends to lean towards the commentary provided by Mr. Bartlett from Desjardins. According to the provisions of the Public Sector Pension Investment Board Act, the primary mandate of the PSPIB is to manage the pensions fund of Federal Public Service employees and members of the RCMP and the Canadian Armed Forces. Now, with the Canada Growth Fund, added to the mix when a promising $500 “green” investment presents itself, who gets it – the Canada Growth Fund or the Pension Fund??

I can also not sign off with mentioning a word on the 2022 federal budget proposal regarding the addition of two bargaining agent designated seats to the PSPIB. As far as I am aware there has been not yet been one iota of consultation with the federal public service bargaining agents on this issue. Federal Budget 2023 now appears to indicate that the Federal Government will be moving forward with legislation to now codify this arrangement!! If you would have any further insights on the foregoing I would certainly like to know!

I do not have any further insights but if André Dubuc of La Presse mentions it in his article above, I'm sure discussions are taking place.

As far as any potential conflict of interest arising between PSP's clients and this new Canada Growth Fund, I am certain PSP has already thought of this and will make sure it fulfills its primary mandate first. In my humble opinion, it's a possibility in theory but in practice, there are going to be so many opportunities to avoid any potential conflicts of interest.

Also see Ryan Tumilty's article, Liberals put growth fund in pension plan board's hands. I quote:

A backgrounder the government has provided on the Growth fund said it will fund carbon reducing technology that hasn’t yet been widely adopted, companies that are in early stages of development with less mature technologies and low-carbon natural resource development.

Leo Kolivakis, a senior pension analyst, with experience at several large funds said the government was smart to put the growth fund in PSP Investment’s hands.

“We got to get this up and running fast. We need to figure out how we’re going to do this properly. And to do this properly. We need to have the governance structure and people with the expertise to deploy these funds properly,” he said.

Kolivakis said he is also curious to see more of the details, but he believes the pension plan may have good projects it couldn’t fund as a pension plan, because they aren’t significant enough.

“Many many projects that come through their desk might look great, but because they’re too small, they pass on them because it’s just not in their interest to do it or their clients to do it.”

In the budget, the government said the growth fund will be making its first investments in the first half of this year.

Let's wait and see how PSP will set up this new growth fund but it definitely has all it needs to do this properly.

Comments

Post a Comment