CPP Investments' Suyi Kim on Taking Care of Private Equity Business

Private equity valuations can be a controversial subject; depending on who you ask, they’re an art, a science, or something in between.

Suyi Kim, global head of private equity at CPP Investments, likely knows this better than most. “Not to bore you with the details,” she warns after sitting down with Private Equity International at CPPIB’s Hong Kong office in February, “my first job was actually auditing and evaluating.”

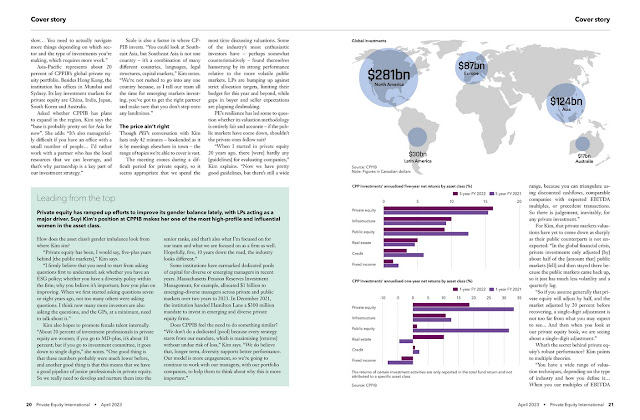

CPPIB is the world’s largest private equity investor, according to PEI’s 2022 Global Investor 100 ranking. The C$536 billion ($395 billion; €372 billion) institution had C$141.6 billion of net private equity investments as of 31 December, per its latest quarterly report. Roughly half of this is held in co-investments and directs. Though now based in Toronto, Kim is a familiar face in Hong Kong. She spent 14 years in the special administrative region, first as CPPIB’s head of PE for Asia and later as head of Asia-Pacific, according to her LinkedIn profile.

Her visit to the region is timely, coming just months after mainland China’s grand reopening. In the weeks preceding our conversation, tourists had started to become visible on Hong Kong’s streets once again. Chinese private equity activity has slowed in recent years, with travel disruption, regulatory uncertainty and geopolitical tensions contributing to diminished LP appetites. Though some North American investors have become less engaged with China, CPPIB was active in the market last year. Key deals include HR services provider 51job and a $35 million co-investment into cosmetics business HCP Global alongside the Carlyle Group.

The institution’s China exposure is “meaningful, but not that large”, Kim notes. “We have been investing in China for over 10 years with experienced teams and partners... This has helped us better understand the market and balance the opportunities versus risks.”

Despite its active 2022, CPPIB has found it “very challenging” not being able to visit China, Kim adds. “And then there are multiple things that you need to navigate – it’s not only the geopolitical tensions. There are internal China policy changes that we need to get our heads around better.”

China was not exempt from the valuation challenges hindering private equity’s global dealmaking efforts.

“When the market adjustment happened – which China headed into earlier than North America – dealflow naturally slowed down because of the valuation expectation gap, and I don’t think the valuation expectation gap has narrowed. Surprisingly, that valuation has stayed up and dealflow has been slow... You need to actually navigate more things depending on which sector and the type of investments you’re making, which requires more work.”

Asia-Pacific represents about 20 percent of CPPIB’s global private equity portfolio. Besides Hong Kong, the institution has offices in Mumbai and Sydney. Its key investment markets for private equity are China, India, Japan, South Korea and Australia.

Asked whether CPPIB has plans to expand in the region, Kim says the “base is probably pretty set for Asia for now”. She adds: “It’s also managerially difficult if you have an office with a small number of people... I’d rather work with a partner who has the local resources that we can leverage, and that’s why partnership is a key part of our investment strategy.”

Scale is also a factor in where CPPIB invests. “You could look at Southeast Asia, but Southeast Asia is not one country – it’s a combination of many different countries, languages, legal structures, capital markets,” Kim notes. “We’re not rushed to go into any one country because, as I tell our team all the time for emerging markets investing, you’ve got to get the right partner and make sure that you don’t step onto any landmines.”

The price ain't rightThough PEI’s conversation with Kim lasts only 42 minutes – bookended as it is by meetings elsewhere in town – the range of topics we’re able to cover is vast.

The meeting comes during a difficult period for private equity, so it seems appropriate that we spend the most time discussing valuations. Some of the industry’s most enthusiastic investors have – perhaps somewhat counterintuitively – found themselves hamstrung by its strong performance relative to the more volatile public markets. LPs are bumping up against strict allocation targets, limiting their budget for this year and beyond, while gaps in buyer and seller expectations are plaguing dealmaking.

PE’s resilience has led some to question whether its valuation methodology is entirely fair and accurate – if the public markets have come down, shouldn’t the private ones follow suit?“When I started in private equity 20 years ago, there [were] hardly any [guidelines] for evaluating companies,” Kim explains. “Now we have pretty good guidelines, but there’s still a wide range, because you can triangulate using discounted cashfl ows, comparable companies with expected EBITDA multiples, or precedent transactions. So there is judgement, inevitably, for any private investment.”

For Kim, that private markets valuations have yet to come down as sharply as their public counterparts is not unexpected. “In the global financial crisis, private investments only adjusted [by] about half of the [amount that] public markets [fell] and then stayed there because the public markets came back up, so it just has much less volatility and a quarterly lag.“So if you assume generally that private equity will adjust by half, and the market adjusted by 20 percent before recovering, a single-digit adjustment is not too far from what you may expect to see... And then when you look at our private equity book, we are seeing about a single-digit adjustment.”

What’s the secret behind private equity’s robust performance? Kim points to multiple theories.

“You have a wide range of valuation techniques, depending on the type of industry and how you define it...When you use multiples of EBITDA – which is what private equity generally relies on the most – for the entry or exit, that multiple generally is not completely up to the public markets. So when the public markets went up dramatically between H2 2020 and Q1 2022, most of the managers – at least, those that we’ve invested with – didn’t fully appreciate to that multiple. There was some gap that you can eat into.”

Conservatism, though, only tells part of the story. “The second factor is... that we have invested in very good GPs and companies whose underlying performance has been good,” Kim explains. “So we get to continue to see for our portfolio companies very strong top-line and bottom-line growth.” CPPIB’s PE portfolio had generated an annualised five-year net return of 16.1 percent as of 31 March 2022, almost double the 9 percent returned by public equities, according to its most recent annual report. Private and public equities accounted for 45 percent and 33 percent of the fund’s total returns over that period, respectively.

Slow and steady

Private equity boomed in the years prior to 2022. Record fundraising and pent-up demand from a pandemic- related slowdown caused asset prices to soar – an uncomfortable dynamic forinvestors unwilling to overspend.

“In the 18 months before last year’s adjustment, we could not deploy our investments on the direct side in particular, so whatever deal that we were doing, we’d either get kicked out in the first round because our valuation was too low or because there’s somebody bidding way above us. We refused to stretch our multiples, so our direct side deployment was much less than half of what we had expected as a budget.”

Now that valuations are slowly starting to come down, is CPPIB looking to snap up assets on the cheap?

“In public equities, if you want to buy, you can buy any time – that is not the case for private investments,” Kim explains. “In private equity, it takes about 18 to 24 months for the seller and buyer valuation expectation gap to be adjusted. The gap is highest at the beginning and then it gets adjusted over time... It takes time.”

CPPIB’s conservative attitude to deployment extends to fund opportunities, the pace of which have caused headaches for some investors over the past year.

“On the fund investment side, we’re more focused on steady deployment,” Kim notes.

“So when the market was very hot and GPs were raising money every 18 months, instead of every four years, we actually looked at how much we’re deploying to the GP over a four-year cycle because otherwise we’d have a lot of vintage concentration. We explain to the GP, ‘In this fund, we’ll give you half [of what we committed last time] so if you come back in two years, over four years we’re giving you the same amount.’”

CPPIB is one of private equity’s most enthusiastic direct and co-investors. The institution does not disclose how much is deployed into the asset class each year, though it is understood to have completed more than 100 deals in 2022 alone. Notable transactions included the $14 billion take-private of cybersecurity giant McAfee alongside Advent International, Permira, Singapore’s GIC and Abu Dhabi Investment Authority, among others; a $1.1 billion investment into UK-based wealth management tech provider FNZ; and an €800 million investment into Germany’s CeramTec.

LPs with large portfolios of directs can sometimes run the risk of being viewed as competitors to GPs – a suggestion Kim is quick to dismiss.

“We don’t compete with our GPs,” she explains. “We like to partner with them on the direct side. More than half of the portfolio that we invested in... we partnered with our GPs.”

Kim also notes that dealmaking has become harder in the current high-interest environment. “There’s limited large leverage financing available... so our deployment pacing also slowed down.

“There are some bottom-up selection issues: even if your allocation or desire did not change, you may find it difficult to invest,” she adds. “It could be the [availability of] leverage financing, it could be the valuation expectation gap – deployment has been slow, so it may appear that your allocation is getting smaller, but it is not necessarily a reflection of a top-down view to change our asset allocation.”

Unlike some of its more rigid peers in the pension space, CPPIB has a pragmatic attitude to portfolio construction.

“Private equity is very lumpy – there’s a cycle, certainly,” she explains.

“So if you were to just artificially fit a one-year budget, two-year budget, you end up doing the deals that you may not want to do. We have a very flexible total portfolio approach... so if you don’t invest in private equity, even if the capital is available, it gets invested somewhere else.

Great interview with Suyi Kim, Senior Managing Director & Global Head of Private Equity at CPP Investments.

You can download the full issue of Private equity International for April 2023 here.

I also embedded it below for those who want to read it as presented by PE International:

CPP Investments is the most important private equity investor on the planet. Period.

Just over 26% of its total C$536 billion portfolio is allocated to private equity (C$ 141.6 billion).

Roughly half of this is held in co-investments and directs.

When it comes to fund investing and co-investments, CPP Investments has led the way among Canada's large pension funds, first with Mark Wiseman, then with Mark Machin and now with John Graham.

This is their bread and butter, they do it better than anyone else and to get roughly half the C$ 141.6 billion portfolio in directs and co-investments, you need to have a skilled internal team that is able to analyze co-investments fast and pull the trigger fast.

These co-investments are larger transactions which allow the Fund to reduce fee drag and retain its target allocation to private equity, one of the best asset classes over the last 20 years.

What will the next 20 years bring?

I predict a lot lower returns as higher for longer is here to stay, meaning when rates are closer to historic norms, you need to readjust your return expectations for private equity lower.

Financial engineering and leverage are over, you really need to roll up your sleeves and realize on your long-term value creation plan.

What I find interesting is they want to do more in China but realize they need the right partners to do this properly.

Again, I note:

Scale is also a factor in where CPPIB invests. “You could look at Southeast Asia, but Southeast Asia is not one country – it’s a combination of many different countries, languages, legal structures, capital markets,” Kim notes. “We’re not rushed to go into any one country because, as I tell our team all the time for emerging markets investing, you’ve got to get the right partner and make sure that you don’t step onto any landmines.”

There are tons of landmines when investing in private equity in emerging markets.

As far as PE valuations, I found this very interesting:

For Kim, that private markets valuations have yet to come down as sharply as their public counterparts is not unexpected. “In the global financial crisis, private investments only adjusted [by] about half of the [amount that] public markets [fell] and then stayed there because the public markets came back up, so it just has much less volatility and a quarterly lag.

“So if you assume generally that private equity will adjust by half, and the market adjusted by 20 percent before recovering, a single-digit adjustment is not too far from what you may expect to see... And then when you look at our private equity book, we are seeing about a single-digit adjustment.”

A single-digit adjustment is nothing to worry about, a double-digit one is something to worry about.

And here, I will explain to everyone, the duration and depth of the next global recession will impact private markets at all of Canada's large pension funds, with no exceptions.

If it's a deep and prolonged global recession, don't be surprised to see double-digit adjustments to PE valuations.

But CPP Investments’ PE portfolio is well diversified by industry, geography, and vintage year.

They need to be because they're managing a private equity colossus.

There are considerable challenges to private equity right now.

I would urge my readers to take the time to read Bain's Global Private Equity Report 2023 here to get into the challenges and opportunities of this important asset class.

I just provide the contents of this report, it is well worth reading it all here:

Below, an older interview where Suyi Kim, Senior Managing Director & Global Head of Private Equity at CPP Investments, discusses her investment strategies. She spoke with Haidi Stroud-Watts and Shery Ahn on "Bloomberg Daybreak: Asia."

And Kurt Björklund, Managing Partner, Permira, Philipp Freise, Partner, Co-Head of European Private Equity, KKR and Imogen Richards, Partner & Global Head, Investment Structuring and Strategy, Pantheon Ventures discuss tapping into private markets with Bloomberg’s Jan-Henrik Foerster at the Bloomberg Invest Summit in London.Take the time to watch this great panel discussion.

Comments

Post a Comment