Top Funds' Activity in Q3 2023

It’s filing season for a string of major hedge funds, and big tech names like Apple, Microsoft, and Nvidia were among the most-traded equities in the third quarter. With the seven big tech firms—Apple (AAPL), Amazon.com (AMZN), Google parent Alphabet (GOOGL), Facebook parent Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA)—playing an outsize role in this year’s stock market rally, it’s no surprise to see them featured heavily in the quarterly filings of large investors. The Securities and Exchange Commission requires anyone managing at least $100 million in publicly traded assets to disclose their holdings within 45 days of the end of each quarter. One of the most dramatic moves in the third quarter was Chris Hohn’s TCI Fund Management selling its entire stake in Microsoft, which had previously totaled 11.8 million shares—worth around $4.4 billion at current prices. Hohn also trimmed holdings in Alphabet to 16.9 million shares from 18.5 million previously. Hohn last year called for Alphabet to aggressively cut costs before the Google parent said it would lay off 12,000 workers. David Tepper’s Appaloosa Management largely boosted its tech holdings in the period—except for Apple, which the hedge fund dumped entirely. Appaloosa sold its 480,000-share stake in Apple and reduced its stake in Taiwan Semiconductor Manufacturing (TSM) to 1 million shares from 1.78 million. Appaloosa increased its Amazon stake to 3.75 million shares from 3.16 million shares in August. The fund’s stake in Alphabet grew to 2.75 million shares from 2.31 million, and its Meta holdings rose to 1.95 million shares from 1.5 million previously. The fund held 1.65 million shares of Microsoft at the end of the quarter, up from 1.24 million previously. It wasn’t all bad news for Apple, though. Soros Fund Management, the investment firm founded by billionaire George Soros, took a new position of around 41,000 shares in the iPhone maker. Soros also bought up 325,000 shares of chip designer Arm Holdings (ARM). Soros sold positions of around 10,000 shares apiece in Microsoft and Nvidia (NVDA). With Nvidia earnings to come next week, trades around the chip maker are particularly under scrutiny. Tiger Global Management—the hedge fund led by Chase Coleman, which took heavy losses last year on tech investments—seems optimistic. It raised its stake in Nvidia to 1.1 million shares in the third quarter, from 628,575 previously. Arguably the most consequential holding of all for market sentiment, Warren Buffett and Berkshire Hathaway’s (BRK.B) mammoth position in Apple, was unchanged.

Brian Swint of Barron's also reports on what Warren Buffett wannabes can learn from Berkshire Hathaway's latest stock moves:

Everybody wants to be able to invest like Warren Buffett. Not only has he amassed an incredible fortune, he also seems to be amiable, humble, and full of sage advice.

The latest 13F filings of Berkshire Hathaway show his firm largely stayed on the sidelines of the stock market in the third quarter. It was a net seller of stocks in a period when the S&P 500 fell almost 4%.

Sure, maybe it would have done better if it had sold some Apple—that one stock accounts for half of the company’s portfolio, and the stake lost nearly $20 billion in value. Don’t worry, Berkshire shares are still up 15% this year.

One lesson to learn from Buffett is that losing is just a part of winning—even his company gets things wrong sometimes, such as buying General Motors, the auto maker that now is no longer part of its portfolio.

Take, for example, his decision to accumulate record levels of cash in the third quarter. If that was still more or less his position, he will have missed out on the euphoria of yesterday’s jump in stocks after the inflation numbers.

Being able to endure downturns and survive mistakes might be the biggest key to Buffett’s success. As Morgan Housel points out in The Psychology of Money, Buffett has made the vast majority of his wealth since his mid-60s—much of it can be explained by simply compounding investments made over more than 70 years of being in the market.

That’s the real wisdom of Buffett—stay in the game for a long time and winning gets easier.

Liz Moyer of Barron's added more on what top funds bought and sold last quarter:

Money managers loaded up on technology shares in the third quarter that ended in September, according to regulatory filings disclosing their stockholdings as of the end of the period. The filings are made after a 45-day delay, so positions could have changed between the end of September and now.

- George Soros’s fund had a new $67 million stake in Apple but no stakes in Disney, Microsoft, or Nvidia. It reported no stake in electric-vehicle maker Rivian, down from 4.2 million shares in June, but a new 1.5 million share stake in Novo Nordisk.

- David Tepper’s Appaloosa reported a new 2.4 million-share stake in China-based KE Holdings, a real estate technology firm. It also reported bigger stakes in Chinese e-commerce company PDD, Amazon.com, Meta Platforms, Alphabet, and Microsoft. It reported no stake in Apple or Broadcom.

- Nelson Peltz’s fund reported a 32.9 million share stake in Walt Disney, up from the end of June as he started a second activist campaign at the company, seeking board seats. Trian Fund Management also had a new 1.2 million shares stake in food distributor Sysco.

- Bill Ackman’s Pershing Square reported a bigger stake in Alphabet, (4.35 million shares) compared with the end of June, and a bigger stake in Hilton Hotels. Pershing reported a smaller 7.07 million shares stake in home improvement company Lowe’s.

It's that time of the year again when we get to peek into the portfolios of the world's top money managers with a customary 45-day lag.

These are arguably my most popular comments and I promise not to disappoint.

Macro headwinds and the Druckenmiller indicator

Let me begin by discussing my macro views first.

I think we are at an inflection point here where economic data comes in weaker than expected.

Let me be crystal clear: I'm expecting the deepest and most prolonged US and global recession since the 1970s and a bear market that will likely last two years.

Consider some of the macro headwinds facing the US economy right now:

80% Of American Households Are In A Worse Financial Position Now Than They Were Before The COVID Pandemic Hit — What You Can Do To Keep Your Head Above Water https://t.co/NEpqmhd7Yk

— Leo Kolivakis (@PensionPulse) November 16, 2023

Leading Economic Index (LEI) from @Conferenceboard fell by -0.8% m/m in October, keeping year/year rate (shown in chart) deeply negative (-7.6%) and in recession territory pic.twitter.com/m8LSEqkcjb

— Liz Ann Sonders (@LizAnnSonders) November 20, 2023

Continuing jobless claims have risen to highest since November 2021, but overall level is still low compared to prior recessions pic.twitter.com/idlLL8Rb95

— Liz Ann Sonders (@LizAnnSonders) November 17, 2023

Walmart Falls on Cautious Consumer Outlook, Late-October Dip https://t.co/zKgqCw9IHD

— Leo Kolivakis (@PensionPulse) November 16, 2023

JUST IN: Walmart, $WMT, falls 8% as CFO says October trends have made them "pause and rethink the health of the consumer."

— The Kobeissi Letter (@KobeissiLetter) November 16, 2023

More specifically, Walmart said they saw a sharp falloff in sales during the last 2 weeks of October.

Management said there is still strain on the consumer… pic.twitter.com/hYdbA2VF8X

⚠️ Deflation Alert

— Genevieve Roch-Decter, CFA (@GRDecter) November 16, 2023

After dealing with inflation for years, now the 'D' word is showing up in earnings calls

CEO of Walmart: “In the US, we may be managing through a period of deflation in the months to come”

Prices of Walmart’s groceries are higher than a year ago, and sharply… pic.twitter.com/ky6bMp9GCl

BREAKING 🚨: Crude Oil

— Barchart (@Barchart) November 16, 2023

Crude Oil crashing right through its 200D moving average and now trading at its lowest price since July pic.twitter.com/EupBsOzcBj

It's a deflationary recession! That's what lies ahead. You can believe that the structural backdrop has changed and is now more prone to inflation than it used to be and still think deflation is likely in the coming downturn. These things are not mutually exclusive. pic.twitter.com/pBps6uHHDZ

— Francois Trahan (@FrancoisTrahan) November 13, 2023

I spend a lot of time tracking housing data (especially when there's monetary tightening in the pipeline) as it gives us a sense of what lies ahead for the broader economy. Ed Leamer documented this phenomenon in his seminal paper from 2006 titled "Housing Is The Business Cycle". pic.twitter.com/uz8a7jyThK

— Francois Trahan (@FrancoisTrahan) November 16, 2023

America is now paying more in gross interest on its record $33 trillion debt than on national defense — here's who holds the IOUs? https://t.co/uI5YiVonxs

— Kabir (@AKabir57) November 17, 2023

"We are at a point at which we are borrowing money to pay debt service... We are at the point of that acceleration, which creates the supply-demand problem." -@RayDalio https://t.co/5MgU1Chzx8

— Jesse Felder (@jessefelder) November 17, 2023

Probably nothing pic.twitter.com/GudSblo9Gi

— Michael A. Arouet (@MichaelAArouet) November 18, 2023

Human nature doesn’t change pic.twitter.com/IZqcygveCc

— Michael A. Arouet (@MichaelAArouet) November 16, 2023

And this week, I learned of a new indicator, the Druckenmiller indicator which is clearly warning of a recession ahead:

The Druckenmiller Indicator has fallen to levels previously associated with recessions pic.twitter.com/afsWcmsQbB

— Barchart (@Barchart) November 17, 2023

If you want to understand why Stanley Druckenmiller has the best long-term track record among all money managers in the history time, it's because he understands macro extremely well and ties it into taking heavy bets in risk assets.

Sell the epic stock market rally?

Anil Varma of Business Insider reports the stock market is edging toward extremes of Great Depression and dot-com eras:

After a rally that defied high interest rates and recession calls, stock valuations are now edging toward levels seen before some of the greatest market meltdowns in history – by one measure at least.

A time-tested way of assessing whether equities are fairly valued is by comparing them with government bonds, considered one of the safest forms of investment.

And by that metric, stocks are looking historically expensive, according to experts from PIMCO and GAM Asset Management.

A key measure of the richness of stocks relative to debt is the so-called equity risk premium — or the extra return on shares over Treasury bonds.

The metric has plunged this year, indicating stretched stock valuations, toward levels seen during the Great Depression of the 1930s and the dot-com bubble of the late 1990s.

"Delving deeper into historical data, we find that in the past century there have been only a handful of instances when US equities have been more expensive relative to bonds – such as during the Great Depression and the dot-com crash," PIMCO portfolio managers Erin Browne, Geraldine Sundstrom, and Emmanuel Sharef write in a recent research note.

"History suggests equities likely won't stay this expensive relative to bonds."

The historically low equity risk premium is a deterrent to investing in stocks, according to Julian Howard of Switzerland's GAM Asset Management. It means stocks are offering investors little incentive to choose them over risk-free assets such as government debt – and that may turn away potential buyers.

"The equity risk premium is very, very narrow. Now, in fact, it is actually almost negative," Howard said in comments on the GAM website.

"And that is a major concern because what it is saying is that actually you don't need to invest in equities in the short to medium term, because if you invest in the six-month Treasury bill, which is giving you 5.5% completely free of risk, then that's actually a risk-reward that is completely unbeatable," he added.

US stocks are on track for their best month in a year amid expectations the Federal Reserve may have reached the end of its interest-rate increases at a time when the economy remains resilient and inflation has moderated.

The S&P 500 is up 7.4% in November, taking its year-to-date gains to 17.3%, amid optimism that corporate earnings will remain buoyant in the coming quarters.

However, PIMCO cautions against that outlook.

"We feel that robust forward earnings expectations might face disappointment in a slowing economy, which, coupled with elevated valuations in substantial parts of the markets, warrants a cautious neutral stance on equities, favoring quality and relative value opportunities," Browne, Sundstrom, and Sharef wrote.

Skepticism abounds. Theron Mohamed of Business Insider warns to prepare for for stocks to plummet 30% and a recession to strike any day now, legendary market prophet says:

Prepare for stocks to plunge by a third and a recession to strike imminently, a legendary market forecaster has said.

"I've been of the opinion that stocks — and I came out with this forecast early last year — would decline about 30% to 40% peak to trough," Gary Shilling, the president of A. Gary Shilling & Co., told "The Julia La Roche Show" in an interview aired this week.

"You'd have a further decline of about 30% from here to get that 40% overall decline, peak to trough," he said.

Shilling's forecast suggests the S&P 500, which hit a record high of nearly 4,800 points in January last year, could nosedive to about 2,900 points, its lowest level since May 2020. The benchmark stock index fell by 18%, including dividends, last year but has rallied 17% this year.

The veteran economist, known for correctly calling several major market trends over the past 50 years, said he expected stocks to fall because the US economy was faltering.

"We probably do have a recession coming shortly if we're not already in it," Shilling said, pointing to the inverted yield curve, weakness in leading economic indicators, and the Fed's commitment to crushing inflation.

"When you look at that combination of things, it's pretty hard to escape a recession," he said.

Shilling served as Merrill Lynch's first chief economist before launching his own economic-consulting and investment-advisory firm in 1978. He said the overall economy tended to soften only a little during recessions, but slash corporate profits would typically plunge by 20% to 30%, and stocks would suffer a similar drop.

He forecast lower inflation in the years ahead as the long-term trend of globalization pushes down prices. He suggested the Federal Reserve would cut interest rates only deep into next year, once the economy has weakened significantly and it's clear that inflation is no longer a threat.

The market prophet — who predicted and profited from the collapse of the mid-2000s housing boom — said he was betting on Treasury bonds and the US dollar. On the other hand, he's placed wagers against stocks via exchange-traded funds and against commodities by shorting copper.

Shilling also disclosed the "biggest bubble" on his radar today was commercial real estate — specifically office buildings, hotels, and shopping malls — and he said he believed it was starting to burst.

Fara Elbahrawy of Bloomberg also reports investors should offload risky assets after recent gains as technical and

macroeconomic headwinds are building, according to Bank of America

Corp.’s Michael Hartnett:

The S&P 500’s recent low, reached on Oct. 27, has been followed by an “epic risk rally,” the strategist wrote in a note. Referring to a broad advance marked by narrowing high-yield spreads, jumps in small-caps, shares of US regional banks, distressed tech and China-exposed assets, Hartnett said investors should “fade it.”

BofA’s own Bull and Bear Indicator has flashed a contrarian buy signal for the past five weeks. Stocks have historically risen by a median of 1% to 3% from the start of this buy signal, which would represent a target of 4,500 for the S&P 500 this time round. Harnett, who has been bearish all year despite a rally in stocks, suggests “fading above these levels.” The US benchmark closed at 4,508 on Thursday.

Riskier assets have rallied this month amid growing expectations the Federal Reserve is done with its rate-hiking campaign, with cooler-than-expected inflation figures increasing optimism about a dovish policy pivot. Global stock funds attracted $23.5 billion in the week through Nov. 15, the second-biggest inflows of the year, according to the BofA note citing data from EPFR Global.

Easier financial conditions, as bond yields dropped to 4% from 5%, have triggered bullish risk and spurred buying in the asset classes Hartnett mentioned. On the other hand, a further drop in yields to 3% would be perceived as recessionary, prompting bearish risk, he said. A less positive outlook may already be evident in oil prices. “Oil now in bear market (-22% from Sept high) on recessionary demand or ‘peak geopolitical risk,’” he wrote.

Bank of America’s latest fund manager survey showed participants turned the most bullish on bonds since the global financial crisis, while also moving net overweight for the first time since April 2022. The survey showed investors’ play book for 2024 is a soft landing, lower rates, and a weaker dollar.

Other strategists are also more optimistic. Morgan Stanley’s Michael Wilson has turned more constructive on the outlook for equities, seeing the S&P 500 ending 2024 at 4,500, while Goldman Sachs Group Inc.’s David Kostin sees the index flirting with its record high as it heads toward about 4,700 by the close of next year. Barclays Plc strategists expect global stocks will outperform bonds, contrary to Hartnett, who sees bonds rallying “big” in 2024.

Stock market strategists are paid to make calls, I get it, but it's tough, very tough.

While I too think this rally is just a countertrend rally that should be faded, I'm not outright bearish because credit markets remain fine for now and the VIX remains below 20:

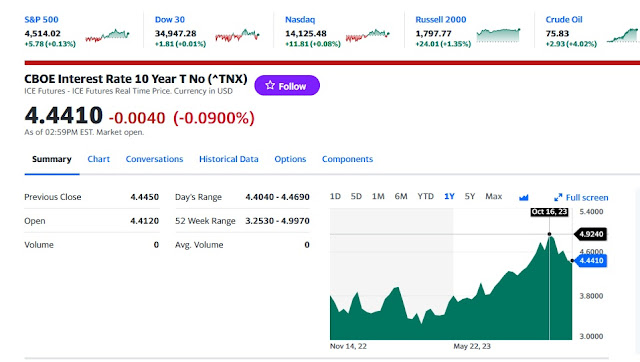

Moreover, after reaching just a hair under 5% in mid-October, 10-year bond yields are dropping and long bonds are rallying lately:

Interestingly, hedge funds remain undeterred and have one of the largest short positions on bonds:

Hedge Funds have one of the largest 10-Year Treasury short positions in history pic.twitter.com/MyBCVSURaX

— Barchart (@Barchart) November 17, 2023

Maybe they see another surge in rates coming because of persistent inflation or unsustainable fiscal deficits.

I don't know, while hedge funds remain short bonds, most fund managers are predicting long-term bond yields will be lower in 2024 in what is turning out to be a very crowded trade:

The most crowded trade for 2024 - 61% of Fund Managers are predicting that long-term bond yields will be lower in 2024. This expectation surpasses even the peak of the Global Financial Crisis when only 40% of managers expected lower long-term bond yields the following year. pic.twitter.com/XHvyJgZ8l6

— Barchart (@Barchart) November 15, 2023

Getting the call on rates right is critically important for asset allocation and risk-taking decisions.

Herding remains a huge problem

The biggest surprise in 2023 is the huge amount of herding going on in the "Magnificent Seven" stocks: Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia and Tesla.

That's a problem especially since large hedge funds are driving this herding behavior:

US equity concentration just hit another record high.

— The Kobeissi Letter (@KobeissiLetter) November 17, 2023

The top 5 stocks in the S&P 500 now account for 25% of the entire index.

Meanwhile, these same 5 stocks currently account for ~70% of the Nasdaq's gain this year.

Technology stocks now reflect a record ~26% of all equity… pic.twitter.com/ToteS9EGpV

Magnificent 7 Valuation compared to the rest of the market 👀 Probably fine pic.twitter.com/M0vh0ZjMIM

— Barchart (@Barchart) November 18, 2023

Hedge fund exposure to mega caps is at the 99th percentile, according to Goldman 👀 pic.twitter.com/hU1jg8alOA

— Markets & Mayhem (@Mayhem4Markets) November 16, 2023

Careful short-term with some of these megas...five of them are now more than 6% above their 50-DMAs. pic.twitter.com/gyzK6SSy3L

— Bespoke (@bespokeinvest) November 17, 2023

Basically, these large hedge funds can pull the plug on "Mag Seven" stocks at a moment's notice and startle markets:

A deer crashed through a restaurant window in Martin, Tennessee, causing chaos as startled waitstaff fled the scene. A teenager near the window suffered a gash to her shoulder from the hoof of the deer and received 11 stitches at a nearby hospital due to the shattered glass. pic.twitter.com/z9pGZILiJt

— CBS News (@CBSNews) November 17, 2023

That hasn't happened yet but when it happens, it will be brutal.

Top Funds Activity in Q3 2023

Alright, I've rambled on enough, time to wrap it up.

Before getting to what top funds bought and sold, however, I'll share with you why I remain a biotech bull despite a very bearish chart below:

If you know how to trade biotechs properly, you can buy the big dips at the right time and sell the big rips when these stocks pop.

Case in point, look at the recent pop in shares of CRISPR after touching a low of $37.55 almost a month ago:

Biotech shares are dangerous -- extremely dangerous -- but if you know what you're buying and selling, you can make great returns.

But when the tide turns, you can get clobbered, so you need to know how to manage risk or deal with sleepless nights.

There are too many biotechs I track to discuss here but here are just some symbols: ALDX, APGE, APLS, CERE, FOLD, IOVA, MDGL, NTLA, SLNO, TGTX, TWST, VERV and easily 20 to 30 more I track closely on a daily basis.

Now, have fun looking into the portfolios of the world's most famous money managers and other top funds.

The links below take you straight to their top holdings and then click to see where they increased and decreased their holdings (see column headings).

Top multi-strategy, event driven hedge funds and large hedge fund managers

As the name implies, these hedge funds invest across a wide variety of

hedge fund strategies like L/S Equity, L/S credit, global macro,

convertible arbitrage, risk arbitrage, volatility arbitrage, merger

arbitrage, distressed debt and statistical pair trading. Below are links

to the holdings of some top multi-strategy hedge funds I track

closely:

1) Appaloosa LP

2) Citadel Advisors

3) Balyasny Asset Management

4) Point72 Asset Management (Steve Cohen)

5) Peak6 Investments

6) Kingdon Capital Management

7) Millennium Management

8) Farallon Capital Management

9) HBK Investments

10) Highbridge Capital Management

11) Highland Capital Management

12) Hudson Bay Capital Management

13) Pentwater Capital Management

14) Sculptor Capital Management (formerly known as Och-Ziff Capital Management)

15) ExodusPoint Capital Management

16) Carlson Capital Management

17) Magnetar Capital

18) Whitebox Advisors

19) QVT Financial

20) Paloma Partners

21) Weiss Multi-Strategy Advisors

22) York Capital Management

Top Global Macro Hedge Funds and Family Offices

These hedge funds gained notoriety because of George Soros, arguably the

best and most famous hedge fund manager. Global macros typically

invest across fixed income, currency, commodity and equity markets.

George Soros, Carl Icahn, Stanley Druckenmiller, Julian Robertson have

converted their hedge funds into family offices to manage their own

money.

1) Soros Fund Management

2) Icahn Associates

3) Duquesne Family Office (Stanley Druckenmiller)

4) Bridgewater Associates

5) Pointstate Capital Partners

6) Caxton Associates (Bruce Kovner)

7) Tudor Investment Corporation (Paul Tudor Jones)

8) Tiger Management (Julian Robertson)

9) Discovery Capital Management (Rob Citrone)

10 Moore Capital Management

11) Rokos Capital Management

12) Element Capital

13) Bill and Melinda Gates Foundation Trust (Michael Larson, the man behind Gates)

Top Quant and Market Neutral Hedge Funds

These funds use sophisticated mathematical algorithms to make their

returns, typically using high-frequency models so they churn their

portfolios often. A few of them have outstanding long-term track records

and many believe quants are taking over the world.

They typically only hire PhDs in mathematics, physics and computer

science to develop their algorithms. Market neutral funds will

engage in pair trading to remove market beta. Some are large asset

managers that specialize in factor investing.

1) Alyeska Investment Group

2) Renaissance Technologies

3) DE Shaw & Co.

4) Two Sigma Investments

5) Cubist Systematic Strategies (a quant division of Point72)

6) Man Group

7) Analytic Investors

8) AQR Capital Management

9) Dimensional Fund Advisors

10) Quantitative Investment Management

11) Oxford Asset Management

12) PDT Partners

13) Angelo Gordon

14) Quantitative Systematic Strategies

15) Quantitative Investment Management

16) Bayesian Capital Management

17) SABA Capital Management

18) Quadrature Capital

19) Simplex Trading

Top Deep Value, Activist, Growth at a Reasonable Price, Event Driven and Distressed Debt Funds

These are among the top long-only funds that everyone tracks. They

include funds run by legendary investors like Warren Buffet, Seth

Klarman, Ron Baron and Ken Fisher. Activist investors like to make

investments in companies where management lacks the proper incentives to

maximize shareholder value. They differ from traditional L/S hedge

funds by having a more concentrated portfolio. Distressed debt funds

typically invest in debt of a company but sometimes take equity

positions.

1) Abrams Capital Management (the one-man wealth machine)

2) Berkshire Hathaway

3) TCI Fund Management

4) Baron Partners Fund (click here to view other Baron funds)

5) BHR Capital

6) Fisher Asset Management

7) Baupost Group

8) Fairfax Financial Holdings

9) Fairholme Capital

10) Gotham Asset Management

11) Fir Tree Partners

12) Elliott Investment Management (Paul Singer)

13) Jana Partners

14) Miller Value Partners (Bill Miller)

15) Highfields Capital Management

16) Eminence Capital

17) Pershing Square Capital Management

18) New Mountain Vantage Advisers

19) Atlantic Investment Management

20) Polaris Capital Management

21) Third Point

22) Marcato Capital Management

23) Glenview Capital Management

24) Apollo Management

25) Avenue Capital

26) Armistice Capital

27) Blue Harbor Group

28) Brigade Capital Management

29) Caspian Capital

30) Kerrisdale Advisers

31) Knighthead Capital Management

32) Relational Investors

33) Roystone Capital Management

34) Scopia Capital Management

35) Schneider Capital Management

36) ValueAct Capital

37) Vulcan Value Partners

38) Okumus Fund Management

39) Eagle Capital Management

40) Sasco Capital

41) Lyrical Asset Management

42) Gabelli Funds

43) Brave Warrior Advisors

44) Matrix Asset Advisors

45) Jet Capital

46) Conatus Capital Management

47) Starboard Value

48) Pzena Investment Management

49) Trian Fund Management

50) Oaktree Capital Management

52) Southeastern Asset Management

Top Long/Short Hedge Funds

These hedge funds go long shares they think will rise in value and short

those they think will fall. Along with global macro funds, they

command the bulk of hedge fund assets. There are many L/S funds but

here is a small sample of some well-known funds.

1) Adage Capital Management

2) Viking Global Investors

3) Greenlight Capital

4) Maverick Capital

5) Pointstate Capital Partners

6) Marathon Asset Management

7) Tiger Global Management (Chase Coleman)

8) Coatue Management

9) D1 Capital Partners

10) Artis Capital Management

11) Fox Point Capital Management

12) Jabre Capital Partners

13) Lone Pine Capital

14) Paulson & Co.

15) Bronson Point Management

16) Hoplite Capital Management

17) LSV Asset Management

18) Hussman Strategic Advisors

19) Cantillon Capital Management

20) Brookside Capital Management

21) Blue Ridge Capital

22) Iridian Asset Management

23) Clough Capital Partners

24) GLG Partners LP

25) Cadence Capital Management

26) Honeycomb Asset Management

27) New Mountain Vantage

28) Penserra Capital Management

29) Eminence Capital

30) Steadfast Capital Management

31) Brookside Capital Management

32) PAR Capital Capital Management

33) Gilder, Gagnon, Howe & Co

34) Brahman Capital

35) Bridger Management

36) Kensico Capital Management

37) Kynikos Associates

38) Soroban Capital Partners

39) Passport Capital

40) Pennant Capital Management

41) Mason Capital Management

42) Tide Point Capital Management

43) Sirios Capital Management

44) Hayman Capital Management

45) Highside Capital Management

46) Tremblant Capital Group

47) Decade Capital Management

48) Suvretta Capital Management

49) Bloom Tree Partners

50) Cadian Capital Management

51) Matrix Capital Management

52) Senvest Partners

53) Falcon Edge Capital Management

54) Park West Asset Management

55) Melvin Capital Partners (Plotkin shut down Melvin after reeling rom Redditor attack)

56) Owl Creek Asset Management

57) Portolan Capital Management

58) Proxima Capital Management

59) Tourbillon Capital Partners

60) Impala Asset Management

61) Valinor Management

62) Marshall Wace

63) Light Street Capital Management

64) Rock Springs Capital Management

65) Rubric Capital Management

66) Whale Rock Capital

67) Skye Global Management

68) York Capital Management

69) Zweig-Dimenna Associates

Top Sector and Specialized Funds

I like tracking activity funds that specialize in real estate, biotech,

healthcare, retail and other sectors like mid, small and micro caps.

Here are some funds worth tracking closely.

1) Avoro Capital Advisors (formerly Venbio Select Advisors)

2) Baker Brothers Advisors

3) Perceptive Advisors

4) RTW Investments

5) Healthcor Management

6) Orbimed Advisors

7) Deerfield Management

8) BB Biotech AG

9) Birchview Capital

10) Ghost Tree Capital

11) Sectoral Asset Management

12) Oracle Investment Management

13) Palo Alto Investors

14) Consonance Capital Management

15) Camber Capital Management

16) Redmile Group

17) Casdin Capital

18) Bridger Capital Management

19) Boxer Capital

21) Bridgeway Capital Management

22) Cohen & Steers

23) Cardinal Capital Management

24) Munder Capital Management

25) Diamondhill Capital Management

26) Cortina Asset Management

27) Geneva Capital Management

28) Criterion Capital Management

29) Daruma Capital Management

30) 12 West Capital Management

31) RA Capital Management

32) Sarissa Capital Management

33) Rock Springs Capital Management

34) Senzar Asset Management

35) Paradigm Biocapital Advisors

36) Sphera Funds

37) Tang Capital Management

38) Thomson Horstmann & Bryant

39) Ecor1 Capital

40) Opaleye Management

41) NEA Management Company

42) Sofinnova Investments

43) Great Point Partners

44) Tekla Capital Management

45) Van Berkom and Associates

Mutual Funds and Asset Managers

Mutual funds and large asset managers are not hedge funds but their

sheer size makes them important players. Some asset managers have

excellent track records. Below, are a few funds investors track closely.

1) Fidelity

2) BlackRock Inc

3) Wellington Management

4) AQR Capital Management

5) Sands Capital Management

6) Brookfield Asset Management

7) Dodge & Cox

8) Eaton Vance Management

9) Grantham, Mayo, Van Otterloo & Co.

10) Geode Capital Management

11) Goldman Sachs Group

12) JP Morgan Chase & Co.

13) Morgan Stanley

14) Manulife Asset Management

15) UBS Asset Management

16) Barclays Global Investor

17) Epoch Investment Partners

18) Thornburg Investment Management

19) Kornitzer Capital Management

20) Batterymarch Financial Management

21) Tocqueville Asset Management

22) Neuberger Berman

23) Winslow Capital Management

24) Herndon Capital Management

25) Artisan Partners

26) Great West Life Insurance Management

27) Lazard Asset Management

28) Janus Capital Management

29) Franklin Resources

30) Capital Research Global Investors

31) T. Rowe Price

32) First Eagle Investment Management

33) Frontier Capital Management

34) Akre Capital Management

35) Brandywine Global

36) Brown Capital Management

37) Victory Capital Management

38) Orbis Allan Gray

39) Ariel Investments

40) ARK Investment Management

Canadian Asset Managers

Here are a few Canadian funds I track closely:

1) Addenda Capital

2) Letko, Brosseau and Associates

3) Fiera Capital Corporation

4) West Face Capital

5) Hexavest

6) 1832 Asset Management

7) Jarislowsky, Fraser

8) Connor, Clark & Lunn Investment Management

9) TD Asset Management

10) CIBC Asset Management

11) Beutel, Goodman & Co

12) Greystone Managed Investments

13) Mackenzie Financial Corporation

14) Great West Life Assurance Co

15) Guardian Capital

16) Scotia Capital

17) AGF Investments

18) Montrusco Bolton

19) CI Investments

20) Venator Capital Management

21) Van Berkom and Associates

22) Formula Growth

23) Hillsdale Investment Management

Pension Funds, Endowment Funds, Sovereign Wealth Funds and the Fed's Swiss Surrogate

Last but not least, I the track activity of some pension funds,

endowment, sovereign wealth funds and the Swiss National Bank (aka the Fed's Swiss surrogate). Below, a

sample of the funds I track closely:

1) Alberta Investment Management Corporation (AIMco)

2) Ontario Teachers' Pension Plan

3) Canada Pension Plan Investment Board

4) Caisse de dépôt et placement du Québec

5) OMERS Administration Corp.

6) Healthcare of Ontario Pension Plan (HOOPP)

7) British Columbia Investment Management Corporation (BCI)

8) Public Sector Pension Investment Board (PSP Investments)

9) PGGM Investments

10) APG All Pensions Group

11) California Public Employees Retirement System (CalPERS)

12) California State Teachers Retirement System (CalSTRS)

13) New York State Common Fund

14) New York State Teachers Retirement System

15) State Board of Administration of Florida Retirement System

16) State of Wisconsin Investment Board

17) State of New Jersey Common Pension Fund

18) Public Employees Retirement System of Ohio

19) STRS Ohio

20) Teacher Retirement System of Texas

21) Virginia Retirement Systems

22) TIAA CREF investment Management

23) Harvard Management Co.

24) Norges Bank

25) Nordea Investment Management

26) Korea Investment Corp.

27) Singapore Temasek Holdings

28) Yale Endowment Fund

29) Swiss National Bank (aka, the Fed's Swiss surrogate)

Portfolio Wealth Advisors President and CIO Lee Munson joins Yahoo Finance Live to weigh in on the possible reasons for the firm's decision to exit its positions.

Munson notes Buffett is “holding on” to investments in companies such as Bank of America due to the net profit boost a possible 2024 bond rally could bring. Munson sheds light on Buffett’s strategy which appears to be changing, insisting that “the real story is what the 13F [filing] doesn’t tell us."

Next, Joe Terranova, Kari Firestone, Jenny Harrington, and Jim Lebenthal join 'Halftime Report' to discuss the Fed's impact on the economy, where consumer spending is heading, and break down Berkshire Hathaway's atest trimmings.

Third, Dr. A. Gary Shilling, President of A. Gary Shilling & Co., an economic consulting firm and a registered investment advisor, joins Julia La Roche on episode 120 for a wide-ranging conversation on the economy.

In this episode, Dr. Shilling predicts an imminent recession, citing key indicators such as the inverted yield curve and actions of the Federal Reserve, which is determined to curb inflation even at the risk of triggering a recession. He expects the Fed to be slower in cutting rates in the event of a recession, emphasizing their focus on ensuring inflation is under control and considering the labor market's slower response to economic changes.

Fourth, Michael Burry's hedge fund, Scion Asset Management, just disclosed their holdings and moves heading into Q4. Here's a summary of all of the biggest insights from their latest disclosure.

Fifth, Ray Dalio, Bridgewater founder and CIO mentor, joins 'Squawk Box' to discuss the state of U.S.-China relations, China's military agenda and social media influence, state of the U.S. economy, Treasury yields, A.I. impact, and more.

Lastly, Citadel CEO and Founder Kenneth Griffin, the wealthiest hedge fund manager in the world, speaks in an exclusive interview with Bloomberg's Sonali Basak from the Citadel Securities Global Macro Conference in Miami.

Update: On Saturday, I learned that Jim Chanos, the legendary short seller known for his bearish bets against Enron and Tesla Inc., is shuttering his hedge funds after almost four decades:

Chanos & Co., which he founded as Kynikos Associates in 1985, plans to return most capital to investors by the end of the year, according to a letter to clients Friday.

“It is no secret that the long/short equity business model has come under pressure and interest in fundamental stock pickers has waned,” Chanos wrote. “While I am as passionate as ever about research and investing, I feel compelled to pursue these passions in a different construct.”

His hedge funds have dropped about 4% so far this year, and the firm’s assets have shrunk to less than $200 million from about $8 billion in 2008. Chanos, 65, will continue to run his firm, mostly investing his personal capital but also managing money for certain clients in separately managed accounts.

His firm will continue to offer investors “bespoke advice on fundamental short ideas and portfolios as well as the occasional profitable macro insight,” Chanos wrote. As it winds down, clients will get roughly 90% of their cash back by year-end, and the rest in the first half of next year.

Chanos, a frequent presence on television and X, the social media platform previously known as Twitter, said he’s shuttering the funds after returning almost $5 billion of profits to investors since the firm’s inception.

The Wall Street Journal reported on his decision earlier.

Chanos started an analyst in the early 1980s, publishing sell-side research when the realized he had a knack for finding troubled companies. Raised in Milwaukee, he initially planned to be a doctor before switching gears to get an economics degree from Yale University. When he started his New York-based firm, he picked the name Kynikos — the Greek word for cynic. His firm tended to look at three types of shorting themes: consumer fads, debt-fueled asset manias and companies with accounting anomalies.

He’s most famous for being among the first investors to notice problems at Enron — a year before the energy company imploded — and helped expose a massive fraud, riding the stock’s decline from an average $79.14 a share in 2000 through December 2001, when it plummeted to 60 cents.

Interestingly, the article ends on this note:

While he’s now shuttering his hedge funds, Chanos said in his letter that he believes “the Golden Age of Fraud is still in full force.”

Among the “plentiful” short opportunities he sees today: data centers and real estate investment trusts.

Looks like the unrelenting bull market has claimed another victim, but Chanos is right, the Golden Age of Fraud is still in full force.

Comments

Post a Comment