A Discussion With Blake Hutcheson and Jonathan Simmons on OMERS' Mid-Year Results

Ontario Municipal Employees Retirement System relied on steady returns from private assets, tailwinds from strong stock markets and a resilient U.S. dollar to earn a 4.4-per-cent return over a volatile first six months of the year.

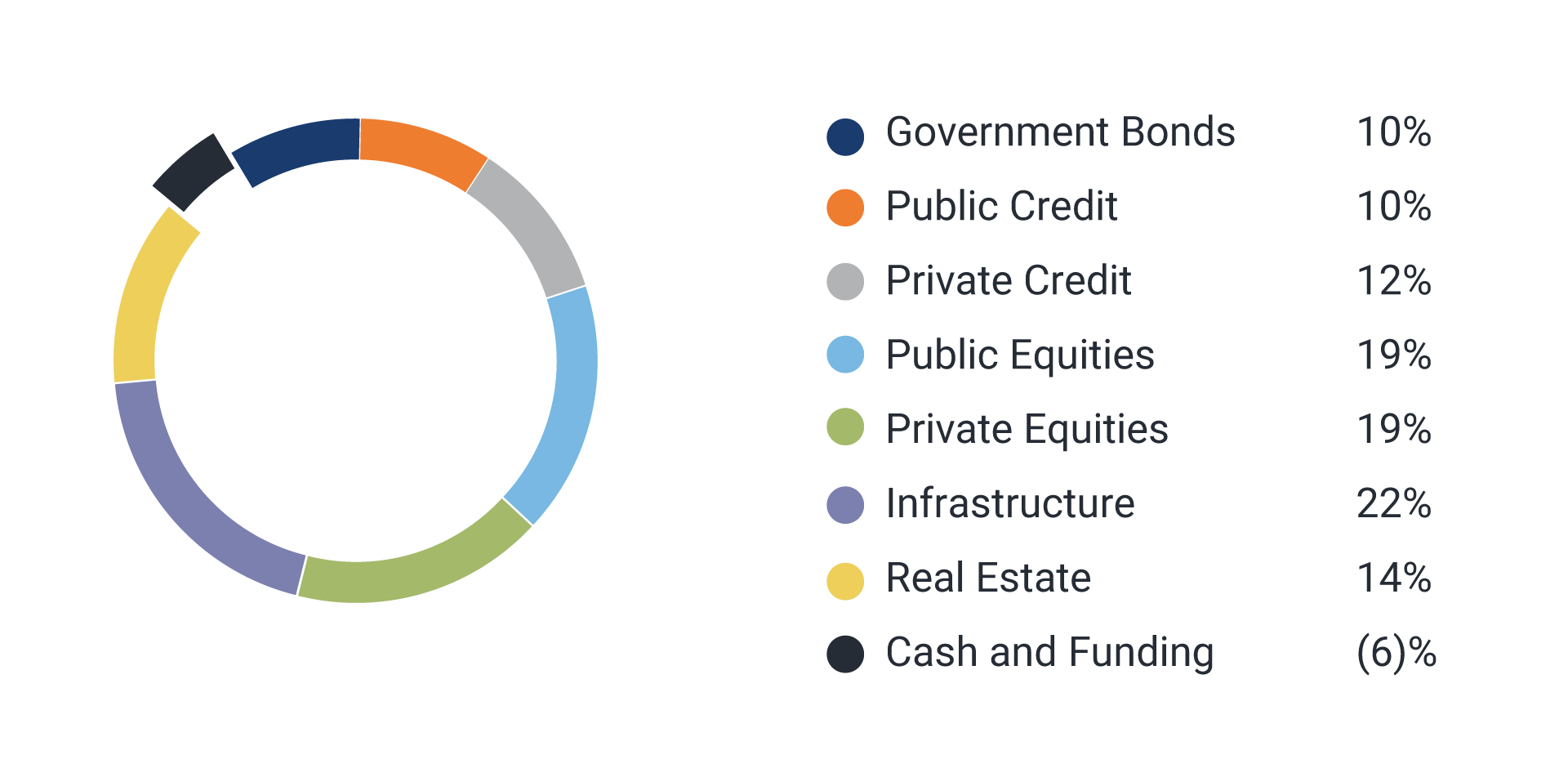

The pension fund had solid returns from its portfolio of public stocks, which gained 10.4 per cent as of June 30, according to mid-year results published Thursday. But stocks make up only 19 per cent of the pension fund’s assets after it shifted billions of dollars from equities into government bonds and credit investments, seeking to take advantage of high interest rates. OMERS also benefited from currency gains on its U.S. dollar assets, which boosted its overall investment return by 1.7 percentage points.

OMERS’s bond portfolio was a drag on returns in the first six months of the year, posting a loss of 0.5 per cent as yields surged higher, making the bonds less valuable on paper. But that trend has since reversed, helping those bonds recover.

Chief executive officer Blake Hutcheson said the move toward credit and fixed-income has been stabilizing for the pension fund, yielding significant cash and bolstering the funds it has available to pay pensions.

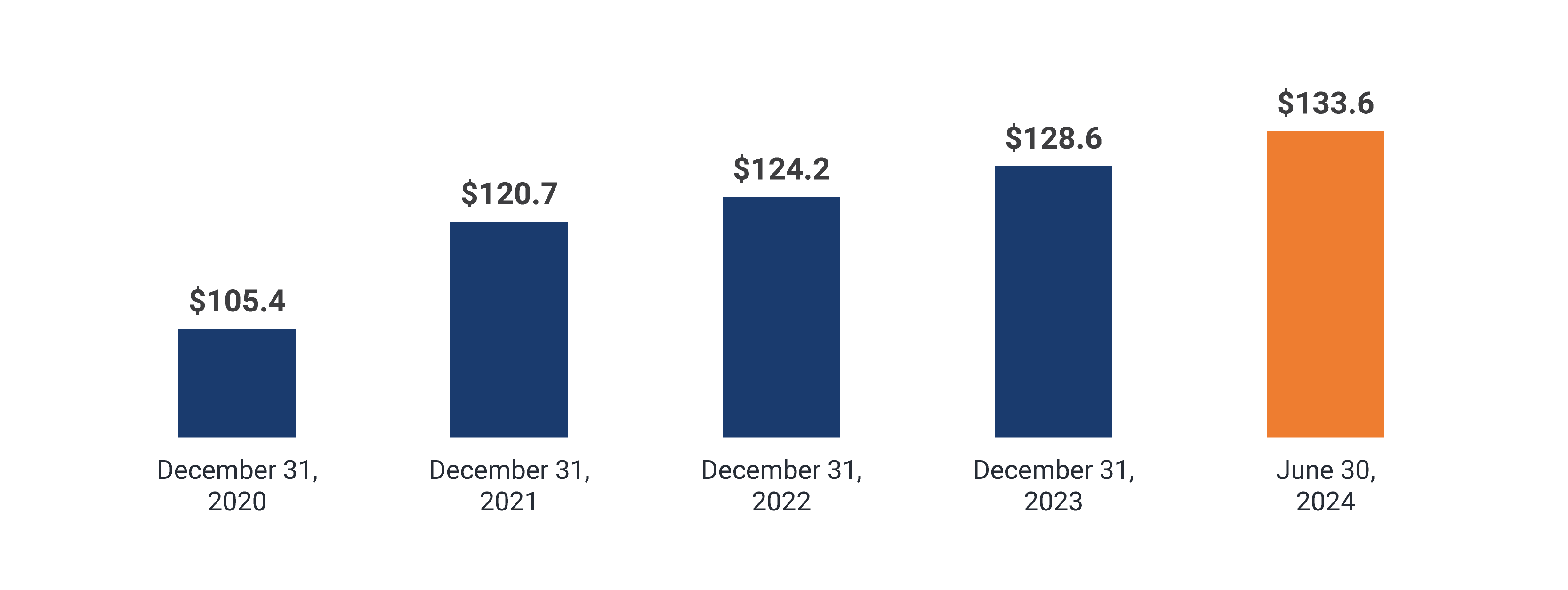

OMERS invests on behalf of approximately 600,000 Ontario public service workers, including nurses, firefighters and police officers. It now manages $133.6-billion of assets, up from $128.6-billion at the end of 2023.

Over 10 years, OMERS has reported an average annual return of 7.1 per cent, adding $67.5-billion of investment income to the fund.

“We’re very happy with that outcome based on the volatility and the turbulence that we’re seeing in a global context,” Mr. Hutcheson said in an interview.

Two other Canadian pension funds, Ontario Teachers’ Pension Plan and the Caisse de dépôt et placement du Québec, reported strikingly similar mid-year returns this week, each gaining 4.2 per cent on their investments. Their results were shaped by the same themes: strong returns from stocks, partially offset by modest losses on bonds and real estate.

The weak spot in OMERS’s results was also its real estate portfolio, which lost 3.1 per cent in the first half of the year. That was largely owing to falling property valuations, and in spite of rising income from the properties OMERS owns.

High interest rates have driven up capitalization rates – the ratio that measures the annual yield from an investment property, giving an indication of how risky it is. And a delay in anticipated interest rate cuts by the U.S. Federal Reserve, which has battled stubbornly high inflation, has left real estate investors waiting for relief.

Mr. Hutcheson, a veteran real estate investor who was previously CEO of OMERS subsidiary Oxford Properties Group, said he doesn’t anticipate a material change in real estate market conditions before the end of 2024.

“Do we expect a turn on a dime this year? No,” he said. But the higher-quality buildings that Oxford owns are proving relatively resilient, he said, and “when it turns, we expect to take advantage of that.”

The private credit portfolio at OMERS, which is made up of non-bank loans to private businesses, gained 7.8 per cent in the first six months of the year, continuing a streak of strong results. The market has become more competitive as banks have reasserted themselves in lending markets and high interest rates have increased pressure on borrowers. But Mr. Hutcheson said OMERS still sees a strong pipeline of attractive deals, adding that most loans have held up well.

“We’ve had very little delinquency and default,” he said. “Certainly for the foreseeable future, we believe in this business.”

Paula Sambo of Bloomberg also reports that OMERS gets a tailwind from Credit and the US dollar to return 4.4% in the first half and you can read her article here.

Earlier today, OMERS issued a press release stating it earned $5.6 billion in the first half of 2024:

OMERS generated a net investment return of 4.4%, or a gain of $5.6 billion, during the six-month period from January 1 to June 30, 2024. For the period ended June 30, 2024, the Plan earned a 10-year average annualized net investment return of 7.1%, a gain of $67.5 billion. Net assets totaled $133.6 billion.

“OMERS had a good start to the year, reflecting the strength and diversification of the portfolio and the strategic decision to maintain currency exposure to the US dollar,” said Blake Hutcheson, OMERS President and CEO. “In an unpredictable global landscape, we remain well positioned with ample capital and will be selective in assessing each opportunity for its growth potential and alignment to our view that quality will see us through the cycles ahead.”

“Returns for the first half of the year were led by double-digit performance from public equities with strong contributions from private credit and infrastructure,” said Jonathan Simmons, OMERS Chief Financial and Strategy Officer. “Real estate valuation losses detracted from returns, outweighing the growing income generated by our high-quality properties.”

Mr. Hutcheson added, “We make a promise to our 600,000+ members to deliver secure income in retirement and everything we do, every day is in service of that commitment. We are proud of the work we do to support our members and to contribute to a vibrant Ontario.”

About OMERSOMERS is a jointly sponsored, defined benefit pension plan, with 1,000 participating employers ranging from large cities to local agencies, and over 600,000 active, deferred and retired members. Our members include union and non-union employees of municipalities, school boards, local boards, transit systems, electrical utilities, emergency services and children’s aid societies across Ontario. OMERS teams work in Toronto, London, New York, Amsterdam, Luxembourg, Singapore, Sydney and other major cities across North America and Europe – serving members and employers, and originating and managing a diversified portfolio of high-quality investments in bonds, public and private credit, public and private equities, infrastructure and real estate.

Media Contact: Don Peat, Director, Media Relations 1 416.417.7385 dpeat@omers.comNet Assets

$ Billions

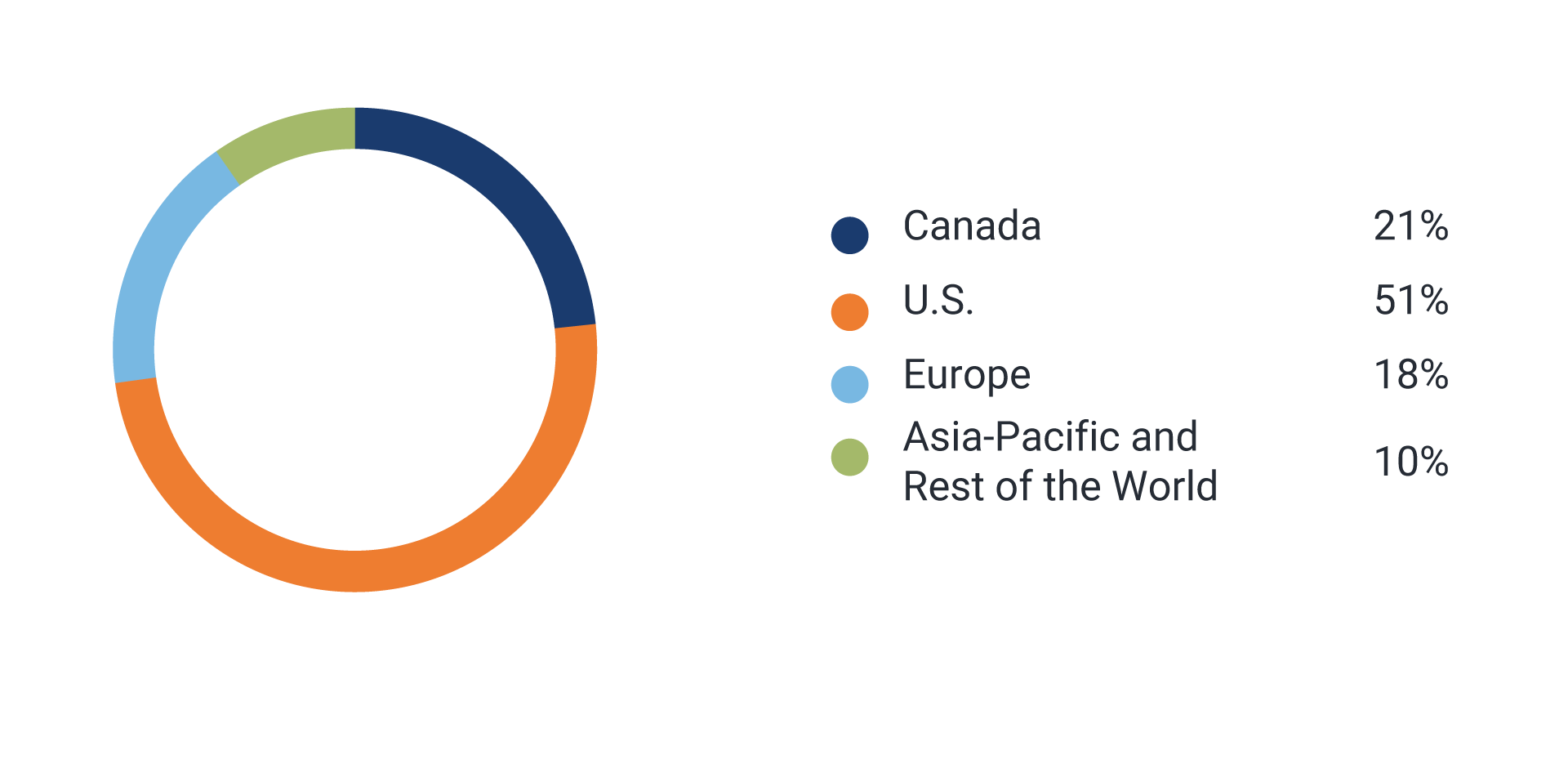

Diversified by Asset Class and Geography

OMERS invests in high-quality assets that are well-diversified by geography and asset type.

Asset Diversification

As at June 30, 2024

Geographic Diversification

As at June 30, 2024

Investment Performance Highlights

Over the six months ended June 30, 2024:

Government bonds, which earn a fixed rate of interest income, generated narrow losses as rising yields decreased their fair value.

Our shorter-dated, floating-rate credit portfolios delivered strong interest income and held their value as benchmark yields rose. Private credit continued to benefit from attractive spreads and outperformed public credit during the period.

Our public equities delivered strong returns from our core holdings in large-cap stocks in the technology, communication, energy and health care sectors.

Returns in private equity were held back by slow earnings growth and a drift downwards in valuation multiples, but significantly benefitted from the strengthening of the US dollar.

Our infrastructure portfolio continued to provide steady returns through stable operating income and higher valuations from operational performance.

Real estate valuation losses outweighed the growing income generated by our high-quality properties.

Our strategic decision to maintain currency exposure to the US dollar and other major currencies improved our net investment results across the portfolio by approximately 1.7%.

Liquidity

We continue to maintain ample liquidity, with $23.1 billion in liquid assets to pay pension benefits, fund investment opportunities, satisfy potential collateral demands related to our use of derivatives, and to fund expenses. We also have the capacity to borrow an additional $1.9 billion while remaining within our 10% leverage limit.

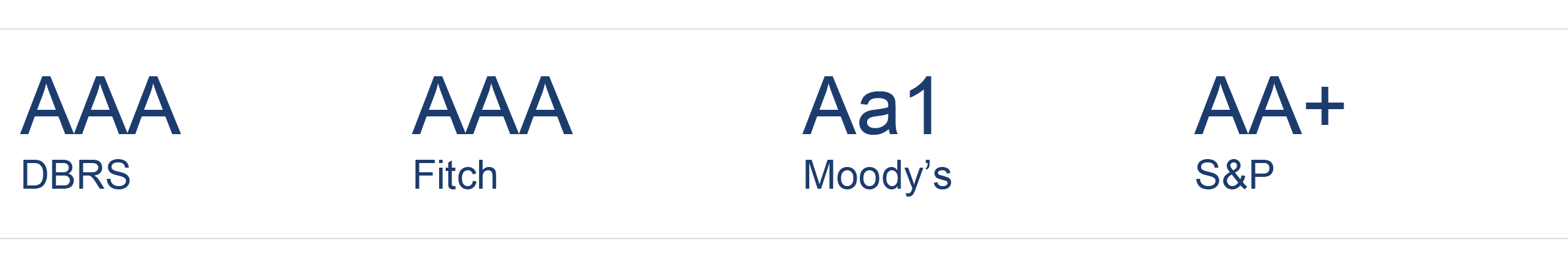

Long-Term Issuer Credit Ratings

This Investment Update presents certain non-GAAP measures. These measures are calculated on the same basis as those calculated and presented in our 2023 Annual Report. This Investment Update and the Condensed Interim Consolidated Financial Statements (the “Interim Financial Statements”) are unaudited. OMERS Administration Corporation’s financial performance set out in this Investment Update is only for the period ended June 30, 2024, unless otherwise indicated. Past performance may not indicate future performance because a broad range of uncertainties (including without limitation those related to interest rates and inflation) could have an impact on the performance of various asset classes. The financial information included in this Investment Update should be read in conjunction with the Interim Financial Statements.

Portfolio update

We continue to rotate capital within the portfolio to best position the Plan in the face of emerging opportunities for growth. The updates below reflect activities undertaken since January 1, 2024.

In line with our long-term asset mix, we deployed capital to take advantage of elevated interest rates, increasing our exposure to government bonds across the curve and investing $5.6 billion into credit.

We signed and closed our Life Sciences portfolio’s royalty investment in Nilemdo (a cholesterol lowering drug).

We secured planning permission to develop a 340,000 sq ft technologically advanced and environmentally sustainable logistics space on a 15-acre brownfield site adjacent to Heathrow Airport, in partnership with a European best-in-class developer and asset manager of logistics real estate.

We closed the sale of CEDA, a provider of industrial maintenance, turnaround and environmental services.

Subsequent to the end of June:

We signed an agreement to sell our investment in LifeLabs with a closing expected later this year.

Our industrial real-estate investment Lineage, the world’s largest operator of temperature-controlled logistics solutions, successfully completed a US initial public offering that was the biggest global stock market debut in 2024 and largest ever for a REIT.

We partnered with another leading global asset manager to announce the acquisition of Grandi Stazioni Retail, which manages all commercial and advertising spaces in 14 of Italy’s major railway stations and high-speed rail hubs. Expanding our presence in Europe, this agreement marked OMERS entry into Italy.

As we look ahead, we are well positioned with ample capital to deploy into the right opportunities that will serve the Plan and its members well for generations to come.

This afternoon I had a chance to catch up with OMERS CEO Blake Hutcheson and CFO & CSO Jonathan Simmons to go over mid-year results.

I want to thank both of them for taking the time to talk to me as well as thank Don Peat for setting up the Teams meeting.

Before I get into our discussion, a few quick thoughts from my end. The results didn't surprise me, they are solid, in line with what OTPP and CDPQ reported this week (see here and here).

Unlike OTPP, both CDPQ and OMERS provided a breakdown of asset class performance for the first semester and it's pretty much the same story, Public Equities, Private Credit and Infrastructure led in terms of performance, Private Equity had low single digit returns and Real Estate is feeling the weight of rising cap rates while Fixed Income got hurt when rates backed up in the first half of the year.

This goes to show you the importance of a well-diversified pension portfolio and while the Andrew Coynes of this world will always lament that our large pension funds should put everything in the S&P 500 through passive ETFs, this would be highly irresponsible given the level of concentration risk in that index (see my comment here).

What Andrew Coyne doesn't get is pension funds are there to pay long-dated liabilities, they're not looking to beat the S&P 500 every year or take more risks than hedge funds, as long as they have have more than enough assets to cover future liabilities and are keeping the contribution rate stable, their sponsors and beneficiaries are more than happy. Capiche?

Discussion With Blake and Jonathan

Alright let me get to my discussion with Blake and Jonathan which was once again very fruitful and insightful because we covered key areas, including problematic areas.

I told them the results were solid, in line with what OTPP and CDPQ reported and Blake chuckled and interjected: "Actually Leo, our results were better than those two."

Obviously, my first question to Blake was the all-important one on all our minds: Will the Maple Leafs win the Stanley Cup in 2025?

Blake chuckled: "100 percent"

In all seriousness, we briefly talked about their minority investment in Maple Leaf Sports & Entertainment which is a great investment.

Blake said:

We really like the asset, we really think 640,000 members should have a piece of that franchise. It's working really well from a value perspective and it gives our members another reason to get excited about OMERS and what they own. It's been a good decision for us and I'll bet you by the end of the season, we do way better than the Habs. I can't bet you we'll have a Cup in our hands because I'm 63 and I was six the last time they won. I'm not a gambler.

Well, I think the Habs are going to surprise a lot of people this year and clinch a playoff spot but even as a die-hard Habs fan, I'll admit loved watching the Leafs in the playoffs led by Auston Matthews, William Nylander, Mitchell Marner, Tyler Bertuzzi and others.

And even though it's blasphemous for a Habs fan to admit this publicly, Matthews and McJesus (what my friends and I nicknamed Connor McDavid of the Oilers) are by far the most exciting players to watch in hockey today and I do hope a Canadian team finally wins the Cup.

Alright, enough on hockey, I think you can you tell I'm itching for the NHL preseason to start.

Blake began by giving me a brief overview of the first half's results:

The short answer, Leo, it's a good start of the year, our portfolio is performing the way we anted it to in a not so easy environment. Geopolitically or economically, when you look at the volatility, generating $5.6 billion in profit is a real statement, I think our 10-year contribution is now closer to $70 billion and we continue to chip away at our funded status. It was just 10 years ago we were just 86% funded, this actually improves our funded status incrementally over last year's numbers and my view is we will be 100% funded in the next couple of years so that's a really positive outcome.

This is a step in the right direction and a lot of the strategic decisions we made over the last few years to keep our focus on privates and to reduce our allocation to some of the more volatile asset classes to get into Credit and Private Credit is paying off.

Given our known liabilities, this is a strategy that works for us, I can't comment on others want to do. The diversification we have, you never know which assets are going to deliver on any given quarter or six-month period but that all being said, these collective assets for us are creating real stability.

We've come off a 4-year rolling (annualized) return of 9.3% and our 3-year based on last year's December numbers is 8%, so both of those things give me confidence in our strategy over the last 3-4 years which is really the time frame the team we have in place has been in place.

So, 4.4% is consistent with that history but you can't predict exactly what thus year will look like, there's still 35% of the year left and a lot of cards to be played so I don't want to guess exactly where this lands but it's a very good start for us, no doubt about it.

I then told them I cover OMERS closely and wanted to cover some of the problem areas first like Thames Water which they wrote down completely in May. I told them Infrastructure's 4.1% return in the first semester in spite of this financial hit is a testament to how well diversified the OMERS Infrastructure portfolio truly is.

Moreover, in any portfolio in public or private markets, you're always going to have losers which is why you want to be highly diversified and make sure you have more winners to offset any losses from losers.

Blake replied:

Thames Water is behind us, we moved forward. The positive return in Infrastructure is a good indication of the power of diversification. We have 30 great assets, at any given time, one or two might give you a black eye, and the good news for us is the vast majority are doing exactly what they're supposed to do.

We written down Thames over a few years so it's not totally reflected in this six months but the final writedown was in this six-month period, so we are looking forward.

Thames wasn't easy from a reputation standpoint, we've had to manage through a very complex time but from a financial standpoint, it's very de minimis, it's behind us, that's why we have the diversification we have.

He added:

As a fiduciary, we were served an option to spend a significant go forward capital on an economical model that did not pay our pensions. It would have been irresponsible to go forward.

Our members understand we are protecting go forward economics and are prepared to deal with some current reputation issues for the sake of doing the right thing long term.

And as I often explain to Board, Leo, I grew up down the street from a family with 17 kids. When there are 17 kids in the family, I can guarantee you one thing, some of them are doing great -- you know, captains of teams, excelling in school -- and some of them have issues, they're sick, they're failing, etc. So when you have a big family like OMERS does in a global context, you'll always have the odd issue and you'll never be inoculated from that reality.

And the reason why you have diversification is because when one or two are in trouble, hopefully the vast majority are doing great or better than great and they offset the others.

You understand that, a lot of journalists just want to focus on the negatives.

Anyone who manages money understands that you're not always going to have winners whether in public equities or bonds or in private equity, real estate and infrastructure.

That goes for all pension funds and mega large alternative funds like Blackstone, Brookfield, etc.

But because Thames Water receives so much media attention, it was hard to manage this publicly but as Blake said, they did the right thing for their members, took a hit reputation wise and minimal hit from a financial standpoint and put it behind them.

Let's face it, the regulators made this investment impossible for OMERS and other investors and asked them to keep pouring insane sums into Thames Water without raising utility rates, so they rightly walked away.

Blake said this on that:

It was an election year, you had a lot of change in relationships with the regulator. We were a minority shareholder in that mix and you have to vote in solidarity with the other partners.

Anyway, we are looking forward, not back, the numbers are still strong irrespective of that given the de minimis economic hit from that so let's move forward.

I asked him to talk to me about Michael Hill, Head of OMERS Infrastructure, who I think is a great guy and asked him what he's doing now in that group.

Blake replied:

He's terrific by the way, he's a very Ontario-born Canadian, went to Western Business School, went to Harvard Business School, had a deep international career operating primarily out of New York in investment banking and infrastructure banking.

We've been really fortunate have him join the OMERS Infrastructure family, he's running that business right out of the gate. He's a tremendous addition, we are blessed to have him.

I told him I recently wrote about their acquisition of Italy's group Grandi Stazioni Retail alongside DWS and think this is a great investment that complements their existing infrastructure portfolio which is one of the best in the world.

On that investment Blake said this:

That was a really good example of understanding the concession in 14 major cities and also bringing in the Oxford team to see where they can do something from a retail perspective so that was a great example of cross-collaboration for the benefit of our pensioners.

That was a great segway into Oxford Properties and the problems real estate teams across the Canadian pension world face.

Blake used to run Oxford Properties and is a real estate expert, so I asked him about how he sees the asset class right now and going forward.

He replied:

Oxford's operating cap was up 9% last year, it's up so far 3% this year. Our office portfolio is 95% leased in Canada, 96% leased in Calgary, 97% leased in British Columbia against markets that range as bad as 30% vacancy in Calgary, 10-15% in Vancouver. So, our office portfolio is outperforming by a considerable margin.

Our retail assets -- Yorkdale Shopping Centre, Square One Centre, Scarborough Centre and Upper Canada Mall -- are having a terrific period, better than pre-pandemic and we aren't having issues leasing. So our fundamentals in our business are still very strong.

What is not strong and is not unique to us, it's universal phenomena, is cap rates are going the wrong direction consistent with the cost of money.

And when cap rates go up, cost of money goes up, it doesn't matter how much growth you build into these businesses, it has a diminishing impact on the portfolio and we haven't seen the end of it yet. In 2024, we continue to see adjustments in that market, I don't think they're getting any worse, they've peaked and capped and I don't think you're going to see a turnaround until 2025-2026 and when we do, you're going to see a substantial difference between great assets and not-so-great assets. there's a lot of portfolios out there that aren't going to get any lifts in 2025-2026, they won't see the great recovery that many of us will. But we have great assets, our operations show it but you can't outrun what happens to cap rate metrics in certain times in history, so that has impacted us.

This is a real estate expert giving us his brutally honest opinion about the state of the market.

Jonathan chimed in to say this:

I just want to jump in here to say when Blake said out offices are doing well, the key word is 'our' because of the quality factor. If you're not in the spaces where our teams have bought, it's quite a different story.

OMERS remains committed to real estate, Blake told me it might be another tough year but since buying the platform in 2001, it's one of the most substantial producers.

I asked Blake what Dan Fournier is doing as Head of Oxford and he told me this:

He's an amazing leader, he hit the ground running because he's such a quick study. He's done a terrific job in setting the culture for Oxford for the future. We pared down considerably, we restructured the team considerably, we've refinanced assets all over the world in a very efficient manner.

The value he's added is monumental. He happens to be in Montreal nursing a knee replacement as we speak so you might want to find him for a beer at some point.

We've been blessed to have him and the difference he made for us is almost hard to articulate.

I told Blake I know one of the best knee replacement surgeons in the city and Canada (a friend of mine) and I'd be happy to meet up with Dan for a beer.

Time was running out so I asked Jonathan to briefly go through Public Equities, Private Credit and Private Equity.

He replied:

The Public Equities portfolio has done very well for us, you've seen that. Markets have certainly helped, benefiting from a large tailwind there. About 2/3 of the portfolio is in hand picked large-cap equities, about 1/3 is in basket-type products with slightly higher diversification but still with a focus on high quality assets. So Public Equities have done great.

The strategic decision we made to lengthen our exposure to Private Credit a couple of years ago has paid off tremendously for us, you've seen the returns. And I would say sure, spreads are a little tighter, interest rates are creeping down and competition is tighter in that market but it's still a very attractive asset class for us and we typically have 5-year loans which turn over quickly, so we are very pleased with how that's going.

Private Equity, frankly interest rates need to come down further to see life come back to the PE market.Hasn't been a lot of activity as you know and until rates come down, we don't expect to see that.

Blake added:

Embedded in those numbers by the way are venture and growth equity businesses with very few data points on value so they create a little bit of a drag in terms of what you see. We have 25 buyout businesses here and in Europe and as Jonathan said, very few comps on multiples getting better and cost of money just means they're a little slower growth than what we would expect but it's still performing as you pointed out very well given all those confines and we still believe in the business.That was a wrap, great discussion with Blake and Jonathan and I hope to reengage with them this fall when they have some time.

Once again, I thank Blake and Jonathan for a fruitful and insightful discussion and remind all of you, you simply will not read the breadth and depth of coverage anywhere else, so lease support this blog.

Below, OMERS President and CEO Blake Hutcheson, recipient of the Ontario Chamber of Commerce Lifetime Achievement Award and the Order of Ontario, highlights the OMERS success story and how the organization is positioned to deliver for its members in the years to come and the positive impact that their pension promise is having on our provincial and national economies.

Comments

Post a Comment