Top Funds' Activity in Q3 2024

US stocks fell on Friday, on track for weekly losses as investors absorbed Chair Jerome Powell's signal that the Federal Reserve won't hurry to make interest-rate cuts.

The S&P 500 (^GSPC) dropped 1.2%, while the Dow Jones Industrial Average (^DJI) slid roughly 0.7%. The tech-heavy Nasdaq Composite (^IXIC) led declines, falling nearly 2%.

Powell's hawkish comments are casting a pall on markets as the initial optimism for President-elect Donald Trump's policies starts to wear off. The S&P has already reversed one-third of its post-election rally, and the Nasdaq is poised for a weekly loss of around 1%.

Retail sales data released on Friday morning reflected continued resilience in the American consumer, a sign of the economic strength Powell suggested would allow the Fed to take its time. October sales rose 0.4% month on month, versus 0.3% expected, including a revision higher for September's reading to 0.8% from 0.4%.

Wall Street is back to puzzling over the Fed's path next year, a question already muddied by this week's inflation prints. As of Friday morning, traders are pricing in 55% odds of a rate cut at its December policy meeting, compared with 72% the day before, per CME FedWatch tool. Bets on a January easing stand at 69%, versus the previous 81%.

At the same time, investors kept a watchful eye on Trump's preparations for power, after vaccine stocks fell amid reports Robert F. Kennedy Jr will be named top health official. JPMorgan Chase (JPM) CEO Jamie Dimon made it clear Thursday he won’t be joining the new president's team.

Meanwhile, shares of Domino's Pizza (DPZ) and Pool Corp. (POOL) popped during morning trading after filings showed Warren Buffett's Berkshire Hathaway bought the stocks.

It's that time of the quarter where we get a sneak peek into the portfolios of the world's most powerful money managers with a 45-day lag.

Before I get to what elite money managers were buying & selling last quarter, I think it's worth going over Bob Pisani's CNBC article on why Greenlight’s David Einhorn says the markets are broken and getting worse:

Greenlight Capital’s David Einhorn was interviewed by our Leslie Picker at CNBC’s Delivering Alpha event Wednesday.

Einhorn spoke about the election results, inflation and some of his current stock picks (including CNH Industrial and Peloton Interactive ), but soon returned to a familiar theme: the long, slow descent of value investing.

“It’s continuing to get worse,” the hedge fund manager told Picker. “We are in a secular destruction of the professional asset management community.”

As he has done several times before, Einhorn pointed a finger at passive, index investors: “The passive people, they don’t care what the value is.”

Markets are ‘broken’

In Einhorn’s estimation, markets are “broken,” repeating a claim he has repeatedly made this year.

“I view the markets as fundamentally broken,” Einhorn said back in February on Barry Ritholtz’s “Masters in Business” podcast. “Passive investors have no opinion about value. They’re going to assume everybody else has done the work.”

Einhorn puts much of the blame on passive investing in index funds like the S&P 500, noting that because the S&P has had a pronounced growth tilt in the past decade as technology has dominated, investors buying index funds are by default propping up growth stocks at the expense of value stocks.

What’s more, the emphasis on earnings growth is distorting markets, the Cornell grad said.

“You have these companies, and all they do is they manage these expectations, right?,” Einhorn told Picker. “And they beat and they raise, and they beat and they raise, and they beat and they raise, and they’re pretty good companies, and the next thing you know, they’re trading at, you know, 55 times earnings, even though they’re growing [at] GDP plus two [percentage points] and something like that. And that’s kind of the gamification of the way that the market structure has changed, right?”

Einhorn noted that “growth can be undervalued” as well, but lamented that value players had become marginalized: “We are such marginal players in terms of the amount of trading that’s going on, so the price discovery from professional people who have a valuation framework, not as the dominant part of their process, but as any part of their process, is much, much smaller than it used to be. And so effectively instead of the valuation becoming the signal, the valuation people were just noise and everybody else is sort of the signal. And this is why I think we have a structurally dysfunctional market, a bit of a broken market, and essentially a perpetual erosion of value as a strategy, as you would.”

This is causing great pain to value investors like Einhorn, many of whom have seen cash flee their funds.

Other market observers agree: “Value stocks have been getting cheaper and cheaper relative to their underlying fundamentals, while growth stocks have been commanding richer and richer valuation multiples,” Rob Arnott, chairman of Research Affiliates, told me in an email. Arnott is well known in the investment and academic community for his work in asset management and quantitative investing.

Logical switch to passive investing

You can’t blame investors for switching to index funds.

Not only are passive funds less costly than paying an active manager, the evidence shows that active managers have been underperforming their benchmarks for decades. The most recent report from the SPIVA U.S. Scorecard, the benchmark study on active management by S&P Global, said 87% of large-cap fund managers lag their benchmarks over a 10-year period.

In other words, passive investors in index funds are making a perfectly logical decision by switching from active portfolio management.

Still, Einhorn’s frustration is understandable. Academic research has long supported the belief that, in the long run, value outperforms growth.

Yet, since the great financial crisis, that long-term trend has been broken. In the last 15 years, for example, the iShares S&P 500 Value ETF (IVE) has gained 286%, while the iShares S&P 500 Growth ETF (IVW) is up 610% — twice as much. Growth has beaten value almost every year since.

Value and active continue to lag

Investors, for better or worse, have come to value profitability (growth) as a primary investment metric, more important than traditional measurements like price to earnings (P/E) or value measurements like price to book.

As for why active managers in general — of all stripes, not just value managers — have underperformed, Arnott told me it boils down to two main issues: higher costs and the fact that active managers compete against each other with little competitive advantage.

“Costs matter,” Arnott told me. “If indexers own the market ... then removing them from the market leaves that self-same portfolio for active managers to collectively own. As their fees and trading costs are higher, their returns must be lower.”

Another reason for long-term underperformance by active managers: They are competing against other active managers who have very little competitive edge against each other.

“Active investors win if there’s a loser on the other side of their trades,” Arnott told me. Since passive investors tend to stay invested, “A winning active manager has to have a losing active manager on the other side of their trades. It’s like looking for the sucker at a poker game: any active manager who doesn’t know who that loser might be, IS that loser.”

‘Free riding’ passive

In this context, the assertion that index investors are “free riding” on the price discovery of active managers falls into the category of statements that are true — but not very interesting.

Arnott readily agreed they are free riders, but then said, “So what? It’s a cop-out to blame index funds and their customers, because – from the customer’s perspective – why should an investor NOT index?”

And indexers may be able to still own value and do reasonably well. Arnott also runs the RAFI indexes, which emphasize book value, sales, cash flow and dividends, unlike other indexes that are based solely on market capitalization. He says this emphasis, particularly on profitability, has led to outperformance over time.

Most expensive market ever

With valuations at these levels, you’d think Einhorn would be bearish. But you’d be wrong.

“This is the most expensive market of all time,” the 55-year-old told Picker. “This is a really, really pricey environment, but it doesn’t necessarily make me bearish. ... An overvalued stock market is not necessarily a bear market and it doesn’t necessarily mean it has to go down anytime soon. I’m not particularly bearish; I can’t really see what’s going to break the market at this time.”

A couple of quick points. First, I am not sure the market will break any time soon but stuff happens when you least expect it. There may be a credit crisis lurking in background and when it hits, it will be a nasty one. There may be an emerging markets crisis or something out of China that scares us.

As far as who is to blame on passive indexing and distortions in markets and why growth has handily outperformed value over many years, I would say a low inflation environment will always favour growth stocks and Bernanke's QE blitz during the GFC as well as Powell's ZIRP in response to the pandemic cemented the outperformance for growth stocks.

But here's the thing about indexing or passive investing, a long time ago when I read Burton Malkiel's seminal book, A Random Walk Down Wall Street, I remember the great economist Paul Samuelson reviewed the book, praising it but also warning what will happen when it's widely adopted and how it can lead to market distortions.

We are there as concentration risk is at historic highs. In fact, the top ten stocks account for 37% of the S&P 500 and the top 5 account for 26% (or something in that range):

Market Concentration Risk Hits All-Time High 🚨

— Barchart (@Barchart) November 2, 2024

The Top 10 S&P 500 stocks now account for a RECORD HIGH 37% of the $SPX pic.twitter.com/37Rdyu68ob

In such a highly concentrated market, good luck to active managers, there's virtually no chance they can beat the S&P 500 unless they too take highly concentrated bets and that comes with its own set of risks.

Anyway, I like Einhorn, think he's a smart guy and when the tide turns he will have some good years beating the S&P 500 but he really needs to stop lamenting about this issue, beta is what beta is.

And while he's not outright bearish, he's not the only one who finds it difficult to find attractive opportunities.

Legendary investor Warren Buffett is building the Noah's Ark of rainy-day funds, stacking up more than $300 billion in Treasuries:

Warren Buffett has been selling shares and stacking up cash at a terrific rate, fanning speculation as to why the world's foremost stock picker is pulling his money out of the market.

Berkshire Hathaway roughly tripled its pile of cash, Treasury bills, and other liquid assets to a record $325 billion over the two years to September 30 (or $310 billion after subtracting almost $15 billion of payables for Treasury bill purchases).

The conglomerate's cash hoard now exceeds Berkshire's total market value just over a decade ago. It accounted for at least 27% of Berkshire's $1.15 trillion of assets at quarter end — the largest proportion in many years.

One big reason for the ballooning cash pile has been a lack of compelling things to buy. Buffett is a value investor who specializes in sniffing out bargains, and those have become rare finds in recent years.

"I have heard every speculative idea imaginable, from accumulating capital for a doomsday scenario to planning to make a gigantic cash dividend," Lawrence Cunningham, the director of the University of Delaware's Weinberg Center on Corporate Governance and the author of several books about Buffett and Berkshire, told Business Insider about the rationale for Berkshire's cash pile.

"Both seem far-fetched," he said. "The most likely cause of cash buildup at Berkshire is absence of attractive capital deployment opportunities."

Cunningham said stocks have surged to record highs, private-business valuations have jumped, Berkshire-owned businesses like Geico and See's Candies can only deploy so much money, and Berkshire's Class A shares have climbed to record levels of about $700,000.

If Buffett is building up his cash reserves it's because he wants to be ready when opportunities arise to scoop them up at attractive prices.

Berkshire Hathaway still has a huge stock portfolio in 41 stocks which you can view here.

Top Funds' Activity in Q3 2024

Alright, let's get to top funds' activity in Q3.

Here are some articles you can read:

- Berkshire Hathaway Adds Domino’s, Reduces Apple, BofA

- Berkshire bites into Domino's Pizza, dips into Pool amid stock retreat

- Druckenmiller Leads Family Offices Boosting US Bank Stock Bets

- Third Point Hedge Fund Buys Tesla, Dumps Micron

- Amazon's Significant Reduction in Louis Moore Bacon's Portfolio Highlights Latest 13F Filing

- Activist Hedge Fund ValueAct Boosts Meta Stake With $121M Bet

- Hedge Funds Add Apple, Reshuffle Technology Portfolio

You can read more 13F articles here.

Now, have a look at David Tepper's Appaloosa portfolio here and see top positions below:

You'll recall his big China Long that he was peddling along with the famous Dr. Michael Bury.

Well, apart from JD.com, he's been selling; in fact, he sold a lot of shares last quarter which suggests to me he's bearish and lightening up his tech exposure.

Did that change this quarter with Trump's election win? Maybe but I doubt it as Tepper understands macro and financial conditions well and he probably thinks it's a good time to raise cash.

Izzy Englander's Millennium was also busy last quarter and bought quite a few names like Microsoft, Spotify, Eli Lilly, Hess, Medtronic and RTX Corporation. You can view the entire portfolio here and top positions below:

Ken Griffin's Citadel loaded up on Nvidia last quarter (I knew it) as well as Chipotle, Medtronic and Marriott. You can view the entire portfolio here and top positions below:

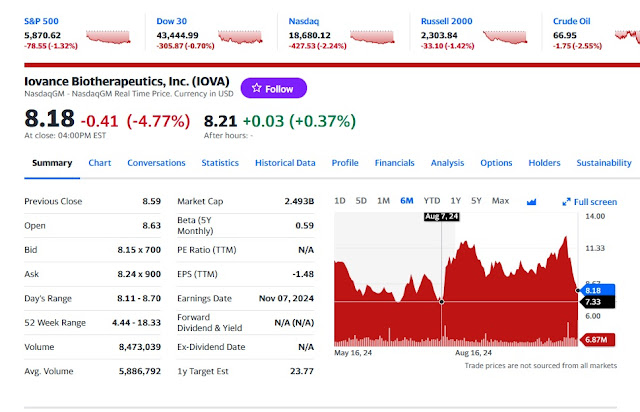

What else? Joseph Edelman's Perceptive Advisors increased its position in Iovance Biotherapeutics (IOVA) and more than doubled his position in Viking Therapeutics (VKTX). You can see his entire portfolio here and top positions below:

I mention Iovance because I added to it yesterday and Viking because I initiated a position today:

I can't get into details here but do a deep dive on these two biotechs (see top holders of Iovance here and Viking here; Citadel also significantly increased its holdings of Viking).

If biotechs are too volatile for your blood, you should be loading up on Eli Lilly on its latest dip:

In fact, as big banks and big hedge funds shorted healthcare and biotech shares in anticipation of RFK's nomination to Secretary of Health, fearing the worst, this is where I see the biggest opportunities right now.

There's so much nonsense in the markets tied to Trump's picks, it leads to great opportunities on the long and short side.

Alright, let me wrap it up.

Next week, Nvidia reports and all eyes will be on this stock but it can honestly go either way (never mind Citadel's big position).

Lastly, Powell's hawkish talk had more to do with market selloff today and the reason why the yield on the 10-year Treasury note remains closer to 4.5% than 4% (settled at 4.428%).

Powell trying to talk markets down never works well, it will backfire spectacularly.

Have fun looking into the portfolios of the world's most famous money managers and other top funds.

The links below take you straight to their top holdings and then click to see where they increased and decreased their holdings (see column headings and click on them).

Top multi-strategy, event driven hedge funds and large hedge fund managers

As the name implies, these hedge funds invest across a wide variety of

hedge fund strategies like L/S Equity, L/S credit, global macro,

convertible arbitrage, risk arbitrage, volatility arbitrage, merger

arbitrage, distressed debt and statistical pair trading. Below are links

to the holdings of some top multi-strategy hedge funds I track

closely:

1) Appaloosa LP

2) Citadel Advisors

3) Balyasny Asset Management

4) Point72 Asset Management (Steve Cohen)

5) Millennium Management

6) Farallon Capital Management

7) Shonfeld Strategic Partners

10) Peak6 Investments

11) Kingdon Capital Management

12) HBK Investments

13) Highbridge Capital Management

14) Highland Capital Management

15) Hudson Bay Capital Management

16) Pentwater Capital Management

17) Sculptor Capital Management (formerly known as Och-Ziff Capital Management)

18) ExodusPoint Capital Management

19) Carlson Capital Management

20) Magnetar Capital

21) Whitebox Advisors

22) QVT Financial

23) Paloma Partners

24) Weiss Multi-Strategy Advisors

25) York Capital Management

Top Global Macro Hedge Funds and Family Offices

These hedge funds gained notoriety because of George Soros, arguably the

best and most famous hedge fund manager. Global macros typically

invest across fixed income, currency, commodity and equity markets.

George Soros, Carl Icahn, Stanley Druckenmiller, Julian Robertson have

converted their hedge funds into family offices to manage their own

money.

1) Soros Fund Management

2) Icahn Associates

3) Duquesne Family Office (Stanley Druckenmiller)

4) Bridgewater Associates

5) Pointstate Capital Partners

6) Caxton Associates (Bruce Kovner)

7) Tudor Investment Corporation (Paul Tudor Jones)

8) Tiger Management (Julian Robertson)

9) Discovery Capital Management (Rob Citrone)

10 Moore Capital Management

11) Rokos Capital Management

12) Element Capital

13) Bill and Melinda Gates Foundation Trust (Michael Larson, the man behind Gates)

Top Quant and Market Neutral Hedge Funds

These funds use sophisticated mathematical algorithms to make their

returns, typically using high-frequency models so they churn their

portfolios often. A few of them have outstanding long-term track records

and many believe quants are taking over the world.

They typically only hire PhDs in mathematics, physics and computer

science to develop their algorithms. Market neutral funds will

engage in pair trading to remove market beta. Some are large asset

managers that specialize in factor investing.

1) Alyeska Investment Group

2) Renaissance Technologies

3) DE Shaw & Co.

4) Two Sigma Investments

5) Cubist Systematic Strategies (a quant division of Point72)

6) Man Group

7) Analytic Investors

8) AQR Capital Management

9) Dimensional Fund Advisors

10) Quantitative Investment Management

11) Oxford Asset Management

12) PDT Partners

13) Angelo Gordon

14) Quantitative Systematic Strategies

15) Quantitative Investment Management

16) Bayesian Capital Management

17) SABA Capital Management

18) Quadrature Capital

19) Simplex Trading

Top Deep Value, Activist, Growth at a Reasonable Price, Event Driven and Distressed Debt Funds

These are among the top long-only funds that everyone tracks. They

include funds run by legendary investors like Warren Buffet, Seth

Klarman, Ron Baron and Ken Fisher. Activist investors like to make

investments in companies where management lacks the proper incentives to

maximize shareholder value. They differ from traditional L/S hedge

funds by having a more concentrated portfolio. Distressed debt funds

typically invest in debt of a company but sometimes take equity

positions.

1) Abrams Capital Management (the one-man wealth machine)

2) Berkshire Hathaway

3) TCI Fund Management

4) Baron Partners Fund (click here to view other Baron funds)

5) BHR Capital

6) Fisher Asset Management

7) Baupost Group

8) Fairfax Financial Holdings

9) Fairholme Capital

10) Gotham Asset Management

11) Fir Tree Partners

12) Elliott Investment Management (Paul Singer)

13) Jana Partners

14) Miller Value Partners (Bill Miller)

15) Highfields Capital Management

16) Eminence Capital

17) Pershing Square Capital Management

18) New Mountain Vantage Advisers

19) Atlantic Investment Management

20) Polaris Capital Management

21) Third Point

22) Marcato Capital Management

23) Glenview Capital Management

24) Apollo Management

25) Avenue Capital

26) Armistice Capital

27) Blue Harbor Group

28) Brigade Capital Management

29) Caspian Capital

30) Kerrisdale Advisers

31) Knighthead Capital Management

32) Relational Investors

33) Roystone Capital Management

34) Scopia Capital Management

35) Schneider Capital Management

36) ValueAct Capital

37) Vulcan Value Partners

38) Okumus Fund Management

39) Eagle Capital Management

40) Sasco Capital

41) Lyrical Asset Management

42) Gabelli Funds

43) Brave Warrior Advisors

44) Matrix Asset Advisors

45) Jet Capital

46) Conatus Capital Management

47) Starboard Value

48) Pzena Investment Management

49) Trian Fund Management

50) Oaktree Capital Management

52) Southeastern Asset Management

Top Long/Short Hedge Funds

These hedge funds go long shares they think will rise in value and short

those they think will fall. Along with global macro funds, they

command the bulk of hedge fund assets. There are many L/S funds but

here is a small sample of some well-known funds.

1) Adage Capital Management

2) Viking Global Investors

3) Greenlight Capital

4) Maverick Capital

5) Pointstate Capital Partners

6) Marathon Asset Management

7) Tiger Global Management (Chase Coleman)

8) Coatue Management

9) D1 Capital Partners

10) Artis Capital Management

11) Fox Point Capital Management

12) Jabre Capital Partners

13) Lone Pine Capital

14) Paulson & Co.

15) Bronson Point Management

16) Hoplite Capital Management

17) LSV Asset Management

18) Hussman Strategic Advisors

19) Cantillon Capital Management

20) Brookside Capital Management

21) Blue Ridge Capital

22) Iridian Asset Management

23) Clough Capital Partners

24) GLG Partners LP

25) Cadence Capital Management

26) Honeycomb Asset Management

27) New Mountain Vantage

28) Penserra Capital Management

29) Eminence Capital

30) Steadfast Capital Management

31) Brookside Capital Management

32) PAR Capital Capital Management

33) Gilder, Gagnon, Howe & Co

34) Brahman Capital

35) Bridger Management

36) Kensico Capital Management

37) Kynikos Associates

38) Soroban Capital Partners

39) Passport Capital

40) Pennant Capital Management

41) Mason Capital Management

42) Tide Point Capital Management

43) Sirios Capital Management

44) Hayman Capital Management

45) Highside Capital Management

46) Tremblant Capital Group

47) Decade Capital Management

48) Suvretta Capital Management

49) Bloom Tree Partners

50) Cadian Capital Management

51) Matrix Capital Management

52) Senvest Partners

53) Falcon Edge Capital Management

54) Park West Asset Management

55) Melvin Capital Partners (Plotkin shut down Melvin after reeling rom Redditor attack)

56) Owl Creek Asset Management

57) Portolan Capital Management

58) Proxima Capital Management

59) Tourbillon Capital Partners

60) Impala Asset Management

61) Valinor Management

62) Marshall Wace

63) Light Street Capital Management

64) Rock Springs Capital Management

65) Rubric Capital Management

66) Whale Rock Capital

67) Skye Global Management

68) York Capital Management

69) Zweig-Dimenna Associates

Top Sector and Specialized Funds

I like tracking activity funds that specialize in real estate, biotech,

healthcare, retail and other sectors like mid, small and micro caps.

Here are some funds worth tracking closely.

1) Avoro Capital Advisors (formerly Venbio Select Advisors)

2) Baker Brothers Advisors

3) Perceptive Advisors

4) RTW Investments

5) Healthcor Management

6) Orbimed Advisors

7) Deerfield Management

8) BB Biotech AG

9) Birchview Capital

10) Ghost Tree Capital

11) Soleus Capital Management

12) Oracle Investment Management

13) Palo Alto Investors

14) Consonance Capital Management

15) Camber Capital Management

16) Redmile Group

17) Casdin Capital

18) Bridger Capital Management

19) Boxer Capital

21) Bridgeway Capital Management

22) Cohen & Steers

23) Cardinal Capital Management

24) Munder Capital Management

25) Diamondhill Capital Management

26) Cortina Asset Management

27) Geneva Capital Management

28) Criterion Capital Management

29) Daruma Capital Management

30) 12 West Capital Management

31) RA Capital Management

32) Sarissa Capital Management

33) Rock Springs Capital Management

34) Senzar Asset Management

35) Paradigm Biocapital Advisors

36) Sphera Funds

37) Tang Capital Management

38) Thomson Horstmann & Bryant

39) Ecor1 Capital

40) Opaleye Management

41) NEA Management Company

42) Sofinnova Investments

43) Great Point Partners

44) Tekla Capital Management

45) Van Berkom and Associates

Mutual Funds and Asset Managers

Mutual funds and large asset managers are not hedge funds but their

sheer size makes them important players. Some asset managers have

excellent track records. Below, are a few funds investors track closely.

1) Fidelity

2) BlackRock Inc

3) Wellington Management

4) AQR Capital Management

5) Sands Capital Management

6) Brookfield Asset Management

7) Dodge & Cox

8) Eaton Vance Management

9) Grantham, Mayo, Van Otterloo & Co.

10) Geode Capital Management

11) Goldman Sachs Group

12) JP Morgan Chase & Co.

13) Morgan Stanley

14) Manulife Asset Management

15) UBS Asset Management

16) Barclays Global Investor

17) Epoch Investment Partners

18) Thornburg Investment Management

19) Kornitzer Capital Management

20) Batterymarch Financial Management

21) Tocqueville Asset Management

22) Neuberger Berman

23) Winslow Capital Management

24) Herndon Capital Management

25) Artisan Partners

26) Great West Life Insurance Management

27) Lazard Asset Management

28) Janus Capital Management

29) Franklin Resources

30) Capital Research Global Investors

31) T. Rowe Price

32) First Eagle Investment Management

33) Frontier Capital Management

34) Akre Capital Management

35) Brandywine Global

36) Brown Capital Management

37) Victory Capital Management

38) Orbis Allan Gray

39) Ariel Investments

40) ARK Investment Management

Canadian Asset Managers

Here are a few Canadian funds I track closely:

1) Addenda Capital

2) Letko, Brosseau and Associates

3) Fiera Capital Corporation

4) West Face Capital

5) Hexavest

6) 1832 Asset Management

7) Jarislowsky, Fraser

8) Connor, Clark & Lunn Investment Management

9) TD Asset Management

10) CIBC Asset Management

11) Beutel, Goodman & Co

12) Greystone Managed Investments

13) Mackenzie Financial Corporation

14) Great West Life Assurance Co

15) Guardian Capital

16) Scotia Capital

17) AGF Investments

18) Montrusco Bolton

19) CI Investments

20) Venator Capital Management

21) Van Berkom and Associates

22) Formula Growth

23) Hillsdale Investment Management

Pension Funds, Endowment Funds, Sovereign Wealth Funds and the Fed's Swiss Surrogate

Last but not least, I the track activity of some pension funds,

endowment, sovereign wealth funds and the Swiss National Bank (aka the Fed's Swiss surrogate). Below, a

sample of the funds I track closely:

1) Alberta Investment Management Corporation (AIMco)

2) Ontario Teachers' Pension Plan

3) Canada Pension Plan Investment Board

4) Caisse de dépôt et placement du Québec

5) OMERS Administration Corp.

6) Healthcare of Ontario Pension Plan (HOOPP)

7) British Columbia Investment Management Corporation (BCI)

8) Public Sector Pension Investment Board (PSP Investments)

9) PGGM Investments

10) APG All Pensions Group

11) California Public Employees Retirement System (CalPERS)

12) California State Teachers Retirement System (CalSTRS)

13) New York State Common Fund

14) New York State Teachers Retirement System

15) State Board of Administration of Florida Retirement System

16) State of Wisconsin Investment Board

17) State of New Jersey Common Pension Fund

18) Public Employees Retirement System of Ohio

19) STRS Ohio

20) Teacher Retirement System of Texas

21) Virginia Retirement Systems

22) TIAA CREF investment Management

23) Harvard Management Co.

24) Norges Bank

25) Nordea Investment Management

26) Korea Investment Corp.

27) Singapore Temasek Holdings

28) Yale Endowment Fund

29) Swiss National Bank (aka, the Fed's Swiss surrogate)

In this conversation, Druckenmiller shares his approach to major trades, like his groundbreaking bet against the British pound, and offers a unique perspective on today’s market, discussing inflation risks, AI’s potential in investing, and what keeps him ahead of the curve. The investor shares his reflections on the Fed’s role, the future of tech, and lessons learned from mentor George Soros.

I'll repeat, this is BY FAR the best interview on markets I've seen in a very long time, a must watch.Also, Famed hedge fund investor David Einhorn has fired back at the establishment, saying the current market is broken. He sees an historic shift of capital as a massive opportunity for investment. Where is he setting his sights and has the horizon moved with change in the oval office?

Comments

Post a Comment