Trump, Musk and Powell Unleash Animal Spirits in Post-Election Euphoria

The stock market climbed to another round of records on Friday, as the Dow and S&P 500 wrapped up their best week in a year after Donald Trump’s election win.

The Dow Jones Industrial Average rose 259.65 points, or 0.59%, to close at 43,988.99. The blue chip average traded above 44,000 for the first time ever during the session. The S&P 500 gained 0.38% to close at 5,995.54, after briefly trading above 6,000 for its own milestone. The tech-heavy Nasdaq Composite lagged, up just 0.09% to 19,286.78, but set an intraday record high as well.

All three averages finished the week at record closing levels.

It was a strong week across the board for equities, due in large part to Wednesday’s huge rally following Trump’s victory. The S&P 500 finished up 4.66% for the week, as the Dow was higher by 4.61%. Both indexes notched their best week since November 2023. The Nasdaq outdid even those moves, toting a 5.74% advance, while the small-cap benchmark Russell 2000 surged 8.57%.

“Equities are eager to price in Trump’s domestic growth policies (via small-caps) and hopes for easier regulation relative to the Biden administration,” Barclays strategist Venu Krishna said in a note to clients.

“Whether these moves are sustainable remains to be seen; momentum is extending lofty gains as ‘winners keep winning’, and the sharp post-Election Day moves have pushed major gauges near (or into, in the case of [Russell 2000]) technically overbought territory,” Krishna added.

Investors generally view a Republican-controlled government as more favorable on expectations for deregulation, the potential for more mergers and acquisitions and proposed tax cuts. However, concerns over the large federal deficit and increased tariffs have also sparked fears of an uptick in inflation.

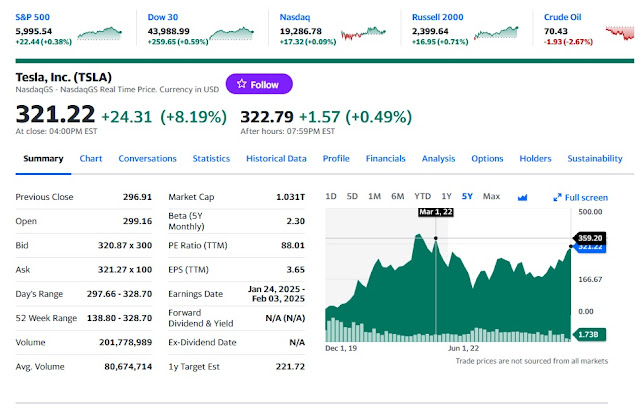

Some stocks associated with Trump performed well again on Friday. Tesla, whose CEO Elon Musk campaigned with the president-elect, rose 8.2% and was on track for its fourth straight positive session. The automaker’s market cap surpassed the $1 trillion mark. Law enforcement tech stock Axon Enterprises jumped more than 28% after the company raised its full-year revenue guidance. Trump Media jumped 15% after the president-elect said he had no plans to sell his shares in the social media company.

Stocks also got a boost from the Federal Reserve this week, as the central bank lowered interest rates by a quarter percentage point on Thursday. Fed Chair Jerome Powell noted he is “feeling good” about the economy during a press conference following the change.

While some on Wall Street are worried about the valuations for the stock market, the strength of this week’s move has bolstered confidence that there could still be room to move higher in the final months of the year.

“When everything seems like it’s all working well, it’s like, ‘what’s going to hit us?’” Keith Lerner, co-chief investment officer at Truist Wealth, said on CNBC’s “Closing Bell” on Friday.

“There’s probably something from left field. Sentiment’s getting a little bit stretched, maybe some choppiness after this round number. But all in all, we still think you want to stick with that primary uptrend,” he continued.

Sentiment is a little bit stretched? That's an understatement, this is all-out euphoria spurred by President-elect Trump's resounding victory in the US presidential election:

"Roughly $18 billion" flowed into US equity ETFs on Wednesday, "almost 16 times the daily average inflow this year."

— The ETF Institute® (@ETF_Institute) November 7, 2024

Flows reflected the "Trump trade" - betting on a loosening of regulations for banking and crypto and support for US based companies.https://t.co/MRRicZCZiu

On Wednesday, $20 billion flowed into US equity funds, the largest in five months, after Trump claimed victory. Small-cap stocks saw $3.8 billion in inflows, their biggest since March. The S&P 500 hit a record high, boosted by the election result and a Fed rate cut. pic.twitter.com/tCiq7Dxhp0

— BigBreakingWire (@BigBreakingWire) November 8, 2024

Everything related to the "Trump trade" melted up in the stock market led by big banks and big tech, especially Tesla shares which made Elon Mush a fortune this week (adding to his already immense fortune):

As far as sectors, all the sectors were up this week led by Consumer Discretionary (Amazon and Tesla), Energy (traditional not renewable), Industrials, Financials, and Information Technology:

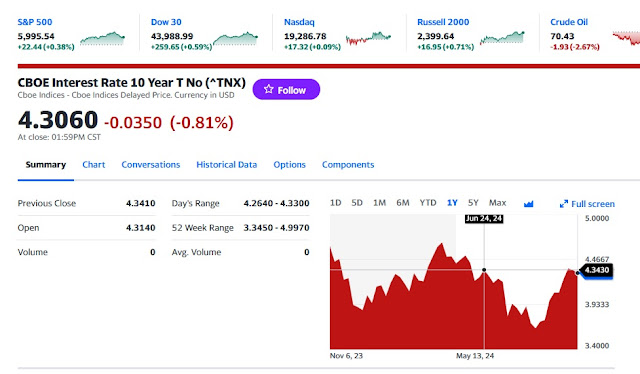

The US dollar and bond yields also rose but as I told my readers last week, the yield on the 10-year Treasury note will probably reach a high near 4.5% and decline after the Fed cuts this week and that's exactly what happened.

After reaching a high of 4.47% on Wednesday, the yield on the 10-year settled at 4.3% today:

And after the huge run-up in stocks, I still think long bonds offer the best risk-adjusted returns out there over the next three to six month.Importantly, Inflation expectations fell to lowest level since December 2020:

Americans are feeling increasingly better about the short-term path for inflation.

The latest consumer sentiment survey from the University of Michigan revealed that consumers expect inflation to sit at 2.6% in a year, a decrease from last month's expectation of 2.7%. November's reading is the lowest since December 2020 and within the 2.3% to 3% range seen in the two years before the pandemic.

Expectations for long-run inflation did tick higher, though, rising to 3.1% from 3% the month prior.

The overall consumer sentiment index popped to a reading of 73, up from 71 in October. Interviews for the survey concluded on Monday and therefore don't capture any reactions to election results.

The responses come as inflation has continued to trend lower throughout 2024. In September the Consumer Price Index (CPI), a popularly cited inflation reading, increased 2.4% over the prior year. This marked its lowest annual increase in prices since February 2021.

While price increases are still sitting above the Federal Reserve's 2% goal, Fed Chair Jerome Powell noted on Thursday that the central bank has made significant "progress" in fighting inflation. He also added that inflation expectations "remain well anchored." Inflation expectations are considered a key part of the Fed's calculus due to the fact that consumers' willingness to pay higher prices could feed inflation.

The responses come as inflation has continued to trend lower throughout 2024. In September the Consumer Price Index (CPI), a popularly cited inflation reading, increased 2.4% over the prior year. This marked its lowest annual increase in prices since February 2021.

While price increases are still sitting above the Federal Reserve's 2% goal, Fed Chair Jerome Powell noted on Thursday that the central bank has made significant "progress" in fighting inflation. He also added that inflation expectations "remain well anchored." Inflation expectations are considered a key part of the Fed's calculus due to the fact that consumers' willingness to pay higher prices could feed inflation.

Since the Fed began cutting interest rates in September, the 10-year Treasury yield (^TNX) has risen roughly 80 basis points to hit a recent high of about 4.47%. Part of the rise is due to a market repricing after Donald Trump's presidential election win. The president-elect's policies, including proposed tariffs that could cause businesses to pass on their higher costs to consumers, are viewed as more inflationary than those of his former opponent, Kamala Harris.

But Powell doesn't think inflation expectations are the main factor driving bond yields higher.

"It appears that the moves are not principally about higher inflation expectations," Powell said. "They’re really about a sense of more likelihood of stronger growth."

A fresh reading on CPI is slated for release on Wednesday. Wall Street economists expect headline inflation rose just 2.6% annually in October, an increase from the 2.4% rise in September. Prices are set to rise 0.2% on a month-over-month basis, per economist projections, in line with the increase seen in September.

If Powell is right and growth, not inflation expectations, are driving bond yields higher, then as the US economy slows, you'd expect long bond yields to come down after the recent backup.

That means employment indicators, not inflation indicators, will take precedence here and if job growth stalls for any reason, yields are headed lower.

Now, come January, a new Trump administration will be sworn in and their mandate is clear on the economy and on immigration.

Trump has stated he wants tariffs imposed but the devil is always in the detail here and that all remains to be seen.

I just don't see broad tariffs being imposed because if they go that route, inflation expectations will rise, bond yields will rise and the stock market and other assets (like housing) are cooked.

A second inflation wave mid-2025 remains a big risk and that is something to keep an eye on.

Right now, there's a tremendous amount of speculative frenzy and froth in the stock market based on what Trump will do once in power again.

It's beyond silly but with volatility comes lots of opportunities so you need to pay attention here and pick your spots right, both on the long and short side.

Anyways, the US election is over, the Fed cut rates as expected, so I expect things to calm down until Nvidia reports earnings on November 20th.

Alright, let me wrap it up with the top performing US large-cap stocks this week:

And the worst performing large-cap stocks this week:

Next week Wall Street will hear from more companies as they announce their quarterly results, including Live Nation (LYV), Spotify (SPOT), Home Depot (HD), and Hertz (HTZ).

On Monday, Nov. 11, the stock market will be open but the bond market will be closed in observance of Veterans Day.

Below, the most important interview I saw this week. Nicolai Tangen, CEO of NBIM, visits Stan Druckenmiller in New York — one of the most renowned investors of our time, known for his insights into macroeconomics and markets.

In this conversation, Druckenmiller shares his approach to major trades, like his groundbreaking bet against the British pound, and offers a unique perspective on today’s market, discussing inflation risks, AI’s potential in investing, and what keeps him ahead of the curve. The investor shares his reflections on the Fed’s role, the future of tech, and lessons learned from mentor George Soros.

This is BY FAR the best interview on markets I've seen in a very long time, a must watch.

Comments

Post a Comment