OTPP Is Shaping a Better, More Innovative Future

As a purpose-driven organization, we are focused on ensuring our investments make a positive mark on the world. Responsible investing is embedded in everything we do. In 2020 alone, our Responsible Investing team assessed more than 70 potential and realized transactions valued at more than C$25 billion.

Today we are pleased to publish our Responsible Investing and Climate Change Report (PDF) that details our efforts and impact. This report consolidates previously separate reports about our responsible investing and climate change actions.

Turning the spotlight on Environmental, Social and Governance (ESG) opportunities and risks, we share some of the ways we are working to have a positive impact. These include:

- Setting interim targets as part of our net-zero objective to meaningfully reduce our portfolio’s carbon emissions intensity for years to come

- Decreasing our portfolio carbon footprint intensity in 2020

- Details on how we will significantly increase our green investments from more than $30 billion

- Actively engaging with over 100 companies on ESG topics and voting against 220 directors of boards with less than 30% gender diversity

The actions we are taking today position us to continue delivering retirement security for our members while shaping a better future for all. We look forward to sharing more on our journey toward a more sustainable and equitable future.

Take the time to read OTPP's Responsible Investing and Climate Change Report here.

The report is 30 pages and packed with great information and insights.

Below, I go over the CIO's (Ziad Hindo) message to stakeholders:

The global pandemic shook the foundations of our business, and businesses around the world. It also underlined the importance of taking a responsible approach to investing that minimizes the impact of environmental and social risks on people, communities and companies.

Active and engaged management of environmental, social and governance (ESG) issues is a fundamental element of how we invest. It is deeply embedded in what we do every day, and the global health crisis only strengthened this conviction. In fact, amid the pandemic, we intensified our focus and efforts on ESG, particularly around one of the most crucial issues of our time: climate change.

The most important milestone in our ESG journey so far

The commitment we made earlier this year to achieve net-zero greenhouse gas emissions by 2050 aligns our organization with the Paris Agreement. It also demonstrates the scale of the impact we want to have. Our plan isn’t only about bringing Ontario Teachers’ to net zero; it’s about helping the world around us get to net zero, too.

As a leading global investor, we have an important role to play – we need to use our capital and influence to accelerate the global transition to a net-zero world. That’s why we’ve committed to targets that will significantly reduce our emissions intensity – first, by almost half by 2025, then by two-thirds by 2030. These are ambitious and industry-leading, both in scale (across our entire portfolio of public and private assets, including those that are externally managed) and magnitude.

Investing for long-term impact

Climate change permeates the entire investing landscape. Tackling it requires significant expertise and massive amounts of capital. We are poised to significantly grow our existing $30 billion+ in green investments through opportunities that enable the net-zero transition, reduce greenhouse gases and build a sustainable economy. Our investment teams are pivoting their strategies to reflect this imperative.

Pursuing sustainable investments is only one side of the ledger. To complement our growing green investments, we believe it is our responsibility to support the transition of businesses to a more sustainable global economy. This means allocating capital to emissions-intensive businesses that, with pragmatic owners and patient capital, can be transformed to thrive in the low-carbon world. I believe this approach – while more challenging than simple divestment – will lower real-world emissions and create greater long-term value. This will be a win for the environment and our members.

Aiming for widespread prosperity

Our long-term ability to meet our financial obligations is connected to how well the world is doing. Beyond climate, social factors such as diversity, equity and inclusion play crucial roles in building widespread global prosperity.

At Ontario Teachers’, we draw strength from diversity of background and thought because we believe it improves decision making and leads to better outcomes. Attracting talent from broader pools and addressing issues that matter to our employees are ways in which we’re creating a culture of belonging among employees.

Beyond our walls, we are working with our partners, peers and portfolio companies to promote diversity in the finance industry and beyond. We will continue championing diversity at our private portfolio companies, engaging with public company boards to improve their practices and exercise our influence by voting against those that do not.

Ultimately, our ability to effectively manage these and the many other ESG risks and opportunities will help determine our long-term sustainability. I am confident the actions we are taking today position us to continue delivering retirement security for our members while shaping a better future for all.

This is an excellent comment, one I may note written by the CIO, not the CEO.

Ziad Hindo and Jo Taylor (the CEO) are on the same page when it comes to OTPP's approach to responsible investing and addressing the challenges and opportunities of climate change.

They both write extremely well and there's one particular section which I highlighted above and will do again below:

Climate change permeates the entire investing landscape. Tackling it requires significant expertise and massive amounts of capital. We are poised to significantly grow our existing $30 billion+ in green investments through opportunities that enable the net-zero transition, reduce greenhouse gases and build a sustainable economy. Our investment teams are pivoting their strategies to reflect this imperative.

Pursuing sustainable investments is only one side of the ledger. To complement our growing green investments, we believe it is our responsibility to support the transition of businesses to a more sustainable global economy. This means allocating capital to emissions-intensive businesses that, with pragmatic owners and patient capital, can be transformed to thrive in the low-carbon world. I believe this approach – while more challenging than simple divestment – will lower real-world emissions and create greater long-term value. This will be a win for the environment and our members.

When CDPQ recently unveiled its 2021 Climate Strategy, a lot of media attention was centered around the fourth pillar of their strategy, exiting from oil-producing companies by 2022.

This caught a lot f people by surprise, including yours truly, because even though these investments make up 1% of CDPQ's total assets, up until then, there was no mention of exiting out of this sector.

Moreover, most of Canada's large pensions are not divesting from fossil fuels, preferring to engage with these companies to help them transition to net-zero.

So, some were caught off guard from CDPQ's ambitious new climate strategy and some even told me: "Even though this represents a small percentage of total assets, it sends the wrong message exiting from oil producing companies."

Maybe to some it does, to others, it's music to their ears.

Also, to be fair, Kim Thomassin, Executive Vice-President and Head of Investments in Québec and Stewardship Investing, told me that engagement with large oil producers is far from easy and they even gave up with some well-known mega oil producers because they found it to be futile.

But OTPP and others are committed to engagement, not divestment, and it's important to highlight the heterogeneity of ESG investing approaches among Canada's large pensions.

There's no one-size-fits-all, just because CDPQ is doing it this way, doesn't mean OTPP, CPPIB and others need to do it the exact same way, but let's be clear, all of Canada's large pensions take climate change very seriously and it impacts all their investments across public and private markets.

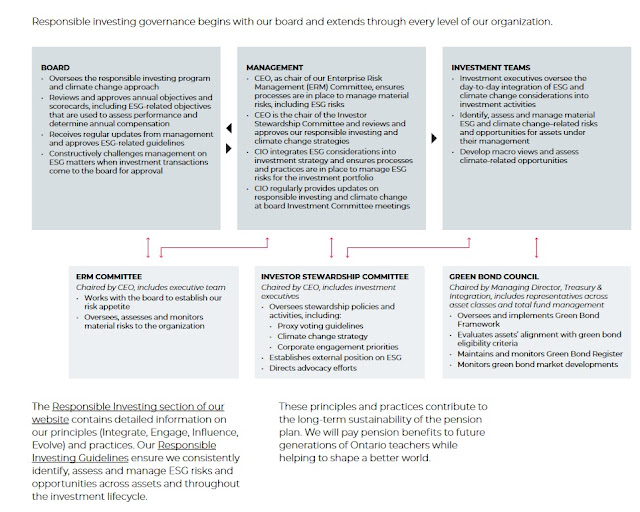

Anyway, getting back to OTPP's Responsible Investing and Climate Change Report, I note the governance below:

It's critical to understand all the moving parts and in particular, senior management's role:

- CEO, as chair of our Enterprise Risk Management (ERM) Committee, ensures processes are in place to manage material risks, including ESG risks

- CEO is the chair of the Investor Stewardship Committee and reviews and approves our responsible investing and climate change strategies

- CIO integrates ESG considerations into investment strategy and ensures processes and practices are in place to manage ESG risks for the investment portfolio

- CIO regularly provides updates on responsible investing and climate change at board Investment Committee meetings

Now you understand why Ziad Hindo wrote a message to stakeholders, he's directly responsible for integrating ESG considerations into the investment strategy and providing regular updates on responsible investing and climate change at board Investment Committee meetings. Jo Taylor reviews and approves the responsible investing and climate change strategies.

Moving on, OTPP is on the right path to significantly reduce its portfolio emissions intensity by 45% by 2025 and by 67% by 2030:

Recall, I recently discussed Ontario Teachers' acquisition of HomeEquity Bank and how it set new interim targets to cut the carbon emissions intensity of its portfolio as part of a plan to reach net-zero emissions by 2050. You can read that comment here as well as OTPP"s press release here.

The bottom line is this: "Ontario Teachers’ has set industry-leading targets to reduce portfolio carbon emissions intensity by 45% by 2025 and two-thirds (67%) by 2030, compared to its 2019 baseline. These emission reduction targets cover all the Fund’s real assets, private natural resources, equity and corporate credit holdings across public and private markets, including external managers."

The key points underlying these ambitious new targets include:

- Significantly growing investments in companies that generate clean energy, reduce demand for fossil fuels and build a sustainable economy;

- Pivoting asset class strategies increasingly towards green investments;

- Actively investing in transition assets to secure future direct and tangible reductions in carbon emissions;

- Setting portfolio companies on a clear path to implement Paris-aligned net-zero plans and meaningfully reduce emissions;

- Issuing green bonds and investing the proceeds in climate solutions and sustainable companies;

- Advocating for clear climate policies and partnering with other industry leaders to effect global change;

- Reporting annually on progress against the 2025, 2030 and 2050 targets.

The critical point I want to make is OTPP and other large pensions need to invest their way toward their net-zero targets, that's an imperative.

Whether that means investing in renewable infrastructure projects, green real estate, sustainable investing private equity or new green technologies, there is definitely a concerted effort going on to invest more assets in the transition economy across public and private markets.

This is done deliberately but judiciously, always ensuring these investments help generate returns to meet future liabilities.

This brings me to Barbara Shecter's recent Financial Post article on how Ontario Teachers' is targeting up to 10 per cent of assets for its innovation platform by 2026:

The Ontario Teachers’ Pension Plan has set a big target for its innovation and disruption investment platform: to propel its share of the fund’s assets to as much as 10 per cent by 2026, up from around three per cent today.

“We started almost from scratch … and we have huge ambitions,” Ziad Hindo, chief investment officer at Teachers, told FP Finance in a recent interview.

“On a five-year basis, we’re looking to build a portfolio to perhaps an allocation between eight and 10 per cent of the fund. We still see tremendous opportunities in the disruptive tech space, spanning sectors.”

The latest sign of commitment to the Teachers Innovation Platform (TIP) was this month’s hire of Avid Larizadeh Duggan to lead venture and growth equity investments in Europe, the Middle East, Africa as managing director. The latest member to join the team assembled by TIP’s inaugural senior managing director Olivia Steedman has had a career in technology spanning more than 20 years, with stints as an international angel investor, founder, board member, chief operating officer and product manager.

Larizadeh Duggan, who continues to serve as a non-executive director of Barclays UK, and earned her MBA at Harvard and degrees in engineering from Stanford, said it was a “privilege” to join TIP.

“In only two years, the team has partnered globally with some of the best entrepreneurs and demonstrated how they can help scale companies in a thoughtful and sustainable way with long-term capital and experience,” she said.

For Teachers, achieving the growth targets it has set will depend on the TIP team, which operates from offices in London, Hong Kong, Toronto and California, being able to find and acquire assets at the right price in the hot market for disruptive tech plays.

“It’s difficult to know what pace it’ll grow because it’s … dependent on how many really high-quality businesses we can find,” Jo Taylor, Teachers’ chief executive, told FP Finance.

He said searching for quality investments in the competitive and disruptive tech sector is worth the effort because, if the price is right, the growth profile and inherent risk relative to other sectors can juice returns.

“It’s a good asset class,” said Taylor. “It provides us with strong risk adjusted returns, whilst being more risky, and it’s growing because actually the value of our assets are growing really well.”

He anticipates that the Teachers Innovation Platform’s growth will come from both increasing revenues and profits at the firms the fund invests in, and further allocations of capital to the TIP team to lead investments, participate in syndicates, and provide “complementary” capital to support the late-stage venture and growth equity investments.

“It should grow as a proportion of that portfolio faster because it’s businesses where the growth … should be higher,” said Taylor. “But, also, we want to deploy more capital there…. And then (if) we continue to deploy capital at the rate we have been doing recently that should add to growth.”

TIP’s first investment following its creation in the spring of 2019 was in Elon Musk’s SpaceX.

There has been a steady stream of transactions since including a flurry in June. Among them, TIP led a $375-million Series D funding round for ApplyBoard, which valued the online platform that connects students to higher education around the world at $4 billion.

The same month, the Teachers’ team led a US$138-million Series C funding round for Beamery, an artificial intelligence-powered talent placement and retention company based in the United Kingdom, and teamed up with BlackRock to lead a $226-million series B round for Motif FoodWorks, a plant-based food technology company.

“You’ve seen us quite active, even this year,” Hindo said, noting that the COVID-19 pandemic added complication to many investment strategies. “We’re cementing and building our partnership approach and we take also (a) very direct approach ourselves here. Frankly, we’re excited.”

TIP’s notable investments

Here’s a quick look at five key investments by the Teachers’ Innovation Platform:

SpaceX

TIP’s inaugural investment in June 2019 was in Elon Musk’s Space Exploration Technologies Corp.. which designs and manufactures reusable rockets and is deploying Starlink, a low-earth-orbit satellite system designed to deliver high speed broadband internet to remote and underserved communities globally.

Epic Games

Luke Porter, TIP’s principal in London, was actively involved in the platform’s investment in the interactive entertainment company and provider of 3D-engine technology behind the popular game Fortnite. Epic is also behind Unreal Engine, which Teachers has called “the world’s most advanced real-time 3D creation tool.”

Pony.ai

In November 2020, TIP led a US$267 million funding round for Fremont, Calif.-based autonomous driving company Pony.ai, which at the time had a valuation of over US$5 billion.

Verily

The investment in this San Francisco-based engineering firm that applies scientific and technological advances to significant problems in health and biology (formerly Google Life Sciences), pre-dates the formation of TIP. In January 2019, Ontario Teachers participated in a US$1 billion funding round led by technology investment firm Silver Lake.

Kry

In January 2020, TIP led a US$155 million funding round for Europe’s largest digital healthcare provider with operations in Sweden, the United Kingdom, France, Norway, and Germany. The money was raised to expand, bringing the digital health app into new markets across Europe. Following the initial transactions, TIP made follow-on investments in Kry, Epic, Verily and SpaceX.

Recall, I first covered TIP with Ziad Hindo two years ago and more recently with Olivia Steedman who is responsible for that portfolio.

From scratch, it has literally grown by leaps and bounds and I am not surprised they are able to attract top talent like Avid Larizadeh Duggan to lead venture and growth equity investments in Europe, the Middle East, Africa as managing director.

She makes a great addition to this already impressive and growing team.

Ziad had already explained to me what TIP is all about, namely, investing in "disruptive technology everywhere" and OTPP built this innovation platform for three main reasons:

- Defensive: OTPP has over 100 portfolio companies and they want to understand how disruptive technology will impact them. This is part of Teachers' rigorous risk management approach.

- Offensive: OTPP is seeking high risk-adjusted returns and this platform will allow them to capitalize on new opportunities in disruptive technologies that will shape the world for years to come.

- Access to innovative partnerships: The platform will allow OTPP to build on its existing partnerships but also to build new partnerships with technology leaders.

At the time, Ziad mentioned OTPP's deal with Verily, an Alphabet (Google) company, on a $1 billion investment round led by Silver Lake, as it advanced plans on business strategies that are additive and complementary to its current life sciences portfolio.

But let me take a big step back to really explain why TIP is so critical to OTPP.

It's all about portfolio construction. Go back to read my recent in-depth interview with OPTrust's CIO James Davis.

There are two main risks all pensions face in a low-rate, low-growth world:

- Stability of contribution rate and benefits

- Sustainability of the plan over the long run

That second risk isn't about sustainable investing, it's about taking enough risk to generate sufficient returns to ensure the plan is sustainable over the long run.

In OTPP's case, it has adopted conditional inflation protection, which is good, but it also needs to generate returns to pay out long-dated liabilities.

And its demographics are older, placing more pressure to generate returns but also manage risks appropriately.

OTPP is basically doing this taking a two-prong approach:

- Shifting more assets out of low-yielding fixed income into core infrastructure assets which act like utilities

- Shifting more assets into innovation to take risks investing in the companies of tomorrow.

This "barbell approach" to borrow a bond term isn't without risks but they have thought things through very carefully and this is how they are investing assets to meet their future liabilities.

My point here is there's not much of a choice, when you're the size of OTPP, you need to take risks across the capital structure to generate requisite returns and you need to think very long term.

The same goes for other large pensions, everyone is trying to meet their objective function given the constraints they have and given the high uncertainty in the investment and geopolitical landscape.

Do I think OTPP can easily attain 10% of total assets in its innovation platform in five years?

I'm honestly not sure but so far it certainly looks that way as they are making the right investments which can explode in size if they grow fast.

Earlier this afternoon, I contacted Dan Madge, Director of External Communications at OTPP to ask him the following:

While I understand why Teachers' wants to go big in innovation (needs the returns), 10% by 2026 sounds like a lot compared to overall portfolio.

How realistic is it to get 10% of total assets into TIP? Are these investments scalable? Where will they invest? Are green technologies part of that drive to attain 10% by 2026?

Where is the current weighting of that portfolio to gauge how it can go up to 10% in five years?

Dan will get back to me with all the answers but the truth is these investments, if done right, are very scalable and there will undoubtedly be some investments in green technologies.

I also note the following which Jo Taylor shared with Barbara Shecter:

“It’s a good asset class,” said Taylor. “It provides us with strong risk adjusted returns, whilst being more risky, and it’s growing because actually the value of our assets are growing really well.”

Again, they're not betting the farm on these investments but they are betting enough (10% by 2026) to generate outsized returns over the long run and that will make a difference at the margin as the rest of the portfolio focuses on core, stable assets.

I think I am explaining this right but will edit or update this comment if Dan Madge has more to share from Jo, Ziad and Olivia.

The best way I can explain this to a layperson is say you are older and want to invest over many years and not outlive your savings. If you're worried about low rates and low growth over for a long time and outliving your savings, you need to invest in "safer' dividend stocks but also a small percentage in "riskier" Nasdaq (QQQ), biotech (XBI) and other growth industries like renewable energy (TAN) to gain some growth exposure in your portfolio.

Obviously what OTPP is doing is way better because it pools investment and longevity risk of its members and it invests across public and private assets all over the world, leveraging off its world-class partners.

What else? Let me take this opportunity to congratulate Kathryn Fric for being appointed OTPP's new Chief Risk Officer:

Ontario Teachers' Pension Plan Board (Ontario Teachers') announced that Kathryn Fric has been appointed as its new Chief Risk Officer effective November 1, reporting to President and Chief Executive Officer Jo Taylor.Ms. Fric joins Ontario Teachers’ following an extensive 18-year career at Sun Life Financial, where she was most recently Senior Vice President, Enterprise and Operational Risk, responsible for the oversight of strategic, operational asset liability management and market risks as well as its insurance risk management programs. Previous roles at Sun Life included Senior Vice President and Chief Credit Risk Officer, Head of Public Fixed Income Credit Research and Portfolio Manager for Public Fixed Income. Kathryn started her career in Finance at Ford Motor Co. Canada before moving to Deloitte and then Citibank in progressively senior roles.

“I am pleased to welcome Kathryn to our Executive Team. She brings significant leadership and deep investment and enterprise risk management experience which will solidify our strong risk culture,” said Mr. Taylor. “Risk management is an important capability at Ontario Teachers’ and plays a key role in all our activities. I am confident that Kathryn is well-placed to help the organization understand and manage the complex risks our business faces.”

As CRO, Ms. Fric will be responsible for providing independent risk oversight of all risk-related activities, leading the establishment of a risk framework and ensuring forward-looking strategic and investment opportunities are incorporated into enterprise operations and objectives.

Ms. Fric is a designated Chartered Financial Analyst, currently sits on the Board of the Corporation of Massey Hall and Roy Thomson Hall and earned both a Bachelor of Arts and a Master of Business Administration from Western University.

Ms. Fric has an impressive resume and she's filling a role that Barb Zvan left behind to become CEO of UPP. I wish her and her team many years of success as she assumes this important role.

Lastly, let me end by honoring OTPP's amazing members, Ontario's teachers.

Yesterday was World Teachers' Day and I celebrated it along with my wife who is one of the best teachers in Canada (she truly is):

I marvel the dedication teachers, nurses, and other front line workers have shown and continue to show throughout this pandemic and if this pandemic has taught us anything, these people are the backbone of our society.

And Ontario's teachers, nurses and other front line workers are lucky to have world-class organizations managing their retirement money, making sure they can retire in dignity and security. More on that tomorrow.

Below, a primer explaining the difference between venture capital, growth equity and private equity.

Also, Goldman Sachs Asset Management Division’s Nishi Somaiya explains the outlook for private investments in growth equity and technology companies.

Very bright lady, listen carefully to her comments below.

Update: Dan Madge got back to me tonight and shared Olivia Steedman's answers to my questions:

How realistic is it?

We have an ambitious, international strategy with our Teachers’ Innovation Platform. We are optimistic we can grow our innovation asset class to 7-10% of net assets over the next 5-to 10 years, although this will depend on a number of factors including pricing and the attractiveness of market opportunities. While it is hard to predict precisely where we will end up, we anticipate meaningful growth in the innovation portfolio in absolute dollar terms and as a percentage of net assets.

Since TIP was established in 2019 it has been a story of tremendous growth – establishing teams in Toronto, London, Hong Kong and Silicon Valley, a portfolio of 17 companies worldwide, and building capabilities including a team of more than 20 investment professionals and partnerships with leaders in this space. We see enormous opportunities in the tech sector and will continue to build our global expertise to realize the best opportunities.

Are these investments scalable?

We invest in talented, visionary management teams with companies that have the potential to shape future markets. Our approach is to work closely with these companies and support them to scale, often leveraging the support of Ontario Teachers’ broad global ecosystem and depth of expertise.

Where will they invest?

We invest across a broad range of sectors, with the consistent theme of identifying unique applications of technology to solve challenging problems. Our portfolio includes companies as varied as Pony.ai, which focuses on autonomous vehicles, to Beamery, which is helping leading companies worldwide attract, engage and retain top talent.

Are Green technologies part of that drive to attain 10% by 2026?

We look to companies that are shaping a better future through technology and that includes those who share our vision for a sustainable future. One example is our investment in Motif FoodWorks, a Boston-based company that creates novel ingredients that are improving the taste, texture and nutrition of plant-based foods – and helping to increase consumer adoption of meat-free alternatives in the process.

Where is the current weighting of that portfolio to gauge how it can go up to 10% in five years?

Our TIP portfolio at June 30, 2021 was approximately $5.7 billion or about 3% of net assets.

I thank Olivia for answering all my questions and Dan for getting back to me so promptly, I really appreciate it.

Comments

Post a Comment