Positioning Your Portfolio in Uncertain Times

The Dow was little changed on Friday, notching a winning week as optimism about a short-term debt ceiling deal trumped a disappointing jobs report.

The Dow Jones Industrial Average dropped 8.69 points to 34,746.25. The S&P 500 fell about 0.2% to 4,391.34. The technology-focused Nasdaq Composite fell 0.5% to 14,579.54.

The major averages all ended in the green for the week. The Dow rose 1.2% for its best week since June. The S&P 500 rose about 0.8% for its best week since August. The Nasdaq rose just shy of 0.1% since Monday.

Energy stocks plowed higher on Friday as West Texas Intermediate crude futures, the U.S. oil benchmark, crossed $80 per barrel on Friday for the first time since November 2014. WTI crude settled at $79.35. Exxon Mobil rose 2.5%, Chevron advanced 2.2% and ConocoPhillips added nearly 4.8%.There was something for both bears and bulls in Friday’s jobs report, which explains the gyrations in stocks following the release. The headline number was a major disappointment as the economy added just 194,000 jobs in September, well below the Dow Jones estimate of 500,000, the Labor Department reported.

On the positive side, the unemployment rate itself fell to a much lower point than economists forecast. At 4.8%, that’s the same level seen in late 2016. Plus, August’s jobs report miss was also revised up to 366,000 compared to the initial read of 235,000.

A bleaker labor picture could stall the Federal Reserve, as it prepares to slow its $120 billion-per-month bond-buying program.

“This jobs number could call into question the starting point for taper late this year,” said Jamie Cox, Managing Partner for Harris Financial Group. “There are lots of positives in the report, like an uptick in average hourly earnings, but not enough to sugar coat the fact the employment picture remains murky with all the Covid related cross currents.”

The Department of Labor said Thursday that jobless claims for the prior week totaled 326,000. That was lower than the 345,000 economists had been calling for. Continuing claims, meanwhile, declined by 97,000 to 2.71 million.

Stocks are coming off a volatile week but the major averages weren’t derailed by the debt ceiling debacle. Stocks advanced during regular trading on Thursday as Washington reached a deal to raise the debt ceiling into December.

Uncertainty around the debt ceiling had been a headwind for the market but other risks remain, including accelerating inflation and rising rates. The 10-year Treasury yield was around 1.57% on Thursday, and UBS sees it rising to 1.8% by the end of the year.

Wall Street is also preparing for third-quarter earnings season, which kicks off next week.

Noel Randewich and Devik Jain of Reuters also report that Wall Street dips after September jobs miss:

U.S. stocks dipped on Friday after data showed jobs growth in September was weaker than expected, yet investors still expected the Federal Reserve to begin tapering asset purchases this year.

Comcast Corp (CMCSA) tumbled 4.3% after Wells Fargo cut its price target on the media company. This exerted pressure on the S&P 500 and Nasdaq, which went into negative territory. Charter Communications Inc (CHTR) fell 4.5% after Well Fargo downgraded that cable operator to "underweight" from "overweight".

Most of the 11 major S&P sectors fell, with real estate (XLRE) and materials (XME) the deepest decliners, each down about 0.6%.

The S&P 500 energy sector index (XLE) jumped 2.3%, with oil up more than 4% on the week as a global energy crunch has boosted prices to their highest since 2014.

The Labor Department's nonfarm payrolls report showed the U.S. economy in September created the fewest jobs in nine months as hiring dropped at schools and some businesses were short of workers. The unemployment rate fell to 4.8% from 5.2% in August and average hourly earnings rose 0.6%, which was more than expected.

“I think that the Federal Reserve made it very clear that they don’t need a blockbuster jobs report to taper in November," said Kathy Lien, Managing Director at BK Asset Management in New York. "I think the Fed remains on track.”

Futures on the federal funds rate priced in a quarter-point tightening by the Federal Reserve by November or December next year.

In afternoon trading, the Dow Jones Industrial Average (.DJI) was down 0.03% at 34,743 points, while the S&P 500 (.SPX) lost 0.13% to 4,393.92.

The Nasdaq Composite (.IXIC) dropped 0.38% to 14,598.71.

Third-quarter reporting season kicks off next week, with JPMorgan Chase (JPM) and other big banks among the first to post results. Investors are focused on global supply chain problems and labor shortages.

Analysts on average expect S&P 500 earnings per share for the quarter to be up almost 30%, according to Refinitiv.

"I think it’s going to be a dicey earnings season," warned Liz Young, head of investment strategy at SoFi in New York. "If supply-chain issues are driving up costs, a company with strong pricing power can pass through those rising costs. But you can’t pass through a labor shortage if you can’t find workers to hire."

Declining issues outnumbered advancing ones on the NYSE by a 1.30-to-1 ratio; on Nasdaq, a 1.49-to-1 ratio favored decliners.

The S&P 500 posted 24 new 52-week highs and 3 new lows; the Nasdaq Composite recorded 75 new highs and 95 new lows.

Alright, it's Friday, time for me to cover the stock market and today I have a lot to cover and want to make it particularly interesting for my readers.

First, let's check out how S&P sectors performed this week:

As shown above, energy (XLE), financials (XLF), utilities (XLU), industrials (XLI), consumer staples (XLP), consumer discretionary (XLY) and materials (XME) all outperformed the broader market (SPY) whereas technology (XLK), communication services (XLC), healthcare (XLV) and real estate (XLRE) all underperformed the broader market this week.

It's a bit of a mixed bag but clearly cyclical sectors leveraged to the economy -- financials, industrials, energy and materials -- are performing well this week.

But if you look over the past month, energy stocks are on fire, up 20%, financials are up 4% and the rest of the sectors are down:

So much for divesting out of fossil fuels, when all the sectors are struggling, you need to get your alpha and beta from anywhere you can, and energy has been the place to be over the past month.

True, in terms of weighting, financials are far more important and they too are up over the past month, but my point is everyone is crapping on traditional energy stocks and like I stated last week when I warned my readers to get ready for a crazy October, "...supply bottlenecks and if you look at energy in particular, there's no

investment whatsoever, which can bolster energy stocks a lot higher from

here":

That's a pretty nice weekly breakout on energy stocks and I'm sure Peter Letko and Daniel Brosseau feel pretty good about this even if they're wrong about Canadian pensions needing to invest more in Canadian stocks.

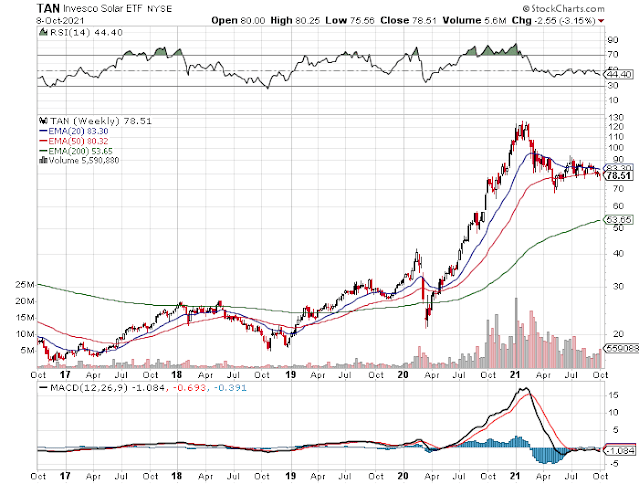

While traditional energy stocks are on fire, alternative energy stocks like solar stocks (TAN) have been getting crushed since peaking earlier this year and are at important levels here where if they break lower, it can get real ugly, real fast:

Of course, it's not just solar stocks, anything that was "hot" earlier on this year is getting crushed as rates back up a bit. To wit, look at biotech stocks (XBI) and concept stocks related to energy transition like Plug Power (PLUG), QuantunScape (QS) and Nio (NIO) which is a Chinese electric vehicle manufacturer:

But not Tesla, even though Risk Off is affecting the riskiest parts of the stock market, good old Tesla continues to defy logic and keeps getting ramped up, making a beautiful breakout here:

I reckon Tesla's top institutional holders are doing everything in their power to keep ramping this stock up, burning short sellers and if it hits over $1,000, it will make Elon Musk dance like a little kid again:

Dance Zorba, dance! You're now the world's richest person, courtesy of an ESG bubble the likes of which we haven't ever seen before!

Ah, you got laugh at these markets, Fed officials making stock trades prior to engaging in massive QE, everything is so corrupt, big quant hedge funds pumping and dumping meme stocks at will, bitcoin, NFTs, whatever, so much nonsense this year!

Speaking of the Fed, Francois Trahan of Trahan Macro Research wrote a real gem this week going over why he expects more Fed-induced volatility in 2022 and how you can hedge for it:

Another week, another list of inflation surprises. I won't bore you with news of BMO raising pay by 20% for its call-center employees and other headlines of the same ilk. That said, the Core PCE release for the month of August showed underlying inflation in the U.S. to be growing at its fastest pace since 1991 (longer than most have been in this industry). This is stunning. Especially since the Fed has yet to act. When does "transitory" mean anyway?

In all fairness, the Fed is well within its purview in keeping rates where they are. Indeed, the change in the central bank's mandate, or the implementation of that mandate to be more exact, that was announced in August of 2020 states that the Fed now targets an "average" inflation rate of 2% as opposed to a target of 2%. A small change with big consequences. Most importantly, perhaps, the Fed's statement used murky language that gives them lots of liberties. What's clear is that what we are living right now is the biggest deviation between the fed funds rate and the "traditional" mandate of the post-Volker era (see Taylor Rule and Neutral Rate for evidence). In other words, this is a big deal.

A departure from the Fed era of transparency implies that we will likely see more surprises in the bond market (i.e. sudden moves in yields like what was seen this past February). This is important for equity investors because a change in yields weighs on many Growth stocks with lofty valuations while simultaneously benefiting some of the Value names (i.e. Banks). Whether you like it or not, some aspects of your job will be impacted by this subtle change. Indeed, a world where bond yields move more suddenly is one where equities see sharp changes in market leadership. This is a difficult world to navigate for PMs and this report puts forth one strategy for managing the newfound Fed-induced volatility.

You can read Francois's latest weekly comment here, it is truly superb, one of his best and if I'm not mistaken, it's that last free one since he launched Trahan Macro Research (institutional investors, make sure you subscribe to their research).

Let me just share first page:

And this about how inflation is creating tighter economic conditions than the Fed implies:

I'm still not convinced runaway inflation is settling in, but I agree that it's stickier than what most people thought it would be, including the Fed.

The grand conspiracy theorist in me is convinced the Fed and other central banks are still fighting a losing battle, namely, global deflation.

They are actively trying to get inflation going because they are trying to inflate debts away but their interventionist policies are only exacerbating massive inequality which will ultimately lead to a major deflationary bust.

That remains my long-term thesis but in the meantime, markets are active, portfolio managers need to position their portfolios for what lies ahead, and this isn't an easy environment to make big sector bets.

For example, yesterday morning, I called my former PSP colleague and favorite stock trader, Fred Lecoq, and we went over a bunch of daily, weekly and monthly charts on stocks and sector ETFs.

Unlike others who enjoy the balance sheet of a large pension or hedge fund, Fred has significant skin in the game, he has learned a lot over the years and continuously learns swing trading his own money. His made more than he's lost and that's a testament to his long endurance in a very tough game (but a hell of a rewarding one if you can survive the hits).

I told Fred "we haven't seen a real bear market like 1974-75 or 2000-2001 yet." I added: "Everyone is convinced the Fed will keep intervening in markets, saving the day and part of me truly believes the Fed will take its cue from the Bank of Japan and start buying stocks if they crash."

Fred isn't sure of that but he's certainly aware of past bear markets as he lived them and knows full well markets can turn on a dime.

He told me right now, "it's a call on rates and he likes cyclicals like energy, financials and industrials."

He told me: "Buy Bank of America, it's breaking out here."

We were looking at how much the yield on the 10-year Treasury note can back up to and I said if economic activity picks up, potentially to where it was in December 2019, just under 2%:"If that's the case, stick with financials and energy," Fred told me.

But I also told him we can get a deflationary shock from China or somewhere else or failed debt ceiling talks later this year and that can come back to haunt us as rates will head lower.

"If that happens, stick with Nasdaq type growth stocks (QQQ) and get ready for volatility," he told me.

I told him it's a tough environment and he replied: "Leo, it's always tough out there in the trenches!"

Like I said, it's much easier sitting behind a Bloomberg trading other people's money, much harder when you're trading your own capital and every basis point counts!

But honestly, my conversations with Fred should be recorded, the amount of stuff we cover in markets is incredible.

And no Fred, I took your advice and didn't buy Lightspeed on Thursday but I'm keeping a very close eye on it:

What else? Fred and I were impressed with how some of the Chinese internet plays like Alibaba (BABA) and Baidu (BIDU) came back strong this week, mostly on Thursday and Friday.

Let me end with Martin Roberge of Canaccord Genuity who writes this in his latest weekly market wrap-up on the value turning point:

We published the October 2021 edition of the Quantitative Strategist Monday, in which we reiterate our defensive stance on stocks but look for an opportunity to upgrade our view before year-end. Also, we adopt a domestic bias in our sector strategy as we believe that China’s Evergrande wind-down, along with widespread power shortfalls in China, should have more ripple effects in Europe/Asia than in North America. As such, we reinstate a small > large tilt while maintaining the cyclicals > defensives and value > growth bents. On the latter, we highlight that the strong performance of the energy sector since the pandemic low is such that the 40-wma of the energy/technology price ratio has moved above its 80-wma (see our Chart of the Week). This crossover in Q4/2000 confirmed a multi-year value > growth cycle which followed the dotcom bust. It is also interesting to see that like in late-1999/early 2000, the energy/technology price ratio exhibits an inverse head-and-shoulders formation which, according to technical analysis, is a powerful trend-change indicator. Time will tell if history repeats itself but with commodity prices reversing multi-year downtrends relative to bond prices, another strong Q4 for energy stocks may confirm that value is overtaking growth for a little while.

Indeed, time will tell if a secular bull market in commodities is underway, that will be bullish for Canada, Australia and commodity currencies.

But I'm skeptical, eventually these big calls are all about inflation vs deflation. If you believe inflation is just getting underway, go long commodities, if you think the opposite, tuck most of your cash under a mattress and use a portion to try to swing trade these crazy markets to generate returns.

It's that brutal. Trust me.

Alright, let me wrap it up, wish everyone a great long and happy Thanksgiving weekend in Canada.

Below, CNBC's Jim Cramer joins "Squawk Box" to discuss September's jobs report and what that means for Federal Reserve Chairman Jerome Powell.

Also, Nancy Tengler from Laffer-Tengler Investments and Gina Sanchez, Chantico Global CEO join The Exchange with what they expect from the stock market as we head into year-end.

Third, Chris Toomey from Morgan Stanley Private Wealth Management joins the Halftime Report following the release of the September jobs report. "Despite everybody's hope and desire to get everything back to normal," the economic recovery is still slowed due to the delta variant, Toomey tells Scott Wapner.

Lastly, Mohamed El-Erian, a Bloomberg Opinion columnist, says stagflation is a low probability tail risk. He speaks with Bloomberg's Jonathan Ferro on "Bloomberg The Open." El-Erian's opinions are his own.

Comments

Post a Comment