CPP Investments and Bridge Form US$1.1 Billion Warehouse Partnership

Bridge Industrial (“Bridge”) a privately-owned, vertically integrated real estate operating company and investment manager, and Canada Pension Plan Investment Board (“CPP Investments”) today announced the formation of a joint venture to develop industrial properties in several core markets across the United States.

CPP Investments and Bridge have allocated US$1.1 billion in equity to the joint venture, and will focus on developing industrial assets for long-term ownership in core U.S. markets. CPP Investments will own a 95% stake in the joint venture and Bridge will own the remaining 5%.

“We’re excited to form this new strategic partnership with CPP Investments, which will allow Bridge to continue to scale our infill portfolio in our core U.S. markets,” said Steve Poulos, Founder and CEO of Bridge. “Demand for industrial space continues to outpace supply in infill markets across the U.S., supporting Bridge and CPP Investments’ shared vision of the long-term value and opportunity in the industrial sector.”

The venture was seeded with a 175-acre site within Miami’s Airport West submarket, located in the city of Doral. The development will include six buildings that will total 2.6 million square feet of state-of-the-art warehouse space once completed.

“We’re pleased to form a new partnership in the growing industrial real estate sector alongside proven developer and operator Bridge, further diversifying our real estate investments across multiple U.S. markets,” said Peter Ballon, Managing Director, Global Head of Real Estate, CPP Investments. “The significant demand for purpose-built logistics real estate that can help ease existing warehouse supply burdens aligns with our long-term investment strategy.”

About Bridge Industrial

Bridge Industrial (www.bridgeindustrial.com) is a privately-owned, vertically integrated real estate operating company and investment manager that focuses on the acquisition and development of Class A industrial real estate in the supply-constrained core industrial markets of Chicago, Miami, New Jersey/New York, Los Angeles/San Francisco, Seattle, and London. Since its inception in 2000, Bridge has successfully acquired and developed more than 51 million square feet of industrial buildings/projects valued at more than $8.3 billion.

About CPP Investments

Canada Pension Plan Investment Board (CPP Investments™) is a professional investment management organization that manages the Fund in the best interest of the more than 20 million contributors and beneficiaries of the Canada Pension Plan. In order to build diversified portfolios of assets, investments are made around the world in public equities, private equities, real estate, infrastructure and fixed income. Headquartered in Toronto, with offices in Hong Kong, London, Luxembourg, Mumbai, New York City, San Francisco, São Paulo and Sydney, CPP Investments is governed and managed independently of the Canada Pension Plan and at arm’s length from governments. At September 30, 2021, the Fund totalled C$541.5 billion. For more information, please visit www.cppinvestments.com or follow us on LinkedIn, Facebook or Twitter.

Bridge leverages its local offices and expertise to identify, execute and manage opportunities on behalf of its institutional capital partnerships.

Among its investment strategies, you'll find:

- Build-To-Core: Development of irreplaceable infill industrial properties for long-term ownership and cash flow.

- Value-Add: Acquiring existing infill industrial properties to create value through leasing, redevelopment, and capital improvements.

- Core/Core-Plus: Acquire best-in-class industrial properties in Bridge’s core infill markets to benefit from long-term ownership and cash flow.

CPP Investments' joint venture is focusing on build-to-core which is the development of irreplaceable infill industrial properties for long-term ownership and cash flow.

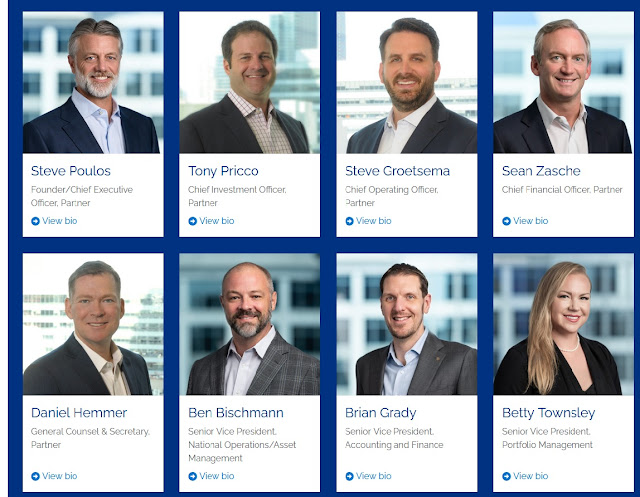

You can view the list of of people working at Bridge here. Below, I embedded the senior team:

You'll recall, I covered Bridge back in May when it and PSP Investments partnered to deploy around $1.4 billion into the acquisition and development of last-mile warehousing and distribution facilities in, and around, London and the Midlands region of the United Kingdom.

They are pros at what they do and are top-notch at developing and managing industrial properties.

In fact, today, Andrew Coen of Commercial Observer reports Hartford Investment lends $118M on Miami industrial development:

Bridge Industrial has secured a $117.5 million debt package to refinance a Miami Gardens industrial park, Commercial Observer has learned.

Hartford Investment Management supplied the fixed-rate loan, which will retire existing floating-rate construction financing for the first phase of the developer’s Bridge Point Commerce Center project. Steve Roth of CBRE’s debt & structured finance team arranged the transaction.

Located at 4310 NW 215th Street and delivered last January, the first phase of the Bridge Point Commerce Center consists of three buildings totaling 1.1 million square feet. The buildings are 97 percent leased with CITY Furniture and HapCor as anchor tenants. Construction is underway on Phase II of the project, which encompasses two buildings totaling 1.5 million square feet and is scheduled for completion in early 2023.

“Modern, last-mile logistics centers like Bridge Point Commerce Center continue to outperform the market,” Kevin Carroll, partner of the southeast for Bridge Industrial, said in a statement. “We are pleased to have been able to take advantage of historically low interest rates and lock into an extremely attractive fixed rate.”

Representatives for Hartford Investment Management did not immediately respond to a request for comment.

Chicago-based Bridge Industrial has become one of South Florida’s most active industrial developers with 16 transactions totaling 500 acres throughout Miami Dade and Broward counties comprising roughly 7 million square feet, according to the company.

There's a reason why Hartford Investment is lending Bridge $118M for Miami industrial development, they trust them that they will deliver and are good for this loan.

Why is Bridge taking out this loan? Because as Kevin Caroll states, they locked into an extremely attractive low fixed rate (cost of capital is historically cheap, it makes sense to lend money).

As far as industrial properties, last week, I discussed how AIMCo and OMERS are ramping them up and also referred to other funds, including CPP Investments:

Earlier this week, I went over my recent discussion with Deborah Orida, CPP Investments' Chief Sustainability Officer and Global Head of Real Assets, where she told me that they have 30% of their $46 billion real estate portfolio in industrial properties, adding "we were first movers in this sector and it paid off nicely."

CPP Investments, HOOPP and I'd say PSP were among the first movers in snapping up industrial properties early on before they became a hot item.

Lastly, CPP Investments posted an important comment on investing to enable an economy-wide evolution to a low-carbon future:

Most current initiatives to tackle the climate crisis do not address strategic sectors that are both essential and high emitting.

These strategic sectors include agriculture, chemicals, cement, conventional power, oil and gas, steel and heavy transportation.

The successful decarbonization of these strategic sectors is not only essential to meet wider net-zero ambitions, but also to sustain economic growth, stability and a responsible transition.

CPP Investments sees an opportunity to create value and pursue new investments by applying a decarbonization investment approach, which seeks attractive returns by enabling an economy-wide evolution to a low-carbon future. This investment approach is premised on identifying, funding and supporting high-emitting companies that are committed to lowering their emissions in a way that will allow CPP Investments to capture attractive risk-adjusted returns. We believe that high-emitting companies that navigate this evolution successfully will preserve and surface embedded value for patient investors.

The climate challenge will require unprecedented collaboration and capital. We welcome dialogue and opportunities for partnership with like-minded companies, industry leaders, investors, and other interested parties as we build a dedicated investment approach to support current and future portfolio companies in their transition.

Please take the time to download and read this report here.

For more information, please contact:

Bill Rogers

Managing Director, Head of Sustainable Energies, Europe and Asia

Global Leadership Team

brogers@cppib.comMike Conrad

Principal, Sustainable Energies

mconrad@cppib.comArt Pithayachariyakul

Principal, Sustainable Energies

apithayachariyakul@cppib.com

Alright, it's Christmas week, everyone has Covid fatigue, including your truly, but I feel it's my duty to share some health information with everyone.

As I've been warning people, the Omicron variant is a fast-moving freight train.

Covid cases in Quebec are exploding up and pretty soon the rest of the country will follow.

Talking to a friend of mine who is a doctor treating COVID-19 patients, he told me:

“Omicron will hit everyone, this will be the last and worst wave in terms of cases as herd immunity kicks in. The important number to remember is Omicron has an R factor of 5. Delta has an R factor of 1. That means Omicron is four times more contagious than Delta. Hospitals in Quebec did emergency planning meetings last week preparing for influx of patients and staff shortages as many nurses, orderlies and doctors will get sick. We expect cases in Quebec will hit 10,000 by Friday. Wear your N/95 when out, surgical masks are useless with this variant. It will be a brutal winter.”

I don't mean to be alarmist but take Omicron seriously, it's not always as "mild" as they portray it on the news and it's so contagious that all my doctor friends are convinced everyone will catch it.

As in all Covid cases, it's not just about you, it's about limiting community spread and not infecting a loved one or the most vulnerable by accident.

Rapid tests are being doled out but the best way to limit spread is to stay home and limit your contact with people, even if that means not getting together with all your family and friends over the holidays.

It sucks, Omicron hit us when we were all hoping to enjoy relatively normal holidays, but it is what it is, it's a pandemic and hopefully this is the final massive wave.

Take care and stay safe, nobody likes restrictions but we need to think of others and our frontline workers who are exhausted and need our support (not just words but actions).

What else? I did my Moderna booster shot on Friday morning, a half dose, and even though I feel grateful, I'm not changing a thing in my behavior and not taking stupid risks for no reason.

I had side-effects, bad chills and felt lousy Friday evening but I also fell asleep early and forgot to take my Tylenol (take extra-strength Tylenol the two first nights if you feel lousy, it helps).

Below, the US is facing a warehouse shortage, with 1 billion square feet of new industrial space needed by 2025 to keep up with demand, according to commercial real estate services company JLL. More e-commerce activity and faster delivery is driving up demand and shifting local economies, like in the Lehigh Valley region of Pennsylvania. Now, open land is scarce, forcing real estate developers to find unconventional spots, like a scuba diving center, if they want to keep building.

For every Cyber Monday purchase, there is a warehouse employee packing up those soon-to-be presents.

The big online shopping holiday comes amid a warehouse shortage across the United States as distribution center vacancy rates are at all-time lows. Nearly 96% of existing industrial space is in use, according to commercial real estate services company JLL.

Comments

Post a Comment