Talking Co-Investments and More With CalPERS's Yup Kim

This morning, Yup (pronounced "yup" as in opposite of "nope") and I had a nice chat about what CalPERS is doing in private equity, focusing more on co-investments.

I will begin by thanking Yup for taking the time to speak to me, I quite enjoyed our conversation.

The last time I spoke with someone at CalPERS was with Ben Meng, the former CIO, in June 2020 right before he departed that organization.

In July, Franklin Templeton appointed Ben Meng as Executive Vice President and Chairman of Asia Pacific:

Dr. Meng’s appointment builds on Franklin Templeton’s strategy to expand the reach and breadth of its investment offerings in the Asia Pacific region, with a particular focus in private equity, venture capital and other alternative asset capabilities. He will also leverage his expertise gained from serving in top investment roles at two of the largest asset owners in the world to help expand the reach of Franklin Templeton’s tailored solutions it provides to institutional clients globally.

“Expanding our alternative asset business and deepening our overall commitment to the Asia Pacific region are key strategic priorities for Franklin Templeton, and Ben is uniquely experienced and positioned to lead important initiatives in the region,” said Ms. Johnson. “He brings to Franklin Templeton a strong track record for delivering results across a broad range of asset classes and extensive experience and knowledge of the region. His approach to asset and risk allocation, along with his belief in active investment, align well with our investment philosophy, and we are thrilled to welcome Ben to the Franklin Templeton family.”

“I have long respected Franklin Templeton’s business, its long-term focus, and its collaborative, client-first culture and global reach. I am excited to build upon the firm’s nearly 75-year history and to be part of its next phase of growth in the Asia Pacific region,” said Dr. Meng. “I look forward to working closely with Jenny and the Franklin Templeton team to execute upon the firm’s strategic priorities across the region.”

I wish Ben Meng much success at Franklin Templeton.

Interestingly, I asked Wayne where CalPERS is on a successor to Ben and he told me "they held second-round interviews this week" (let's all hope they get it right and that the next CIO stays at least five years there).

Alright, back to Yup Kim.

First, a little background from the time he was appointed to CalPERS in September 2020:

CalPERS announced today that Yup Kim will join the pension fund as its new investment director in private equity.

Kim will help lead the CalPERS Private Equity Program engaging across all functions, including strategy, team management, and investment activities for primary, secondary, and co-investment opportunities globally. He comes to CalPERS from the Alaska Permanent Fund Corporation, where he served as senior portfolio manager for private equity and special opportunities.

Kim will begin as investment director on Monday, September 28. He will report to Greg Ruiz, managing investment director of private equity.

“Yup has been a thought leader in the industry with a unique combination of strategic insight, investing acumen, and managerial experience,” Ruiz said. “The evolution of Alaska Permanent’s Private Equity Program stands out for its innovation, thoughtfulness and investment returns. I look forward to partnering with Yup in the years to come as we continue to strengthen and evolve our Private Equity Program.”

Kim joined the Alaska Permanent Fund in 2016, and before that held roles at Deutsche Bank Private Equity, Performance Equity, Silver Point Capital, and Citigroup. He has a bachelor’s degree in economics from Yale University.

“CalPERS’ Private Equity Program has tremendous potential to generate long-term outperformance across the private markets spectrum,” Kim said. “There are incredible, unearthed competitive advantages at CalPERS that we’ll focus on cultivating and compounding over time to deliver strong results for all of our beneficiaries. I am thrilled to have the opportunity to contribute to a world-class Private Equity Program at CalPERS.”

Speaking with Yup, I can tell he really knows private equity well and he has a long-term game plan.

I told him a long time ago, I spoke to a guy called Réal Desrochers who came from CalSTRS to head up CalPERS's PE program.

Back then, Réal lamented "there were far too any GP relationships" and this was "watering down returns, effectively turning the CalPERS PE portfolio into a giant benchmark producing below average returns."

Réal's focus back then was on cutting down GP relationships to focus on fewer of them, trying to concentrate the portfolio (not sure how successful he was).

But as Yup Kim explained to me today, this approach effectively "limits you to invest with mega buyout funds whereas they want to invest across the PE spectrum."

He said there are 30 investment professionals working at CalPERS Private Equity and they are segmented into groups dedicated to:

- Global venture capital

- Global growth equity

- Global large buyouts

- Global middle-market buyouts

- Secondaries

- Co-investments

The way Yup explained it to me is they want teams to specialize and even go as far as specializing on deals.

For example, "those looking at software deals which trade at 30x ARR (annual recurring revenue) won't necessarily be working on industrial deals where EBITDA is 9x."

He gave another example on US healthcare deals where you have a wide spectrum in the value chain from biotech/ pharma to the payor space to medtech and healthcare IT to the provider space and how they need to pick which segment they'd like to focus on.

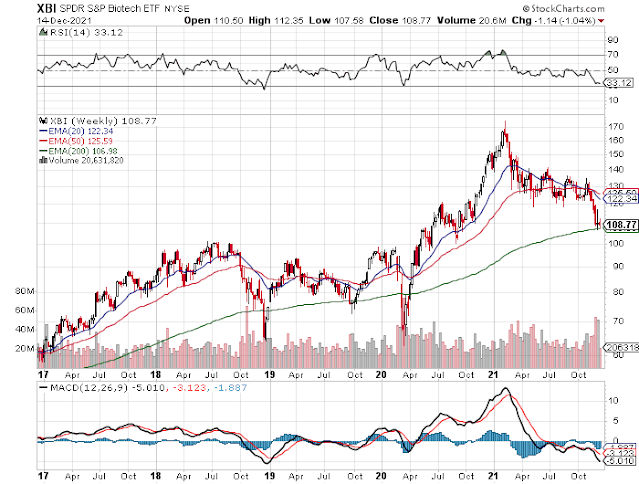

He also gave the example of how the Alaska Permanent Fund became known as the "biotech king". It's been reported those bets paid off huge for that fund:

Alaska Permanent Fund Corp.’s bet on biotechnology back in 2013 has generated some of the fund’s healthiest returns from what was once an unloved sector.

Biotechnology, which accounts for almost 19% of the Permanent Fund’s $12.49 billion private-equity portfolio, has generated outsized returns, particularly from direct investments and co-investments. The fund’s roughly $500 million direct biotech portfolio has returned some 5.5-times invested capital for a more than 102% net annualized return as of Sept. 30, 2020, since inception,...

As an aside, take it from someone who made and lost money on biotech, it's not easy even if you follow top biotech funds like Perceptive Advisors, you can get burned easily and the bubble in biotech stocks petered out earlier this year along with the bubble in hyper-growth stocks:

Still, biotech is binary, there will always be some home runs, like Arena Pharmaceuticals (ARNA) which got bought out by Pfizer earlier this week for $6.7 billion in cash, propelling its shares up to a new 52-week high:

On co-investments, which was central to my discussion last week, I reiterated my concerns:

A bigger issue for me is how will CalPERS move from 8% in Private Equity to 13%?

Here is what I posted on Linkedin earlier today:

[...] the biggest issue CalPERS will face going from 8% to 13% in private equity is how to do this in a cost effective manner which takes into account the size of their total portfolio. For example, CPP Investments which is Canada’s biggest pension fund, has roughly the same assets as CalPERS (a bit less in USD but growing fast) but invests 25% of its assets in PE through partnerships with top global funds and more importantly through co-investments with top funds on large transactions to reduce fee drag and remain well allocated in private equity. This allows them to get the most bang for their PE buck but to do co-investments properly, you need a dedicated PE team that knows how to analyze them and direct investments. You need to compensate these people properly to attract and retain qualified staff.Importantly, forget leverage, the focus needs to be on the approach CalPERS will use to invest in private equity.

If CalPERS doesn't beef up its co-investment capabilities, it will never be able to increase its allocation to private equity in a cost effective way and achieve its long-term return target.

Only investing in funds won't cut it, the fees are a big drag on returns over time.

I shared some more context with Yup, telling him if you do a performance attribution at the private equity portfolios at Canada's large pensions, you'll see that co-investments where LPs pay no fees rank at the top, followed by purely direct deals (small fraction of portfolios), syndication deals, and fund investments rank at the bottom because of fees.

I also told him at the more developed PE programs at Canada's large pensions, co-investments make up almost half the portfolio, allowing these large pensions to maintain a sizable allocation to PE while reducing fee drag.

Yup agreed that co-investments are critical and require two things to be successful:

- Solid governance process (flexibility is necessary)

- Speed of analysis and quick turnaround time to maintain solid co-investment relationships with GPs (once you develop a reputation, it's easier).

He told me that co-investments now make up 25% of the private equity investments CalPERS has made since July 2021, and they are looking to grow that (very respectable, I thought it was less).

But he also cautioned me that "co-investments aren't just about fee reduction, they're about developing robust relationships with our GPs where we learn from them and understand their investment judgment and capabilities."

He added: "Unlike the Canadian funds that have dedicated direct teams twice the size of their funds teams, we’ll need to take a slightly more integrated approach between our fund segment and direct teams."

I said: "Don't believe everything you hear, Canada's large pensions still rely on fund relationships first and foremost in private equity and that will never change."

What else?

Yup told me they're doing active due diligence on all their PE partners, learning as much as possible on their investment process, not waiting for fundraising to roll around, but instead developing long-term collaborative relationships and being more proactive in sourcing funds and deals.

He said they're looking into bolstering their data and integrating data from public markets too to help them with their selection process on funds and deals.

Lastly, in terms of going from 8% to 13% in Private Equity, Yup cautioned me: "It won't happen overnight. We need to diversify vintage year risk properly, it will slowly happen over the next five years as opportunities arise."

I totally agree and I like the way CalPERS is looking at the entire PE spectrum despite its size.

The biggest mistake some Canadian pensions do is they ignore certain segments of private markets because "they don't move the needle."

For example, mid-market infrastructure, why do a $50 million deal when you can write a $500 million cheque to do a much bigger deal?

Well, if you had dedicated resources, you can do ten $50 million deals in the mid-market space and come out ahead. Capiche?

All this to say, I like CalPERS segmentation/ specialization approach and it makes sense to me.

I promised Yup I'd get back to him with some Canadian VC and mid-market PE funds so here they are:

- Maverix Private Equity (John Rufollo, founder & managing partner formerly from OMERS Ventures)

- Searchlight Capital (Erol Uzumeri, one of the founding partners came from OTPP Private Equity)

- Peleton Capital Management (Founding Managing Partners Steve Faraone and Mike Murray who also came from OTPP and teamed up with Steve Smith to focus on long-term mid-market PE. You can read my comment on their differentiated approach here).

I want to make it clear, none of these funds have ever given me a dime, I have no business relationship with them and that's the way I want to keep it (I'm not in the capital introduction business, not for me).

I am just mentioning them here because I promised Yup Kim to provide him with some excellent Canadian mid-market PE and growth equity funds to look into (there are plenty of others).

What else?

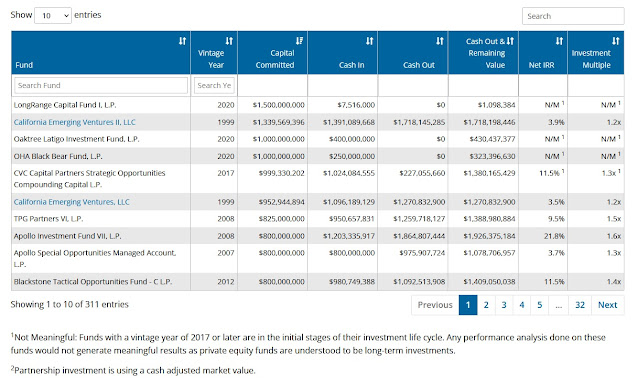

I invite all my readers to look into CalPERS's private equity program fund performance review here:

As of March 31, 2021, the since inception Net IRR is 11.2% and the Net Multiple is 1.5x.

The table below reflects the performance of all active PE partnership investments as of March 31, 2021. At the end of each quarter, the General Partners report on the value of invested capital. The General Partners have 120 days to provide Limited Partners with financial data, so there is generally a 2-quarter delay in performance reporting.

The table is updated quarterly and provides information on the status of all active CalPERS private equity commitments; it doesn't include any exited partnership investments.

- The Fund column lists the names of all active partnership investments.

- Vintage Year is the year in which CalPERS’ first cash flow for the investment occurred.

- Capital Committed identifies the original amount CalPERS committed to each fund.

- Cash In represents capital contributed for investments and management fees.

- Cash Out represents distributions CalPERS has received back from the fund.

- Cash Out & Remaining Value represents the distributions CalPERS has received plus the reported value of the invested capital.

- Net IRR is the Net Internal Rate of Return based on CalPERS’ actual cash flows and the reported value of the invested capital.

- Investment Multiple is the Cash Out & Remaining Value divided by the Cash In.

In evaluating private equity performance, CalPERS emphasizes using both the realized Internal Rate of Return (IRR) and Investment Multiple. Interim IRRs by themselves are not the best indicators of current or future fund performance.

The IRR is calculated based on CalPERS records of cash flows and financial statements from the investment managers.

I had fun digging into the table. For example, I clicked twice on the arrow next to capital committed in second column to see which funds received the most capital from CalPERS:

I recognized many of them but others I didn't know of.

For example, I read about LongRange which was founded by Robert Berlin, who was briefly a partner at Navab Capital before its founder, Alex Navab, died unexpectedly in 2019. Before that, he was at Baupost running private equity.

LongRange received $1.5 billion in November of last year from CalPERS which is the sole investor in its first fund:

“Our investment team has acted within their delegated authority and has fully briefed the board on this investment,” CalPERS board president Henry Jones said in a statement. “Working together, the board and investment team continue to evolve our private equity portfolio to drive value for our members and beneficiaries.”

In addition to the capital contributed by CalPERS, the firm’s owners have put up an additional $15 million to invest, the firm’s form ADV shows.

LongRange will invest between $50 million and $400 million in target companies via majority, minority, and joint venture stakes. The fund seeks to invest in European and North American companies with revenues of more than $200 million, the firm’s website shows. A spokesperson for LongRange declined to comment.

CalPERS also made significant investments in Oakhill Advisors Black Bear Fund and Oaktree's Latigo Investment Fund, two credit managers looking to exploit dislocations in credit markets.

I searched for Thoma Bravo and couldn't find it but I'm pretty sure they are there too along with many other top GPs.

As Yup Kim told me, they want to build "robust, long-term relationships with top GPs."

I wish him, Greg Ruiz and the entire CalPERS' PE team much success as they manage this important portfolio over the next decade and for generations to come.

Below, I embedded the latest CalPERS November board meeting (three clips covering three days). You can fast forward through some parts but it is definitely worth listening to others.

Comments

Post a Comment