Did Hyper-Growth Stocks Just Get Powelled?

Stocks dropped on Friday, after a disappointing November jobs report, as the market wrapped up a roller-coaster week driven by Covid omicron variant concerns.

The Dow Jones Industrial Average fell 59.71 points to 34,580.08, dragged down by a 1.9% loss in Boeing. The Dow was down as much as 300 points earlier in the session. The S&P 500 dropped 0.8% to 4,538.43. The technology-focused Nasdaq Composite dipped 1.9% to 15,085.47. The major averages posted a losing week.

Technology stocks were among the most notable losers on Friday as Tesla fell 6.4% and Zoom Video declined nearly 4.1%. DocuSign cratered 42.2% after the company issued fourth-quarter sales guidance that was lower than what analysts expected.

Stocks tied closely to the virus have led the market on its week-long seesaw, and that continued Friday. Companies that benefit from the economic expansion, such as hotels and airlines, led losers. Las Vegas Sands was off by nearly 3.7% and Delta Air Lines fell 1.8%. Norwegian Cruise Line fell 4.5% and Carnival lost close to 3.9%.“The uncertainty regarding Omicron is high, but coupled with the disappointing jobs number and investors decided to dump in front of the weekend,” said Ryan Detrick, chief market strategist at LPL Financial.

November’s jobs report showed slower-than-expected job creation last month. Nonfarm payrolls increased by just 210,000 for the month, well below the 573,000 jobs predicted by economists polled by Dow Jones.

However, the unemployment rate fell sharply to 4.2%, better than estimates of 4.5%.

“It is unsettling to see that we were unable to build on October’s strong numbers, with uncertainty only set to increase as the winter progresses,” said Steve Rick, Chief Economist at CUNA Mutual Group. ”That said, it is not completely surprising that this month fell short with the country preparing to respond to the COVID-19 Omicron variant and continuing to battle rising inflation and the ongoing supply chain crisis.”

Elsewhere in markets, Chinese ride-hailing giant Didi announced during Asia trading hours on Friday that it will start delisting from the New York Stock Exchange and make plans to list in Hong Kong instead. Shares fell 22.2%.

Friday’s market moves continued a highly volatile streak for stocks as the market digests the new Covid variant omicron and what it means for investors. The omicron variant has now been detected in five U.S. states, with symptoms so far reported as mild.

Despite a rebound on Thursday that saw the Dow rise more than 600 points, the 30-stock average dropped 0.9% for the week. The S&P 500 fell 1.2% and the Nasdaq Composite lost 2.6% this week.

Barclays told clients on Friday to stay the course and buy the market on dips.

“We remain of the view that overall macro and liquidity conditions are supportive of equities, and advise to add on weakness, looking for the bull market to carry on,” said Emmanuel Cau of Barclays.

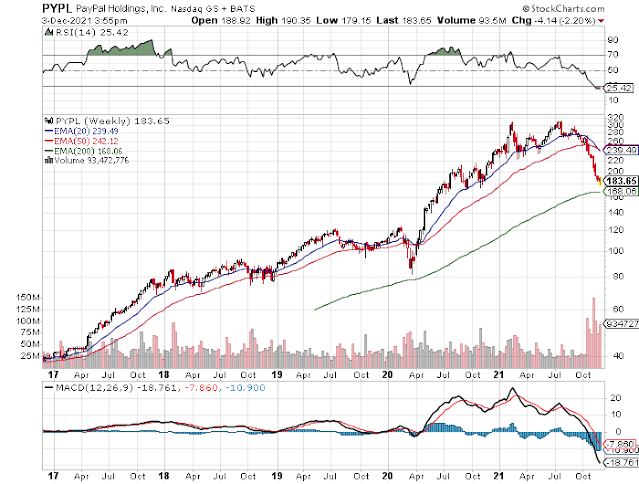

They say an image is worth a thousand words, so here is the image I can share as we end the week on another ugly note:

I discussed the unARKing of the market in mid-January but the real unARKing has occurred over the past month and week with very popular growth names getting absolutely destroyed:

The worst-performing tech stocks this week suggest the U.S. is done with Covid lockdowns https://t.co/XESSvaaGiG

— Leo Kolivakis (@PensionPulse) December 3, 2021

I can go on and on:

You get the picture, it's a real bloodbath for many popular hyper-growth stocks that shot up like crazy earlier this year.

It was even worse for some popular Chinese growth stocks getting slammed on fears of delisting and Chinese government intervention:

Even some popular US mega cap tech stocks are feeling the pain:

OUCH! More pain for Cathie Wood!

Cathie Wood’s Ark Loads Up on Twitter After Stock Hit Year-Low https://t.co/g2oFIOsFn5 via @Yahoo

— Leo Kolivakis (@PensionPulse) December 3, 2021

Of course, Ms. Wood isn't giving up so easily, she's sticking to her guns:

Cathie Wood says inflation will 'unwind pretty quickly' and that stocks will probably be fine — here are 3 of her picks to keep riding the bull https://t.co/JBCpuLOxcq

— Leo Kolivakis (@PensionPulse) December 3, 2021

And you know what? If inflation pressures ease up and rate fears subside, she might turn out to be right, but for the foreseeable future, I see more pain ahead for her and other hyper-growth type investors as it could get a lot worse before it gets better.

ARK Innovation ETF drops another 6%, bringing YTD performance to -23%. pic.twitter.com/blkzXPCKRQ

— Holger Zschaepitz (@Schuldensuehner) December 3, 2021

History does not repeat itself, but it rhymes. $ARKK vs dotcom bubble 👇 ht @gnoble79 pic.twitter.com/G4efaMycsM

— Michael A. Arouet (@MichaelAArouet) December 2, 2021

Yeah, I know, her darling Tesla is still holding up relatively well, but you have to wonder how long before this stock falls back to earth (it was down 6% today but still up huge over last 2 years an hasn't broken important support levels yet):

Interestingly, while Ark stocks are getting clobbered, the S&P technology ETF (XLK) is holding up relatively well, mostly owing to the great performance of Apple, Microsoft and NVIDIA (they make up 46% of this ETF):

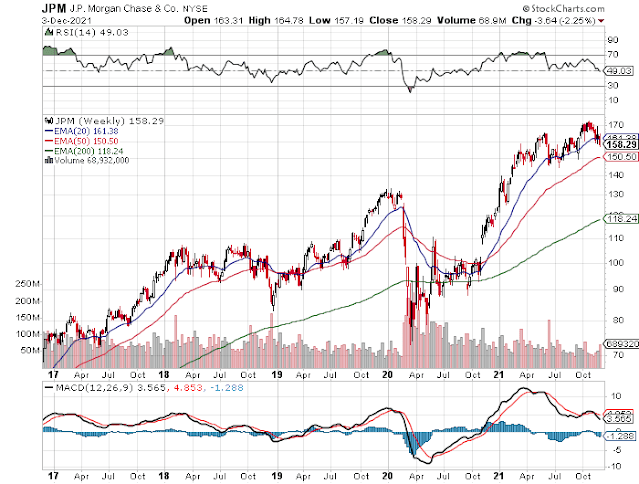

Elsewhere, even some popular financial stocks look very fragile here after running up big all year:

Alright, so what gives? Why are markets so edgy lately? The often cited factors are:

- Omicron

- Fed tapering

- Congress debt ceiling

- Weak US jobs report

Let me start with the disappointing US jobs report. Nonfarm payrolls increased by 210,000 in November, following a gain of 546,000 the previous month. The number was well below Wall Street expectations of 573,000.

What do I keep telling you? Never, ever try to predict US nonfarm payrolls on any given month, you will turn out to be wrong most of the time.

They will likely revise the figures up next month or the month after that, but the important point is employment gains are picking up over the past six months and that's what the market is fixated on:

Now U.S. 2-year yields are close to the highest since March 2020. This was a "weird" report, according to one analyst, but the market's takeaway seems to be it's a solid report that gives the Fed the greenlight to hike rates next year. pic.twitter.com/sMwNOYkPNc

— Lisa Abramowicz (@lisaabramowicz1) December 3, 2021

As far as Omicron, it's still too early to tell but so far, it hasn't displaced the Delta variant which remains the dominant strain and it looks relatively mild.

It's important to note the typical natural course of viruses is to get more transmissible as new mutations emerge but far less lethal.

Let's hope this is the case with Omicron but the first real world data showing it may evade some of our immunity has been reported by scientists in South Africa and we need to pay attention to re-infection rates:

Covid: First data points to Omicron re-infection risk https://t.co/kl7UArGFn3

— Leo Kolivakis (@PensionPulse) December 3, 2021

More worrisome than Omicron is Congress fighting over debt and spending again:

As if Omicron weren't enough, Congress is fighting over debt and spending again: Morning Brief https://t.co/9kSwjyBZBj via @Yahoo

— Leo Kolivakis (@PensionPulse) December 3, 2021

Leave it up to Congress to take us over the precipice but for now disaster seems to have been averted until mid-February when we will be back in the same predicament again.

And that leaves Mr. Powell and his hawkish tone this week:

Hawkish Powell Is a Force Markets Haven’t Faced in Three Years https://t.co/vzd41RkhLH via @Yahoo

— Leo Kolivakis (@PensionPulse) December 2, 2021

Powell Changed His Tone, Not His Game. Time to Stop Panicking. | Barron's https://t.co/oGJAtR9qNE

— Leo Kolivakis (@PensionPulse) December 3, 2021

I'm not sure what to make of Powell's newfound concern over inflation except I agree with those who think the Fed tends to react too late and by the time they react, inflation trends will have subsided.

Moreover, while everyone is focused on the Fed and tapering, they're ignoring what the ECB is doing, expanding its balance sheet like crazy:

TAPER WHAT? #ECB balance sheet keeps rising despite rampant inflation. Total assets have risen by another €14.7bn in the past week to hit fresh ATH at €8,457bn. ECB balance sheet now equal to 81.2% of Eurozone GDP vs Fed's 37.4%, BoE's 42%, BoJ's 134.6%. pic.twitter.com/SfkhW4jc5n

— Holger Zschaepitz (@Schuldensuehner) December 1, 2021

Today, ECB President Christine Lagarde called the prospect of an interest-rate increase next year unlikely, but said she’d quickly take action to combat elevated inflation should it become necessary.

I don't know if anyone has been noticing but the euro is sliding versus the greenback which has been climbing steadily lately:

What does US dollar strength mean? It means US import prices will be dropping and that means inflation pressures will ease on that front, something the Fed welcomes.

What else? Remember all the big bad bond bears? In case you haven't been paying attention, US long bonds are rallying lately and prices are breaking out here as yields fall:

Amid all the noisy narratives surrounding #inflation dynamics, what percentage of investors do you think woke up today knowing that bonds have outperformed stocks over the past six months? pic.twitter.com/UNpPutYC5o

— Darius Dale (@42macroDDale) December 3, 2021

It sure doesn't seem like the US bond market is worried about inflation but skeptics will blame the Fed and other central banks for buying Treasuries.

We shall see but I agree with those who take a more in-depth macro view and see increasing risks of deflation here:

Euro$ Futures: There Be Landmines https://t.co/bH8gIzFHqE

— Alhambra Investments (@Alhambralnvest) December 4, 2021

There are also increasing risks of structural inflation.

Before I forget, please take the time to listen to Fiera Capital founder, Chairman of the Board and Chief Executive Officer Jean-Guy Desjardins and Candice Bangsund, Vice President and Portfolio Manager, Global Asset Allocation, share their insights on the global macroeconomic landscape, the economic outlook, and the implications for financial markets and investors’ portfolios. The discussion took place yesterday and was wonderfully moderated by Monique Leroux.

Mr. Desjardins really did a great job explaining demand-pull and cost-push inflation and going over many risks, including the risk of structural inflation and how central banks will respond. I asked him a very important question around minute 36 at the end and enjoyed his response.

Those of you who are perfectly bilingual, please take off translation option on the bottom right-hand side to listen to Mr. Desjardins speak in both languages (he's fluently bilingual). You can view the webinar here (might require registration):https://www.icastpro.ca/events/fiera-capital/hnz6m3/2021/12/02/market-vision-2022-and-beyond

What I admire about Mr. Desjardins is his passion for markets and his ability to communicate his views very clearly and discuss some important risks. He remains optimistic over the next five years but says we are in for a volatile period over the near term. Take the time to listen to this webinar, both he and Candice did a great job highlighting important points.

Alright, it's Friday night, time to order some pizza and relax a little, it's been a long week.

I wish everyone a wonderful weekend, don't fret too much about markets.

Below, Stephen Weiss, CEO and managing partner of Short Hills Capital Partners, joins the 'Halftime Report' to discuss his take on the markets. He remains cautious despite the sell-off in markets as there will be more news in the next couple of weeks about the omicron variant and the Fed.

And Keith Banks, vice chairman at Bank of America and head of the investment solutions group, joins the 'Halftime Report' to discuss why he believes the market sell-off won't derail the year-end rally.

Third, Yung-Yu Ma, BMO Wealth Management Chief Investment Strategist, joined Yahoo Finance Live yesterday to discuss the latest news out of the Fed.

Fourth,Carter Worth of Worth Charting, lays out the key levels he's watching in the market's charts. With CNBC's Dominic Chu and the Fast Money traders, Tim Seymour, Steve Grasso, Brian Kelly and Nadine Terman.

Lastly, Dr. Scott Gottlieb, former FDA commissioner and CNBC contributor, joined 'Squawk Box' yesterday to discuss the omicron coronavirus variant.

Comments

Post a Comment